Table of Contents

- Understanding the Risks of Online Shopping

- Data Interception

- Phishing and Spoofed Sites

- Card‑Not‑Present Fraud

- Core Protection Features Built Into Credit Cards

- Tokenization

- EMV 3‑D Secure (3DS)

- Real‑Time Fraud Monitoring

- Zero‑Liability Policies

- Virtual Card Numbers

- Choosing the Right Card for Maximum Online Safety

- Issuer Reputation and Security Track Record

- Availability of 3DS and Tokenization Support

- Rewards and Benefits Aligned With Shopping

- Customer Service Accessibility

- Compatibility With Digital Wallets

- Practical Steps to Secure Your Online Purchases

- Use Strong, Unique Passwords for Retail Accounts

- Enable Account Alerts

- Shop on Secure Websites Only

- Leverage Virtual Card Numbers When Available

- Regularly Review Statements

- Keep Your Device Software Updated

- Know the Dispute Process

- Debunking Common Myths About Online Card Security

- Myth: “If a site is popular, it’s safe.”

- Myth: “Credit cards are less secure than debit cards.”

- Myth: “I don’t need to monitor my account if I have alerts.”

- Myth: “Using a digital wallet removes all risk.”

- Integrating Card Security Into Your Broader Digital Lifestyle

- Synchronize Security Settings Across Accounts

- Leverage Account Aggregators Wisely

- Stay Informed About New Threats

Credit cards for online shopping protection have become a cornerstone of safe e‑commerce. From the moment a shopper clicks “Buy Now,” a series of invisible defenses activate, ready to defend against fraud, data breaches, and unauthorized charges. Understanding these safeguards helps consumers shop confidently, knowing their financial information is guarded by layers of technology and policy.

In today’s digital marketplace, threats evolve as quickly as the platforms that host them. Cybercriminals employ phishing emails, fake websites, and card‑skimming scripts to capture sensitive data. Yet, credit card issuers continuously upgrade their tools—tokenization, real‑time alerts, and zero‑liability policies—to stay ahead of the curve. The result is a dynamic relationship where both the cardholder and the issuer share responsibility for a secure transaction.

This article walks through the mechanisms that make credit cards a reliable shield for online purchases, offers practical steps to maximize protection, and clarifies common misconceptions. By the end, readers will have a clear roadmap for leveraging their card’s features, choosing the right product, and handling disputes efficiently.

Understanding the Risks of Online Shopping

Before diving into protection methods, it’s essential to recognize the typical vulnerabilities shoppers face.

Data Interception

When a shopper enters card details on a website, the information travels across the internet. If the site lacks proper encryption (HTTPS), data can be intercepted by malicious actors. Even on encrypted sites, compromised browsers or malicious extensions can expose keystrokes.

Phishing and Spoofed Sites

Phishing emails often masquerade as legitimate retailers, directing users to look‑alike domains that harvest credentials. These fake pages may appear authentic, complete with logos and design elements, but they send data straight to criminals.

Card‑Not‑Present Fraud

Unlike in‑store transactions, online purchases do not require the physical card, making it easier for fraudsters to use stolen numbers. Without the card present, merchants rely on other verification methods, which can sometimes be bypassed.

Core Protection Features Built Into Credit Cards

Modern credit cards embed several layers of security designed specifically for online commerce.

Tokenization

When a shopper saves a card for future purchases, the issuer replaces the actual number with a unique token. This token is useless to attackers because it cannot be reverse‑engineered into the original card number. Tokenization is widely adopted by major wallets such as Apple Pay and Google Pay.

EMV 3‑D Secure (3DS)

Three‑Domain Secure adds an authentication step that requires the cardholder to confirm the purchase via a password, biometric, or one‑time code. While some users find the extra step cumbersome, it dramatically reduces fraud rates by confirming the legitimate owner’s presence.

Real‑Time Fraud Monitoring

Issuers employ machine‑learning models that analyze purchase patterns, location data, and device fingerprints. When an anomaly is detected—such as a high‑value purchase from an unfamiliar country—the system may block the transaction or send an immediate alert to the cardholder.

Zero‑Liability Policies

Most major credit cards guarantee that cardholders will not be held responsible for unauthorized transactions, provided the fraud is reported promptly. This policy encourages consumers to act quickly without fearing financial loss.

Virtual Card Numbers

Some banks issue temporary, single‑use numbers that can be used for a specific merchant. If a virtual number is compromised, it cannot be reused, limiting exposure to a single transaction.

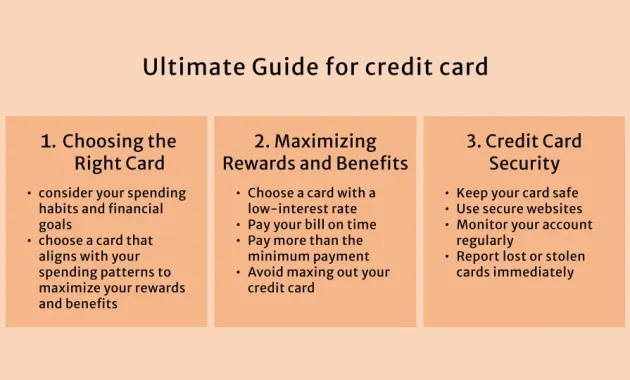

Choosing the Right Card for Maximum Online Safety

Selecting a credit card that aligns with your online shopping habits can amplify protection. Below are key criteria to evaluate.

