Table of Contents

- Understanding Introductory APRs and Balance Transfers

- What Is an Introductory APR?

- How Balance Transfers Work

- Why the Intro Period Matters

- Key Features to Evaluate When Choosing a Card

- Length of the Introductory Period

- Transfer Fees

- Standard APR After the Promo

- Credit Score Requirements

- Additional Perks and Fees

- Top Low Intro APR Cards for Balance Transfers in 2024

- 1. Citi® Diamond Preferred Card

- 2. Discover it® Balance Transfer

- 3. Bank of America® Unlimited Cash Rewards Credit Card

- 4. U.S. Bank Visa® Platinum Card

- Step‑by‑Step Guide to Using a Low Intro APR Card Effectively

- Step 1: Assess Your Current Debt Landscape

- Step 2: Choose the Right Card Based on Your Profile

- Step 3: Apply and Secure the Card

- Step 4: Initiate the Balance Transfer

- Step 5: Create a Repayment Plan

- Step 6: Avoid New Debt on the Transferred Card

- Step 7: Monitor the End Date

- Common Pitfalls and How to Dodge Them

- Missing a Payment

- Ignoring the Transfer Fee

- Overlooking the Standard APR

- Using the Card for New Purchases

- Beyond Balance Transfers: Complementary Strategies for Debt Management

- Build Credit While Paying Down Debt

- Leverage Cash‑Back Rewards Wisely

- Consider a Debt Consolidation Loan

- Real‑World Example: From High‑Interest Debt to Financial Freedom

- Choosing the Right Card for Your Situation

When you’re juggling multiple credit‑card balances, the interest you pay can quickly eclipse the principal you owe. Low intro APR cards for balance transfers provide a focused solution: they let you move existing debt to a new card that offers a temporary, reduced interest rate, often as low as 0% for a set period. This strategy can transform a high‑interest avalanche into a manageable, predictable repayment plan.

Imagine Jane, a freelance graphic designer, who accumulated $8,000 in balances across three cards, each charging between 18% and 22% APR. By consolidating her debt onto a single low‑intro‑APR card with a 12‑month 0% promotional rate, she reduced her monthly interest expense from $140 to virtually zero, freeing cash to pay down the principal faster.

For many consumers, the promise of a “zero‑percent introductory APR” is more than a marketing buzzword—it’s a financial lever that, when used correctly, can accelerate debt payoff, improve credit utilization, and lower overall borrowing costs. The following guide walks through the mechanics, highlights the most competitive offers available in 2024, and outlines essential steps to maximize the benefits while avoiding common pitfalls.

Understanding Introductory APRs and Balance Transfers

What Is an Introductory APR?

An introductory APR (Annual Percentage Rate) is a temporary interest rate applied to new purchases, balance transfers, or both, for a predefined period after you open the card. During this window, the rate is often significantly lower than the standard APR—sometimes as low as 0%.

How Balance Transfers Work

A balance transfer moves the outstanding debt from one or more existing credit cards to a new card. The new issuer pays off the old balances on your behalf, and the amount appears as a new balance on the new card, subject to the promotional APR. Most issuers charge a transfer fee, typically ranging from 3% to 5% of the transferred amount.

Why the Intro Period Matters

The promotional window is the heart of the savings opportunity. If you can pay off the transferred balance—or a substantial portion—before the intro period expires, you avoid the higher standard APR that kicks in afterward. For example, a 15‑month 0% intro on a $5,000 transfer means you could potentially save up to $750 in interest if you clear the balance within that time frame.

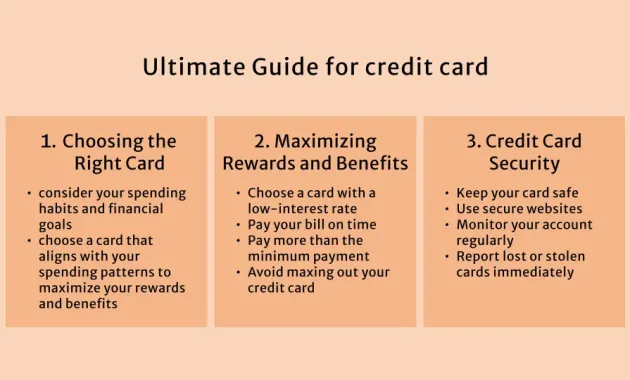

Key Features to Evaluate When Choosing a Card

Length of the Introductory Period

Longer intro periods provide more breathing room. Cards offering 15 to 21 months of 0% APR are particularly valuable for larger balances or slower repayment plans.

