Table of Contents

- What Does a Temporary Freeze Actually Do?

- Key Features of a Freeze

- When Is a Temporary Freeze the Right Choice?

- Lost or Stolen Card (Before Reporting

- Traveling Abroad

- Suspicious Activity Detected

- Managing Recurring Subscriptions

- Step‑by‑Step Guide to Freeze Your Credit Card

- 1. Log Into Your Online Account or Mobile App

- 2. Locate the “Security” or “Card Management” Section

- 3. Choose the “Freeze Card” or “Lock Card” Option

- 4. Confirm the Freeze

- 5. Verify the Freeze

- 6. Unfreeze When Needed

- Special Considerations for Different Issuers

- Bank of America

- Chase

- Discover

- Synchrony

- Managing Your Account After a Freeze

- Set Up Real‑Time Alerts

- Check Recurring Payments

- Maintain a Backup Payment Method

- Potential Pitfalls and How to Avoid Them

- Assuming All Transactions Are Blocked

- Forgetting to Unfreeze

- Overlooking Fees on Premium Cards

- Not Updating Your Credit Utilization

- Integrating the Freeze Into a Broader Credit Strategy

- Combining Freeze With Budgeting Apps

- Using Freeze During Major Life Changes

- Educating Family Members

Freezing a credit card temporarily can feel like hitting the pause button on a potentially risky situation. Whether you’ve misplaced your wallet, noticed suspicious activity, or simply want a short‑term safeguard while traveling, the ability to lock your account without closing it altogether offers peace of mind and flexibility. This article walks you through the entire process, from understanding the mechanics to managing your account afterward, ensuring you stay in control without missing a beat.

In the modern banking landscape, most issuers provide an online or mobile option to freeze (sometimes called “lock”) a card with just a few taps. The feature is distinct from a permanent cancellation; it merely blocks new purchases, cash advances, and sometimes even recurring payments, while keeping your account open and your credit line intact. Knowing when and how to use this tool can save you from fraudulent charges and the hassle of disputing them later.

Below, we’ll explore the reasons you might consider a temporary freeze, the exact steps required across different platforms, and the best practices to keep your credit healthy while the card sits in limbo.

What Does a Temporary Freeze Actually Do?

A temporary freeze is a reversible security measure. When you activate it, the issuer disables the card’s magnetic stripe, chip, and contactless functions. Most systems also block online transactions, though some may still allow recurring subscriptions unless you specifically pause them. Importantly, the freeze does not affect your credit score, because the account remains open and the credit limit stays available.

Key Features of a Freeze

- Immediate effect: Transactions are declined within seconds of activation.

- Reversible: You can unfreeze the card instantly via the same channel.

- No impact on credit history: The account stays active, preserving your credit utilization ratio.

- Potential fee considerations: Most issuers offer the service for free, but some premium cards may have limits.

When Is a Temporary Freeze the Right Choice?

Identifying the right moment to freeze your card can prevent unnecessary stress. Here are common scenarios where a temporary lock makes sense.

Lost or Stolen Card (Before Reporting

If you misplace your wallet and are unsure whether the card is truly missing, a freeze buys you time. You can still locate the card and reactivate it if found, without the need for a full replacement.

Traveling Abroad

International trips often trigger fraud alerts due to unfamiliar merchants. Freezing the card while you’re in a low‑risk area—then unfreezing it once you reach your destination—helps avoid false declines.

Suspicious Activity Detected

When you notice unauthorized charges, a quick freeze halts further abuse while you investigate. Pair this action with a formal dispute to protect yourself fully.

Managing Recurring Subscriptions

If you plan to pause a subscription service (e.g., a gym membership during a vacation), freezing the card can prevent the next billing cycle from going through. Remember to check if the merchant processes payments via tokenization, which may bypass a simple freeze.

Step‑by‑Step Guide to Freeze Your Credit Card

The exact steps vary by issuer, but most follow a similar pattern. Below is a generalized process that applies to major banks and credit unions. Adjust the instructions according to your specific provider’s interface.

1. Log Into Your Online Account or Mobile App

Start by signing in to the issuer’s website or official mobile application. If you haven’t set up online access yet, you’ll need to register using your card number, Social Security number, and a secure password.

2. Locate the “Security” or “Card Management” Section

Look for a menu labeled “Security Settings,” “Card Services,” or “Manage Cards.” This area typically houses options for activating, deactivating, or replacing cards.

3. Choose the “Freeze Card” or “Lock Card” Option

Click the button that reads “Freeze Card,” “Lock Card,” or something similar. A confirmation prompt will appear, explaining that the card will be unusable for purchases and cash advances.

4. Confirm the Freeze

Confirm your choice. Most platforms provide an instant visual cue—often a red lock icon or a status change from “Active” to “Frozen.” Some issuers also send an email or push notification confirming the action.

5. Verify the Freeze

To be absolutely certain, attempt a small online purchase (or use a test transaction if your issuer offers a sandbox environment). The transaction should be declined with a message indicating the card is frozen.

