Table of Contents

- Finding the Official Login Page

- Step‑by‑Step Login Process

- 1. Enter Your User ID

- 2. Input Your Password

- 3. Complete Multi‑Factor Authentication (MFA)

- 4. Navigate the Dashboard

- Troubleshooting Common Login Issues

- Incorrect Username or Password

- Account Locked After Multiple Failed Attempts

- Problems Receiving MFA Codes

- Security Best Practices for Your Online Account

- Managing Payments and Balances Online

- Setting Up Autopay

- Checking Your Available Balance Instantly

- Updating Personal Information and Preferences

- Exploring Additional Features on the Portal

- What to Do If You Suspect Fraud

- Accessing Support Resources

First Premier Bank credit card login is the gateway to managing your finances, tracking transactions, and taking advantage of the rewards program offered by the institution. For many cardholders, the online portal represents a convenient way to stay on top of balances, make payments, and update personal information without the need for a phone call or a branch visit. Yet, like any digital service, the login process can sometimes raise questions or present obstacles that leave users unsure of the next steps.

In this article we will walk through the entire experience, from locating the correct login page to securing your account against unauthorized access. By following a clear, narrative flow, you will gain confidence in navigating the First Premier Bank website, handling common errors, and making the most of the tools available to you as a cardholder. Whether you are a new member just receiving your first card or a seasoned user seeking to refresh your knowledge, the information below is structured to serve every level of familiarity.

We will also integrate relevant insights from related topics, such as understanding the broader payment landscape and avoiding typical pitfalls when managing credit card payments. These connections will help you see how First Premier Bank fits within the larger ecosystem of digital banking.

Finding the Official Login Page

The first step in any online banking activity is confirming that you are on the legitimate website. Phishing attempts often mimic the look of a bank’s portal, leading users to malicious sites designed to capture credentials. To ensure you are accessing the correct page:

- Type the URL directly into your browser: https://www.firstpremierbank.com. Avoid clicking on email links unless you have verified the sender.

- Look for the secure lock icon in the address bar, which indicates an encrypted HTTPS connection.

- Check for the bank’s branding elements, such as the logo and color scheme, which should match the physical cards and statements you have received.

Once on the homepage, locate the Login button typically positioned at the top right corner. Clicking this will redirect you to the dedicated credit card login portal where you will enter your credentials.

Step‑by‑Step Login Process

1. Enter Your User ID

First Premier Bank assigns each cardholder a unique User ID during the account activation phase. This identifier is usually a combination of letters and numbers and is distinct from your credit card number. If you have forgotten your User ID, the portal offers a “Retrieve User ID” option that requires you to answer security questions or provide your email address.

2. Input Your Password

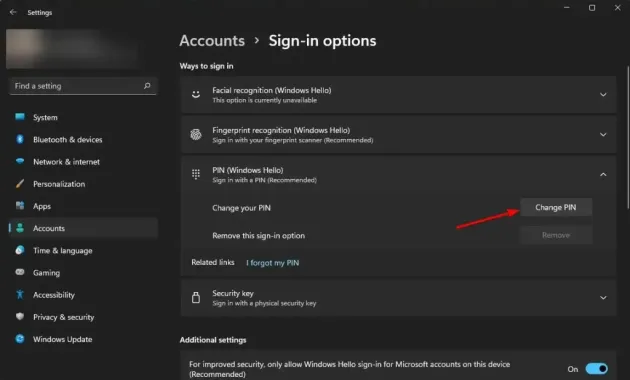

Your password must meet the bank’s complexity requirements: a minimum of eight characters, at least one uppercase letter, one lowercase letter, one numeral, and one special character (e.g., @, #, $). When creating a new password, avoid common words or patterns that could be guessed easily. The system will also prompt you to change your password after a set period, typically every 90 days.

3. Complete Multi‑Factor Authentication (MFA)

To add an extra layer of security, First Premier Bank employs MFA. After entering your credentials, you will receive a one‑time code via SMS, email, or an authenticator app. Enter this code on the subsequent screen to finalize the login. If you do not receive the code, verify that your contact information is up to date in the Profile Settings section.

