Table of Contents

- Origins and Positioning of Visa’s Premium Tiers

- Core Benefits Comparison

- Eligibility and Credit Requirements

- Credit Score Benchmarks

- Income and Spending Expectations

- Application Process Nuances

- Real‑World Use Cases: When Each Tier Shines

- Frequent Business Traveler

- Occasional Vacationer with Moderate Spending

- Credit Builder and Perk Seeker

- Cost‑Benefit Analysis: Is the Higher Fee Worth It?

- Additional Perks Worth Exploring

- Entertainment and Event Access

- Purchase Protection Extensions

- Partner Program Bonuses

- How to Choose the Right Tier for You

- Step‑by‑Step Decision Framework

- Future Trends: What’s Next for Visa’s Premium Cards?

When you step into the world of premium credit cards, the terms “Visa Signature” and “Visa Infinite” appear frequently, promising a suite of exclusive benefits. Understanding credit card tiers Visa Signature vs Infinite is essential for anyone looking to maximize travel rewards, concierge services, and overall card value. While both tiers sit above the standard Visa Classic and Visa Gold offerings, they cater to different spending habits, credit profiles, and lifestyle needs.

This article walks you through the origins of these tiers, the concrete benefits each provides, the eligibility criteria you’ll likely encounter, and how to assess whether the extra cost of a Visa Infinite card translates into real value for you. By the end, you’ll have a clear picture of which tier aligns with your financial goals and day‑to‑day habits.

Origins and Positioning of Visa’s Premium Tiers

Visa, as a global payment network, structures its card products into a hierarchy that helps issuers differentiate their premium offerings. Visa Signature debuted in the early 2000s as a step up from Visa Gold, targeting affluent consumers who wanted more than basic rewards. Visa Infinite followed a few years later, positioned as the pinnacle of Visa’s consumer cards, aimed at high‑net‑worth individuals and frequent travelers.

Both tiers share the same underlying Visa network, meaning they are accepted worldwide wherever Visa is. However, the “brand” attached to each tier signals to merchants and service providers the level of service and protection a cardholder can expect.

Core Benefits Comparison

Below is a side‑by‑side look at the most commonly advertised benefits. Specifics can vary by issuing bank, but the framework remains consistent across most U.S. and international issuers.

- Travel Protections: Both tiers offer trip cancellation/interruption insurance, travel accident insurance, and rental car collision damage waiver. Visa Infinite typically provides higher coverage limits and adds lost luggage reimbursement.

- Concierge Services: Signature cards include a basic concierge that can handle restaurant reservations and event tickets. Infinite upgrades the service with a 24/7 personal assistant, often with faster response times and more exclusive experiences.

- Rewards Structure: Signature cards usually grant 1.5–2 points per dollar on travel and dining, while Infinite cards may push that to 2–3 points per dollar, sometimes with bonus categories for luxury hotels or airline purchases.

- Airport Lounge Access: Signature holders often receive a complimentary lounge pass per visit or access to partner lounges through programs like Priority Pass. Infinite members frequently enjoy unlimited lounge access across multiple networks, plus complimentary guest passes.

- Purchase Protection & Extended Warranty: Both tiers provide purchase protection against theft or damage within a limited window, and extended warranty coverage. Infinite may extend the protection period and increase the claim limit.

- Annual Fees: Signature cards generally carry fees ranging from $95 to $150, while Infinite cards start around $450 and can exceed $650 depending on the issuer and bundled benefits.

Eligibility and Credit Requirements

Understanding credit card tiers Visa Signature vs Infinite also involves looking at the credit scores and income levels issuers typically demand. While there is no hard rule, trends are apparent.

Credit Score Benchmarks

- Visa Signature: Most issuers require a good to excellent credit score, usually 700 + on the FICO scale. Some banks may approve applicants with scores in the high 600s if other factors—such as income or existing relationship—are strong.

- Visa Infinite: Expect a requirement of 740 or higher, with many issuers preferring scores above 770. The higher bar reflects the greater risk associated with larger credit limits and more generous rewards.

Income and Spending Expectations

Issuers often look for annual incomes that can comfortably support the higher credit limits typical of Infinite cards—often $100,000 or more for individuals, or a combined household income in the $150,000 range. Additionally, they may evaluate recent spending patterns; a demonstrated ability to spend $20,000–$30,000 annually on travel and dining can improve your chances.

Application Process Nuances

Applying for a Visa Infinite card may involve additional steps, such as a more detailed financial questionnaire or a phone interview. Some banks also require applicants to have an existing relationship, like a checking or savings account with a minimum balance, before approving an Infinite card.

Real‑World Use Cases: When Each Tier Shines

To illustrate how the differences play out in everyday scenarios, consider the following examples.

Frequent Business Traveler

Maria travels weekly for consulting work. She values lounge access, travel insurance, and accelerated point earnings on airfare. A Visa Infinite card with unlimited lounge entry and 3 points per dollar on airline purchases can offset the high annual fee within a few trips, especially when she redeems points for business class upgrades.

