Table of Contents

- How Free Credit Score Access Works Within a Card Account

- Key Features to Look For

- Top Credit Cards Offering Free Credit Score Monitoring

- 1. Capital One® Quicksilver Cash Rewards Credit Card

- 2. Discover it® Cash Back

- 3. Chase Freedom Unlimited®

- 4. American Express® Blue Cash Everyday™ Card

- 5. Citi® Double Cash Card

- Why Free Credit Score Access Matters for Cardholders

- Integrating Score Monitoring Into Your Financial Routine

- Potential Drawbacks and How to Mitigate Them

- How to Leverage the Free Score When Applying for New Credit

- Real‑World Example: From Score Check to Better APR

- Connecting the Dots: Managing Your Card, PIN, and Authorized Users

- Future Trends: Expanding Free Credit Score Services

In today’s data‑driven world, knowing your credit score has become as essential as checking the weather before you step outside. For many consumers, the phrase “free credit score” instantly conjures images of subscription‑free apps or occasional promotional offers. Yet a growing number of credit card issuers have begun embedding free credit score access directly into their online portals, turning a routine financial check into a seamless part of everyday card management. This article unpacks the mechanics behind these cards, highlights the most notable providers, and offers practical tips for maximizing the benefit without compromising privacy or security.

Understanding the value of a credit score is the first step. A single number, ranging typically from 300 to 850, distills years of borrowing behavior into a metric that lenders use to gauge risk. A higher score can unlock lower interest rates, better loan terms, and even influence rental or employment decisions. Consequently, having real‑time visibility into this number helps cardholders spot trends, correct errors, and make informed decisions about new credit applications. The convenience of a free score embedded in a credit card account eliminates the need for third‑party services, reduces the risk of data breaches, and often updates more frequently than traditional bureau reports.

