Table of Contents

- Understanding How Hotel Credit Cards Generate Free Nights

- Earn Rates and Bonus Categories

- Sign‑up Bonuses as Accelerators

- Redemption Mechanics

- Top 5 Hotel Credit Cards for Free Nights in 2024

- 1. Marriott Bonvoy Brilliant™ American Express® Card

- 2. Hilton Honors American Express Aspire Card

- 3. World of Hyatt Credit Card

- 4. IHG® Rewards Premier Credit Card

- 5. Choice Privileges® Visa Signature® Card

- How to Maximize Free Night Rewards

- Leverage the Sign‑Up Bonus Early

- Concentrate Spending on Hotel Purchases

- Combine Points with Cash for Premium Stays

- Utilize Annual Credits and Free Night Guarantees

- Monitor Redemption Value

- Common Pitfalls to Avoid

- Ignoring Annual Fees

- Letting Points Expire

- Overpaying for Redemption

- Misunderstanding Transfer Options

- Applying for Too Many Cards Simultaneously

- Choosing the Right Card for Your Travel Style

- Frequent Business Traveler

- Leisure Vacationer Who Values Luxury

- Budget‑Conscious Traveler

- Hybrid Traveler

- Putting It All Together: A Sample Yearly Plan

When the phrase “free night” appears on a credit card offer, travelers often picture a spontaneous weekend getaway without spending a dime. In reality, earning those complimentary stays requires a strategic blend of spending, timing, and choosing the right card. This article walks you through the mechanics of hotel credit cards, highlights the top five cards that consistently deliver free nights, and shares practical tips to stretch every point.

Whether you’re a frequent flyer, a business traveler, or someone who simply enjoys occasional vacations, the right hotel credit card can turn everyday purchases into valuable currency. Below, we explore how the system works, which cards stand out in 2024, and how to avoid the hidden costs that can erode your rewards.

Understanding How Hotel Credit Cards Generate Free Nights

Hotel credit cards belong to a broader category of travel rewards cards, but they focus their point‑earning power on a specific brand or portfolio of hotels. The core concept is simple: each dollar spent earns points, and once you accumulate enough points, you can redeem them for a free night at participating properties.

Earn Rates and Bonus Categories

- Base earn rate: Most cards offer a baseline of 1–2 points per $1 spent on all purchases.

- Hotel spend bonus: Spending at the card’s partner hotels typically yields 5–10 points per $1, dramatically accelerating accumulation.

- Travel and dining accelerators: Many cards also provide elevated earn rates on flights, restaurants, and car rentals, adding flexibility for non‑hotel spenders.

Sign‑up Bonuses as Accelerators

Manufacturers frequently attach a large sign‑up bonus (often 50,000–100,000 points) after you meet a minimum spend within the first three months. This bonus can translate to one or more free nights right out of the gate, making the initial decision to apply a crucial moment in your rewards journey.

Redemption Mechanics

Redemption varies by brand. Some programs, like Marriott Bonvoy, use a fixed point chart based on hotel tier, while others, such as Hilton Honors, employ a dynamic pricing model that reflects demand and seasonality. Understanding the specific redemption curve is essential to ensure you’re getting the best value per point.

Top 5 Hotel Credit Cards for Free Nights in 2024

After reviewing earn rates, annual fees, and redemption flexibility, five cards consistently rise to the top for delivering free nights efficiently. Below each card’s core features are broken down, followed by a quick assessment of who benefits most.

1. Marriott Bonvoy Brilliant™ American Express® Card

- Annual fee: $650

- Earn rate: 6 points per $1 at Marriott hotels; 3 points per $1 on all other purchases.

- Sign‑up bonus: 100,000 points after $5,000 spend in the first 3 months.

- Free night guarantee: Automatic free night (up to 50,000 points) after 30 nights in a calendar year.

- Additional perks: Annual $300 Marriott credit, Priority Pass lounge access, and complimentary elite status.

This card shines for travelers who already favor Marriott’s 7,000+ properties worldwide. The high annual fee is offset by the generous free night guarantee and the $300 statement credit that can be applied toward stays or dining at Marriott venues.

2. Hilton Honors American Express Aspire Card

- Annual fee: $450

- Earn rate: 14 points per $1 at Hilton hotels; 7 points per $1 on flights booked directly with airlines or through Amex Travel; 3 points per $1 on all other purchases.

- Sign‑up bonus: 150,000 points after $4,000 spend in the first 3 months.

- Free night benefit: Annual free weekend night award (up to 50,000 points) and a complimentary weekend night after every 40 nights booked.

