Table of Contents

- Cards That Directly Reimburse Global Entry Fees

- American Express Platinum Card

- Chase Sapphire Reserve®

- Capital One Venture X Rewards Credit Card

- Citi® / AAdvantage® Executive World Elite Mastercard®

- Cards Offering TSA PreCheck Credit (Often Paired with Global Entry)

- U.S. Bank Altitude™ Reserve Visa Infinite® Card

- How to Activate and Use the Global Entry Credit

- Step‑by‑Step Guide

- Tips for Maximizing the Benefit

- Comparing the Top Cards – Which One Fits Your Travel Profile?

- Annual Fee vs. Overall Value

- Reward Structure

- Additional Travel Perks

- Credit Accessibility

- Real‑World Example: Using Multiple Credits in One Trip

- Potential Pitfalls and How to Avoid Them

- Overlooking the Credit Timeline

- Paying with an Ineligible Card

- Missing the Renewal Window

- Neglecting Other Card Benefits

- Future Outlook: Will More Cards Add Global Entry Credits?

For travelers who cross borders regularly, the Global Entry program is a valuable shortcut through customs and immigration. The application fee, however, can be a hurdle—especially for those who are just beginning to build a travel‑focused credit portfolio. Fortunately, several premium credit cards embed the Global Entry fee into their benefits, effectively reimbursing the cost once a statement credit is applied. This article walks you through the most prominent cards that offer this credit, explains the mechanics of claiming it, and highlights additional perks that often accompany these travel‑oriented products.

Understanding how a credit card can offset the Global Entry fee requires a brief look at the program itself. Global Entry, administered by U.S. Customs and Border Protection, grants expedited clearance for pre‑approved, low‑risk travelers upon arrival in the United States. The application costs $100 for adults and $50 for children, with a five‑year validity. While the fee is non‑refundable, many issuers treat it as a reimbursable travel expense, similar to airline fee credits. By pairing a Global Entry‑eligible card with frequent travel, you can effectively eliminate the upfront cost while enjoying smoother airport experiences.

Below, we explore the credit cards that currently provide a Global Entry credit, assess their overall value, and outline practical steps to secure the reimbursement. Whether you are a seasoned globetrotter or a first‑time applicant, the information is organized to help you make an informed decision without wading through marketing hype.

Cards That Directly Reimburse Global Entry Fees

Several issuers have built Global Entry credits into the core of their premium travel cards. The following list groups cards by issuing bank, outlines key eligibility criteria, and notes any ancillary benefits that may influence your choice.

American Express Platinum Card

- Annual Fee: $695 (as of 2026)

- Global Entry Credit: Up to $100 every 4 years (covers one full application)

- Additional Travel Perks: $200 airline fee credit, $300 Uber Cash, access to Centurion Lounges, and complimentary hotel elite status.

- Credit Requirement: Excellent credit (typically 720+ FICO)

To claim the credit, cardholders must pay the Global Entry application fee with the Platinum Card, then wait for the statement credit, which usually appears within 30 days. The credit automatically applies; no additional forms are required. Because the card also includes a broad suite of travel protections, many users find the high annual fee justified when they leverage the full benefits.

Chase Sapphire Reserve®

- Annual Fee: $550

- Global Entry Credit: Up to $100 every 4 years

- Travel Credits: $300 annual travel credit, 3X points on travel and dining, Priority Pass lounge access.

- Credit Requirement: Good to excellent credit (typically 700+ FICO)

The Sapphire Reserve automatically applies the Global Entry credit after the fee is posted. Cardholders also benefit from a $300 annual travel credit that offsets a wide range of travel expenses, making this card a strong contender for those who value flexibility over the exclusive lounge network offered by Amex.

Capital One Venture X Rewards Credit Card

- Annual Fee: $395

- Global Entry Credit: Up to $100 every 4 years

- Other Benefits: 10,000 bonus miles each anniversary, 2X miles on all purchases, and Capital One Lounge access.

- Credit Requirement: Good to excellent credit (typically 680+ FICO)

Capital One’s approach is straightforward: pay the Global Entry fee with the Venture X card, and the credit will appear on your next statement. The card’s generous mileage earnings and lounge access make it appealing for travelers who prefer a flat‑rate rewards structure.