How Free Credit Score Access Works Within a Card Account

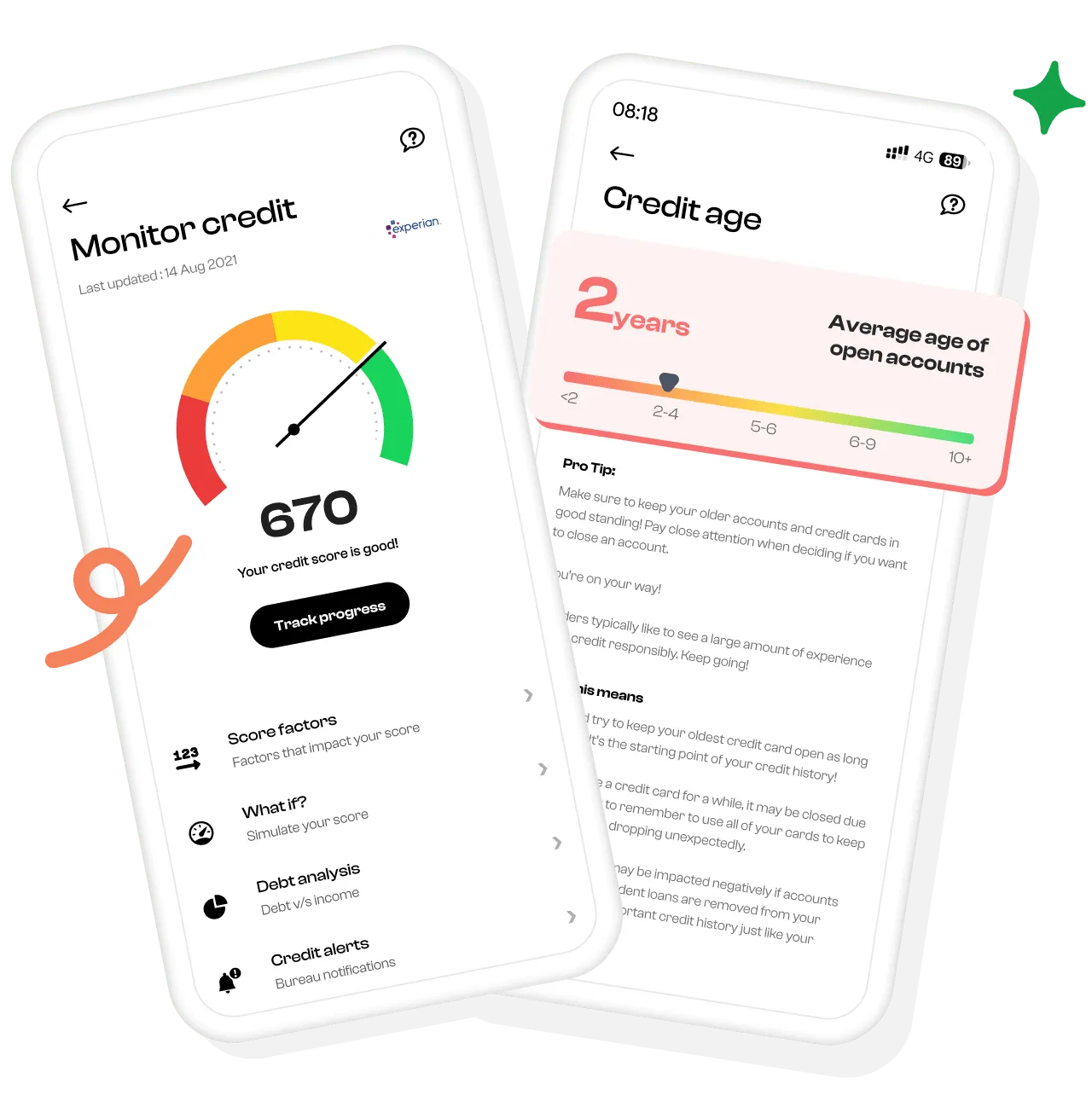

When a card issuer offers a free credit score, they typically partner with one of the major credit bureaus—Equifax, Experian, or TransUnion—or use a third‑party analytics platform that aggregates bureau data. The score is displayed on the issuer’s website or mobile app, often alongside a brief summary of the factors influencing the current number. Updates may occur monthly, quarterly, or even in real time, depending on the agreement between the issuer and the data provider.

Key Features to Look For

- Frequency of Updates: Some issuers refresh the score every 30 days, while others provide a “snapshot” that may lag by a few weeks.

- Score Model: FICO® scores are the industry standard for lending decisions, but VantageScore® is also common. Knowing which model you’re viewing can help you compare it with scores you receive from other sources.

- Data Security: Look for two‑factor authentication (2FA) and encryption protocols that protect your personal information when you log in.

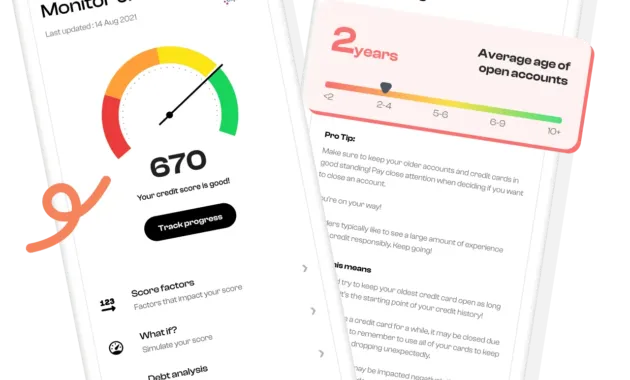

- Additional Insights: Many platforms include a breakdown of the five credit pillars—payment history, credit utilization, length of credit history, new credit, and credit mix—providing actionable insights.

Top Credit Cards Offering Free Credit Score Monitoring

Below is a curated list of credit cards that integrate free credit score access into their cardholder experience. The selection criteria include the reliability of the score source, update frequency, and overall card benefits.

1. Capital One® Quicksilver Cash Rewards Credit Card

Capital One provides a free VantageScore® updated weekly through its “CreditWise” tool. Cardholders can view their score, see recent activity that impacted it, and receive personalized tips for improvement. The Quicksilver card also offers unlimited 1.5% cash back on every purchase, making it a solid all‑around choice for everyday spending.

