Table of Contents

- Understanding the Role of Credit Cards in Modern Finance

- Credit Utilization and Its Impact

- The Rewards Landscape

- When the Number Becomes a Problem

- Case Study: The “Card Collector”

- Financial Implications of Over‑Extending Credit

- Credit Score Volatility

- Hidden Costs

- Opportunity Cost of Time

- Best Practices for Managing Multiple Credit Cards

- Consolidate Billing Cycles

- Leverage Technology

- Prioritize High‑Value Cards

- Maintain Low Utilization Across All Cards

- Regularly Review Credit Reports

- Know When to Decline an Offer

- Strategic Card Acquisition: Quality Over Quantity

- Evaluating Your Personal Threshold

Credit cards have become a staple of modern financial life, offering convenience, rewards, and a safety net for unexpected expenses. Yet, as the variety of cards expands, many consumers wonder: how many credit cards is too many? The answer is not a simple number; it depends on personal financial habits, credit goals, and the ability to manage multiple accounts responsibly.

In this article we will trace the evolution of credit‑card ownership, examine the factors that turn a useful tool into a liability, and provide a step‑by‑step framework for assessing your own card portfolio. The narrative follows a typical consumer’s journey—from the excitement of the first rewards card to the point where the number of cards begins to erode credit health.

Understanding the Role of Credit Cards in Modern Finance

Credit cards serve several functions: they enable cash‑less purchases, provide a line of credit for emergencies, and often include perks such as cash‑back, travel points, or purchase protection. When used wisely, a card can improve a person’s credit mix—a factor that credit scoring models consider when calculating a credit score.

Credit Utilization and Its Impact

One of the most influential components of a credit score is the credit utilization ratio, which measures the amount of credit used relative to the total credit limit. Keeping utilization below 30 % is generally recommended; lower utilization often leads to higher scores. Adding more cards can raise total available credit, thereby reducing utilization—provided the user does not increase spending proportionally.

The Rewards Landscape

Rewards programs have become increasingly sophisticated, with some cards offering accelerated points on travel, dining, or groceries. For consumers who can align spending patterns with card categories, the incremental benefit of an additional card can be substantial. However, the complexity of managing multiple reward structures can also lead to missed deadlines, forfeited points, or unnecessary annual fees.

When the Number Becomes a Problem

Having several credit cards is not inherently harmful, but certain warning signs indicate that the balance may be tipping toward excess. Below are common red flags that suggest you might have too many cards.

- Frequent Missed Payments: Juggling due dates across multiple accounts increases the risk of overlooking a payment, which can trigger late fees and score drops.

- Annual Fee Overload: If the combined annual fees exceed the value of the rewards and benefits, the cards become a net cost.

- Credit Inquiries Accumulating: Opening several cards in a short period generates hard inquiries, temporarily lowering the credit score.

- Difficulty Monitoring Activity: Inadequate oversight can lead to fraudulent charges going unnoticed.

- Psychological Burnout: Feeling overwhelmed by the number of cards often leads to neglect of optimal usage.

Case Study: The “Card Collector”

Consider a consumer who began with a single rewards card in 2015. Over the next five years, they added a travel‑focused premium card, a cash‑back card for groceries, and two store‑branded cards to chase promotional offers. By 2020, the individual held six cards, each with a different billing cycle and reward structure. The first missed payment occurred when a billing date shifted due to a holiday, resulting in a $35 late fee and a slight dip in the credit score. This scenario illustrates how the cumulative complexity can turn a financial tool into a liability.

Financial Implications of Over‑Extending Credit

Beyond the immediate risk of missed payments, an excessive number of cards can have long‑term consequences on both credit health and personal finances.

Credit Score Volatility

Every new account reduces the average age of credit, another factor in scoring models. While a younger average can be offset by low utilization, the net effect may still be a modest score decline, especially if the individual also carries balances.

Hidden Costs

Annual fees, foreign transaction fees, and interest charges on carried balances can add up quickly. For example, a card with a $95 annual fee may be worthwhile only if the user earns at least $1,000 in annual rewards; otherwise, the fee becomes an expense.

