Table of Contents

- Annual Fee and Baseline Value

- Guaranteed Credits

- Travel Credits and Airline Perks

- Airline Fee Credit in Action

- Additional Airline Benefits

- Airport Lounge Access

- Quantifying the Value

- Hotel and Resort Benefits

- Fine Hotels & Resorts (FHR) Program

- Shopping, Entertainment, and Lifestyle Perks

- Shopping Protections

- Entertainment Access

- Insurance and Protections

- Key Insurance Features

- Points Earning and Redemption

- Earn Rates

- Redemption Options

- Cost‑Benefit Analysis for 2024

- Who Should Consider the Amex Platinum in 2024?

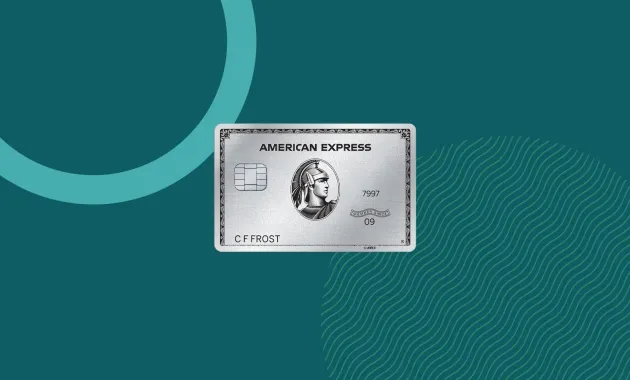

When the American Express Platinum Card first appeared, it promised a suite of premium perks that catered to frequent travelers and high‑spending consumers. Four years later, the question remains: are those benefits still worth the steep annual fee in 2024? This article follows the journey of a typical Platinum holder—starting from the moment the card arrives in the mailbox, through the first flight, to the night the annual fee is charged—examining each benefit with concrete figures and realistic use‑cases.

Our exploration begins with the most visible cost: the $695 annual fee (plus taxes). For many, that figure alone feels like a barrier. Yet, the Platinum’s ecosystem of credits, lounge access, and insurance can quickly offset that number if the card is used strategically. By tracking how a cardholder can earn and redeem points, claim travel credits, and tap into exclusive experiences, we can gauge whether the card truly pays for itself.

In the sections that follow, we break down every major category of the Amex Platinum, compare it to other elite metal cards, and provide a transparent cost‑benefit analysis. The goal is not to sell the card, but to present a factual story that lets readers decide if the Platinum aligns with their financial habits and travel goals.

Annual Fee and Baseline Value

The first checkpoint on any premium credit card journey is the annual fee. At $695, the Amex Platinum sits near the top of the fee spectrum, only eclipsed by a few invitation‑only cards. To determine baseline value, we subtract the fee from the sum of guaranteed annual credits and perks that most users can actually activate.

Guaranteed Credits

- Airline Fee Credit: Up to $200 per calendar year for incidental airline fees (baggage, seat selection, in‑flight purchases).

- Uber Cash: $200 total ($15 per month, plus a $35 bonus in December) for rides or Uber Eats in the United States.

- Saks Fifth Avenue Credit: $100 annually ($25 quarterly) for purchases at Saks.com or in stores.

- Hotel Credit: $200 in statement credits when booking eligible stays through Fine Hotels & Resorts or The Hotel Collection.

- Equinox Membership: Up to $300 in annual credits (available to U.S. members only) for Equinox gym access.

Adding these guarantees together yields $1,000 in direct credits, already surpassing the $695 fee by $305 before any other benefit is considered.

Travel Credits and Airline Perks

Travel is where the Platinum card shines brightest. Beyond the $200 airline fee credit, Amex partners with a broad network of airlines, offering status‑matching opportunities and the ability to earn Membership Rewards points on every ticket.