Transfer Fees

Even a low or zero‑percent APR can be offset by high transfer fees. Calculate the total cost by adding the fee (e.g., 3% of $10,000 = $300) to any interest that might accrue after the intro period.

Standard APR After the Promo

Know the post‑promo rate. Some cards revert to 19% or higher, which could erode savings if you carry a balance beyond the introductory window.

Credit Score Requirements

Most low‑intro‑APR cards target consumers with good to excellent credit (typically a FICO score of 700+). Understanding your credit profile helps you select realistic options and avoid unnecessary hard inquiries.

Additional Perks and Fees

While the focus is on the APR, consider other card features—annual fees, rewards programs, and additional benefits like travel insurance. Some cards may waive the annual fee for the first year, which can be advantageous during the intro period.

Top Low Intro APR Cards for Balance Transfers in 2024

1. Citi® Diamond Preferred Card

- Intro APR: 0% on balance transfers for 21 months

- Transfer Fee: 3% of each transferred amount (minimum $5)

- Standard APR: 16.99% – 26.99% variable

- Annual Fee: $0

This card offers the longest 0% intro period currently available, making it ideal for large balances. Its lack of an annual fee and relatively low transfer fee further enhance its cost‑effectiveness.

2. Discover it® Balance Transfer

- Intro APR: 0% for 18 months on balance transfers

- Transfer Fee: 3% (minimum $5)

- Standard APR: 17.24% – 28.24% variable

- Annual Fee: $0

- Bonus: Cash back match on purchases (100% match of cash back earned in the first year)

Beyond the competitive intro period, Discover it provides a cash‑back incentive that can offset the transfer fee, especially for users who continue to use the card for everyday purchases.

3. Bank of America® Unlimited Cash Rewards Credit Card

- Intro APR: 0% for 18 months on balance transfers

- Transfer Fee: 3% (minimum $10)

- Standard APR: 16.99% – 26.99% variable

- Annual Fee: $0

- Rewards: Unlimited 1.5% cash back on all purchases

For cardholders who want a blend of low‑interest debt consolidation and ongoing rewards, this option balances both objectives.

4. U.S. Bank Visa® Platinum Card

- Intro APR: 0% for 20 months on balance transfers

- Transfer Fee: 3% (minimum $5)

- Standard APR: 16.49% – 23.49% variable

- Annual Fee: $0

U.S. Bank’s 20‑month intro period is a strong middle ground between the longest and the most widely available offers, and the card’s straightforward terms make it a solid choice for consumers focused solely on debt payoff.

Step‑by‑Step Guide to Using a Low Intro APR Card Effectively

Step 1: Assess Your Current Debt Landscape

List each credit‑card balance, its APR, and the monthly minimum payment. Calculate the total interest you would pay over the next 12 months if you maintain the status quo. This baseline will help you quantify potential savings.

Step 2: Choose the Right Card Based on Your Profile

Match the card’s intro period, fee structure, and credit‑score requirements to your situation. For instance, if you have a $12,000 balance and a solid credit score, the Citi® Diamond Preferred’s 21‑month window could provide the most breathing room.

Step 3: Apply and Secure the Card

Submit a complete application, ensuring the information matches your credit report. A hard inquiry will temporarily affect your score, but the long‑term savings often outweigh this minor dip.

Step 4: Initiate the Balance Transfer

Most issuers let you transfer balances online or by phone. Provide the account numbers and amounts you wish to move. Remember to verify the transfer fee before confirming.

Step 5: Create a Repayment Plan

Divide the transferred amount by the number of months in the intro period to set a target monthly payment. For example, a $9,000 transfer with a 18‑month intro requires $500 per month to clear the balance before the promotional rate ends.

To track progress, you might find a credit card payoff calculator especially helpful. It can show how different payment amounts affect the payoff timeline and interest savings.

Step 6: Avoid New Debt on the Transferred Card

Resist the temptation to make large purchases on the new card during the intro period, as any new balance may accrue interest at the standard APR unless the card also offers a 0% rate on purchases.

