Table of Contents

- What Exactly Is a Chargeback?

- Key Characteristics

- Common Reasons for Chargebacks

- Unauthorized or Fraudulent Transactions

- Goods or Services Not Received (GNR)

- Defective or Not as Described

- Duplicate Billing

- Canceled Recurring Payments

- The Chargeback Lifecycle

- 1. Cardholder Initiates a Dispute

- 2. Issuer Sends a Representment Request

- 3. Review and Decision

- 4. Arbitration (If Needed)

- Impact on Merchants and Cardholders

- For Merchants

- For Cardholders

- Best Practices to Prevent Unnecessary Chargebacks

- For Merchants

- For Cardholders

- Legal and Regulatory Framework

- Technology’s Role in Chargeback Management

- Chargebacks vs. Refunds: Knowing the Difference

- How Chargebacks Influence Credit Card Benefits

- Future Trends: Emerging Alternatives to Traditional Chargebacks

- Key Takeaways

When you see the term chargeback on credit card in your banking app, it can feel like a sudden mystery—money disappearing, a transaction marked as “reversed,” and a flurry of notifications from both your bank and the merchant. A chargeback is not merely a refund; it is a formal dispute initiated by the cardholder that forces the issuer to pull funds back from the merchant’s account. This mechanism, built into the payment ecosystem, serves as a consumer protection tool, but it also carries significant implications for businesses.

Understanding the chargeback process is essential for anyone who uses credit cards regularly, whether you are a frequent shopper, a small‑business owner, or a financial professional. By demystifying each step—from the initial complaint to the final resolution—you can protect your rights, avoid costly mistakes, and make smarter decisions when disputes arise. This article walks you through the entire journey, offering clear explanations, practical tips, and insights into the rules that govern chargebacks.

Below, we’ll explore the anatomy of a chargeback, the reasons they occur, the timelines involved, and the responsibilities of each party. We’ll also address how chargebacks intersect with other credit‑card features, such as fraud protection and credit‑building strategies, linking to related resources for deeper learning.

What Exactly Is a Chargeback?

A chargeback is a reversal of a credit‑card transaction initiated by the cardholder’s bank (the issuer) after the cardholder disputes a charge. Unlike a simple refund—where the merchant voluntarily returns the money—a chargeback is a formal, rule‑based process enforced by the card networks (Visa, Mastercard, American Express, Discover). It protects consumers from fraud, unauthorized transactions, and merchant errors.

Key Characteristics

- Issuer‑Driven: The cardholder contacts their bank, not the merchant, to start the process.

- Network Rules: Each card network has a set of guidelines (e.g., Visa Claims Resolution) that dictate valid reasons and required documentation.

- Time‑Sensitive: There are strict windows—usually 120 days from the transaction date—within which a cardholder can file a claim.

- Potential Fees: Merchants may incur chargeback fees (often $20–$100) and may face penalties for excessive chargebacks.

Common Reasons for Chargebacks

Chargebacks arise from a variety of situations. Recognizing these can help both consumers and merchants preempt disputes.

Unauthorized or Fraudulent Transactions

When a card is lost, stolen, or used without the cardholder’s consent, the issuer may reverse the charge. This is the most prevalent reason and underscores why credit cards are considered safer than debit cards for online purchases.

Goods or Services Not Received (GNR)

If a buyer never receives the purchased item or the service isn’t delivered as promised, they may file a chargeback. Merchants can defend themselves by providing shipment tracking, delivery confirmations, or signed receipts.

Defective or Not as Described

When the product delivered differs significantly from the description—wrong size, color, or functionality—customers may claim a chargeback under “product not as described.” Proper return policies and clear product images can mitigate this risk.

Duplicate Billing

Technical glitches sometimes cause a merchant to charge a card twice for the same order. The cardholder can dispute the duplicate transaction, prompting a chargeback for the extra amount.

Canceled Recurring Payments

Subscriptions that are not canceled correctly often lead to unexpected charges. If a consumer believes they cancelled a service but continues to be billed, they may initiate a chargeback.

