Table of Contents

- What Freelancers Need in a Credit Card

- 1. Flexible Cash‑Flow Management

- 2. Reward Structure Tailored to Gig Work

- 3. No Foreign Transaction Fees

- 4. Robust Expense‑Tracking Tools

- 5. Strong Credit‑Building Benefits

- Top Credit Cards for Freelancers in 2024

- Chase Ink Business Unlimited®

- American Express® Blue Business Cash™ Card

- Capital One® Spark Cash for Business

- Bank of America® Business Advantage Travel Rewards World Elite Mastercard®

- Discover it® Business Card

- How to Maximize Rewards as a Freelancer

- 1. Category Stacking with Business Expenses

- 2. Leverage Introductory 0% APR Periods

- 3. Use Employee Cards for Subcontractors

- 4. Combine Rewards with Cash‑Back Matching Offers

- 5. Automate Payments and Alerts

- Common Pitfalls and How to Avoid Them

- Additional Resources for the Savvy Freelancer

Freelancers navigate a financial landscape that blends personal and business expenses, unpredictable income, and the constant need for flexible cash flow. For many, a well‑chosen credit card becomes the silent partner that smooths cash‑flow gaps, earns rewards on everyday purchases, and protects against fraud. The keyword “best credit cards for freelancers” captures a growing demand for tools that adapt to the gig economy’s unique rhythm.

Imagine Maya, a freelance graphic designer who juggles client invoices, software subscriptions, and occasional travel to meet with overseas partners. Without a dedicated business credit card, she finds herself paying interest on carried balances, missing out on cashback, and struggling to separate personal from business spending for tax purposes. After switching to a card designed for freelancers, Maya experiences smoother monthly budgeting, earns cash back on software subscriptions, and even receives travel insurance that covers her occasional trips.

This narrative mirrors the reality of countless independent workers. The right credit card can transform financial chaos into a structured system that supports growth, rewards productivity, and safeguards against unexpected costs. Below, we explore the features freelancers should prioritize, highlight the top cards currently available, and offer actionable tips to maximize benefits while steering clear of common pitfalls.

What Freelancers Need in a Credit Card

Before diving into specific products, it’s essential to understand the criteria that make a card truly valuable for a freelancer. These criteria stem from the daily challenges and long‑term goals that independent professionals face.

1. Flexible Cash‑Flow Management

- Low or 0% intro APR on purchases gives freelancers breathing room to settle invoices without incurring interest.

- Grace periods that align with typical billing cycles (e.g., 21–25 days) help avoid unnecessary finance charges.

2. Reward Structure Tailored to Gig Work

- Category‑specific bonuses for software, marketing, and travel—areas where freelancers often spend.

- Flat‑rate cash back for all other purchases ensures every dollar spent contributes to earnings.

3. No Foreign Transaction Fees

Freelancers who source talent or clients abroad benefit from cards that waive the typical 3% fee, turning international transactions into cost‑free opportunities.

4. Robust Expense‑Tracking Tools

Integrated dashboards or partnerships with accounting software (e.g., QuickBooks, FreshBooks) streamline bookkeeping, reducing time spent on tax preparation.

5. Strong Credit‑Building Benefits

Consistent, on‑time payments can improve credit scores, a vital factor for freelancers seeking loans or larger credit lines. For a deeper look at credit‑building, see How to Use a Credit Card to Build Credit History – The Proven Roadmap You’ve Been Waiting For.