Citi® / AAdvantage® Executive World Elite Mastercard®

- Annual Fee: $395

- Global Entry Credit: Up to $100 every 4 years

- Airline Perks: Complimentary Admirals Club membership, priority boarding, and preferred seating on American Airlines flights.

- Credit Requirement: Good to excellent credit (typically 680+ FICO)

The Global Entry credit is automatically applied after the fee is posted. This card is particularly valuable for frequent American Airlines flyers who can combine the Admirals Club membership with the expedited customs clearance.

Cards Offering TSA PreCheck Credit (Often Paired with Global Entry)

While the focus of this guide is Global Entry, many of the same cards also extend a $50 credit for TSA PreCheck, the domestic counterpart that speeds security screening. For travelers who may only need domestic acceleration, this credit can be an additional reason to select a particular card.

U.S. Bank Altitude™ Reserve Visa Infinite® Card

- Annual Fee: $395

- Global Entry Credit: Up to $100 every 4 years

- TSA PreCheck Credit: $50 every 4 years

- Other Benefits: 3X points on travel and mobile wallet purchases, $325 annual travel credit.

The credit process mirrors that of other premium cards: pay the fee, and the statement credit posts automatically. The inclusion of both Global Entry and TSA PreCheck credits provides flexibility for travelers who split time between international and domestic trips.

How to Activate and Use the Global Entry Credit

Claiming the credit is a simple, largely automated process, but a few procedural steps can ensure you receive the reimbursement without delay.

Step‑by‑Step Guide

- Confirm that your card is eligible for the Global Entry credit by reviewing the issuer’s benefits guide.

- Apply for Global Entry through the official CBP portal, and select “Pay with Credit Card”.

- Enter your eligible credit card number; the $100 fee will be charged immediately.

- After the transaction posts, monitor your upcoming credit card statement. The credit typically appears within 30 days, though some issuers may take up to 45 days.

- If the credit does not appear, contact the card’s customer service and reference the “Global Entry reimbursement” policy.

Because the credit is a statement adjustment, it does not affect your rewards points or cash‑back earnings—only the net cost of the application is reduced.

Tips for Maximizing the Benefit

- Timing: Align the fee payment with the start of a new billing cycle to avoid overlapping credit periods.

- Family Members: Some cards allow you to claim the credit for dependent applications (e.g., a spouse or child) as long as the fee is charged to your account.

- Renewals: Remember that the credit refreshes every four years, matching the Global Entry renewal interval. Set a calendar reminder to re‑apply before the expiration date.

- Combine Credits: If your card also offers an airline fee credit, use that for ancillary travel expenses while the Global Entry credit covers the enrollment cost.

Comparing the Top Cards – Which One Fits Your Travel Profile?

Choosing the right card depends on more than just the Global Entry credit. Consider the following dimensions to align the card with your spending habits and travel frequency.

Annual Fee vs. Overall Value

A high annual fee can be offset quickly if you utilize multiple benefits. For example, the American Express Platinum’s $200 airline fee credit and extensive lounge network may justify its $695 fee for frequent flyers. Conversely, the Capital One Venture X’s $395 fee is balanced by a flat‑rate 2X miles on all purchases, which can be more predictable for occasional travelers.

Reward Structure

If you prefer points that can be transferred to airline partners, the Chase Sapphire Reserve’s 3X points on travel and dining may be ideal. Meanwhile, Capital One’s 10,000‑mile anniversary bonus provides a straightforward mileage boost without the need for partner transfers.

Additional Travel Perks

Some cards bundle hotel elite status (e.g., Marriott Bonvoy Gold with the Amex Platinum), rental car upgrades, or complimentary baggage allowances. Assess which of these perks you are likely to use, as they can significantly enhance the card’s ROI.

Credit Accessibility

While the Amex Platinum and Chase Sapphire Reserve require excellent credit, the Capital One Venture X and U.S. Bank Altitude Reserve accept slightly lower scores. If your credit profile is still building, consider starting with a card that offers a Global Entry credit but a lower annual fee, such as the Capital One Venture X.

Real‑World Example: Using Multiple Credits in One Trip

Imagine a business traveler who flies internationally twice a month and commutes domestically weekly. By holding both a Chase Sapphire Reserve and a U.S. Bank Altitude Reserve, the traveler can enjoy the following scenario:

- Global Entry credit applied to the Sapphire Reserve, eliminating the $100 enrollment fee.