2. Discover it® Cash Back

Discover’s “Credit Scorecard” delivers a free FICO® Score updated monthly, directly visible in the online account dashboard. In addition to the rotating 5% cash back categories, the card has no annual fee and a first‑year cash back match, further enhancing its value proposition.

3. Chase Freedom Unlimited®

Through Chase’s “Credit Journey” feature, cardholders can monitor their credit score for free, with updates sourced from TransUnion. The tool also offers a credit health dashboard that tracks changes over time. The Freedom Unlimited card rewards users with a flat 1.5% cash back on all purchases, plus a sign‑up bonus after meeting the spend threshold.

4. American Express® Blue Cash Everyday™ Card

American Express partners with Experian to provide a free credit score that refreshes monthly. The Blue Cash Everyday card focuses on grocery and streaming purchases, offering 3% cash back at U.S. supermarkets (up to $6,000 per year) and 2% at U.S. gas stations. The score tool is integrated into the Amex app, allowing quick access alongside account management.

5. Citi® Double Cash Card

Citi’s “Citi Credit Score” service supplies a free FICO® Score updated every 30 days. The Double Cash Card’s straightforward rewards structure—1% cash back on purchases plus an additional 1% as you pay them off—makes it a favorite among balance‑carryers who still want to keep tabs on their credit health.

Why Free Credit Score Access Matters for Cardholders

Having a credit score at your fingertips does more than satisfy curiosity; it can materially influence financial outcomes. For instance, a sudden dip in the score might signal a missed payment, an unexpected increase in credit utilization, or even fraudulent activity. Early detection enables swift remedial action—such as paying down balances or disputing inaccuracies—before the issue escalates to a denied loan application or higher interest rates.

Moreover, regular score monitoring cultivates disciplined credit habits. When you see a direct correlation between paying your credit card balance in full each month and a rising score, the positive feedback loop encourages continued responsible behavior. This is especially relevant for individuals building credit for the first time, such as recent graduates or new immigrants, who can leverage the free score to track progress without incurring additional costs.

Integrating Score Monitoring Into Your Financial Routine

- Set a Monthly Reminder: Allocate a specific day each month to log into your card portal and review the score update.

- Compare Across Platforms: If you have multiple cards offering scores, compare the numbers and note any discrepancies that may arise from different scoring models.

- Use Alerts Wisely: Enable notifications for significant score changes; many issuers send alerts when a score moves by 10 points or more.

- Combine With Other Tools: Pair your issuer’s score with a free credit report from AnnualCreditReport.com to verify the underlying data.

Potential Drawbacks and How to Mitigate Them

While the convenience of a free score is appealing, there are a few considerations to keep in mind. First, the score displayed may not be the exact figure lenders see during a formal credit inquiry, especially if the issuer uses a model that differs from the one most lenders rely on. Second, some issuers may limit the depth of insights, offering only the score without detailed factor analysis. Finally, the presence of the score within a credit card portal can inadvertently encourage “score‑checking” behavior that distracts from broader financial goals.

Mitigation strategies include cross‑checking your free score with a separate FICO® Score from a reputable source at least once a year, and focusing on the actionable insights—such as payment history and credit utilization—rather than the raw number alone. If you need a more comprehensive view, consider using a credit‑monitoring service that provides alerts for new hard inquiries, public records, and identity theft incidents.

How to Leverage the Free Score When Applying for New Credit

Before you submit a credit card or loan application, a quick glance at your free score can guide your decision. If the score is in the “good” to “excellent” range (typically 670+), you are more likely to qualify for cards with premium rewards, lower APRs, and generous credit limits. Conversely, if your score falls below 620, you might prioritize cards designed for rebuilding credit, such as secured cards, before pursuing higher‑tier offers.

In practice, you could log into your Capital One account, note the VantageScore®, and then use that information when deciding whether to apply for a new travel rewards card that requires a minimum FICO® score of 700. If the score is borderline, you might delay the application, reduce existing balances, and re‑check the score after a month of disciplined payments.

