Table of Contents

- What Exactly Is a Revolving Line of Credit?

- Key Components of a Revolving Credit Arrangement

- How Does a Revolving Line of Credit Differ From a Credit Card?

- Purpose and Flexibility

- Interest Calculation

- Credit Reporting

- Benefits of Using a Revolving Line of Credit

- Cash Flow Management

- Cost Efficiency

- Credit Building

- Convenient Access

- Potential Risks and Drawbacks

- Variable Interest Rates

- Minimum Payment Trap

- Over‑Borrowing Temptation

- Fee Accumulation

- When Is a Revolving Line of Credit the Right Choice?

- Steps to Secure and Manage a Revolving Line of Credit

- 1. Assess Your Credit Profile

- 2. Compare Offers

- 3. Choose the Right Limit

- 4. Establish a Repayment Plan

- 5. Monitor Utilization and Rates

- 6. Review Fees Annually

- Real‑World Example: A Small Business Owner’s Experience

- Common Misconceptions About Revolving Credit

- “If I have a line, I don’t need an emergency fund.”

- “Interest rates are always lower than credit cards.”

- “I can’t be charged fees if I don’t use the line.”

- Future Trends: How Revolving Credit Is Evolving

- Digital Platforms and Instant Access

- Dynamic Pricing Models

- Integrated Financial Management

When you hear the term “revolving line of credit,” the first image that might come to mind is a credit card balance that you can carry month to month. While that is a common example, a revolving line of credit is a broader financial tool that gives borrowers flexibility to draw, repay, and redraw funds up to an approved limit. Understanding how this mechanism operates can help you decide whether it fits into your budgeting strategy, especially if you are juggling multiple financial commitments.

In this article we walk through the fundamentals of a revolving line of credit, compare it with other credit products, and outline practical steps to manage it responsibly. By the end, you’ll be equipped with the knowledge to assess its suitability for your situation and avoid common pitfalls that lead to unnecessary interest costs.

What Exactly Is a Revolving Line of Credit?

A revolving line of credit (often shortened to “revolver”) is a pre‑approved borrowing limit that a financial institution extends to a qualified borrower. Unlike a term loan, which provides a lump sum that must be repaid in fixed installments over a set period, a revolver allows you to:

- Withdraw any amount up to the maximum limit at any time.

- Repay the borrowed portion at your own pace, subject to minimum payment requirements.

- Borrow again after repayment, without reapplying for a new loan.

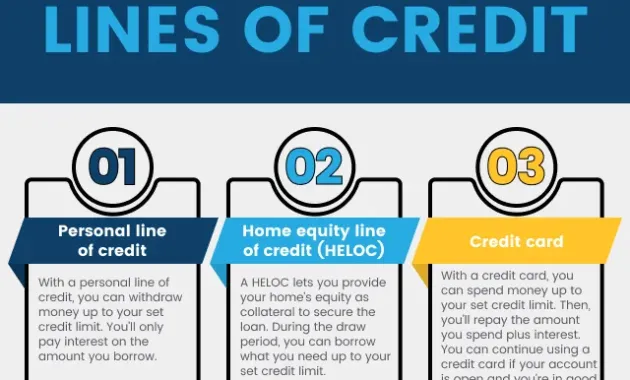

This cyclical borrowing and repayment process is why the product is called “revolving.” The most familiar example is a credit card, but banks also offer personal revolving lines of credit, home‑equity lines of credit (HELOCs), and business credit lines.

Key Components of a Revolving Credit Arrangement

- Credit Limit: The maximum amount you may draw at any given time. Limits are set based on credit score, income, and debt‑to‑income ratio.

- Interest Rate: Usually variable, tied to an index such as the prime rate. Interest accrues only on the outstanding balance, not on the unused portion.

- Minimum Payment: Typically a percentage of the current balance or a fixed dollar amount, whichever is higher.

- Fees: May include annual fees, transaction fees, or inactivity fees if the line remains unused for a prolonged period.

How Does a Revolving Line of Credit Differ From a Credit Card?

While both products share the revolving nature, there are several distinctions that affect cost, accessibility, and usage patterns.

