Table of Contents

- Understanding the Pentagon Federal Credit Union Card Login Portal

- Step‑by‑Step Login Procedure

- Security Features Embedded in the Portal

- Common Issues and How to Resolve Them

- Forgotten Member ID or Password

- Two‑Factor Authentication Failures

- Browser Compatibility Problems

- Account Lockout Due to Multiple Failed Attempts

- Best Practices for Secure Access

- Create a Strong, Unique Password

- Enable Two‑Factor Authentication

- Monitor Account Activity Regularly

- Secure Your Devices

- Beware of Phishing Attempts

- Mobile Access and the Pentagon Federal App

- Setting Up the Mobile App

- Benefits of Mobile Banking

- Maintaining Access Over Time

- Receiving Update Notifications

- Periodic Password Changes

- Reviewing Security Settings

Pentagon Federal Credit Union (PenFed) card login is the gateway to a suite of banking services that members rely on daily. Whether you are checking your balance, transferring funds, or reviewing recent transactions, a reliable and safe login experience is essential. This article walks you through every aspect of the PenFed card login process, from locating the official portal to implementing best‑practice security measures, ensuring that you can manage your finances with confidence.

PenFed members often ask how to avoid the pitfalls that can arise when accessing their accounts online. The answers lie in understanding the structure of the login page, recognizing common error messages, and staying informed about the latest security enhancements. By following the guidance below, you will be equipped to navigate the system efficiently and protect your personal data.

In the sections that follow, we will explore the technical details of the login interface, examine frequent obstacles members encounter, and provide actionable tips for a smoother, safer experience. Let’s begin by examining the fundamentals of the PenFed card login environment.