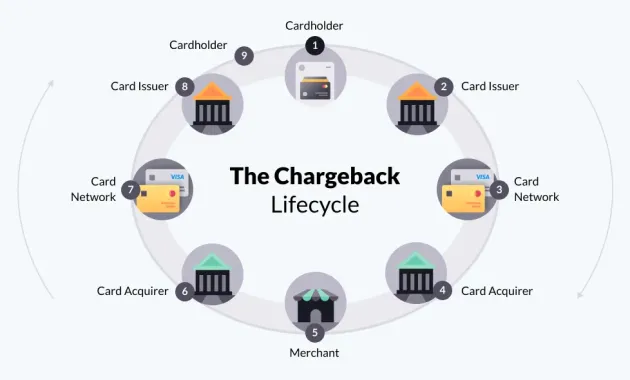

The Chargeback Lifecycle

The journey from dispute to resolution follows a structured path, involving several stakeholders.

1. Cardholder Initiates a Dispute

The process starts when the cardholder contacts their issuing bank, explaining the reason for the dispute. The issuer may request supporting evidence, such as receipts or communication with the merchant.

2. Issuer Sends a Representment Request

If the issuer deems the claim valid, they forward a “chargeback” notice to the merchant’s acquiring bank (the acquirer). The acquirer then notifies the merchant, who must respond within a set timeframe—usually 7–30 days—by submitting a “representment.” This includes proof that the transaction was legitimate (e.g., delivery proof, signed receipt, or evidence of the cardholder’s authorization).

3. Review and Decision

The issuer reviews the merchant’s evidence alongside the cardholder’s claim. If the evidence is compelling, the issuer may reject the chargeback, returning the funds to the merchant. Otherwise, the chargeback stands, and the funds remain withdrawn from the merchant’s account.

4. Arbitration (If Needed)

When the dispute remains unresolved, the card network may step in for arbitration. This is a final, often costly, stage where the network evaluates the case based on its rules. The decision is binding for both parties.

Impact on Merchants and Cardholders

Chargebacks serve a dual purpose: they protect consumers while also imposing responsibilities on merchants. Understanding the consequences helps both sides navigate the system responsibly.

For Merchants

- Financial Loss: Beyond the reversed transaction amount, merchants may incur chargeback fees and potential fines for high chargeback ratios.

- Reputation Damage: Repeated chargebacks can lead to “card‑not‑present” (CNP) risk flags, causing banks to increase reserve requirements or even terminate merchant accounts.

- Operational Burden: Gathering documentation, responding within tight deadlines, and managing disputes can strain resources, especially for small businesses.

For Cardholders

- Protection Against Fraud: Chargebacks provide a safety net, allowing consumers to recover funds when unauthorized transactions occur.

- Credit Score Impact: Properly filed chargebacks do not affect credit scores, but repeated frivolous disputes could lead to issuer scrutiny.

- Potential Delays: While the dispute is processed, the cardholder may see a temporary “pending” credit on their account, which could affect budgeting.

Best Practices to Prevent Unnecessary Chargebacks

Both merchants and consumers can take proactive steps to reduce the likelihood of chargebacks. Below are actionable tips for each group.

For Merchants

- Provide clear product descriptions, high‑resolution images, and detailed sizing charts.

- Implement robust fraud detection tools—such as AVS (Address Verification Service) and 3‑D Secure—to verify cardholder identity.

- Maintain comprehensive records: receipts, shipping logs, and communication logs.

- Offer transparent return and cancellation policies, and display them prominently on checkout pages.

- Send order confirmation emails with tracking numbers and contact information for support.

For Cardholders

- Regularly monitor account statements and set up transaction alerts.

- Use reputable merchants and verify website security (look for HTTPS and padlock icons).

- Keep receipts and order confirmations in case a dispute arises.

- Before filing a chargeback, try to resolve the issue directly with the merchant; many problems are settled through customer service.