Purpose and Flexibility

Credit cards are designed primarily for everyday purchases and are integrated with merchant networks, rewards programs, and consumer protections like fraud liability limits. A personal revolving line of credit, on the other hand, is often accessed via checks, online transfers, or a debit card linked to the account. This makes it more suitable for larger, less frequent expenses such as home repairs or tuition.

Interest Calculation

Credit cards typically calculate interest on a daily basis and apply it if you carry a balance beyond the grace period. Revolving lines of credit may calculate interest monthly, and some lenders offer interest‑only payment options during the draw period, especially for HELOCs. Understanding the exact method is crucial because it influences the total cost of borrowing.

Credit Reporting

Both products report balances and payment history to credit bureaus, but a revolving line of credit may have a different impact on your credit utilization ratio. Since the limit is often higher than that of a typical credit card, using a small portion of the line can improve your utilization score.

Benefits of Using a Revolving Line of Credit

When managed prudently, a revolver offers several tangible advantages over other borrowing options.

Cash Flow Management

The ability to draw only what you need, when you need it, provides a cushion for unexpected expenses. This can prevent the need for high‑interest payday loans or the stress of depleting savings.

Cost Efficiency

Because interest is charged only on the amount you actually use, you avoid paying interest on unused credit. For borrowers who can pay down balances quickly, the effective cost can be lower than that of a fixed‑rate installment loan.

Credit Building

Consistent on‑time payments demonstrate responsible credit behavior, which can boost your credit score over time. A well‑managed revolving line can also increase your total available credit, thereby lowering your overall utilization ratio.

Convenient Access

Most lenders provide online portals or mobile apps where you can transfer funds directly to your checking account, write checks, or use a linked debit card. For example, learning how to pay credit card with bank transfer quickly and securely shares similar steps that apply to moving money from a revolving line to cover other obligations.

Potential Risks and Drawbacks

Flexibility can become a double‑edged sword if discipline wanes.

Variable Interest Rates

Since most revolving lines carry variable rates, your monthly interest expense can rise unexpectedly if the underlying benchmark rate increases. Monitoring rate changes is essential to avoid surprise cost spikes.

Minimum Payment Trap

Paying only the minimum amount each month extends the repayment period and dramatically increases the total interest paid. A simple calculation can reveal how much more you’ll pay over the life of the debt if you stick to the minimum.

Over‑Borrowing Temptation

Having a large credit limit readily available may encourage unnecessary spending. This is why setting personal limits below the lender‑approved amount can be an effective self‑control strategy.

Fee Accumulation

Annual fees, transaction fees, or inactivity fees can erode the financial benefit of a revolving line if the account is not used wisely. Review the fee schedule before committing.

When Is a Revolving Line of Credit the Right Choice?

Not every financial situation calls for a revolver. Below are scenarios where it often makes sense.

- Irregular Income Streams: Freelancers or contract workers who experience fluctuating cash flow can use a line to smooth out gaps between invoices.

- Planned Large Purchases: Home renovations, vehicle repairs, or tuition payments that are spread over months benefit from the ability to draw funds as needed.

- Emergency Reserve: A revolving line can serve as a backup to an emergency fund, offering quick access without the need to liquidate investments.

If your primary goal is to earn rewards or enjoy purchase protection, a credit card may still be the better vehicle. However, for pure borrowing flexibility, a personal revolving line often wins on cost and convenience.

Steps to Secure and Manage a Revolving Line of Credit

Approaching a revolver responsibly begins with preparation and continues with disciplined usage.

1. Assess Your Credit Profile

Before applying, obtain a copy of your credit report and verify your score. Lenders typically require a good to excellent credit rating for the most favorable terms. If you spot errors, dispute them early to avoid a lower limit or higher rate.

2. Compare Offers

Interest rates, fees, and draw methods vary widely among banks and credit unions. Use comparison tools and read the fine print. For instance, the article on Understanding the Pentagon Federal Credit Union Card Login Portal illustrates how portal navigation can affect your ability to manage credit products efficiently.