- Additional perks: Hilton Diamond status, $250 Hilton resort credit, and Priority Pass lounge membership.

For guests who regularly stay at Hilton’s 6,500+ locations, the Aspire card’s high earn rate and regular free night awards make it a powerful tool. The $250 resort credit also adds a tangible cash offset that can fund dining, spa, or other on‑property experiences.

3. World of Hyatt Credit Card

- Annual fee: $95

- Earn rate: 4 points per $1 at Hyatt hotels; 2 points per $1 on dining, airline tickets purchased directly with airlines, and local transit; 1 point per $1 on all other purchases.

- Sign‑up bonus: 30,000 points after $3,000 spend in the first 3 months.

- Free night award: One free night (up to 25,000 points) after you spend $15,000 in a calendar year.

- Additional perks: Automatic Hyatt Discoverist elite status, up to $100 in Hyatt resort credit (after $5,000 spend), and free night when you stay 2 nights and spend $500 in a single booking.

Hyatt’s portfolio is smaller but includes many luxury and boutique properties that often require fewer points for a free night compared to larger chains. The relatively low annual fee and frequent free night eligibility make this card a solid entry point for new reward hunters.

4. IHG® Rewards Premier Credit Card

- Annual fee: $89 (waived first year)

- Earn rate: 10 points per $1 at IHG hotels; 2 points per $1 on travel and dining; 1 point per $1 on all other purchases.

- Sign‑up bonus: 125,000 points after $1,500 spend in the first 3 months.

- Free night benefit: Complimentary night after 10 stays (subject to a 30,000‑point cap).

- Additional perks: Free night each anniversary year, automatic Platinum elite status, and a $5 credit toward IHG restaurant purchases each month.

IGR’s wide global footprint (over 5,900 hotels) and generous sign‑up bonus make it an attractive option for those who travel to both major cities and secondary markets. The free night after 10 stays is particularly valuable for business travelers who log multiple trips annually.

5. Choice Privileges® Visa Signature® Card

- Annual fee: $95

- Earn rate: 5 points per $1 on Choice hotels; 2 points per $1 on travel and dining; 1 point per $1 on all other purchases.

- Sign‑up bonus: 30,000 points after $2,500 spend in the first 3 months.

- Free night benefit: Free night after 15 stays (subject to 20,000‑point cap) and a free night on your cardmember anniversary.

- Additional perks: Complimentary elite status, no foreign transaction fees, and a $25 annual travel credit.

Choice Hotels’ “budget‑friendly” positioning can be a boon for travelers who prioritize cost over brand prestige. The card’s low annual fee, combined with frequent free night eligibility, offers a straightforward path to complimentary stays without a high price tag.

How to Maximize Free Night Rewards

Owning a high‑earning hotel credit card is only part of the equation. To turn points into free nights efficiently, consider the following strategies, each designed to stretch your points further while keeping costs in check.

Leverage the Sign‑Up Bonus Early

Most of the top cards provide a sizable bonus after meeting a relatively modest spend requirement. Align the required spend with your regular expenses—such as upcoming travel bookings, grocery bills, or recurring subscriptions—to hit the threshold without inflating your budget.

Concentrate Spending on Hotel Purchases

Because hotel spend earns the highest points multiplier, book directly through the brand’s website or app whenever possible. This not only guarantees the bonus rate but also often unlocks exclusive member rates that can’t be matched on third‑party platforms.

Combine Points with Cash for Premium Stays

When a property’s point requirement exceeds your balance, many programs allow a “points + cash” redemption. This method can be especially useful for high‑category hotels where the cash component is relatively low compared to the total cost of the stay.

Utilize Annual Credits and Free Night Guarantees

Cards like the Marriott Brilliant™ and Hilton Aspire provide annual statement credits and guaranteed free nights. Keep track of these benefits in a spreadsheet or calendar reminder so you don’t miss out.

Monitor Redemption Value

Free night value can fluctuate dramatically based on location, season, and property tier. A 50,000‑point night at a mid‑range hotel may be worth $250, while the same amount at a luxury resort could exceed $1,000. Use tools like What Is Trip Delay Insurance and How Does It Work? to compare the cash price versus point cost, ensuring you’re extracting the highest cent‑per‑point value.

Common Pitfalls to Avoid

Even seasoned travelers can fall into traps that diminish the value of their hotel credit cards. Below are the most frequent mistakes and how to sidestep them.