Airline Fee Credit in Action

Imagine a frequent flyer who books three round‑trip tickets per year. Each trip incurs $30 in checked‑bag fees, $20 for seat upgrades, and $10 for in‑flight Wi‑Fi. The total incidental cost per trip is $60, which multiplied by three equals $180—well within the $200 credit limit. The cardholder effectively eliminates these out‑of‑pocket expenses, turning the credit into a direct dollar‑for‑dollar reduction of travel costs.

Additional Airline Benefits

- Access to American Express® Global Lounge Collection (including Centurion Lounges, Priority Pass™, and Delta Sky Club when flying Delta).

- Complimentary upgrades and priority boarding on select carriers.

- Earn 5 Membership Rewards points per dollar on flights booked directly with airlines or through Amex Travel.

These perks collectively enhance the travel experience while generating points at a rate that far exceeds standard cards.

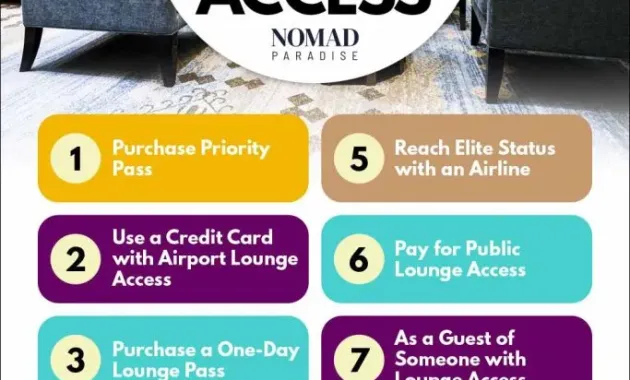

Airport Lounge Access

Lounge access is often the headline feature that draws prospective Platinum members. The card grants entry to over 1,300 lounges worldwide, including the coveted Centurion Lounges, which are known for their upscale amenities, complimentary meals, and premium beverages.

Quantifying the Value

Average lounge entry fees range from $40 to $60 per visit when purchased individually. If a traveler uses the lounge four times per year, the implied savings are $160‑$240. For a business traveler making eight trips, the value climbs to $320‑$480. Even a casual vacationer who accesses a lounge twice a year still captures $80‑$120 in savings.

Moreover, the Centurion Lounge network offers no guest fee for the primary cardholder, and a discounted $50 fee for up to two guests—still a bargain compared to the per‑visit market rate.

Hotel and Resort Benefits

Staying at high‑end hotels often incurs hidden costs—room upgrades, late‑checkout fees, and complimentary breakfast. Amex Platinum holders receive a suite of hotel benefits that translate into tangible monetary value.

Fine Hotels & Resorts (FHR) Program

- Room upgrade upon arrival (subject to availability).

- Daily breakfast for two.

- Late checkout (usually until 4 p.m.).

- Guaranteed 4‑pm check‑in.

- Property‑specific amenity credit (typically $100 per stay).

When the average nightly rate for a luxury property is $350, a two‑night stay with FHR can easily generate $250‑$300 in added value, especially when factoring in the complimentary breakfast ($30‑$40) and the upgrade.

Shopping, Entertainment, and Lifestyle Perks

Beyond travel, the Platinum card extends benefits into everyday spending and leisure activities. These perks are often overlooked but can accumulate quickly for cardholders who leverage them.

Shopping Protections

- Extended warranty up to one additional year on eligible purchases.

- Purchase protection against damage or theft for up to 90 days.

- Return protection for items that a retailer refuses to accept back within 90 days.

While these are not direct cash credits, they effectively reduce the total cost of ownership for high‑value items.

Entertainment Access

Cardholders receive early access to ticket sales for concerts, theater productions, and sporting events through the American Express Presale and Preferred Seating programs. For fans who regularly attend live events, securing premium seats at pre‑sale pricing can represent savings of $50‑$200 per event.

Insurance and Protections

Comprehensive travel insurance is a core component of the Platinum’s value proposition. The card includes coverage that would otherwise require separate policies, each bearing its own premium.

Key Insurance Features

- Trip Cancellation & Interruption Insurance (up to $10,000 per trip).