Understanding the Pentagon Federal Credit Union Card Login Portal

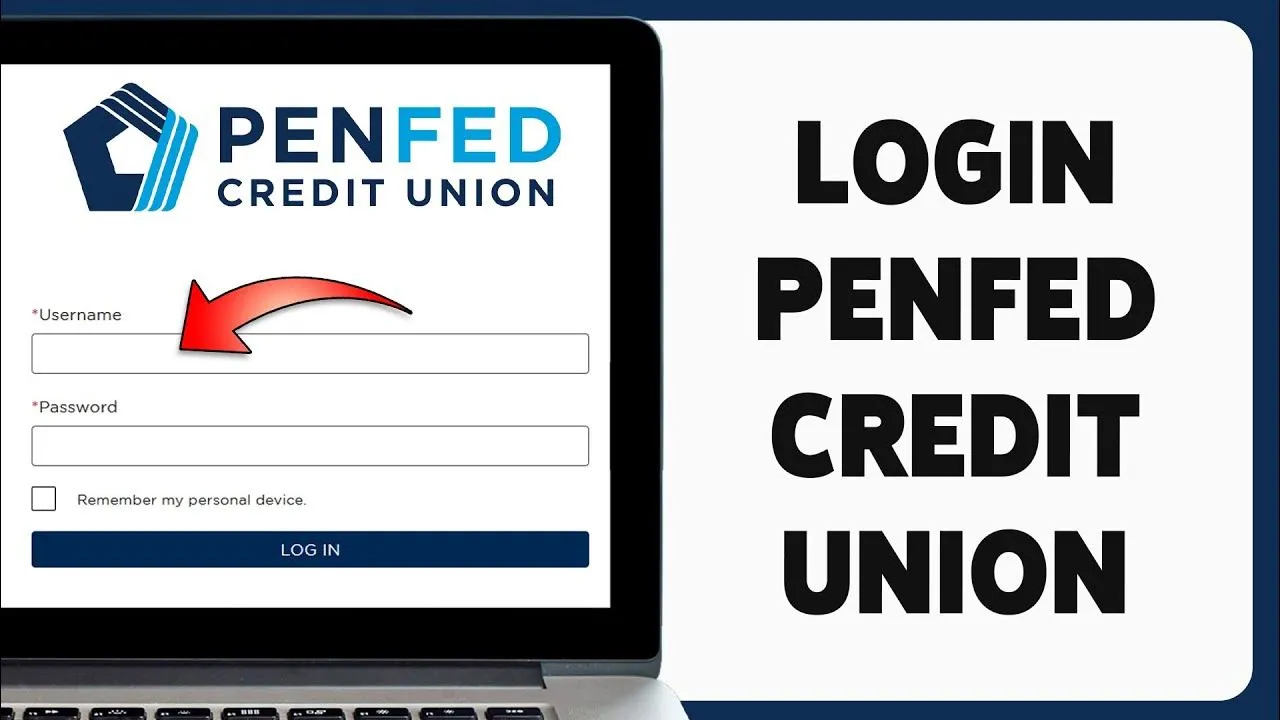

The official PenFed login portal can be accessed via the URL https://www.penfed.org/login. The page is designed with a clean layout, featuring fields for your Member ID (or Username) and Password, as well as options for two‑factor authentication (2FA) and password recovery.

Step‑by‑Step Login Procedure

- Navigate to the official site: Always type the URL directly or use a trusted bookmark. Avoid clicking links from unsolicited emails.

- Enter your Member ID: This is a unique numeric identifier assigned when you opened your PenFed account.

- Provide your password: Passwords must be at least eight characters, include a mix of letters, numbers, and symbols.

- Complete two‑factor authentication if enabled: You will receive a code via SMS, email, or an authenticator app.

- Click “Sign In”: Upon successful verification, you will be redirected to your account dashboard.

PenFed also offers a “Remember Me” checkbox for personal devices, which stores an encrypted token to expedite future logins. However, this feature should be disabled on shared or public computers.

Security Features Embedded in the Portal

The PenFed login page employs several layers of protection:

- SSL Encryption: All data transmitted between your browser and PenFed’s servers is encrypted using HTTPS.

- Device Recognition: The system tracks familiar devices and may prompt additional verification for new ones.

- CAPTCHA Challenges: Automated bots are deterred by occasional visual puzzles.

- Timeouts and Auto‑Logout: Sessions expire after a period of inactivity, reducing exposure risk.

These mechanisms work together to safeguard your credentials and financial information. Understanding them helps you recognize legitimate prompts versus potential phishing attempts.

Common Issues and How to Resolve Them

Even with a robust system, members sometimes encounter obstacles. Below are the most frequently reported problems and practical solutions.

Forgotten Member ID or Password

If you cannot recall your Member ID, use the “Forgot Member ID?” link on the login page. You will be asked to provide personal details such as your Social Security number, date of birth, and the last four digits of your account number. For password resets, select “Forgot Password?” and follow the multi‑step verification process, which may include answering security questions or entering a verification code sent to your registered phone.

Two‑Factor Authentication Failures

When the 2FA code does not arrive, verify that your contact information is up to date in the member profile. Check for network issues that might block SMS or email delivery. If you are using an authenticator app, ensure the time on your device is synchronized, as a drift can cause mismatched codes.

Browser Compatibility Problems

Older browsers may not support the latest encryption standards. PenFed recommends using the most recent versions of Chrome, Firefox, Safari, or Edge. Clearing the browser cache and cookies can also resolve unexpected login errors.

Account Lockout Due to Multiple Failed Attempts

After several incorrect entries, PenFed temporarily locks the account to protect against brute‑force attacks. Wait 30 minutes before trying again, or contact PenFed’s member services to expedite the unlock process.

For members interested in reducing interest charges while managing their accounts online, a helpful resource is the article How to Stop Credit Card Interest Accumulation – Proven Tactics to Keep Your Money Working for You. This guide provides practical steps that complement secure login habits.

Best Practices for Secure Access

Maintaining security extends beyond the login page itself. Implementing the following habits will reinforce your overall protection.

Create a Strong, Unique Password

Never reuse passwords across different financial institutions. Use a password manager to generate and store complex passwords, making it easier to comply with PenFed’s requirements.

Enable Two‑Factor Authentication

Even if 2FA is optional, enabling it adds a critical layer of defense. Choose the method that best fits your lifestyle—SMS, email, or a dedicated authenticator app.