Step 7: Monitor the End Date

Set calendar reminders a month before the intro period expires. If you haven’t cleared the balance, consider a second balance‑transfer card with another 0% offer, but be mindful of cumulative fees.

Common Pitfalls and How to Dodge Them

Missing a Payment

Many issuers will cancel the promotional APR if you miss a payment or make a late payment. Always set up automatic payments for at least the minimum amount to protect the intro rate.

Ignoring the Transfer Fee

A 3% fee on a $15,000 transfer equals $450. If the interest saved during the promo period is less than that amount, the transfer might not be worthwhile. Run the numbers before proceeding.

Overlooking the Standard APR

Some cards jump from 0% to 29% after the intro period. If you anticipate needing more time, choose a card with a lower post‑promo APR or a longer intro.

Using the Card for New Purchases

Unless the card also offers a 0% purchase APR, new spending will accrue interest immediately. This can quickly erode the savings you achieved through the balance transfer.

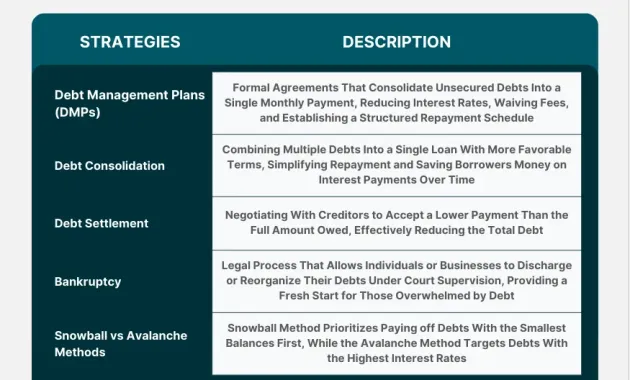

Beyond Balance Transfers: Complementary Strategies for Debt Management

Build Credit While Paying Down Debt

Maintaining a low credit utilization ratio (the balance divided by the credit limit) can improve your credit score even as you pay down debt. A balance‑transfer card with a high credit limit can help keep utilization low, provided you avoid adding new balances.

Leverage Cash‑Back Rewards Wisely

If your chosen card offers cash‑back rewards, consider applying those earnings directly toward your balance. For example, the Discover it® Balance Transfer’s cash‑back match could add up to $200–$300 in the first year, effectively reducing the amount you owe.

Learning how to use a credit card to build credit history can also complement your debt‑reduction plan, as a stronger credit profile may qualify you for even better future offers.

Consider a Debt Consolidation Loan

For some borrowers, a personal loan with a fixed low interest rate may be a better fit than a credit‑card balance transfer, especially if the loan term aligns with your repayment goals and carries no fees.

Real‑World Example: From High‑Interest Debt to Financial Freedom

Mark, a 34‑year‑old teacher, faced $13,500 in credit‑card debt spread across four cards, with APRs ranging from 19% to 24%. After calculating his monthly interest, he realized he was paying $260 in interest alone each month. He applied for the Citi® Diamond Preferred Card, transferred $12,000 of his balances (incurring a $360 fee), and kept the remaining $1,500 on a low‑interest personal loan.

With a 21‑month 0% intro, Mark set a payment schedule of $600 per month, which cleared the transferred balance just before the promotional period ended. Over the life of the debt, he saved approximately $2,800 in interest—a 60% reduction compared to his original scenario. Moreover, his credit utilization dropped from 68% to 32%, boosting his credit score by 30 points.

Choosing the Right Card for Your Situation

Every consumer’s debt profile is unique. If you have a moderate balance (<$5,000) and a strong credit score, the Discover it® Balance Transfer offers an attractive cash‑back component with a solid 18‑month intro. For larger balances, the extended 21‑month period of the Citi® Diamond Preferred provides the most time to pay down without accruing interest.

Evaluate your financial goals—whether it’s rapid payoff, minimizing fees, or earning rewards—and align them with the card features outlined above. By doing so, you can transform a costly debt situation into a structured, low‑interest repayment plan.

Remember, the true power of a low intro APR card lies in disciplined execution. Set up automatic payments, track your progress, and avoid new debt. When used responsibly, balance transfers can be a catalyst for improved credit health and lasting financial stability.