3. Choose the Right Limit

Set a limit that matches your anticipated needs, not your desire to spend. A lower limit reduces the temptation to over‑borrow and often results in a lower annual fee.

4. Establish a Repayment Plan

Even if the lender only requires a minimum payment, design a personal schedule that pays off the balance faster. Automate payments to avoid missed due dates.

5. Monitor Utilization and Rates

Regularly log into your online account to track outstanding balances, interest accrual, and any rate adjustments. Many banks send alerts when you approach a certain utilization threshold.

6. Review Fees Annually

At the end of each year, evaluate whether the fees you’re paying are justified by the benefits you receive. If not, consider switching to a product with lower costs.

Real‑World Example: A Small Business Owner’s Experience

Maria, a boutique bakery owner, needed a reliable source of working capital to purchase seasonal ingredients and upgrade equipment. She applied for a $25,000 revolving line of credit from her local bank. After approval, she used $8,000 during a busy holiday season, repaid $4,500 within two months, and then drew an additional $5,000 for new ovens. Because she only paid interest on the outstanding balances and kept the line open for future needs, Maria avoided taking out a higher‑interest term loan that would have required a lump‑sum payment upfront.

Maria’s story highlights three core advantages:

- Flexibility to respond to fluctuating cash flow.

- Interest savings by borrowing only what she needed.

- Improved credit profile through consistent, on‑time payments.

Common Misconceptions About Revolving Credit

Despite its prevalence, many borrowers hold inaccurate beliefs that can lead to costly mistakes.

“If I have a line, I don’t need an emergency fund.”

A line of credit is a borrowing tool, not a savings instrument. Relying solely on credit can result in debt accumulation if emergencies occur repeatedly.

“Interest rates are always lower than credit cards.”

While personal revolving lines often have lower rates, some credit cards—especially those with promotional 0% APR offers—can be cheaper for short‑term balances. Always compare the APR and any introductory terms.

“I can’t be charged fees if I don’t use the line.”

Many lenders impose inactivity fees after a set period of non‑use. Review the agreement to understand these conditions.

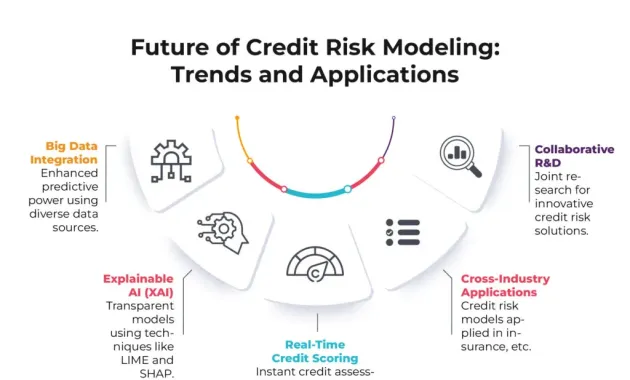

Future Trends: How Revolving Credit Is Evolving

Technology and regulation are reshaping the landscape of revolving credit.

Digital Platforms and Instant Access

Fintech companies now offer app‑based revolving lines that approve and fund draws within minutes. These platforms often use alternative data—such as utility payments—to assess creditworthiness, broadening access for under‑banked consumers.

Dynamic Pricing Models

Some lenders experiment with AI‑driven pricing that adjusts interest rates based on real‑time risk assessment, potentially offering lower rates to borrowers who demonstrate disciplined repayment behavior.

Integrated Financial Management

Future banking portals may combine budgeting tools, alerts, and automatic repayment options, making it easier for users to stay on top of balances and avoid unnecessary interest. Learning to stop credit card interest accumulation shares principles that will apply to managing revolving lines as well.

Staying informed about these developments can help you choose a product that aligns with both your current needs and long‑term financial goals.

In summary, a revolving line of credit is a versatile borrowing solution that provides on‑demand access to funds, interest‑only charges on the amount used, and the ability to rebuild credit with responsible use. By evaluating your financial situation, comparing offers, and implementing disciplined repayment habits, you can leverage this tool to smooth cash flow, fund strategic purchases, and maintain a healthy credit profile.