Table of Contents

- What Is Trip Delay Insurance and How Does It Work?

- Key Eligibility Criteria

- Top Credit Cards Offering Robust Trip Delay Coverage

- Premium Travel Cards

- Mid‑Tier Cards with Strong Perks

- Specialty Cards for Specific Regions

- How to Activate and Use Trip Delay Insurance

- Step‑by‑Step Checklist

- Common Pitfalls and How to Avoid Them

- Insufficient Documentation

- Booking Through Third‑Party Sites

- Exceeding the Reimbursement Cap

- Integrating Trip Delay Insurance with Overall Travel Planning

- When to Add Stand‑Alone Travel Insurance

- Real‑World Example: A Delayed Flight from New York to London

- Tips to Maximize the Value of Trip Delay Benefits

- Future Trends: Evolving Travel Protection in the Credit Card Industry

Traveling has become an integral part of modern life, and with each journey comes the risk of unexpected delays. From weather‑related cancellations to airline strikes, the inconvenience can quickly turn into a financial burden. Credit cards with trip delay insurance provide a safety net, reimbursing expenses such as meals, accommodations, and transportation when your trip is postponed beyond a certain threshold.

Understanding how this benefit works, which issuers include it, and how to file a claim can make the difference between a stressful ordeal and a manageable setback. This article walks you through the mechanics of trip delay insurance, highlights cards that excel in this arena, and offers actionable steps to ensure you get the most out of the protection your card provides.

Whether you are a frequent flyer, a weekend road‑tripper, or someone who occasionally ventures abroad, the insights below will help you navigate the landscape of travel‑focused credit card perks with confidence.

What Is Trip Delay Insurance and How Does It Work?

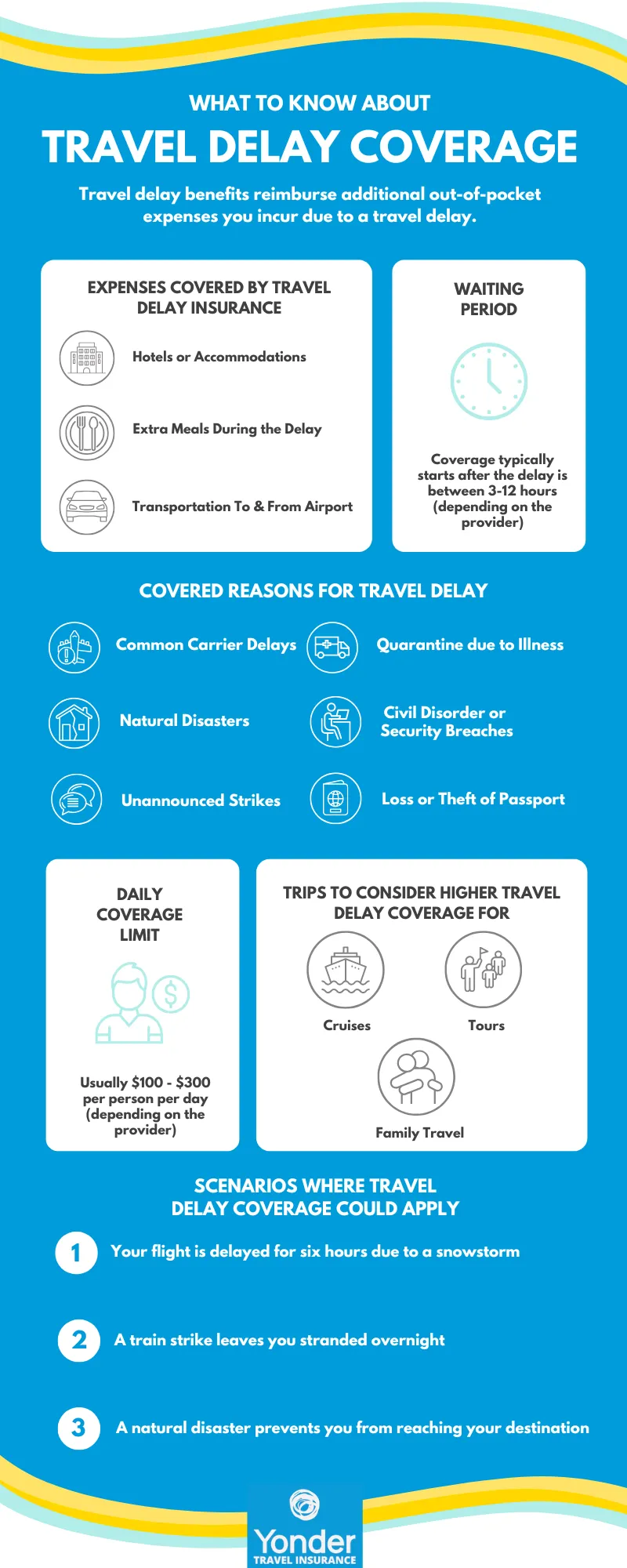

Trip delay insurance is a travel‑related benefit attached to certain credit cards. When a covered trip is delayed for a specified duration—typically 6, 12, or 24 hours—the card issuer reimburses reasonable, out‑of‑pocket expenses incurred as a direct result of the delay. These expenses can include:

