Table of Contents

- Online Account Management

- Setting Up and Managing Alerts

- Bill Pay and Paperless Statements

- Going Paperless

- Reward Tracking and Redemption

- Maximizing Reward Value

- Security Features and Fraud Prevention

- Steps to Strengthen Your Account

- Mobile App Integration

- Using Contactless Payments Wisely

- Customer Support and Self‑Service Tools

- When to Reach Out Directly

BB&T credit card online services have become an essential part of modern banking, allowing cardholders to manage their finances with a few clicks. From checking balances to redeeming rewards, the digital platform offers a suite of tools that simplify everyday financial tasks. This article walks you through each feature, explains how to use them effectively, and highlights security measures that protect your account.

Imagine waking up, grabbing your phone, and instantly seeing the latest transaction on your BB&T credit card. No need to wait for a paper statement or call customer service; the information is right there, organized and secure. This convenience is the core promise of BB&T’s online ecosystem, and it extends far beyond a simple balance check. Below, we explore the full range of services available and how they can fit into your financial routine.

Whether you are a long‑time BB&T customer or just signed up for your first credit card, understanding the online portal can save you time, reduce fees, and help you stay on top of your credit health. Let’s dive into the key components of BB&T’s digital credit‑card environment.

Online Account Management

The first step in leveraging BB&T credit card online services is logging into the secure portal. After completing the standard authentication process, you are greeted with a dashboard that presents the most critical information at a glance: current balance, available credit, recent transactions, and any pending payments. The layout is intentionally clean, allowing you to locate what you need without scrolling through multiple screens.

Setting Up and Managing Alerts

- Payment reminders: Receive email or SMS notifications a few days before your due date to avoid late fees.

- Spending thresholds: Configure alerts that trigger when you approach a specific percentage of your credit limit.

- Unusual activity warnings: Get immediate alerts if the system detects transactions that differ from your typical spending patterns.

These alerts can be customized in the Settings tab, ensuring you only receive the notifications that matter most to you. By staying informed, you reduce the risk of missed payments and unexpected charges.

Bill Pay and Paperless Statements

One of the most appreciated features of BB&T’s online services is the ability to pay your credit card bill directly from the portal. You can schedule one‑time payments, set up recurring transfers from a checking account, or even use external bank accounts for added flexibility. The process is straightforward: select “Pay Bill,” choose the amount, pick the source account, and confirm.

Going Paperless

Switching to electronic statements not only helps the environment but also provides faster access to your financial records. When you opt for paperless statements, each monthly report is instantly available for download in PDF format, and you can archive them in a secure cloud folder for future reference. This feature aligns with the broader industry trend highlighted in Why Choose Paperless Statements?, emphasizing convenience and security.

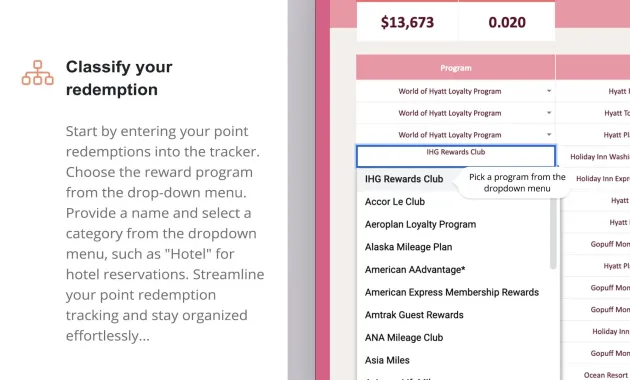

Reward Tracking and Redemption

BB&T credit cards often come with reward programs that earn points, cash back, or travel miles on everyday purchases. The online portal includes a dedicated rewards tab where you can monitor accrued points in real time, view redemption options, and see the value of each reward category.

Maximizing Reward Value

- Check the “Bonus Categories” section monthly to identify purchases that earn extra points.