For those who already have a credit card with a free score, consider the following workflow:

- Check the score a week before any planned credit inquiry.

- Identify the main factor dragging the score down (e.g., high utilization).

- Implement a corrective action, such as paying down balances or requesting a credit limit increase.

- Re‑check the score after the issuer’s next update cycle.

By aligning your actions with the feedback loop provided by the free score, you improve the odds of approval and secure better terms.

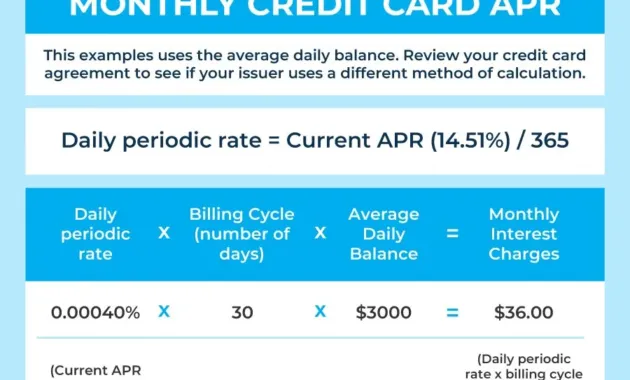

Real‑World Example: From Score Check to Better APR

Consider Jane, a 32‑year‑old marketing professional who holds a Discover it® Cash Back card. She notices her monthly VantageScore® has dipped from 720 to 695 over two months. The Discover Credit Scorecard indicates the drop is due to a spike in her credit utilization—her balance on a newly opened retail store card rose to 45% of its limit.

Using the insights, Jane pays down the retail card balance to bring utilization below 30%, which is generally considered optimal. Within the next update cycle, her score climbs back to 715. Armed with the improved score, she applies for a personal loan to consolidate debt, receiving an APR 0.75% lower than the offer she would have received with a sub‑700 score. This scenario demonstrates how a free credit score tool embedded in a credit card can directly influence borrowing costs.

Connecting the Dots: Managing Your Card, PIN, and Authorized Users

While monitoring your credit score, don’t overlook other aspects of card management that affect security and credit health. If you need to request a new credit card PIN quickly and safely, ensure you follow the issuer’s recommended verification steps to prevent unauthorized access. Adding trusted individuals as authorized users can also help build credit for family members, but be aware that their activity will reflect on your account and potentially impact your score. For guidance on this process, refer to our guide on how to add an authorized user to your account. Finally, understanding what constitutes a good APR for a credit card can help you decide whether a card’s rewards outweigh its interest costs, especially if you occasionally carry a balance.

Future Trends: Expanding Free Credit Score Services

As data analytics evolve, more issuers are likely to enhance their free score offerings. Upcoming trends include real‑time score updates triggered by every transaction, AI‑driven recommendations tailored to individual spending patterns, and integrated budgeting tools that adjust credit utilization automatically. Some fintech startups are already experimenting with open‑banking APIs that pull score data from multiple bureaus, offering a consolidated view within a single dashboard.

Regulatory bodies are also paying attention. The Consumer Financial Protection Bureau (CFPB) encourages transparency in credit reporting, and future guidelines may require issuers to disclose the specific scoring model and update frequency more clearly. Such mandates could level the playing field, ensuring consumers receive consistent, accurate information regardless of the card they hold.

In the meantime, the existing suite of credit cards with free score monitoring provides a valuable resource for anyone looking to stay on top of their credit health without additional fees. By selecting a card that aligns with your spending habits, rewards preferences, and score monitoring needs, you can turn a routine financial task into a strategic advantage.

Whether you are a seasoned credit user or just beginning to build your financial profile, the integration of free credit score access into credit card platforms represents a meaningful step toward greater financial literacy and empowerment. Keep an eye on your score, act on the insights it offers, and let your credit card serve not just as a payment tool, but as a gateway to smarter financial decisions.