- Meals and non‑alcoholic beverages

- Hotel or alternative lodging

- Ground transportation (taxi, rideshare, rental car)

- Internet or communication fees needed to arrange new travel plans

The reimbursement amount varies by card, ranging from $200 to $1,000 per traveler, with some premium cards offering up to $2,500. Coverage is generally limited to the primary cardholder and, in many cases, authorized users who travel on the same itinerary.

Key Eligibility Criteria

- Purchase Requirement: The travel expense must be charged to the eligible credit card. Cash purchases or bookings made through third‑party agents that do not capture the card number may be excluded.

- Delay Threshold: Most policies activate after a delay of 6 hours or more, but the exact trigger point differs by issuer.

- Maximum Duration: Some cards cap the coverage period (e.g., up to 5 days), after which additional expenses are not reimbursed.

- Documentation: Receipts, airline or train delay confirmations, and a completed claim form are typically required.

Top Credit Cards Offering Robust Trip Delay Coverage

![9 Best Credit Cards for Trip Cancellation & Interruption [2025]](https://blog.avaller.com/wp-content/uploads/2026/01/9-best-credit-cards-for-trip-cancellation-interruption-2025-630x380.webp)

Not all credit cards provide trip delay insurance, and among those that do, the terms can vary dramatically. Below is a curated list of cards that consistently receive strong ratings for their travel protection features.

Premium Travel Cards

- Chase Sapphire Reserve® – Up to $500 per trip for delays of 12 hours or more. The benefit is automatic when the travel is booked with the card.

- American Express® Platinum Card – Offers $500 reimbursement for delays exceeding 6 hours, plus access to Amex Travel’s concierge for re‑booking assistance.

- U.S. Bank Altitude™ Reserve Visa Infinite® Card – Provides $250 per traveler after a 6‑hour delay, with a 5‑day maximum reimbursement window.

Mid‑Tier Cards with Strong Perks

- Citi® / AAdvantage® Platinum Select World Elite Mastercard® – Covers up to $250 for delays of 6 hours, making it a solid choice for frequent American Airlines flyers.

- Capital One Venture Rewards Credit Card – Includes $100 trip delay coverage after a 12‑hour delay, suitable for occasional travelers who still want some protection.

Specialty Cards for Specific Regions

- British Airways Visa Signature® Card (U.S.) – Reimburses up to $300 for delays of 6 hours or more on BA‑operated flights.

- Air Canada Aeroplan Visa – Provides $200 coverage for delays of 8 hours, ideal for Canadians traveling on Air Canada routes.

When selecting a card, consider not only the trip delay benefit but also the overall suite of travel protections (e.g., trip cancellation/interruption insurance, lost luggage reimbursement, and rental car insurance). Often, premium cards bundle several of these perks, delivering greater overall value.

How to Activate and Use Trip Delay Insurance

Unlike a feature that requires a separate activation step, trip delay insurance is usually embedded in the card’s terms of service. However, to ensure you’re covered, follow these best practices:

Step‑by‑Step Checklist

- Book Using the Card: Pay for the airline, train, or cruise ticket with the credit card that offers the benefit. This creates a record that the issuer can verify.

- Keep Confirmation Documents: Save electronic tickets, boarding passes, and the airline’s delay notice. A screenshot of the delay notification can be useful if the airline’s website updates later.

- Track the Delay Duration: Note the exact time the original departure was scheduled and the new departure time. Most policies require a minimum delay of 6–12 hours.

- Collect Receipts Promptly: For every expense incurred because of the delay (meals, hotel, transport), obtain itemized receipts. Credit card statements alone may not satisfy the insurer.

- Submit a Claim Within the Specified Window: Most issuers require claims to be filed within 30 to 60 days of the delay. Use the online portal or the dedicated claims phone line.

- Follow Up: If the issuer requests additional documentation, provide it promptly to avoid claim denial.

If you’re unsure whether a particular purchase qualifies, a quick call to the card’s benefits department can clarify. For instance, the how to activate a new credit card by phone guide explains how to reach the right representative efficiently.

Common Pitfalls and How to Avoid Them

Even with a robust card, travelers sometimes miss out on reimbursement due to avoidable mistakes. Understanding these pitfalls helps you safeguard your claim.

