Table of Contents

- Official Channels to Opt Out

- Online Opt‑Out via the FTC’s Website

- Phone Opt‑Out

- Mail‑In Option

- Understanding What Happens After You Opt Out

- Effect on Existing Offers

- Impact on Legitimate Marketing Communications

- Re‑Enrolling in Prescreened Offers

- Common Mistakes and How to Avoid Them

- Using Incomplete or Inaccurate Information

- Confusing “Do Not Call” with “Do Not Mail”

- Relying on Third‑Party Services

- Assuming Opt‑Out Covers All Credit‑Related Mail

- Additional Strategies to Reduce Credit Card Spam

- Update Your Marketing Preferences with Individual Issuers

- Register with the Direct Marketing Association (DMA) Mail Preference Service

- Consider a PO Box or Mail Forwarding Service

- Monitor Your Credit Reports Regularly

- How Opt‑Out Intersects With Broader Credit Health

- Step‑by‑Step Checklist for a Successful Opt‑Out

Opting out of credit card offers is a practical step for anyone who wants to reduce the amount of junk mail, protect their personal data, and avoid the temptation of impulse applications. The process is straightforward, but many consumers remain unaware of the tools and resources available to them. This article walks you through the official opt‑out mechanisms, highlights common pitfalls, and provides actionable tips to ensure your request is processed correctly.

Every year, banks and credit bureaus generate millions of pre‑approved credit card offers based on consumer data collected from credit reports, purchase histories, and public records. While some recipients welcome these offers as a chance to compare rewards or interest rates, a growing number view them as intrusive. The Federal Trade Commission (FTC) and the major credit reporting agencies have established free, centralized opt‑out services that let you tell them you no longer wish to receive these solicitations.

Understanding the why and how behind the opt‑out process can also illuminate broader aspects of credit management. For example, knowing when you are being targeted can signal changes in your credit profile, and learning how to control the flow of offers can help you stay focused on building credit responsibly—perhaps by exploring secured credit cards that suit your financial goals.

Official Channels to Opt Out

The first step is to use the official opt‑out services provided by the three major credit bureaus: Experian, TransUnion, and Equifax. Each bureau offers a free opt‑out option that applies to both mail and telephone solicitations.

Online Opt‑Out via the FTC’s Website

- Visit https://optout.ic3.gov (the FTC’s dedicated portal).

- Enter your personal details, including name, address, and Social Security number, to verify identity.

- Select the “Mail” and/or “Phone” options you wish to block.

- Submit the form; the system will forward your request to the three credit bureaus.

Phone Opt‑Out

- Call 1‑888‑5‑OPTOUT (1‑888‑5‑678‑6884) from a landline or mobile phone.

- Follow the automated prompts to confirm your name and address.

- After verification, the request is processed for a minimum of five years.

Mail‑In Option

- Download the Opt‑Out Prescreen Form from the FTC website.

- Complete the form with your personal information and the “Do Not Call” and “Do Not Mail” checkboxes.

- Mail the form to:

OptOutPrescreen.com

P.O. Box 105281

Atlanta, GA 30348

All three methods achieve the same result: the bureaus will remove your name from the lists used by lenders to generate prescreened offers. It’s worth noting that the online and phone options take effect within a few days, while mailed requests may require up to 30 days for processing.

Understanding What Happens After You Opt Out

Once your request is accepted, the credit bureaus will flag your consumer file. Any lender that accesses the file for prescreening purposes will see a “do not solicit” indicator and must refrain from sending you unsolicited credit offers. However, there are several nuances to keep in mind.

Effect on Existing Offers

Opting out does not cancel offers that have already been mailed or are in transit. You may still receive a few pieces of mail that were printed before your request was processed.

Impact on Legitimate Marketing Communications

Opt‑out only applies to prescreened offers based on your credit file. If a bank sends you a promotional email or a targeted advertisement because you are a customer or have expressed interest in a product, that communication is not covered by the opt‑out. You will need to use the individual issuer’s unsubscribe link or contact their customer service directly.

Re‑Enrolling in Prescreened Offers

If you decide later that you want to receive offers again, you can re‑enroll by calling 1‑888‑5‑OPTOUT and selecting the option to “reactivate” or by visiting the online portal and opting back in. The process is reversible at any time.

Common Mistakes and How to Avoid Them

Even with clear instructions, many consumers make errors that delay or nullify the opt‑out. Below are the most frequent pitfalls and the steps to correct them.

Using Incomplete or Inaccurate Information

All three bureaus require exact matches on name, address, and Social Security number. A typo or missing middle initial can cause the request to be ignored. Double‑check every field before submitting.

Confusing “Do Not Call” with “Do Not Mail”

Both options exist independently. If you only select “Do Not Call,” you will continue receiving paper offers, and vice versa. Most consumers prefer to block both to eliminate all unsolicited communications.