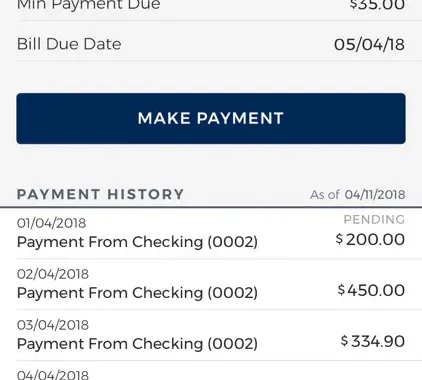

Monitor Account Activity Regularly

Log in at least once a week to review recent transactions. Promptly report any unauthorized activity to PenFed’s fraud department.

Secure Your Devices

Keep operating systems, browsers, and security software up to date. Install reputable antivirus programs and avoid jailbreaking or rooting mobile devices, which can expose them to vulnerabilities.

Beware of Phishing Attempts

Legitimate PenFed communications will never ask for your password or personal data via email. If you receive a suspicious message, forward it to phishing@penfed.org for verification.

Members who wish to avoid unexpected interest rate changes can refer to How to Safely Opt Out of a Credit Card Interest Rate Increase and Keep Your Money Secure, which outlines steps to stay informed and protect your finances.

Mobile Access and the Pentagon Federal App

PenFed offers a dedicated mobile application for iOS and Android devices, providing the same login experience as the web portal, optimized for small screens. The app includes biometric authentication options such as fingerprint or facial recognition, further simplifying secure access.

Setting Up the Mobile App

- Download the official PenFed app from the Apple App Store or Google Play Store.

- Open the app and tap “Sign In”.

- Enter your Member ID and password, then follow the on‑screen prompts to enable biometric login.

- Confirm your identity via the chosen biometric method; the app will store a secure token for future sessions.

Benefits of Mobile Banking

The app allows you to:

- Check balances and transaction history instantly.

- Deposit checks using the camera.

- Transfer funds between PenFed accounts or to external banks.

- Receive real‑time alerts for suspicious activity.

For members who frequently need to move money, the guide How to Pay Credit Card with Bank Transfer Quickly and Securely offers a concise overview of safe transfer methods that can be executed directly from the mobile app.

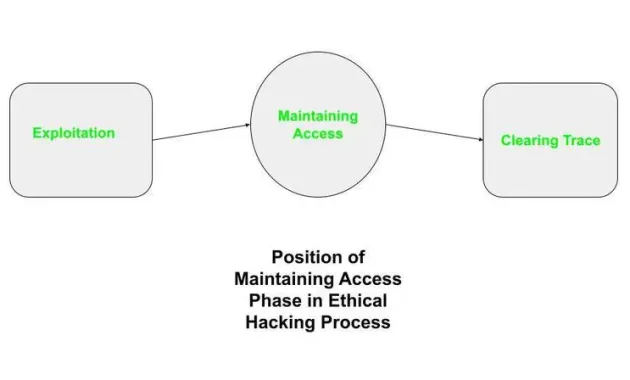

Maintaining Access Over Time

As technology evolves, PenFed periodically updates its login infrastructure. Staying informed about these changes ensures uninterrupted access.

Receiving Update Notifications

PenFed sends email or SMS alerts when major updates are scheduled. These messages typically include the expected downtime and any actions required from members, such as resetting passwords or re‑enrolling in 2FA.

Periodic Password Changes

Even if not mandated, changing your password every six months reduces the risk of credential compromise. Use the “Change Password” option in the account settings menu.

Reviewing Security Settings

Occasionally audit your security preferences, confirming that your recovery email, phone number, and security questions are current. This reduces friction during recovery processes.

For a deeper dive into the mechanics of online credit‑card services, the article Unlock the Full Potential of BB&T Credit Card Online Services – A Comprehensive Guide provides valuable context that parallels many of PenFed’s features.

By adhering to the practices outlined above, you can maintain a seamless and secure connection to your PenFed card account, empowering you to manage your finances efficiently without unnecessary interruptions.