Table of Contents

- Understanding the Foundations of Credit Scores

- Choosing the Right Credit Card for Credit Building

- Secured vs. Unsecured Cards

- Key Features to Look For

- Practical Steps to Build Credit Using a Credit Card

- 1. Keep Utilization Low

- 2. Pay On Time, Every Time

- 3. Pay More Than the Minimum

- 4. Let the Card Age

- 5. Monitor Your Credit Reports

- Common Pitfalls and How to Avoid Them

- Maxing Out Your Card

- Applying for Too Many Cards at Once

- Ignoring Statement Closing Dates

- Neglecting to Freeze a Card When Needed

- Integrating Credit Card Use with Broader Financial Goals

- Linking Credit Building to Savings

- Leveraging Rewards Wisely

- Preparing for Major Purchases

- Using Credit Card Payoff Tools

Building a credit history can feel like assembling a puzzle without a picture on the box. The first piece you often overlook is the humble credit card. When used responsibly, a credit card becomes a powerful tool that signals reliability to lenders, landlords, and even employers. This article walks you through the practical ways a credit card can help you establish and improve your credit profile.

Imagine a new graduate named Maya who just moved to a new city. She needs a place to live, a car loan, and eventually a mortgage. With no credit history, each of those goals appears out of reach. By selecting the right credit card and following a disciplined strategy, Maya can turn that blank slate into a credit record that opens doors. The process is systematic, not magical, and the steps outlined here work for anyone willing to stay consistent.

Below, we break down the essential concepts, actionable steps, and common mistakes to avoid. By the end, you’ll have a clear roadmap that you can start applying today.

Understanding the Foundations of Credit Scores

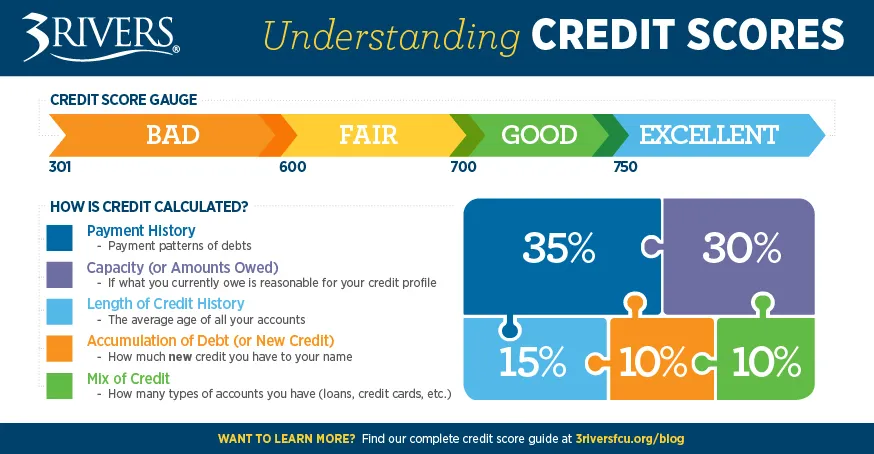

Before you can use a credit card to build credit, you need to know what drives a credit score. The three major credit bureaus—Equifax, Experian, and TransUnion—calculate scores using five primary factors:

- Payment History (35%): Timely payments are the single most important factor.

- Credit Utilization (30%): The ratio of your outstanding balances to your total credit limits.

- Length of Credit History (15%): The age of your oldest account and the average age of all accounts.

- Credit Mix (10%): A blend of revolving (credit cards) and installment (loans) accounts.

- New Credit (10%): Recent inquiries and newly opened accounts.

Each factor interacts with the others, but a credit card influences all of them, especially payment history, utilization, and length of credit history. Understanding this layout helps you prioritize actions that move the needle the most.

Choosing the Right Credit Card for Credit Building

Secured vs. Unsecured Cards

For newcomers, a secured credit card is often the safest entry point. You deposit a refundable amount—usually equal to your credit limit—and the issuer reports your activity to the bureaus. Over time, responsible use can qualify you for an unsecured card with better rewards and higher limits.

Key Features to Look For

- Low or No Annual Fee: Fees erode the benefit of early credit building.

- Reporting to All Three Bureaus: Guarantees that every positive activity is captured.

- Reasonable Credit Limit: A modest limit reduces temptation to overspend while still allowing utilization management.

- Transparent Terms: Clear information on interest rates and penalties.

When Maya reviewed her options, she chose a secured card with a $500 limit and no annual fee. The card reported to all three bureaus, giving her a solid foundation.