For readers interested in strengthening their overall credit‑card experience, consider exploring how to use a credit card to build credit history. A solid credit profile can make future disputes smoother, as issuers are more likely to work collaboratively with established customers.

Legal and Regulatory Framework

Chargebacks are governed by a combination of card‑network rules, federal regulations, and, in some jurisdictions, state consumer protection laws. In the United States, the Fair Credit Billing Act (FCBA) provides a legal foundation for disputing fraudulent and erroneous charges on credit cards. The FCBA mandates that consumers have up to 60 days after the statement date to report billing errors, though most issuers extend the window to 120 days.

Internationally, the European Union’s Payment Services Directive (PSD2) introduces similar consumer rights, emphasizing strong customer authentication and transparent dispute processes. Merchants operating across borders must stay abreast of differing timelines and documentation standards to avoid inadvertent violations.

Technology’s Role in Chargeback Management

Advancements in payment technology have both reduced and complicated chargebacks. On one hand, tokenization and biometric authentication lower fraud rates, decreasing the number of unauthorized‑transaction disputes. On the other hand, the rise of “card‑not‑present” (CNP) transactions—common in e‑commerce—has increased the complexity of proving legitimate purchases.

Many merchants now employ specialized chargeback management platforms that automate evidence collection, track deadlines, and even predict the likelihood of a successful representment. These tools integrate with order management systems, pulling shipping confirmations and customer communication logs automatically.

Meanwhile, cardholders benefit from features like instant transaction alerts and the ability to lock or freeze a card temporarily. If you ever need to pause a card due to suspected fraud, you can learn how to freeze your credit card temporarily without affecting your overall credit standing.

Chargebacks vs. Refunds: Knowing the Difference

While both result in the return of funds, refunds are initiated by the merchant and generally involve a simpler process—often a few clicks in the payment gateway. Refunds also preserve the merchant‑cardholder relationship, as they are a cooperative resolution.

Chargebacks, by contrast, are adversarial. They involve third parties (issuer and network) and can trigger fees, penalties, and potential blacklisting for merchants. From a consumer’s perspective, a chargeback should be a last resort after attempts to obtain a refund directly from the merchant have failed.

How Chargebacks Influence Credit Card Benefits

Many credit‑card reward programs tie points or cash back to successful purchases. A chargeback can reverse earned points, potentially reducing the value of a rewards program for the cardholder. Some issuers may also place temporary holds on reward balances until the dispute is settled.

Understanding this interaction can help cardholders make informed decisions about using rewards for high‑value purchases. For example, before buying an expensive electronic device with a card that offers a large sign‑up bonus, verify the merchant’s return policy and ensure you have proof of delivery.

Future Trends: Emerging Alternatives to Traditional Chargebacks

Industry leaders are exploring alternatives to the traditional chargeback model to reduce costs and improve dispute outcomes. One such initiative is the “Chargeback 2.0” framework, which encourages direct merchant‑cardholder communication facilitated by the issuer, aiming to resolve issues before a formal chargeback is filed.

Another emerging solution is the use of blockchain‑based payment verification, which creates immutable transaction records that can be instantly referenced during disputes, potentially eliminating the need for lengthy evidence gathering.

Key Takeaways

Chargebacks on credit cards are a vital consumer protection mechanism, designed to address fraud, errors, and merchant shortcomings. However, they also impose financial and operational burdens on businesses. By understanding the reasons behind chargebacks, the procedural steps involved, and the best practices for prevention, both cardholders and merchants can navigate disputes more efficiently.

Staying informed about the legal framework, leveraging technology, and maintaining transparent communication are essential strategies for minimizing chargeback frequency and impact. Whether you are a frequent shopper protecting your purchases or a merchant safeguarding your revenue, mastering the chargeback process empowers you to make smarter financial decisions.

Remember, the goal is not just to react to disputes but to build a transaction environment where chargebacks become rare exceptions rather than routine occurrences. By applying the insights shared here, you can contribute to a healthier, more trustworthy payment ecosystem.