4. Navigate the Dashboard

Upon successful authentication, you will land on the dashboard. Here you can view your current balance, recent transactions, pending payments, and rewards points. The interface is designed for quick access, with shortcuts to common actions such as “Pay Bill,” “View Statements,” and “Update Personal Info.”

Troubleshooting Common Login Issues

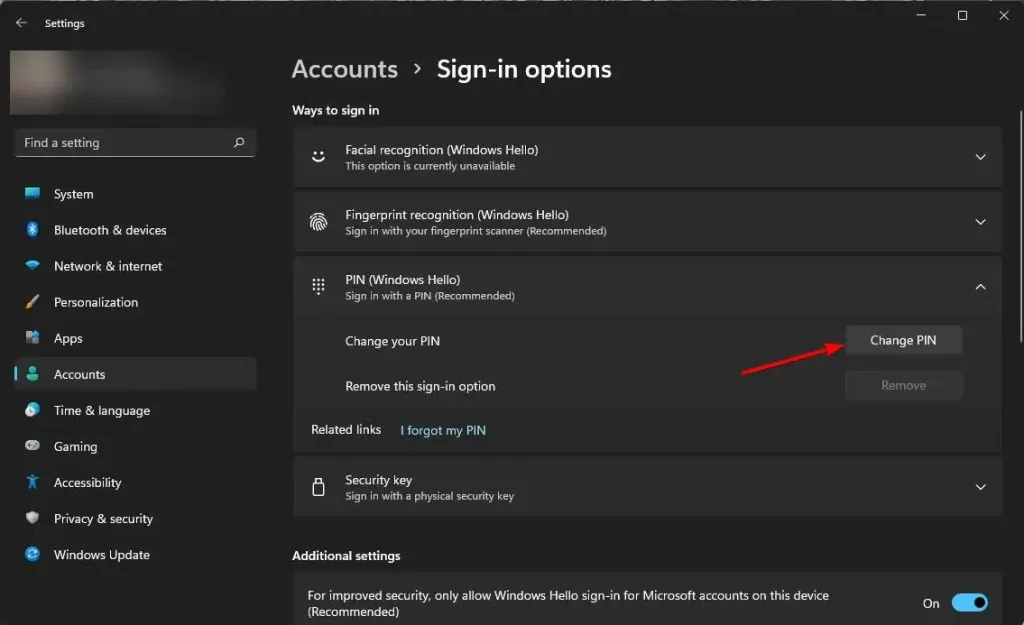

![[Windows 11/10] Troubleshooting - PIN (Windows Hello) Login Failed](https://blog.avaller.com/wp-content/uploads/2026/01/windows-11-10-troubleshooting-pin-windows-hello-login-failed-2-630x380.webp)

Even with careful attention to detail, users sometimes encounter obstacles. Below are the most frequent problems and how to resolve them.

Incorrect Username or Password

If the system displays an error message stating that the username or password is incorrect, consider the following steps:

- Check for caps lock or keyboard layout changes that might alter the input.

- Use the “Forgot Password” link to reset your password. You will be required to verify your identity through security questions or a code sent to your registered phone.

- Ensure you are not mixing up your User ID with your credit card number.

Account Locked After Multiple Failed Attempts

For security reasons, the portal locks the account after a set number of unsuccessful login attempts. To unlock it, you can:

- Wait the prescribed lockout period (usually 15‑30 minutes) and try again.

- Contact First Premier Bank’s customer support for immediate assistance. Have your card number and personal identification ready.

Problems Receiving MFA Codes

When you do not receive the MFA code, verify the following:

- Your mobile device has network coverage and can receive SMS messages.

- The email address on file is correct and not filtering the code as spam.

- If you use an authenticator app, ensure the time on your device is synchronized.

Should the issue persist, you can opt for alternative verification methods such as a voice call to your registered phone number.

Security Best Practices for Your Online Account

Maintaining a secure online environment goes beyond the initial login steps. Here are several practices that help protect your First Premier Bank credit card data:

- Regularly Update Your Password: Change it at least every three months and avoid reusing passwords from other services.