- Use the “Redeem Now” button to apply cash back directly to your statement balance, reducing your next payment.

- Explore travel partners and gift cards for higher conversion rates when you have accumulated a large point balance.

Keeping an eye on your rewards prevents points from expiring and helps you plan purchases that align with upcoming travel or large expenses.

Security Features and Fraud Prevention

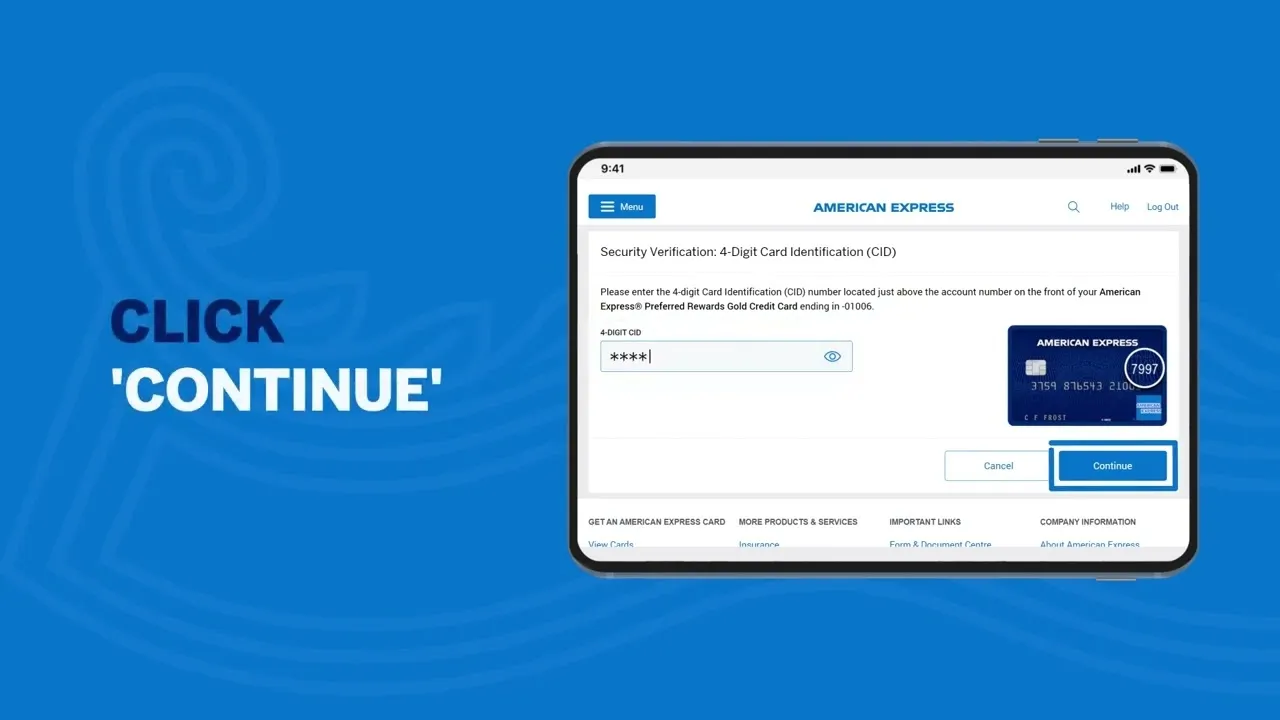

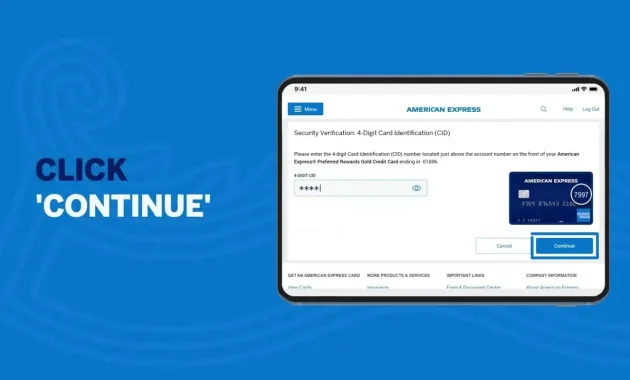

Security is a cornerstone of BB&T’s online services. The platform employs multi‑factor authentication (MFA), encryption protocols, and continuous monitoring to protect your data. In addition, BB&T offers a virtual card number feature that generates a temporary card number for online purchases, shielding your actual card details from potential breaches.

