Table of Contents

- Reward Structure and Cash‑Back Opportunities

- Everyday Dining Earns More

- Travel Rewards Simplified

- Universal 1% on All Other Purchases

- Travel‑Related Perks Beyond Cash Back

- No Foreign Transaction Fees

- Travel Accident Insurance

- Lost Luggage Reimbursement

- Security Features and Card Management Tools

- Zero Liability Protection

- Instant Card Freeze

- Contactless Payments and Tokenization

- Fee Structure and Cost‑Saving Benefits

- No Annual Fee

- Balance Transfer Offers

- Late Fee Waiver Opportunities

- Maximizing the Autograph Card: Practical Tips

- Align Spending with Reward Categories

- Leverage Direct Deposit for Faster Cash‑Back Access

- Combine with Other Wells Fargo Products

- Monitor Travel Benefits Before Each Trip

- Utilize Mobile App Features Regularly

When you first lay eyes on the sleek design of the Wells Fargo Autograph® credit card, you might wonder what lies beyond its polished surface. The answer is a suite of carefully crafted benefits that aim to enhance everyday spending, support travel ambitions, and provide robust security—all while keeping costs in check. Understanding these advantages can transform a simple credit line into a powerful financial tool that works quietly in the background of your daily life.

In this article we will walk through the card’s core features, explore how they interact with real‑world scenarios, and highlight the ways you can maximize value without chasing gimmicks. Whether you are a frequent flyer, a diligent saver, or someone who simply wants a reliable everyday card, the Wells Fargo Autograph card offers a blend of rewards, protections, and convenience that deserve a closer look.

Below, each benefit is broken down with practical examples and tips for getting the most out of the program. The structure follows a logical flow, beginning with the most visible perks—rewards and cash back—then moving to travel‑related features, security tools, and finally the cost‑saving elements that keep the card affordable.

Reward Structure and Cash‑Back Opportunities

The Autograph card’s reward system is built around a straightforward cash‑back model that appeals to both casual shoppers and power spenders. Cardholders earn 3% cash back on dining, 2% on travel, and 1% on all other purchases. These rates are applied automatically, meaning you don’t have to track categories or activate bonuses each month.

Everyday Dining Earns More

Imagine a week where you grab breakfast at a café, have lunch at a restaurant, and order dinner delivery. Each transaction falls under the “dining” category, instantly qualifying for the 3% cash‑back rate. Over a month, a modest $500 dining spend translates into $15 cash back—money that can be applied as a statement credit, deposited into a savings account, or even used toward future purchases.

Travel Rewards Simplified

Travel expenses often involve higher ticket prices, making the 2% cash back on travel purchases a valuable addition. Whether you’re booking a flight, reserving a hotel, or renting a car, the card automatically credits the cash back to your account. For frequent travelers, pairing this benefit with a direct deposit strategy—like the one explained in Understanding Direct Deposit for Cash‑Back Rewards—can streamline the process of turning earned cash back into usable funds.

Universal 1% on All Other Purchases

Even purchases that don’t fit into dining or travel categories still earn a modest 1% cash back. This “catch‑all” rate ensures that every swipe contributes to your rewards pool, reinforcing the idea that the Autograph card works continuously in the background.

Travel‑Related Perks Beyond Cash Back

While cash back is a primary attraction, the Autograph card also offers several travel‑centric benefits that enhance convenience and safety on the road. These perks are designed to reduce friction during travel planning and execution.

No Foreign Transaction Fees

Using the card abroad typically incurs a 3% foreign transaction fee. The Autograph card eliminates this surcharge, allowing you to spend abroad without additional costs—a critical advantage for international travelers who want to keep expenses predictable.

Travel Accident Insurance

If an accident occurs during a covered trip, the card provides up to $25,000 in accidental death and dismemberment insurance. While this isn’t a substitute for comprehensive travel insurance, it adds a layer of financial protection that can be reassuring for solo travelers or families.

Lost Luggage Reimbursement

Should your luggage be delayed or lost, the card reimburses up to $100 per passenger per trip. This coverage can cover essential items like toiletries or clothing, reducing the inconvenience and expense of unexpected travel hiccups.

