Table of Contents

- What Is an Extended Warranty Benefit?

- How Credit Cards Provide Extended Warranty

- Key Features to Look For

- Length of Extension

- Coverage Scope

- Exclusions and Limitations

- Claims Process Efficiency

- Stackability with Manufacturer Warranty

- Top Credit Cards Offering Extended Warranty Benefits

- How to Activate and Use the Extended Warranty

- Step‑by‑Step Checklist

- Common Pitfalls and Tips to Maximize Value

- Missing the Minimum Purchase Requirement

- Failing to Register the Purchase

- Overlooking Exclusions

- Delaying Claim Filing

- Relying Solely on the Card’s Benefit

- Extended Warranty vs. Manufacturer Warranty: A Comparative View

- Integrating Extended Warranty Into Your Overall Financial Strategy

Credit cards with extended warranty benefits have become a subtle yet powerful tool in the modern consumer’s arsenal. From a new laptop to a high‑end appliance, the extra coverage that many issuers automatically attach to qualifying purchases can extend the manufacturer’s warranty by up to two additional years, often at no extra cost. Understanding how this perk works, which cards offer the most value, and how to maximize it can turn a routine purchase into a risk‑free investment.

In today’s market, where product prices continue to climb and repair costs are unpredictable, the extended warranty feature functions like an invisible safety net. It quietly activates when you swipe your card, eliminating the need to buy third‑party protection plans that usually carry hefty premiums. Yet, many cardholders remain unaware of the specifics—what items qualify, how long the extension lasts, and the steps required to file a claim. This article walks you through the mechanics, highlights the best cards, and offers practical tips to ensure you reap the full benefit.

Before diving into the details, it’s worth noting that the extended warranty benefit is just one piece of the broader credit‑card rewards ecosystem. It often works in tandem with purchase protection, price‑drop refunds, and travel insurance, creating a comprehensive shield around your spending. By the end of this guide, you’ll have a clear roadmap for leveraging this advantage without the guesswork.

What Is an Extended Warranty Benefit?

An extended warranty benefit is a supplemental coverage that automatically lengthens the original manufacturer’s warranty on eligible purchases made with a participating credit card. Typically, the extension adds one or two years beyond the standard warranty period, covering defects in materials or workmanship that arise after the original term expires.

The key differentiator from a traditional extended warranty sold by retailers is that the credit‑card version is usually free of charge, provided the purchase meets the issuer’s criteria. It is also administered directly through the card’s customer service department, meaning you do not need to purchase a separate policy or file paperwork at the point of sale.

How Credit Cards Provide Extended Warranty

Most major issuers embed the extended warranty benefit within their cardmember agreement. When you use the card to buy a qualifying item, the issuer records the transaction, flags it for eligibility, and automatically extends the warranty once the original period ends. The process is invisible to the consumer until a claim is needed.

- Eligibility thresholds: Some cards require a minimum purchase amount (often $100 or $200) for the benefit to activate.

- Covered product categories: Commonly covered items include electronics, appliances, furniture, and tools. Luxury goods, automobiles, and consumables are usually excluded.

- Claim filing: When a defect emerges, the cardholder contacts the issuer’s warranty service line, provides proof of purchase, and the issuer works with the manufacturer or an authorized repair center.

Key Features to Look For

Not all extended warranty programs are created equal. When evaluating cards, consider the following attributes:

Length of Extension

Some cards add a full 24 months, while others provide only 12. A longer extension can be especially valuable for high‑ticket items like refrigerators or home theater systems.

Coverage Scope

Check whether the benefit covers parts only, labor, or both. Full‑service coverage mirrors the original warranty, whereas parts‑only coverage may leave you responsible for repair fees.

Exclusions and Limitations

Read the fine print for exclusions such as accidental damage, normal wear and tear, or pre‑existing conditions. Understanding these limits helps you avoid surprise denials.