Practical Steps to Build Credit Using a Credit Card

1. Keep Utilization Low

Credit utilization is calculated each month by dividing your balance by your total limit. Aim for a utilization rate below 30%, and ideally under 10%, to signal that you’re not reliant on credit.

For instance, if your limit is $1,000, try to keep the balance under $100. If you need to make larger purchases, consider spreading them across multiple cards or paying down the balance before the statement closes.

To visualize the impact, you might use a credit card payoff calculator to project how different payment amounts affect both interest and utilization.

2. Pay On Time, Every Time

Payment history carries the most weight. Set up automatic payments for at least the minimum amount to avoid missed deadlines. If possible, schedule the payment a few days before the due date to account for processing delays.

Missing a single payment can cause a score drop of 50 to 100 points, wiping out months of progress. Maya programmed a $20 automatic payment each month, which covered her minimum and kept her on track.

3. Pay More Than the Minimum

While paying the minimum prevents late fees, it also prolongs the balance and can keep utilization high. Paying the full statement balance each month eliminates interest and demonstrates financial responsibility.

If you can’t pay in full, aim to reduce the balance by at least 20% each billing cycle. This strategy speeds up credit building and reduces debt.

4. Let the Card Age

Credit history length improves slowly. Resist the urge to close an old account once you graduate to a better card; the account’s age continues to benefit your score. Closing a card reduces overall available credit, which can spike utilization.

When Maya received an unsecured card with a $2,000 limit, she kept her secured card active, using it occasionally for small recurring charges and paying them off immediately. This kept both accounts “alive” and contributed positively to her average age of credit.

5. Monitor Your Credit Reports

Regularly checking your credit reports helps you spot errors and understand how your actions affect your score. You’re entitled to one free report per year from each bureau via AnnualCreditReport.com.

Many credit card issuers also provide free credit score updates within their online portals. Use these tools to track progress and adjust your strategy as needed.

Common Pitfalls and How to Avoid Them

Maxing Out Your Card

Running a high balance not only hurts utilization but also signals risk to lenders. The article The Hidden Costs of Maxing Out Your Credit Card explains how quickly interest can accumulate and how it can stall credit growth. Keep spending well below your limit and pay down balances promptly.

Applying for Too Many Cards at Once

Each credit inquiry creates a “hard pull,” which can dip your score by a few points. While a handful of inquiries over several months is manageable, a flurry of applications can raise red flags. For a deeper look at balancing benefits and risks, read How Many Credit Cards Is Too Many?.

Ignoring Statement Closing Dates

Credit bureaus often capture balances on the statement closing date, not the payment due date. If you pay after the statement closes, a high balance may still be reported. To keep reported utilization low, aim to pay off or substantially reduce the balance before the closing date.

Neglecting to Freeze a Card When Needed

In rare cases, you may need to temporarily freeze a card to prevent fraud or stop accidental spending. Freezing does not affect your credit history but can protect you from unauthorized charges. The guide How to Freeze Your Credit Card Temporarily offers a quick walkthrough.

Integrating Credit Card Use with Broader Financial Goals

Linking Credit Building to Savings

While a credit card helps you establish credit, it should not replace a savings habit. Set aside a portion of each paycheck for an emergency fund. This buffer reduces reliance on credit for unexpected expenses, which can otherwise harm utilization.

Leveraging Rewards Wisely

Once you have a stable credit profile, consider cards that offer cash back or travel points. However, never let rewards dictate spending. Only charge amounts you can pay in full each month.

Preparing for Major Purchases

When you plan to apply for a mortgage or auto loan, ensure your credit utilization is low and your payment history is spotless for at least six months. Lenders often request a credit report from the past 12 months, so maintain consistent behavior throughout that window.

Using Credit Card Payoff Tools

Advanced calculators can help you model different repayment scenarios, showing how faster payoff improves both your credit score and financial health. These tools are especially useful if you carry a balance for a short period while you transition between cards.

By following the steps above, Maya gradually saw her credit score climb from an initial 560 to a healthy 720 within 18 months. The disciplined use of her secured and unsecured cards, combined with vigilant monitoring, turned a blank credit file into a robust financial asset.

Building credit with a credit card is less about flashy rewards and more about consistent, responsible behavior. Treat the card as a reporting instrument rather than a free spending source. Over time, the positive data you generate will open doors to better interest rates, larger credit lines, and greater financial flexibility.

Start with a modest, low‑fee card, keep utilization low, pay on time, and let the account age. Monitor your reports, avoid common mistakes, and align your credit strategy with broader financial goals. The path is straightforward; the results are lasting.