Opportunity Cost of Time

Managing statements, tracking rewards expiration dates, and optimizing payment strategies consume time—a valuable resource that could be allocated elsewhere. The time cost is often overlooked but becomes significant as the number of cards rises.

Best Practices for Managing Multiple Credit Cards

For those who find that multiple cards align with their financial goals, establishing a disciplined management system is essential. Below are actionable steps to keep the benefits outweighing the drawbacks.

Consolidate Billing Cycles

Whenever possible, request a shift in due dates to cluster payments within a short window. This reduces the chance of missing a payment and simplifies budgeting.

Leverage Technology

Use personal finance apps or spreadsheets to track balances, due dates, and rewards. Some banks also offer customizable alerts for upcoming payments or unusual activity.

Prioritize High‑Value Cards

Identify which cards deliver the greatest net benefit after accounting for fees. Consider closing or downgrading cards that provide marginal rewards relative to their cost.

Maintain Low Utilization Across All Cards

Even if the total credit limit is high, aim to keep individual card balances low. High balances on a single card can still affect the credit utilization ratio for that account, potentially influencing lender decisions.

Regularly Review Credit Reports

Obtain a free credit report annually from each of the major bureaus. Verify that all accounts are reported accurately and dispute any errors promptly.

Know When to Decline an Offer

Before applying for a new card, assess whether the rewards and benefits genuinely address a gap in your current portfolio. If a card’s annual fee outweighs its advantages, it may be wiser to decline.

Strategic Card Acquisition: Quality Over Quantity

When evaluating a new credit card, focus on the alignment with your spending patterns and financial objectives. For instance, a traveler who frequently flies internationally may benefit from a card that offers Global Entry credit, as detailed in Unlock the Best Credit Cards That Offer Global Entry Credit – Your Complete Guide. This targeted approach ensures each additional card serves a distinct purpose.

Activation of a new card should be swift and secure. The process is explained in How to Activate a New Credit Card by Phone in Minutes – The Fast, Secure Way Everyone Is Using, which emphasizes confirming identity and setting a PIN promptly to avoid fraud.

For consumers interested in extending the benefits of authorized users, the article Authorized User vs Joint Account Holder – Which One Fits Your Financial Strategy? provides insight into how adding an authorized user can help build credit for a family member without granting full account control.

Evaluating Your Personal Threshold

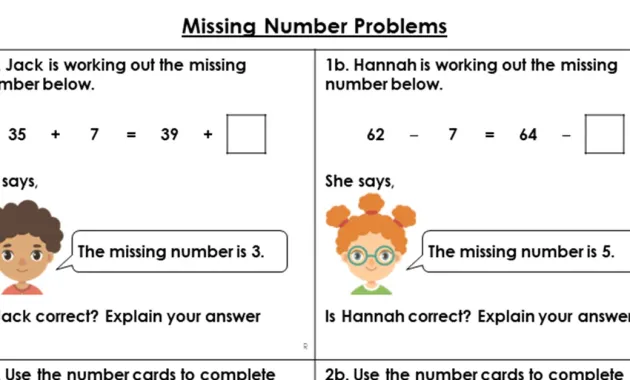

The “right” number of credit cards varies per individual. A practical method to determine your threshold is to conduct a self‑audit:

- List every credit card you own, including the issuer, credit limit, annual fee, and primary rewards.

- Calculate your overall credit utilization and each card’s individual utilization.

- Add up total annual fees and compare them to the estimated annual value of rewards and benefits.

- Assess the time you spend each month managing these accounts.

- Score each card on a scale of 1‑10 based on net benefit, then sum the scores.

If the cumulative time and cost exceed the net benefit, it is an indication that you have crossed your personal limit. Reducing the number of cards to those with the highest scores will streamline your finances while preserving the advantages.

Ultimately, the goal is to maintain a credit portfolio that supports a healthy credit score, maximizes rewards, and remains manageable. By applying the guidelines above, you can answer the question, “how many credit cards is too many,” with data rather than guesswork.