- Enable Browser Alerts: Most modern browsers warn users when they attempt to submit data on unsecured pages. Keep these alerts active.

- Use a Dedicated Device: Access your account from a personal computer or smartphone that you keep free of malware.

- Review Account Activity Frequently: Spotting unauthorized transactions early can limit potential damage.

- Log Out After Each Session: Never leave the portal open on a public or shared computer.

These steps align with broader recommendations discussed in the payment landscape, where security is a cornerstone of consumer confidence.

Managing Payments and Balances Online

The online portal not only displays your current balance but also offers tools to manage upcoming payments. You can schedule one‑time or recurring payments, set up autopay, and even link external bank accounts for seamless fund transfers.

Setting Up Autopay

Autopay ensures that your minimum payment—or the full statement balance—is deducted automatically each month. To configure this feature:

- Navigate to the “Payments” tab on the dashboard.

- Select “Autopay Settings.”

- Choose the amount (minimum, full, or custom) and the funding source.

- Confirm the schedule and save.

Enrolling in autopay can help you avoid late fees and protect your credit score. For a deeper look at payment strategies, see how to master Comenity Bank credit card payment and avoid common pitfalls, which offers analogous advice applicable across multiple issuers.

Checking Your Available Balance Instantly

Knowing your available credit is essential for budgeting and avoiding over‑limit fees. The dashboard provides a real‑time view, but you can also use the “Quick Balance” widget on the homepage for an at‑a‑glance check. This feature mirrors the functionality described in how to instantly check your credit card available balance and boost financial confidence, emphasizing the importance of immediate data access.

Updating Personal Information and Preferences

Keeping your contact details current ensures you receive important notifications, such as payment reminders, fraud alerts, and promotional offers. To edit your profile:

- Click on your name or the “Profile” icon in the upper right corner.

- Select “Personal Information.”

- Update fields such as mailing address, phone number, and email.

- Save changes and confirm via the verification code sent to your new contact method.

First Premier Bank also allows you to set communication preferences, enabling you to choose between email, SMS, or postal mail for statements and alerts.

Exploring Additional Features on the Portal

Beyond basic account management, the online portal offers several value‑added tools:

- Rewards Tracker: Monitor points earned from purchases, see redemption options, and receive personalized offers.

- Transaction Search: Filter transactions by date, merchant, or amount to locate specific purchases quickly.

- Export Statements: Download PDFs or CSV files for personal record‑keeping or tax preparation.

- Secure Messaging: Communicate directly with customer support without exposing sensitive information over the phone.

These capabilities encourage cardholders to engage with their accounts proactively, fostering a sense of control over financial decisions.

What to Do If You Suspect Fraud

Despite robust security measures, unauthorized activity can still occur. If you notice a transaction you did not authorize, act swiftly:

- Immediately flag the transaction in the portal by selecting “Report as Fraud.”

- Contact First Premier Bank’s fraud hotline (the number is printed on the back of your card) to initiate a dispute.

- Change your password and review your MFA settings.

- Monitor your account for additional suspicious activity over the next several weeks.

Prompt reporting not only limits potential losses but also helps the bank refine its fraud detection algorithms, benefiting the broader customer base.

Accessing Support Resources

First Premier Bank provides multiple channels for assistance:

- Live Chat: Available 24/7 from the login page, offering real‑time help for navigation or technical issues.

- Phone Support: Hours of operation are listed on the “Contact Us” page; the line is staffed by trained representatives.

- FAQ Section: A searchable knowledge base covers topics from password resets to rewards redemption.

- Community Forums: Users can share experiences and solutions, though official advice should always be verified with the bank.

Utilizing these resources can reduce the time spent troubleshooting and ensure you remain confident in using the online platform.

In summary, mastering the First Premier Bank credit card login process opens the door to a comprehensive suite of financial tools. By following the steps outlined—verifying the correct URL, entering accurate credentials, completing MFA, and adhering to security best practices—you can manage your account efficiently and securely. Should obstacles arise, the troubleshooting guide and support channels provide clear pathways to resolution. Regularly reviewing balances, setting up autopay, and keeping personal information up to date further enhance the experience, turning a simple login into a gateway for financial empowerment.