Relying on Third‑Party Services

Some websites claim to “opt you out” for a fee. The FTC’s services are free, and using a paid intermediary can expose you to additional privacy risks. Stick to the official channels to guarantee security and compliance.

Assuming Opt‑Out Covers All Credit‑Related Mail

Only prescreened offers based on your credit file are blocked. Direct mail from your existing banks, credit unions, or loyalty programs will still arrive unless you unsubscribe directly with those institutions.

Additional Strategies to Reduce Credit Card Spam

While the official opt‑out process handles the bulk of prescreened offers, there are complementary actions you can take to further declutter your mailbox and protect your information.

Update Your Marketing Preferences with Individual Issuers

Log into your online banking portal and locate the “communications preferences” section. Most banks allow you to choose between email, SMS, postal mail, and phone calls. Turning off “postal mail” for promotional offers can dramatically reduce unwanted envelopes.

Register with the Direct Marketing Association (DMA) Mail Preference Service

The DMA offers a free “Do Not Mail” registry that adds your address to a national list used by many advertisers. While not all credit card issuers honor this list, it does curb a wide variety of other junk mail.

Consider a PO Box or Mail Forwarding Service

If you receive a high volume of unsolicited mail, renting a PO Box for personal correspondence can separate essential letters from marketing junk. Some forwarding services also scan and digitize important documents, allowing you to discard the physical clutter.

Monitor Your Credit Reports Regularly

Regularly reviewing your credit reports with the three major bureaus (via AnnualCreditReport.com) helps you spot unexpected activity that may trigger prescreened offers. If you notice new hard inquiries or unfamiliar accounts, you can address potential fraud before it escalates.

How Opt‑Out Intersects With Broader Credit Health

The decision to opt out does not affect your credit score. However, being proactive about the information you share can indirectly benefit your credit journey. For instance, by reducing the number of offers you receive, you may be less tempted to open new accounts impulsively—a behavior that can lead to hard inquiries and a temporary dip in your score.

If you are actively building credit, consider focusing on products that align with your financial plan. The good APR for a credit card, for example, is a critical factor in managing debt cost. A lower APR means less interest accrues on balances, which can accelerate repayment and improve your utilization ratio—a key component of credit scoring models.

Additionally, opting out can free up mental space to evaluate credit offers more deliberately. When you finally do receive a targeted offer—perhaps from a bank you already trust—you can compare its features, such as rewards structures or annual fees, against your current cards. This measured approach aligns with the disciplined habits recommended for long‑term credit health.

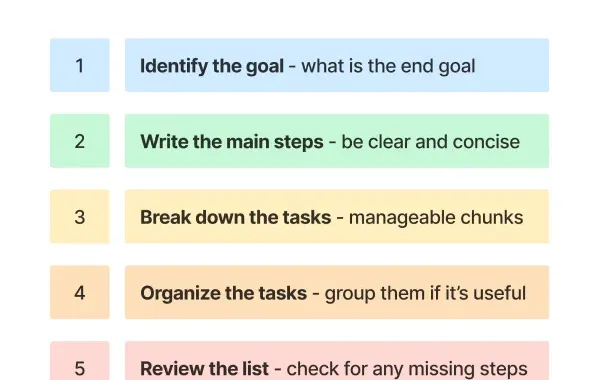

Step‑by‑Step Checklist for a Successful Opt‑Out

- Gather personal information: full legal name, current address, Social Security number, and date of birth.

- Choose your preferred method: online portal, phone call, or mailed form.

- Submit the request and note the confirmation number (if provided).

- Wait 5–30 days for processing, depending on the method used.

- Inspect incoming mail for any remaining prescreened offers; note any that arrive after the processing window.

- If offers persist, contact the specific issuer directly and request removal from their mailing list.

- Update marketing preferences on any existing bank or credit‑card accounts.

- Consider additional measures such as DMA registration or a PO Box.

- Schedule an annual review of your credit reports to detect unexpected activity.

- Re‑evaluate your opt‑out status each year, especially after major life events like a move or name change.

Following this checklist ensures that you have covered every angle—from the official opt‑out to personal preferences—maximizing the likelihood that unwanted credit card offers will stop arriving.

In practice, many consumers find that after the first few weeks of opting out, the volume of junk mail drops dramatically. The remaining envelopes may be from existing relationships or targeted campaigns that require separate unsubscription steps. By staying organized and using the resources outlined above, you can maintain a clean mailbox and protect your personal data without sacrificing the ability to receive valuable offers when you truly need them.

Ultimately, the opt‑out process is a simple yet powerful tool in the broader toolkit of credit management. It reflects a proactive stance toward privacy, financial discipline, and information overload. Whether you are a seasoned cardholder or someone just starting to build credit, taking control of the offers that land in your mailbox is a small step that yields noticeable benefits.

Should you wish to explore alternative credit options after opting out, resources like the guide on Wells Fargo credit cards can provide insight into products that match your needs without the clutter of unsolicited promotions.