Claims Process Efficiency

A streamlined, online claim portal and responsive customer support can turn a potentially frustrating experience into a quick resolution.

Stackability with Manufacturer Warranty

Ideally, the extended warranty should begin as soon as the manufacturer’s warranty ends, creating a seamless transition without gaps in coverage.

Top Credit Cards Offering Extended Warranty Benefits

Below is a concise overview of some popular cards known for robust extended warranty programs. While the list is not exhaustive, it highlights a range of options across different fee structures and reward categories.

- Chase Sapphire Preferred® Card: Extends eligible warranties by up to two years on purchases of $250 or more. The card carries a $95 annual fee and pairs well with travel rewards.

- American Express® Gold Card: Provides a 12‑month extension on qualifying items, with a $250 annual fee. The benefit works alongside Amex’s Purchase Protection for added peace of mind.

- Citibank® Double Cash Card: Offers a 24‑month extension on purchases of $100+ and is a no‑annual‑fee card, making it attractive for budget‑conscious shoppers.

- U.S. Bank Visa® Platinum Card: Adds up to two years of coverage on eligible purchases and includes a low $39 annual fee, plus a suite of travel‑related benefits.

- Discover it® Cash Back: Extends warranties by 12 months on items bought for $100 or more, with a no‑annual‑fee structure and rotating cash‑back categories.

When selecting a card, align the extended warranty feature with your spending habits and existing portfolio. For instance, if you already own a travel‑focused card, adding a no‑annual‑fee card that emphasizes warranty protection can round out your coverage.

How to Activate and Use the Extended Warranty

The activation is typically automatic, but confirming eligibility can prevent future hassles. Follow these steps after each qualifying purchase:

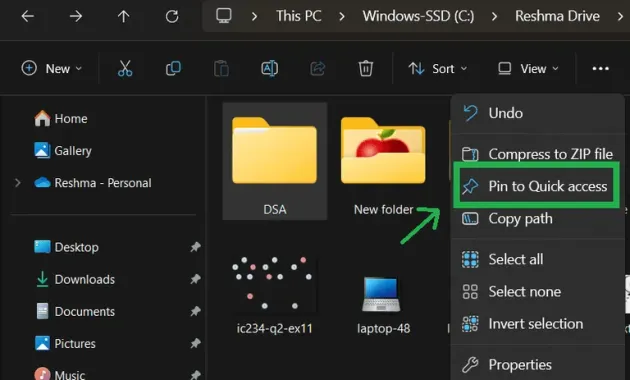

Step‑by‑Step Checklist

- Retain the original receipt and any manufacturer warranty documentation.

- Log into your card’s online portal within 30 days to verify that the transaction is flagged for warranty extension.

- Mark the purchase as “eligible for extended warranty” if the portal offers such an option.

- Store the receipt digitally alongside the warranty confirmation email from your issuer.

When a defect appears after the manufacturer’s warranty expires, contact the card issuer’s warranty department promptly. Provide the purchase receipt, the original warranty card, and a description of the issue. The issuer will either arrange for repair, replacement, or a refund, depending on the manufacturer’s policy.

For a real‑world illustration, consider a homeowner who bought a high‑end dishwasher for $1,200 using a card that adds a 24‑month extension. Two years after the manufacturer’s warranty ended, the dishwasher’s motor failed. Because the homeowner kept the receipt and confirmed the purchase in the online portal, the claim was processed within a week, and the appliance was replaced at no extra cost.

Common Pitfalls and Tips to Maximize Value

Even with an automatic benefit, missteps can undermine the protection. Below are frequent mistakes and how to avoid them.

Missing the Minimum Purchase Requirement

Some cards require a minimum spend per transaction. A $90 purchase on a card with a $100 threshold will not trigger the warranty extension, even if the item is otherwise eligible.

Failing to Register the Purchase

While many issuers automatically track eligible transactions, a handful require you to manually register the purchase within a set window (often 30 days). Skipping this step can result in a denied claim later.