- Trip Delay Insurance (up to $500 per trip after a 12‑hour delay).

- Lost Luggage Reimbursement (up to $3,000 per passenger).

- Rental Car Insurance (secondary coverage for damage or theft).

- Premium Global Assist® Hotline (24/7 medical and legal referrals).

When combined, these coverages can protect a traveler from potential out‑of‑pocket expenses ranging from a few hundred to several thousand dollars per journey. For a family of four on a $5,000 vacation, the insurance umbrella alone can save $500‑$1,000 in worst‑case scenarios.

For readers interested in deeper insurance mechanics, the article The Hidden Mechanics Behind a Credit Card Chargeback provides an excellent overview of how protections interact with card issuers.

Points Earning and Redemption

Membership Rewards points are the currency that ties the Platinum’s benefits together. Understanding the earn‑rate and redemption options is essential for measuring true ROI.

Earn Rates

- 5 points per dollar on flights booked directly with airlines or through Amex Travel.

- 5 points per dollar on prepaid hotels booked via Amex Travel.

- 1 point per dollar on all other purchases.

For a traveler who spends $4,000 annually on flights and $2,000 on hotels (both booked through Amex), the points earned total (5 × $4,000) + (5 × $2,000) = 30,000 points, equivalent to $300 in travel when redeemed at a 1 cent per point rate. Adding everyday spending of $10,000 yields another 10,000 points ($100 value), bringing the total annual point value to $400.

Redemption Options

Points can be transferred at a 1:1 ratio to over 20 airline and hotel partners, often achieving 1.5–2 cents per point when booked strategically. Using the same 30,000 points, a savvy traveler could secure $450‑$600 in premium cabin flights, dramatically increasing the net benefit.

For a broader perspective on how premium metal cards compare in points structures, see the article Premium Metal Credit Cards Comparison – Which Elite Card Wins the Battle?.

Cost‑Benefit Analysis for 2024

Summarizing the numbers provides a clearer picture of whether the Amex Platinum pays for itself. Below is a simplified annual benefit estimate for a moderate user who travels twice a year, dines out occasionally, and takes advantage of the listed credits.

| Benefit Category | Estimated Annual Value |

|---|---|

| Airline Fee Credit | $180 |

| Uber Cash | $200 |

| Saks Fifth Avenue Credit | $100 |

| Hotel Credit (Fine Hotels & Resorts) | $250 |

| Equinox Credit (if utilized) | $150 |

| Lounge Access (4 visits) | $200 |

| Insurance & Protections (estimated avoided costs) | $500 |

| Points Redemption Value | $400 |

| Total Estimated Benefits | $2,080 |

| Annual Fee | $695 |

| Net Positive Value | $1,385 |

Even if a cardholder only uses half of the listed credits and accesses lounges twice a year, the net positive remains well above the annual fee. The key is to activate the credits that align with one’s lifestyle—otherwise, the card can feel expensive.

Who Should Consider the Amex Platinum in 2024?

The Platinum card is best suited for individuals who:

- Travel internationally or domestically at least twice a year.

- Can leverage the airline fee credit and hotel credit without exceeding the caps.

- Value lounge access and are comfortable with the occasional $50 guest fee.

- Prefer to earn points at accelerated rates on travel purchases.

- Are comfortable paying a high annual fee in exchange for bundled insurance and lifestyle perks.

Conversely, a low‑spender who rarely travels or does not utilize the credits may find the fee outweighs the benefits. For such users, a lower‑fee travel card with a modest rewards structure could be more appropriate.

Ultimately, the decision hinges on personal spending patterns and travel frequency. By mapping one’s annual expenses against the benefit table above, prospective members can calculate a personalized ROI before committing to the $695 fee.

In the end, the Amex Platinum continues to deliver a comprehensive suite of benefits that, when fully utilized, exceed its cost. The card transforms ordinary travel expenses into credits, upgrades, and protected experiences, effectively turning a high‑fee premium product into a cost‑saving tool for the right user.