Occasional Vacationer with Moderate Spending

James takes a couple of vacations a year and spends modestly on dining out. A Visa Signature card offering 2 points per dollar on travel and dining, plus a complimentary lounge pass each trip, provides enough perks to justify a $120 annual fee without overcommitting to higher spending thresholds.

Credit Builder and Perk Seeker

Alisha recently achieved a credit score of 720 and wants to explore premium benefits without a massive fee. She opts for a Signature card from a bank that also provides a modest sign‑up bonus. The card helps her continue building credit while enjoying essential protections, positioning her for an Infinite upgrade later.

Cost‑Benefit Analysis: Is the Higher Fee Worth It?

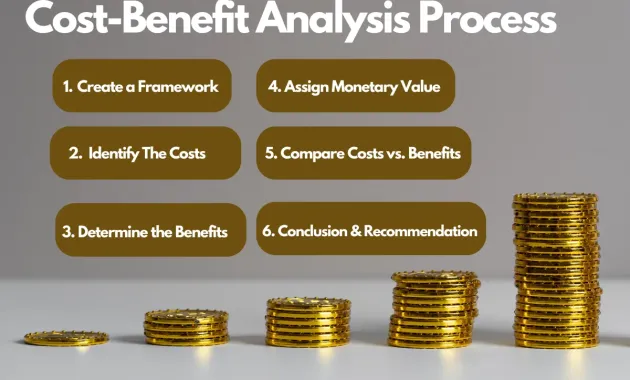

Calculating whether the extra cost of a Visa Infinite card pays off requires a straightforward approach: estimate the annual monetary value of the benefits and compare it to the difference in annual fees.

For instance, suppose a Signature card charges $120 annually, and an Infinite card charges $500. If the Infinite card provides $300 in travel credits, $200 in lounge access (valued by the cardholder), and $150 in insurance coverage, the total benefit reaches $650, outweighing the $380 fee difference. Conversely, if a user rarely travels, the same benefits may hold less tangible value, making the Signature tier more appropriate.

Tools such as a credit limit increase calculator can help forecast how a higher credit line associated with an Infinite card might affect your overall credit utilization and score, further influencing the cost‑benefit equation.

Additional Perks Worth Exploring

Beyond the headline benefits, both tiers often bundle niche perks that can be decisive for certain users.

Entertainment and Event Access

Signature cards may grant early ticket access to concerts and sports events. Infinite cards frequently include exclusive invites to VIP experiences, such as private wine tastings or meet‑and‑greet sessions with celebrities.

Purchase Protection Extensions

While both tiers protect new purchases, Infinite cards sometimes double the claim limit, making high‑value items like electronics or luggage safer to buy.

Partner Program Bonuses

Some issuers tie Visa Infinite cards to airline or hotel loyalty programs, offering automatic elite status upgrades after a certain spend threshold. Signature cards may provide a lower tier of status, still valuable but less impactful.

How to Choose the Right Tier for You

Choosing between Visa Signature and Visa Infinite should start with an honest assessment of your financial habits, travel frequency, and willingness to pay higher fees for enhanced benefits.

Step‑by‑Step Decision Framework

- Calculate Expected Annual Spend: Estimate how much you’ll spend on travel, dining, and everyday purchases. Multiply by the points multiplier for each tier to gauge rewards.

- Value the Perks: Assign monetary values to lounge visits, travel insurance, and concierge services based on your usage.

- Compare Fees: Subtract the annual fee from the total perk value to see the net benefit.

- Assess Credit Health: Ensure your credit score and income meet the tier’s typical requirements.

- Review Issuer Specifics: Look at each bank’s unique benefits, such as additional statement credits for rideshares or grocery stores.

Applying this framework can clarify whether the premium you pay for an Infinite card translates into tangible savings or experiences.

Future Trends: What’s Next for Visa’s Premium Cards?

Visa continues to evolve its premium offerings, incorporating digital tools and personalized experiences. Emerging trends include:

- Dynamic Rewards: Real‑time adjustments to point multipliers based on spending patterns, encouraging higher engagement.

- Integrated Travel Platforms: Seamless booking through card portals, with automatic application of travel credits.

- Enhanced Security: Biometric authentication and tokenization becoming standard even on premium cards.

Keeping an eye on these developments can help you stay ahead of the curve, ensuring your chosen card remains relevant and valuable.

In summary, the decision between Visa Signature and Visa Infinite hinges on a balance of spending behavior, travel frequency, and the perceived value of exclusive perks. By carefully evaluating your own needs against the structured benefits and costs, you can select the tier that not only aligns with your financial profile but also enhances your everyday experiences.

If you’re interested in exploring related premium card comparisons, you might find the analysis of Capital One Venture X vs Chase Sapphire Reserve insightful, as it dives into similar travel‑focused reward structures.

Remember, the ultimate goal is to let your credit card work for you—delivering convenience, protection, and rewards that justify its cost. Whether you gravitate toward the solid benefits of Visa Signature or the elite suite of Visa Infinite, a thoughtful approach will ensure you get the most out of your premium card.