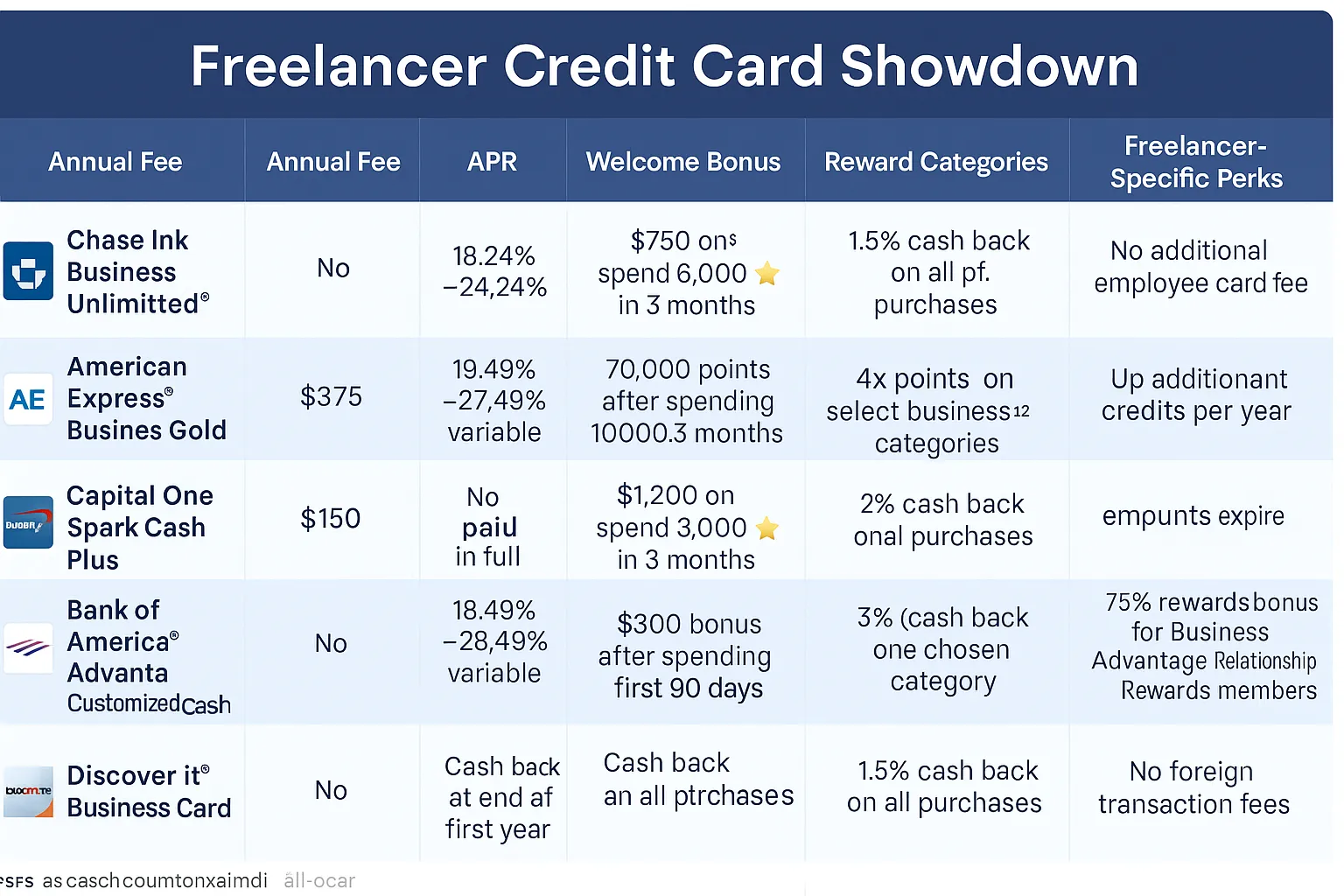

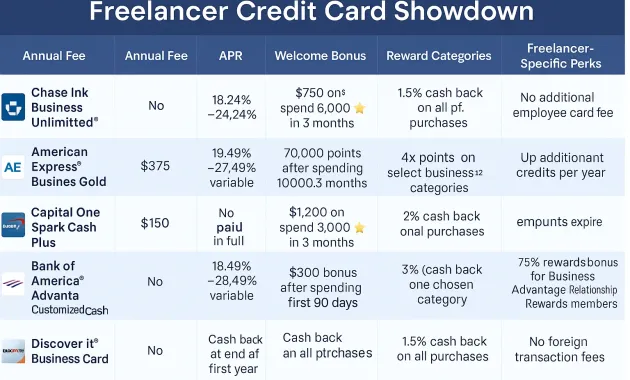

Top Credit Cards for Freelancers in 2024

The market offers several cards that align closely with the needs outlined above. Below, each card is examined for its rewards, fees, and freelancer‑specific perks.

Chase Ink Business Unlimited®

- Reward Rate: 1.5% cash back on every purchase, no caps.

- Intro APR: 0% for 12 months on purchases.

- Annual Fee: $0.

- Freelancer Perk: Complimentary employee cards (ideal for subcontractors) and integration with QuickBooks Self‑Employed.

American Express® Blue Business Cash™ Card

- Reward Rate: 2% cash back on all eligible purchases up to $50,000 per year, then 1% thereafter.

- Intro APR: 0% for 12 months on purchases.

- Annual Fee: $0.

- Freelancer Perk: No foreign transaction fees and access to Amex Offers tailored for business services.

Capital One® Spark Cash for Business

- Reward Rate: Unlimited 2% cash back on all purchases.

- Intro APR: None (standard purchase APR applies).

- Annual Fee: $95 (waived for the first year).

- Freelancer Perk: One‑click cash back redemption and expense‑management tools compatible with popular invoicing platforms.

Bank of America® Business Advantage Travel Rewards World Elite Mastercard®

- Reward Rate: 1.5 points per $1 on travel and dining; 1.5 points on all other purchases for qualifying customers.

