Table of Contents

- Common Status Indicators and What They Mean

- Why “Under Review” Can Take Varying Amounts of Time

- How to Check Your Application Status Online

- Mobile Apps as a Convenient Alternative

- Checking Status by Phone or Email

- Email Inquiries and Automated Replies

- Understanding the Impact of Credit Pulls

- When a Hard Pull Is Reported

- What to Do If Your Application Is Pending for an Extended Period

- Using a Checking Account to Pay Pending Balances

- Best Practices for Future Applications

- Leveraging Credit Card Perks While Waiting

Checking the status of your credit card application is a common step for anyone who has recently submitted personal or business information to a bank or issuer. The moment you hit “submit,” the process moves behind the scenes, and you are left waiting for a decision. Knowing where you stand can reduce anxiety and help you plan your finances more effectively. This article walks you through the typical timeline, the tools available, and the actions you can take while you await a final answer.

Most applicants wonder whether there is a single “magic button” that instantly reveals whether their card will be approved or denied. In reality, the journey involves several checkpoints, each designed to verify your identity, assess risk, and confirm eligibility. By understanding these checkpoints, you can interpret status updates more accurately and avoid unnecessary follow‑up calls.

Below, we explore the most reliable ways to check your credit card application status, explain the meaning of common status messages, and provide actionable advice to keep the process moving smoothly. Whether you applied online, by phone, or in person, the principles remain the same.

Common Status Indicators and What They Mean

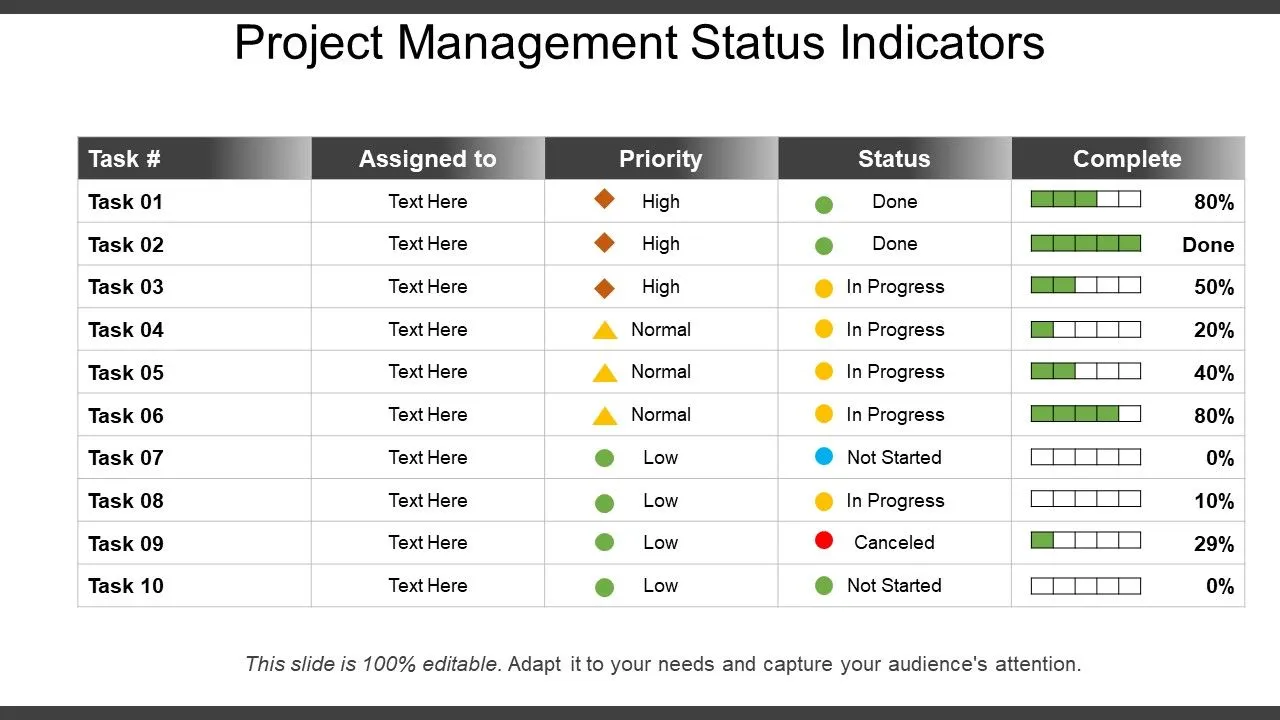

When you log into the issuer’s portal or receive an email, you will likely encounter one of several status codes. Recognizing these codes helps you gauge how far your application has progressed.