- TSA PreCheck credit applied to the Altitude Reserve for domestic security speed.

- Annual travel credits ($300 from Sapphire Reserve, $325 from Altitude Reserve) covering airline tickets, hotel stays, and ride‑share expenses.

- Earned points: 3X on travel from Sapphire Reserve plus 3X on travel from Altitude Reserve, effectively doubling point accumulation on qualifying purchases.

Such a combination illustrates how strategically stacking cards can amplify savings, especially when each card’s exclusive credit aligns with distinct travel segments.

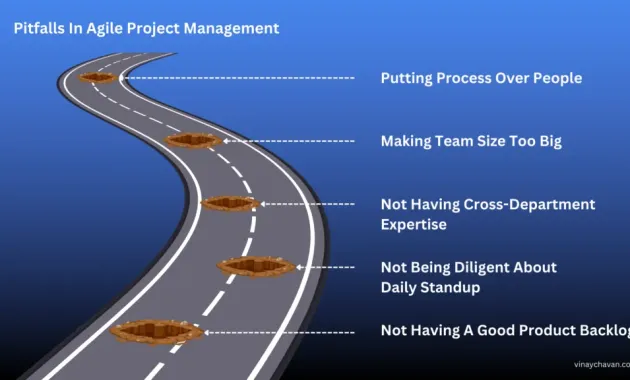

Potential Pitfalls and How to Avoid Them

Even with clear benefits, there are common missteps that can diminish the value of a Global Entry credit.

Overlooking the Credit Timeline

The credit is issued only once per four‑year period. If you pay the fee early in the cycle and then renew the card before the next eligibility window, you may miss out on the subsequent credit. Keep a personal log of when each credit was applied.

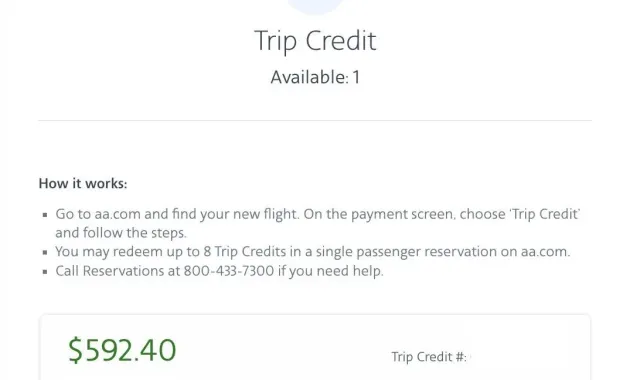

Paying with an Ineligible Card

Some issuers only recognize the primary cardholder’s name on the transaction. If you use an authorized user card, the credit might not trigger. Verify the card’s policy, or refer to the article Authorized User vs Joint Account Holder – Which One Fits Your Financial Strategy? for guidance on managing authorized user relationships.

Missing the Renewal Window

Global Entry renewals must be submitted up to 90 days before expiration. Submitting after this window can result in longer processing times, potentially causing you to miss the credit opportunity if your card’s eligibility resets before you can re‑apply.

Neglecting Other Card Benefits

Focusing solely on the Global Entry credit may cause you to overlook more valuable perks, such as airline fee credits or lounge access. Review the full benefits summary annually to ensure you’re leveraging every advantage.

Future Outlook: Will More Cards Add Global Entry Credits?

Travel credit cards continue to evolve, and issuers frequently refresh benefit packages to stay competitive. Recent trends suggest that more mid‑tier cards may begin to offer Global Entry credits, especially as the program’s popularity grows among business travelers. Keep an eye on announcements from major banks, and consider subscribing to issuer newsletters for early notice of benefit updates.

Additionally, the introduction of digital wallets and integrated travel platforms may streamline the credit application process, potentially allowing real‑time reimbursement rather than waiting for a monthly statement cycle. While such changes are speculative, they reflect the broader industry movement toward frictionless travel experiences.

In summary, selecting a credit card that provides a Global Entry credit can effectively eliminate the $100 application fee, while also granting access to a suite of complementary travel benefits. By evaluating annual fees, reward structures, and ancillary perks, you can identify the card that aligns best with your travel habits and financial goals. Remember to monitor credit timelines, use the correct payment method, and capitalize on related benefits such as TSA PreCheck credits and annual travel allowances. With careful planning, the cost of Global Entry becomes a negligible expense, allowing you to focus on the journeys ahead.