Table of Contents

- How to Access Your KeyBank Credit Card Account

- Step‑by‑Step Login Process

- Common Login Issues and How to Resolve Them

- Security Features You Should Know

- Managing Your Account After Login

- Reviewing Statements and Transactions

- Making Payments Efficiently

- Leveraging Rewards and Benefits

- Updating Personal Information

- Mobile App vs. Desktop Portal: Which Is Right for You?

- Advantages of the Mobile App

- Advantages of the Desktop Portal

- Troubleshooting and When to Contact Support

- When Self‑Help Isn’t Enough

- Understanding Account Freezes

- Additional Resources for Credit Card Users

KeyBank credit card account login is the gateway to a suite of online tools that let you monitor balances, pay bills, and protect your financial information. For many cardholders, the first encounter with the portal feels like opening a new chapter in a story where every click reveals a new detail about their spending habits and rewards.

In this article we walk through the entire journey—from locating the login page to mastering the security features that keep your data safe. The narrative is built on real‑world scenarios, so you’ll recognize the challenges and solutions that most users face when they first try to access their accounts.

Whether you are a longtime KeyBank customer or a newcomer who just received a credit card in the mail, the steps below will help you log in confidently, avoid common pitfalls, and take full advantage of the digital tools KeyBank provides.

How to Access Your KeyBank Credit Card Account

Step‑by‑Step Login Process

- Find the official portal. Open your web browser and go to key.com. Look for the “Sign In” button located at the top‑right corner of the homepage.

- Select the correct account type. KeyBank offers separate login sections for banking, loans, and credit cards. Click the “Credit Cards” tab to ensure you are directed to the right environment.

- Enter your User ID. This is usually the eight‑digit number you created when you first enrolled for online access. If you have forgotten it, click “Forgot User ID?” and follow the verification prompts.

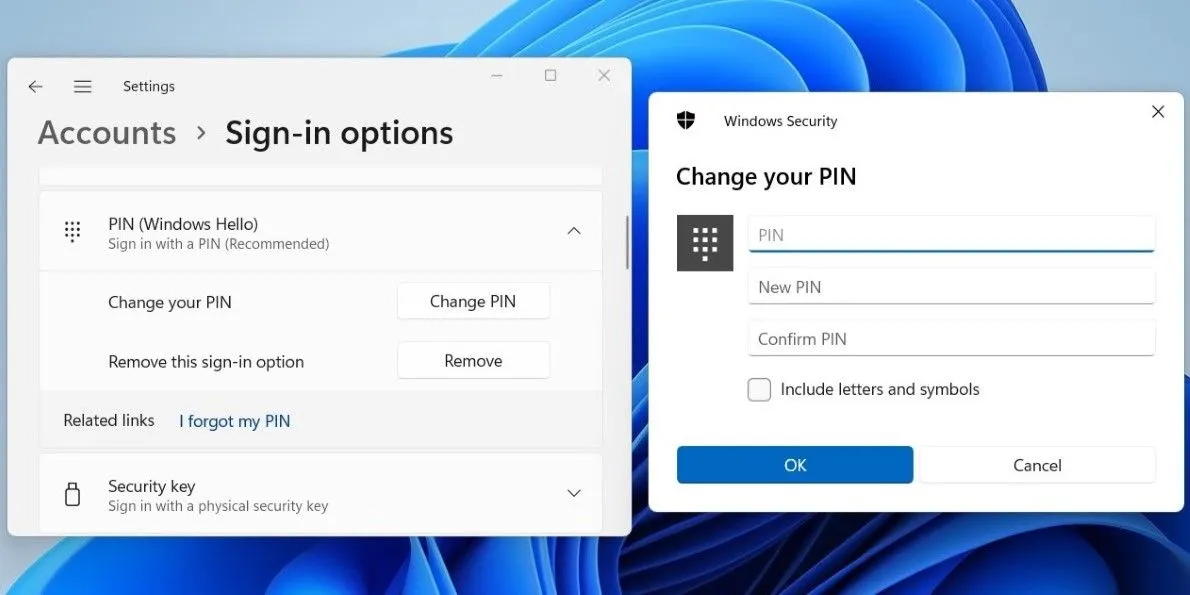

- Input your password. Use a combination of letters, numbers, and special characters. The portal enforces a minimum of eight characters, at least one uppercase letter, and one numeric digit.

- Complete the two‑factor authentication (2FA). KeyBank often sends a one‑time code to your registered mobile number or email address. Enter the code in the field provided.

- Click “Sign In”. If all credentials are correct, you will be taken to the account dashboard where balances, recent transactions, and reward points are displayed.

Common Login Issues and How to Resolve Them

Even with a clear set of steps, many users encounter obstacles. Below are the most frequent problems and practical fixes.

- Incorrect User ID or Password. Double‑check for caps lock, stray spaces, or mistyped characters. If the problem persists, use the “Reset Password” link to create a new password after answering security questions.

- Browser Compatibility. Some older browsers (e.g., Internet Explorer 10 or earlier) do not support the modern encryption standards used by KeyBank. Switching to Chrome, Firefox, Edge, or Safari usually resolves the issue.