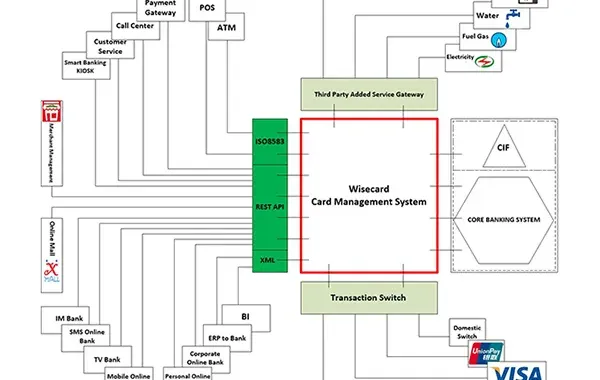

Security Features and Card Management Tools

In an era where data breaches and fraud are constant concerns, the Autograph card equips users with several security mechanisms that help safeguard personal information and financial assets.

Zero Liability Protection

Unauthorized transactions are covered under the zero‑liability policy, meaning you won’t be responsible for fraudulent charges if you report them promptly. This protection is standard among major issuers but remains a cornerstone of user confidence.

Instant Card Freeze

The ability to freeze your card instantly via the Wells Fargo mobile app provides a rapid response option if you suspect loss or theft. For a deeper dive into the importance of this feature, see Why Freezing a Credit Card Makes Sense. Freezing the card halts all pending and future transactions until you decide to unfreeze it.

Contactless Payments and Tokenization

Contactless payments offer a quick, secure way to pay, while tokenization replaces your card number with a unique identifier during digital transactions. Both technologies reduce the exposure of sensitive data, aligning with modern security expectations.

Fee Structure and Cost‑Saving Benefits

One of the most compelling aspects of the Wells Fargo Autograph card is its modest fee schedule, especially when compared to premium travel cards that charge high annual fees for comparable benefits.

No Annual Fee

The card carries a $0 annual fee, making it an accessible option for individuals who want rewards without a recurring cost. This contrasts sharply with many airline or hotel co‑branded cards that require fees upwards of $95.

Balance Transfer Offers

New cardholders can take advantage of a 0% introductory APR on balance transfers for the first 12 months, subject to a 3% transfer fee. This feature can be useful for consolidating higher‑interest debt, thereby reducing overall interest expenses.

Late Fee Waiver Opportunities

If a payment is missed, the first late fee may be waived as a courtesy, depending on your payment history. Understanding how late fees impact your account can help you avoid unnecessary charges; further details are covered in Understanding Late Fees and Their Impact.

Maximizing the Autograph Card: Practical Tips

To extract the highest value from the Autograph card, consider integrating the following strategies into your financial routine.

Align Spending with Reward Categories

Plan routine expenses—such as grocery deliveries, dining out, and travel bookings—to fall under the 3% and 2% cash‑back categories. This intentional alignment can boost your annual cash‑back earnings by several hundred dollars without changing your lifestyle.

Leverage Direct Deposit for Faster Cash‑Back Access

Enroll in direct deposit for your cash‑back rewards. By having earnings deposited directly into a checking or savings account, you eliminate the delay between statement closing and reward availability, providing immediate liquidity for upcoming purchases.

Combine with Other Wells Fargo Products

If you already hold a Wells Fargo checking or savings account, linking the Autograph card can simplify fund transfers and enable seamless reward redemption. Additionally, some customers may qualify for promotional offers that bundle multiple products together.

Monitor Travel Benefits Before Each Trip

Before embarking on a journey, review the card’s travel insurance and lost‑luggage coverage to ensure you understand the claim process. Keeping documentation, such as boarding passes and receipts, ready can expedite reimbursements if needed.

Utilize Mobile App Features Regularly

The Wells Fargo mobile app provides real‑time alerts, spending categorization, and the ability to freeze or unfreeze the card instantly. Regularly checking these tools helps you stay informed about your spending patterns and quickly address any irregularities.

By following these practices, you create a habit loop that turns the Autograph card from a passive financial instrument into an active contributor to your financial goals.

In summary, the Wells Fargo Autograph card blends a clear cash‑back structure, travel conveniences, solid security measures, and a fee‑friendly design to serve a broad spectrum of users. Its lack of an annual fee, combined with competitive reward rates, makes it a viable alternative to higher‑cost premium cards, while still delivering meaningful perks for everyday spending and occasional travel. When paired with disciplined usage and strategic planning—such as aligning purchases with reward categories and leveraging direct deposit—the card can generate tangible financial benefits that enhance both short‑term cash flow and long‑term savings.