Steps to Strengthen Your Account

- Enable MFA using a mobile authenticator app for an extra verification layer.

- Regularly review the “Device Activity” log to ensure only recognized devices have access.

- Activate the “Card Lock” feature if you suspect your card is lost or stolen; it can be toggled on or off instantly through the app.

For a broader perspective on protecting your card, see our guide on How to Protect Your Credit Card from Skimmers – 7 Actionable Steps You Can Take Today. Implementing these practices adds multiple layers of defense against fraud.

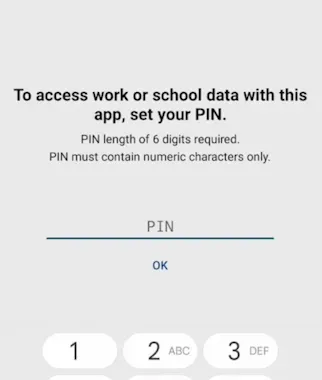

Mobile App Integration

BB&T’s mobile app mirrors the functionality of the web portal, optimized for touchscreens and on‑the‑go use. The app provides instant push notifications for transactions, a built‑in camera for mobile check deposits, and a streamlined interface for quick payments. Because the app is regularly updated, new features—such as contactless payment support—are added without requiring a separate download.

Using Contactless Payments Wisely

When you enable Apple Pay or Google Pay within the BB&T app, you can make contactless purchases at participating retailers. The underlying technology, explained in detail in How Contactless Credit Card Payments Really Work – The Technology, Security, and Future You Need to Know, ensures that each transaction is tokenized, reducing exposure of your actual card number.

Customer Support and Self‑Service Tools

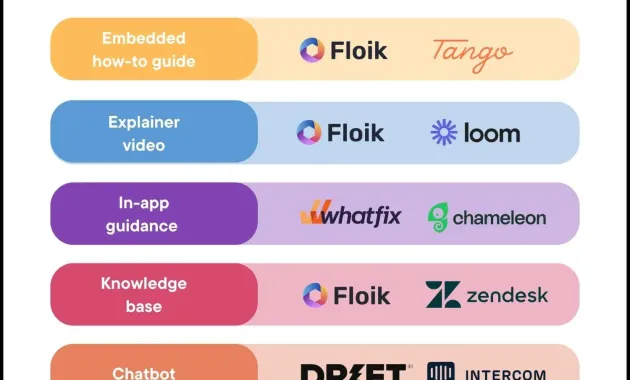

Even with a comprehensive online suite, you may occasionally need assistance. BB&T offers several self‑service options within the portal, such as a searchable knowledge base, chat support, and the ability to schedule a call with a representative. If you prefer human interaction, the “Contact Us” page provides phone numbers and secure messaging channels.

When to Reach Out Directly

- Disputing a transaction that appears fraudulent.

- Requesting a credit limit increase or a new card design.

- Seeking clarification on complex reward redemption rules.

The integration of live chat and secure messaging means you can resolve many issues without leaving the platform, keeping the experience seamless and efficient.

In summary, BB&T credit card online services combine robust account management, reward optimization, advanced security, and mobile convenience into a single, user‑friendly ecosystem. By taking advantage of alerts, paperless statements, virtual card numbers, and the mobile app’s features, cardholders can maintain greater control over their finances while minimizing risk. The platform’s continuous updates and responsive support ensure that both everyday tasks and occasional challenges are handled with minimal friction.