- Cookies Disabled. The login portal relies on cookies to maintain session data. Enable cookies in your browser settings, then reload the page.

- Account Lockout. After multiple failed attempts, KeyBank may temporarily lock the account for security reasons. Wait 15‑30 minutes, then try again, or contact customer support for immediate assistance.

Security Features You Should Know

KeyBank invests heavily in protecting cardholder data. Understanding these features helps you feel more secure while navigating the portal.

- Two‑Factor Authentication (2FA). As mentioned, a one‑time code is required on each login, adding a layer beyond just a password.

- Device Recognition. The system flags new devices and may prompt additional verification, reducing the risk of unauthorized access.

- Secure Socket Layer (SSL) Encryption. All data transmitted between your browser and KeyBank’s servers is encrypted using 256‑bit SSL, preventing eavesdropping.

- Automatic Log‑out. After a period of inactivity (usually 10 minutes), the portal logs you out automatically, protecting the session from being hijacked.

Managing Your Account After Login

Reviewing Statements and Transactions

Once inside, the dashboard presents a snapshot of your current balance, available credit, and recent activity. Clicking the “Statements” tab downloads a PDF of your monthly statement, which you can print or save for tax purposes. Each transaction can be expanded to view merchant details, dates, and any applied rewards.

Making Payments Efficiently

KeyBank offers several payment options directly from the portal:

- One‑Time Payments. Enter the amount and select a funding source (e.g., checking account or external bank).

- Scheduled Payments. Set up recurring monthly payments to avoid late fees.

- Automatic Minimum Payments. Enable this feature to ensure the minimum amount is always paid on time.

For users who prefer mobile, the KeyBank mobile app mirrors these functionalities, letting you pay on the go. The app’s interface is optimized for touch, but the core steps remain identical to the desktop portal.

Leveraging Rewards and Benefits

KeyBank credit cards often include cash‑back, travel points, or extended warranty perks. Within the “Rewards” section, you can track earned points, redeem them for gift cards, or transfer them to airline partners. If you’re curious about how extended warranties compare across cards, the article Unlock Free Protection: How Credit Cards with Extended Warranty Benefits Safeguard Your Purchases provides a detailed comparison.

Updating Personal Information

Keeping your contact details current is essential for receiving alerts and 2FA codes. Navigate to the “Profile” tab, where you can edit your phone number, email address, and mailing address. The system may require you to verify changes through a short confirmation code.

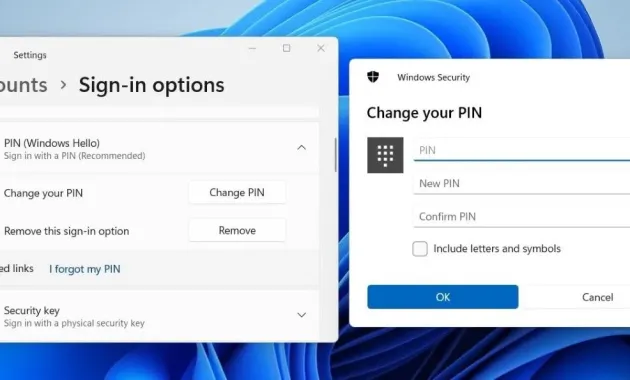

Mobile App vs. Desktop Portal: Which Is Right for You?

Advantages of the Mobile App

- Instant push notifications for purchases and security alerts.

- Fingerprint or facial recognition for quicker, yet secure, logins.

- On‑the‑spot payment options such as Apple Pay or Google Pay integration.

Advantages of the Desktop Portal

- Larger screen makes statement analysis and PDF downloads easier.

- Better for multitasking, such as comparing multiple accounts simultaneously.

- Full access to advanced tools like exportable CSV files for budgeting software.

Choosing between the two often depends on your daily routine. If you travel frequently and need real‑time alerts, the mobile app is a natural fit. For deep‑dive budgeting or when you need to print documents, the desktop portal remains the most efficient solution.

Troubleshooting and When to Contact Support

When Self‑Help Isn’t Enough

If you have exhausted the password reset, cleared browser cache, and still cannot log in, it may be time to reach out to KeyBank’s support team. Prepare the following before calling:

- Last four digits of your credit card.

- Recent transaction details (date, amount, merchant) for identity verification.

- A description of the error message you receive.

Understanding Account Freezes

Occasionally, issuers freeze cards due to suspicious activity. The article Why Issuers Freeze Cards: Common Triggers Explained outlines typical reasons, such as unusually large purchases or repeated failed login attempts. If your account is frozen, the support representative can guide you through the verification process to restore access.

Additional Resources for Credit Card Users

For broader context on credit‑card strategy, consider reading Authorized User vs Joint Account Holder – Which One Fits Your Financial Strategy?. This piece helps you decide whether adding an authorized user to your KeyBank card aligns with your financial goals.

By following the steps and tips outlined above, you can confidently navigate the KeyBank credit card account login process, resolve typical issues, and utilize the platform’s robust features to manage your finances effectively. Remember to keep your login credentials secure, stay aware of security notifications, and take advantage of the tools that help you monitor spending and earn rewards.