Insufficient Documentation

Issuers often reject claims lacking proper receipts or a clear proof of the delay. Keep digital copies of all receipts in a dedicated folder on your phone or cloud storage. If a receipt is lost, a bank statement showing the charge can serve as supplemental evidence, but it’s less persuasive.

Booking Through Third‑Party Sites

Purchases made on travel aggregators that do not capture the card number may void coverage. Whenever possible, book directly through the airline or hotel website, or ensure the aggregator passes the card details to the carrier.

Exceeding the Reimbursement Cap

Some travelers assume the benefit is unlimited. In reality, most cards cap the payout per trip and per traveler. For lengthy delays that require extended lodging, consider supplementing with a travel insurance policy that offers higher limits.

Integrating Trip Delay Insurance with Overall Travel Planning

Trip delay coverage should be viewed as a component of a broader travel risk management strategy. Combining credit card benefits with dedicated travel insurance can provide comprehensive protection.

When to Add Stand‑Alone Travel Insurance

- High‑Cost Trips: If the total cost of your vacation exceeds $5,000, a standalone policy may offer higher limits and broader coverage (e.g., trip cancellation, medical emergencies).

- International Travel: Some credit cards limit medical coverage abroad. A travel medical policy can fill that gap.

- Long‑Duration Delays: For journeys that could be delayed for several days, a policy with multi‑day lodging reimbursement may be more appropriate.

Pairing the two approaches often results in cost savings. For example, you can rely on the credit card’s $500 trip delay limit for short postponements while reserving a travel insurance claim for extended interruptions.

Real‑World Example: A Delayed Flight from New York to London

John, a frequent business traveler, booked a round‑trip flight from JFK to LHR on a Chase Sapphire Reserve® card. A severe snowstorm forced the airline to delay his departure by 14 hours. John followed the checklist:

- He kept the boarding pass and the airline’s email confirming the new departure time.

- He purchased a hotel room for two nights, totaling $420, and saved all receipts.

- He collected receipts for meals and a taxi ride to the hotel, amounting to $115.

- Within 45 days, he logged into the Chase benefits portal, uploaded the documents, and submitted the claim.

The issuer approved $500 of his $535 total expenses, covering the maximum benefit per trip. John’s experience illustrates how a well‑documented claim can quickly turn a frustrating delay into a reimbursable expense.

Tips to Maximize the Value of Trip Delay Benefits

- Combine Cards: If you travel with a spouse, each of you can use a separate card that offers trip delay coverage, effectively doubling the reimbursement limit.

- Leverage Loyalty Programs: Some airlines provide complimentary lounge access for premium cardholders, allowing you to wait comfortably during delays.

- Know the Exclusions: Strikes, civil unrest, and weather events are often covered, but voluntary cancellations or “force majeure” clauses may be excluded. Read the fine print.

- Monitor Card Announcements: Issuers periodically update benefit terms. Subscribing to the card’s newsletter ensures you stay aware of any enhancements.

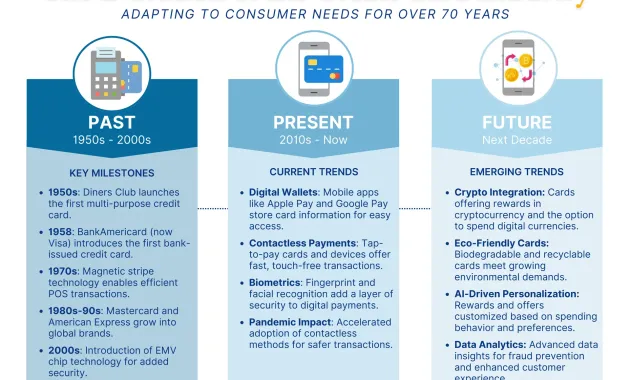

Future Trends: Evolving Travel Protection in the Credit Card Industry

As travel patterns shift and consumer expectations rise, issuers are expanding and customizing their insurance offerings. Emerging trends include:

- Dynamic Coverage: Real‑time integration with airline APIs to automatically trigger trip delay benefits when a flight is delayed beyond a set threshold.

- Bundled Digital Assistants: AI‑powered chatbots that guide cardholders through claim filing, reducing the need for phone calls.

- Eco‑Travel Incentives: Some cards are adding carbon offset credits alongside traditional travel insurance, appealing to environmentally conscious travelers.

These innovations suggest that trip delay insurance will become more seamless and user‑friendly, reinforcing its role as a core component of travel‑centric credit cards.

In practice, the most effective way to safeguard your journeys is to select a credit card that aligns with your travel frequency, understand the specific terms of its trip delay coverage, and maintain meticulous records whenever a delay occurs. By doing so, you transform an unexpected inconvenience into a manageable, reimbursable event, preserving both your schedule and your budget.