- Received/Submitted: Your application has entered the system but has not yet been reviewed.

- Under Review: The issuer’s underwriting team is evaluating your credit report, income, and other details.

- Pending Documents: Additional information is required, such as proof of income or a copy of your ID.

- Approved – Conditional: The card will be issued once you meet specific conditions (e.g., setting up a direct deposit).

- Approved – Final: Your card is on its way; you may receive a welcome packet with activation instructions.

- Denied: The issuer has decided not to extend credit at this time. Reasons are often disclosed in the communication.

Why “Under Review” Can Take Varying Amounts of Time

Under‑review status is the most common point of uncertainty. The duration depends on several factors, including the complexity of your credit profile, the issuer’s internal workload, and any manual verification steps required. Some banks use automated algorithms that can approve a card within minutes, while others perform a manual check that may extend the timeline to several business days.

How to Check Your Application Status Online

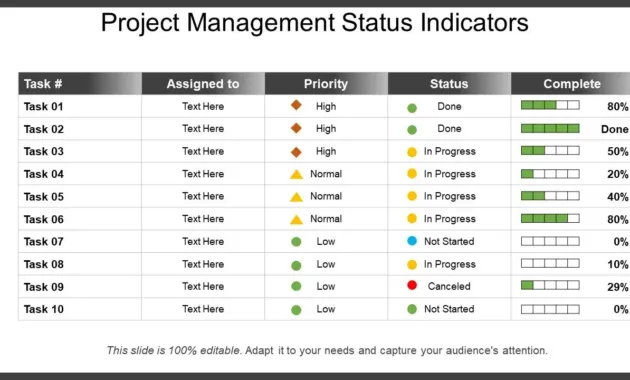

Most major issuers provide an online dashboard where you can view the current status of any pending applications. Follow these steps for a smooth experience:

- Visit the official website of the credit card issuer.

- Locate the “Login” or “Account Access” button, usually found in the top‑right corner.

- Enter your username and password. If you haven’t created an online account yet, use the “Create Account” link and follow the verification prompts.

- Navigate to the “Application Status” or “Pending Requests” section. This area is often grouped under “My Profile” or “Account Services.”

- Read the status message carefully. If additional documents are needed, the portal will typically provide a secure upload link.

For example, a user who recently applied for a travel rewards card can log in and see a status of “Pending Documents.” By clicking the provided link, they can upload a recent pay stub, which often speeds up the approval process.

Mobile Apps as a Convenient Alternative

Many banks now mirror their web portals in mobile applications. The app interface may show a push notification when the status changes, allowing you to stay informed without repeatedly checking the website. Ensure your app notifications are enabled for the issuer’s app to receive real‑time updates.

Checking Status by Phone or Email

If you prefer a personal touch or encounter technical difficulties with the online portal, calling the issuer’s customer service line is an effective option. When you call:

- Have your application reference number handy. This number is usually included in the confirmation email you received after submitting the application.

- Verify your identity by providing the last four digits of your Social Security Number (SSN) or another personal identifier.

- Ask the representative to read the exact status and any next steps required.

While phone inquiries can be helpful, be prepared for possible hold times, especially during peak periods such as holiday shopping seasons.

Email Inquiries and Automated Replies

Some issuers send automated email updates at key milestones—submission, underwriting, and final decision. If you have not received an email within the expected timeframe (usually 24‑48 hours for the initial acknowledgment), you may send a brief, polite inquiry to the support address listed in the original confirmation. Include your application reference number to expedite the response.