Ignoring Annual Fees

High‑fee cards justify their cost through benefits that must be used. If you never travel enough to earn a free night or take advantage of the $300 Marriott credit, the $650 fee becomes a drain on your finances. Perform a simple cost‑benefit analysis: total annual benefits ÷ fee should exceed 1.0 to be worthwhile.

Letting Points Expire

Most hotel loyalty programs keep points active as long as the account has qualifying activity at least once every 24 months. Schedule a small recurring expense—like a monthly grocery purchase on your hotel card—to keep the account alive.

Overpaying for Redemption

Dynamic pricing can make a free night cost more points during peak seasons. If flexibility allows, book off‑peak dates or consider a different brand within the same portfolio that offers a lower point requirement.

Misunderstanding Transfer Options

Some cards permit point transfers to airline partners, but the conversion rates are often unfavorable for hotel stays. Before transferring, calculate the equivalent cash value to ensure you’re not losing more than you gain.

Applying for Too Many Cards Simultaneously

Frequent credit inquiries can temporarily lower your credit score, affecting future loan eligibility. If you’re unsure which card aligns best with your travel pattern, start with one that matches your most frequent hotel brand and evaluate after six months. For a deeper look at managing multiple cards, see How Many Credit Cards Is Too Many? A Deep Dive Into Balancing Benefits and Risks.

Choosing the Right Card for Your Travel Style

Every traveler’s profile is different. Below, we outline three common travel archetypes and recommend the most suitable hotel credit card for each.

Frequent Business Traveler

Business travelers often accumulate numerous stays across multiple brands due to corporate travel policies. The Hilton Aspire card’s high earn rate on both hotel and airline purchases, combined with automatic Diamond status, delivers consistent value. The annual $250 resort credit can offset incidental expenses such as Wi‑Fi or meeting room fees.

Leisure Vacationer Who Values Luxury

If your priority is staying at upscale properties, the Marriott Brilliant™ card’s 6‑point hotel multiplier and free night guarantee after 30 nights make it a strong contender. Marriott’s luxury portfolio includes St. Regis, Ritz‑Carlton, and Edition hotels, where points are often worth more than $200 per night.

Budget‑Conscious Traveler

For those who prefer affordable accommodations without sacrificing rewards, the World of Hyatt and Choice Privileges cards provide a balanced approach. Both have modest annual fees, solid earn rates, and free night awards that can be redeemed at mid‑tier properties for less than $150 in cash value.

Hybrid Traveler

Many people fall between categories, mixing business trips with occasional family vacations. In such cases, a card with flexible earn rates across travel categories—like the IHG Premier card—offers the most adaptability. The high point multiplier at IHG hotels and the ability to earn points on dining and travel purchases ensures that every expense contributes toward a free night.

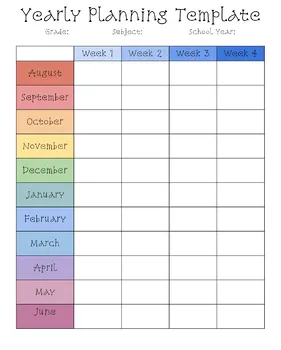

Putting It All Together: A Sample Yearly Plan

To illustrate how the pieces fit, imagine a traveler who spends $20,000 annually on a mix of hotel stays, dining, and general purchases. Here’s a concise roadmap using the Marriott Brilliant™ card as an example:

- Year‑Start: Apply for the card, meet the $5,000 spend requirement within three months, and secure the 100,000‑point sign‑up bonus (equivalent to two free nights at a mid‑range property).

- Monthly Spend: Allocate $1,500 of the $20,000 budget to Marriott stays, earning 6 points per $1 (9,000 points per month).

- Annual Credit: Use the $300 Marriott credit for dining or spa services at any Marriott hotel, effectively reducing out‑of‑pocket costs.

- Free Night Guarantee: After 30 nights, trigger the automatic free night (up to 50,000 points), covering an additional stay without extra points.

- Total Points Earned: Base points from non‑Marriott spend (10,000 points) + Marriott spend (108,000 points) + sign‑up bonus (100,000) = 218,000 points, enough for multiple free nights across various tiers.

This plan demonstrates how strategic allocation of spend and timely use of benefits can produce a year of free or heavily subsidized hotel nights, all while maintaining a manageable budget.

In summary, the path to free hotel stays hinges on selecting a card that aligns with your preferred brand, leveraging sign‑up bonuses, concentrating spend where the multiplier is highest, and staying disciplined about annual fees and point expiration. By following the guidelines above, you can transform routine purchases into unforgettable travel experiences without compromising your financial health.