6. Unfreeze When Needed

When you’re ready to use the card again, return to the same “Security” section and select “Unfreeze” or “Unlock.” The change is typically instantaneous, allowing you to resume normal activity without waiting for a new card.

Special Considerations for Different Issuers

While the core steps remain similar, each issuer may have unique nuances. Below are brief notes on some common providers.

Bank of America

Log in to the online banking portal, navigate to “Account Services,” and toggle the “Card Lock” switch. The feature can also be accessed via the “Bank of America” mobile app under “Card Controls.”

Chase

Use the “Secure Account” feature within the Chase mobile app. Once you locate your credit card, slide the “Freeze Card” toggle. An SMS alert confirms the status change.

Discover

Discover’s “Freeze It” button appears on the account summary page after logging in. The freeze is applied across all Discover cards linked to that profile.

Synchrony

For store‑specific cards managed by Synchrony, the “Freeze Card” option resides under “Account Settings.” If you need guidance, refer to the Unlock Seamless Access to MySynchrony Credit Card Login – The Complete Guide for detailed navigation tips.

Managing Your Account After a Freeze

Freezing a card does not absolve you from monitoring your account. Continue to review statements, set up alerts, and verify that no unauthorized charges slip through.

Set Up Real‑Time Alerts

Enable push or email notifications for any attempted transactions. Even if the card is frozen, an attempted purchase will generate an alert, giving you insight into potential fraud attempts.

Check Recurring Payments

Some merchants use tokenized data that may still process even when the physical card is locked. Contact the service provider to temporarily suspend the billing cycle if necessary.

Maintain a Backup Payment Method

Having an alternative card or a linked checking account ensures you can cover essential expenses while your primary card remains frozen.

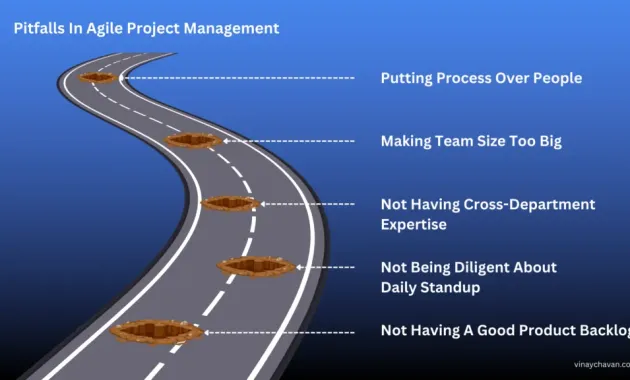

Potential Pitfalls and How to Avoid Them

Although a temporary freeze is straightforward, a few common mistakes can reduce its effectiveness.

Assuming All Transactions Are Blocked

Tokenized recurring payments, as mentioned earlier, may bypass a simple freeze. Always verify with the merchant whether the freeze will stop future charges.

Forgetting to Unfreeze

It’s easy to lose track of a frozen card, especially if you set the freeze weeks in advance. Set a calendar reminder or use the issuer’s “Scheduled Unfreeze” feature (available with some banks) to automatically reactivate the card at a chosen date.

Overlooking Fees on Premium Cards

While most basic cards offer free freezes, some premium or rewards cards limit the number of free freezes per year, charging a small fee for additional locks. Review your card’s terms to avoid surprise costs.

Not Updating Your Credit Utilization

If you freeze a card that carries a high credit limit, your overall available credit drops in the eyes of scoring models. This can momentarily raise your credit utilization ratio, potentially affecting your score if you carry balances on other cards. Monitor your utilization and consider keeping other cards active if you’re close to the 30 % threshold.

Integrating the Freeze Into a Broader Credit Strategy

A temporary freeze can be one component of a comprehensive credit management plan. For example, if you’re working toward paying down debt, you might freeze a card to reduce temptation while using a credit card payoff calculator to track progress. Combining behavioral safeguards with financial tools helps you stay disciplined and avoid new charges that could derail your repayment schedule.

Combining Freeze With Budgeting Apps

Link your card to budgeting software that flags any attempted spend during a freeze. The software can then send a separate alert, reinforcing your commitment to avoid unnecessary purchases.

Using Freeze During Major Life Changes

Life events—such as moving, starting a new job, or returning to school—often bring a surge of new expenses. Temporarily freezing discretionary cards can help you focus on essential spending during the transition.

Educating Family Members

If you share an authorized user account, inform them about the freeze feature. A coordinated approach ensures that no one unintentionally tries to use the card while it’s locked.

By treating the temporary freeze as both a security measure and a behavioral tool, you can protect your finances while reinforcing good spending habits.

In summary, freezing a credit card temporarily is a simple yet powerful way to safeguard your account against loss, theft, or fraud without sacrificing your credit line. By following the step‑by‑step instructions, staying aware of potential edge cases, and integrating the freeze into a broader financial plan, you can maintain control over your credit health with minimal effort. Remember to monitor your statements, set alerts, and schedule an unfreeze when you’re ready to resume normal use.