Issuer Reputation and Security Track Record

Research the issuer’s history of handling breaches and fraud claims. Cards from institutions that quickly roll out security patches and provide transparent communication tend to offer smoother dispute resolutions.

Availability of 3DS and Tokenization Support

Confirm that the card supports both EMV 3‑D Secure and tokenization. While most premium cards do, some low‑cost options may lack one of these features, leaving a gap in defense.

Rewards and Benefits Aligned With Shopping

Cards that offer higher cash‑back or points on e‑commerce purchases provide added value. For example, the best credit cards for points can turn everyday spending into travel rewards, while still delivering robust security.

Customer Service Accessibility

In the event of fraud, quick access to knowledgeable support can reduce resolution time. Look for issuers that provide 24/7 chat, dedicated fraud hotlines, and clear online dispute portals.

Compatibility With Digital Wallets

Cards that integrate seamlessly with Apple Pay, Google Pay, or Samsung Pay benefit from additional biometric safeguards and tokenized transactions, further reducing exposure.

Practical Steps to Secure Your Online Purchases

Even the most secure card requires responsible usage. Follow these actionable tips to tighten your defenses.

Use Strong, Unique Passwords for Retail Accounts

Never reuse passwords across shopping sites. A password manager can generate complex strings and store them securely, preventing credential stuffing attacks.

Enable Account Alerts

Most issuers let you set up instant notifications for any transaction. Activate push or SMS alerts so you can spot suspicious activity within minutes.

Shop on Secure Websites Only

Verify that the site’s URL begins with “https://” and displays a padlock icon. Avoid clicking links from unsolicited emails; instead, type the retailer’s address directly into your browser.

Leverage Virtual Card Numbers When Available

If your bank offers virtual numbers, generate a new one for each merchant. This isolates your primary account number and limits the impact of a breach.

Regularly Review Statements

Set a weekly reminder to scan your credit card statements. Small, unauthorized charges often appear before larger fraud, giving you a chance to dispute early.

Keep Your Device Software Updated

Operating system and browser updates frequently contain patches for known vulnerabilities. Maintaining up‑to‑date software reduces the risk of malware capturing your keystrokes.

Know the Dispute Process

Should fraud occur, contact your issuer immediately via the phone number on the back of your card. Follow up with a written dispute if required, and keep records of all communications.

Debunking Common Myths About Online Card Security

Misconceptions can lead shoppers to either over‑trust or under‑utilize their card’s protections.

Myth: “If a site is popular, it’s safe.”

Popularity does not guarantee security. Even large retailers have suffered data breaches (e.g., the 2023 incident at a major fashion outlet). Always verify encryption and use additional verification steps like 3DS.

Myth: “Credit cards are less secure than debit cards.”

Credit cards actually offer stronger consumer protection because of zero‑liability policies and the ability to dispute charges without impacting your bank balance directly.

Myth: “I don’t need to monitor my account if I have alerts.”

Alerts are valuable, but they may be delayed or filtered. Periodic manual reviews catch anomalies that automated systems might miss.

Myth: “Using a digital wallet removes all risk.”

Digital wallets enhance security but are not infallible. If a device is compromised, attackers could still initiate transactions using the stored tokenized credentials.

Integrating Card Security Into Your Broader Digital Lifestyle

Online shopping is just one facet of a digital life that includes banking, entertainment, and social media. Aligning your credit card security practices with overall digital hygiene creates a cohesive defense strategy.

Synchronize Security Settings Across Accounts

Use the same two‑factor authentication (2FA) method for your email, bank, and shopping accounts. This reduces the chance of a single point of failure.

Leverage Account Aggregators Wisely

Tools that consolidate financial data can simplify monitoring but require granting access to sensitive information. Choose aggregators with strong encryption and transparent privacy policies.

Stay Informed About New Threats

Subscribe to security newsletters from reputable sources. Awareness of emerging scams, such as deep‑fake phishing calls, enables you to respond proactively.

For a deeper look at managing credit card access securely, the MySynchrony Credit Card login guide offers step‑by‑step instructions that complement the protective measures discussed here.

Balancing convenience and safety is an ongoing process. By choosing a card equipped with tokenization, 3DS, and robust fraud monitoring, and by adopting disciplined shopping habits, you create a resilient shield against the evolving landscape of online fraud.

Ultimately, the confidence to shop online stems from a partnership between the issuer’s technology and the cardholder’s vigilance. When both sides stay engaged, the digital marketplace remains a place where transactions are not only swift and convenient but also securely protected.