Understanding the Impact of Credit Pulls

When you apply for a credit card, the issuer performs a hard inquiry on your credit report. This “hard pull” can affect your credit score by a few points, especially if you have a limited credit history. If you have submitted multiple applications in a short period, the cumulative effect may be more noticeable.

For individuals concerned about maintaining a healthy credit profile while applying for several cards, consider reviewing strategies to build credit without a credit card first. An informative guide on this topic can be found in How to Build Credit Without a Credit Card – Proven Paths to a Strong Score. Understanding these alternatives can help you balance the need for new credit with long‑term score stability.

When a Hard Pull Is Reported

After the issuer completes the hard pull, the inquiry appears on your credit report for up to two years. However, it only impacts your score for the first 12 months. Monitoring your credit report during this period can alert you to any discrepancies or unauthorized activity.

What to Do If Your Application Is Pending for an Extended Period

Occasionally, an application may linger in “Under Review” longer than expected. This can happen due to:

- Missing or unclear documentation.

- Discrepancies between the information you provided and the data in your credit file.

- High volume of applications at the issuer’s end.

In these cases, proactive steps can reduce waiting time:

- Log into the online portal and check for any “Pending Documents” messages. Upload any requested files promptly.

- Contact customer service with your reference number to confirm that the issuer has received all necessary information.

- Verify that the personal details (address, employment information) match what appears on your credit report.

If you suspect that a large purchase you intend to make will be affected by the pending status, you might explore alternative financing options temporarily. For instance, Understanding How Credit Cards Handle Big Ticket Items discusses strategies for managing significant expenses while awaiting a new credit line.

Using a Checking Account to Pay Pending Balances

Some issuers allow you to link a checking account for a small, refundable charge that verifies account ownership. This process is described in detail in Unlock the Simple Way to Pay Your Credit Card with a Checking Account – Everything You Need to Know. Completing this step may accelerate the final approval.

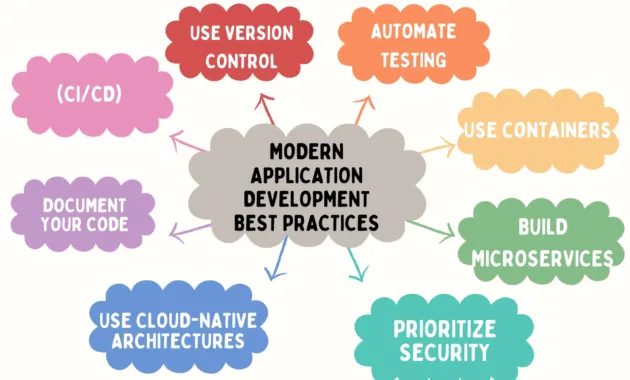

Best Practices for Future Applications

Even after you have checked the status of a current application, the experience provides valuable lessons for future submissions. Adopt these best practices to improve your odds of quick approval:

- Pre‑verify your information: Before you begin the application, gather recent pay stubs, a valid ID, and your Social Security Number.

- Use a consistent address: Ensure the mailing address on your application matches the one on your credit report.

- Limit simultaneous applications: Space out credit card applications by at least 30 days to reduce the impact of multiple hard pulls.

- Monitor your credit report: Regularly review your credit file for errors that could delay underwriting.

- Read the terms: Some cards require a minimum income or a specific credit score range. Confirm that you meet these criteria before applying.

Leveraging Credit Card Perks While Waiting

While you wait for a decision, you can still benefit from other cards you already own. Many issuers provide free credit score tracking as a perk; see The Hidden Perks: Credit Cards That Offer Free Credit Score Tracking – What You Need to Know for a list of cards that include this feature. Monitoring your score can help you anticipate whether a future application is likely to be approved.

In summary, checking your credit card application status is a straightforward process when you know where to look and what each status means. By using the issuer’s online portal or mobile app, contacting support when needed, and responding quickly to any document requests, you can move your application forward efficiently. Understanding the impact of hard pulls, keeping your personal data consistent, and learning from each experience will position you for smoother approvals in the future.