- Intro APR: 0% for 9 months on purchases.

- Annual Fee: $0.

- Freelancer Perk: No foreign transaction fees and travel protections, useful for freelancers who travel for client meetings.

Discover it® Business Card

- Reward Rate: 1.5% cash back on all purchases.

- Cash Back Match: Discover matches all cash back earned in the first year.

- Annual Fee: $0.

- Freelancer Perk: No foreign transaction fees and a free credit score monitoring tool.

Each of these cards balances reward potential with fee structures that protect a freelancer’s bottom line. The best choice often hinges on individual spending patterns—whether the freelancer prioritizes flat‑rate cash back, travel rewards, or software‑specific bonuses.

How to Maximize Rewards as a Freelancer

Choosing the right card is only half the equation. The real advantage emerges when freelancers strategically align their spending with the card’s reward categories and use built‑in tools to capture every possible benefit.

1. Category Stacking with Business Expenses

Many cards offer higher cash back on specific categories such as advertising, software subscriptions, or travel. By consolidating all related expenses onto a single card, freelancers can amplify earnings. For instance, a freelance writer using the Chase Ink Business Unlimited® for all marketing and software purchases will accrue 1.5% cash back on each dollar, turning routine costs into a steady income stream.

2. Leverage Introductory 0% APR Periods

When a new client delays payment, a 0% intro APR can bridge the gap without accruing interest. Freelancers should track invoice due dates and schedule payments to fall within the interest‑free window, effectively using the credit line as a short‑term working capital loan.

3. Use Employee Cards for Subcontractors

Cards like Chase Ink Business Unlimited® allow additional authorized users at no extra cost. By issuing cards to subcontractors, freelancers can keep expenses under a single account, simplifying bookkeeping and ensuring that all spend contributes to the same rewards pool.

4. Combine Rewards with Cash‑Back Matching Offers

Discover it® Business Card’s first‑year cash back match can double earnings on all purchases. Pairing this with a high‑spend month (e.g., buying new equipment) can generate a significant boost, similar to the effect described in The Hidden Costs of Maxing Out Your Credit Card – What Every Cardholder Must Know, but with the advantage of a match rather than a penalty.

5. Automate Payments and Alerts

Setting up automatic payments for the minimum due eliminates the risk of late fees, while customized alerts for approaching credit limits help maintain a healthy utilization ratio—key to preserving a strong credit score.

Common Pitfalls and How to Avoid Them

Even the most rewarding cards can become liabilities if mismanaged. Below are frequent mistakes freelancers encounter, along with preventive strategies.

- Carrying a Balance Beyond Intro APR: Once the promotional period ends, the standard APR can be steep. Plan to pay off the balance before the transition date or transfer the balance to a low‑intro‑APR card, as highlighted in Unlock Savings: The Top Low Intro APR Cards for Balance Transfers in 2024.

- Mixing Personal and Business Expenses: This hampers expense tracking and can cause tax complications. Use a dedicated business card and categorize expenses promptly.

- Ignoring Annual Fee Offsets: Some cards charge fees that outweigh rewards if spend is low. Conduct a simple break‑even analysis—divide the annual fee by the cash‑back rate—to determine the minimum spend needed to justify the fee.

- Overlooking Foreign Transaction Fees: For freelancers working with overseas clients, a 3% fee can erode profit margins. Choose a card with no foreign transaction fees to preserve earnings.

- Missing Out on Bonus Offers: Many cards provide sign‑up bonuses tied to spend thresholds. Set a calendar reminder to meet the threshold within the required timeframe, turning a one‑time offer into a substantial cash infusion.

Additional Resources for the Savvy Freelancer

Beyond credit cards, freelancers benefit from a holistic approach to financial health. Articles such as Premium Metal Credit Cards Comparison – Which Elite Card Wins the Battle? can help evaluate premium options for those whose income supports higher annual fees, while The Ultimate Guide to the Best Cards for Dining Out and Takeout – Earn More While You Feast offers insight into maximizing everyday spend on meals—a common expense for freelancers juggling client lunches and late‑night brainstorming sessions.

By aligning a credit card’s features with the rhythm of freelance work, professionals can turn everyday transactions into a strategic advantage. The right card not only smooths cash flow and simplifies bookkeeping but also rewards the very activities that drive a freelancer’s business forward.

Choosing a credit card is an ongoing process. As income streams evolve and expenses shift, freelancers should periodically reassess their card portfolio, ensuring that the rewards structure, fees, and ancillary benefits remain optimal. With thoughtful selection and disciplined usage, the best credit cards for freelancers become more than a payment tool—they become an integral part of a sustainable, growth‑oriented financial strategy.