Overlooking Exclusions

Accidental damage is usually excluded. If you anticipate a high‑risk usage scenario (e.g., a portable power tool), consider purchasing a separate accidental‑damage plan to fill the gap.

Delaying Claim Filing

Most extended warranty programs require that you file a claim within a reasonable period after the defect is discovered—typically 30 days. Prompt reporting speeds up resolution and prevents claim denial.

Relying Solely on the Card’s Benefit

If you already have a manufacturer’s extended warranty or a third‑party plan, compare the coverage levels. In some cases, the card’s benefit may be redundant, and you might prefer a plan that includes accidental damage.

Extended Warranty vs. Manufacturer Warranty: A Comparative View

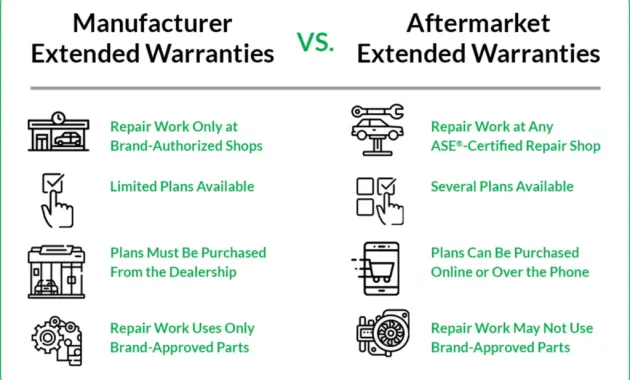

Both warranties serve to protect the consumer, but they differ in origin, scope, and enforcement. The manufacturer’s warranty is built into the product price and typically covers defects for a set period—often one year. It is enforced directly by the maker, meaning you usually return the product to an authorized service center.

The credit‑card extended warranty, by contrast, is a secondary layer that kicks in after the original warranty lapses. It is administered by the card issuer, which acts as an intermediary between you and the manufacturer. While this adds a step, it also means you can often handle claims without physically returning the product, especially when the issuer works directly with the manufacturer’s service network.

For high‑value items, having both layers creates a seamless protection timeline: manufacturer coverage for the first year, followed by the card’s extension for the subsequent one or two years. This continuity can be especially advantageous for products with long‑term depreciation, such as home appliances or electronics.

Integrating Extended Warranty Into Your Overall Financial Strategy

Incorporating the extended warranty benefit into a broader financial plan can enhance your cash‑flow management. By avoiding the cost of separate protection plans, you preserve funds for other priorities, such as paying down higher‑interest debt or investing in retirement accounts.

Moreover, the benefit can indirectly influence other financial decisions. For example, a stronger credit‑card portfolio with robust protection features may improve your overall credit profile, which can be a factor when applying for a mortgage. Understanding this interplay, you might explore resources like how a credit card can affect your mortgage application to see the broader impact of credit‑card choices on major life milestones.

Similarly, linking your credit‑card to digital wallets can simplify tracking of eligible purchases. If you plan to use services like PayPal, a quick read of how to add a credit card to your PayPal account can streamline your shopping experience while ensuring every qualifying transaction is captured.

Finally, maintaining an organized digital record of receipts, warranty extensions, and claim correspondences can be achieved through budgeting apps or cloud storage solutions. This habit not only aids warranty claims but also supports overall financial hygiene.

In summary, credit cards with extended warranty benefits offer a low‑cost, low‑effort way to safeguard your purchases beyond the standard manufacturer coverage. By selecting the right card, staying aware of eligibility criteria, and following best‑practice claim procedures, you can turn everyday spending into a strategic defense against unexpected repair costs.

As technology evolves and product lifecycles lengthen, the importance of such built‑in protections will only grow. Treat your credit‑card benefits as an integral component of your consumer toolkit, and you’ll enjoy greater confidence in every purchase you make.