Table of Contents

- Understanding Credit Utilization Ratio

- Definition

- Why It Matters

- How to Calculate Credit Utilization

- Overall Utilization

- Per‑Card Utilization

- Impact on Credit Scores

- FICO vs. VantageScore

- Best Practices for Managing Utilization

- Keep Below 30%

- Pay Balances Early

- Request Credit Limit Increases

- Strategic Use of Multiple Cards

- Leverage Balance Transfers Wisely

- Monitor Your Credit Regularly

- Understand the Role of Authorized Users

- Integrate Utilization Management with Daily Financial Routines

- Use Technology to Your Advantage

- Consider the Bigger Picture

When Alex first opened his first credit card at age 22, he was excited to have a “plastic friend” that would help him build a credit history. Months later, his credit score plateaued, and a lender’s denial letter left him wondering what he could have done differently. The answer lay in a single, often‑overlooked metric: the credit utilization ratio. This figure, which compares the amount of credit you’re using to the total credit available to you, can sway lenders one way or the other, even if you pay every bill on time.

Understanding the credit utilization ratio is not just for finance professionals; it’s a practical tool for anyone who wants to manage debt responsibly. By the time you finish reading this article, you’ll know exactly how the ratio is calculated, how it interacts with major credit scoring models, and what everyday habits can keep it in the “healthy” zone.

In the sections that follow, we’ll walk through the mechanics of the ratio, illustrate real‑world scenarios, and provide a checklist of best practices. Whether you’re a student, a young professional, or someone looking to rebuild after a setback, mastering credit utilization can be a turning point in your financial journey.

Understanding Credit Utilization Ratio

Definition

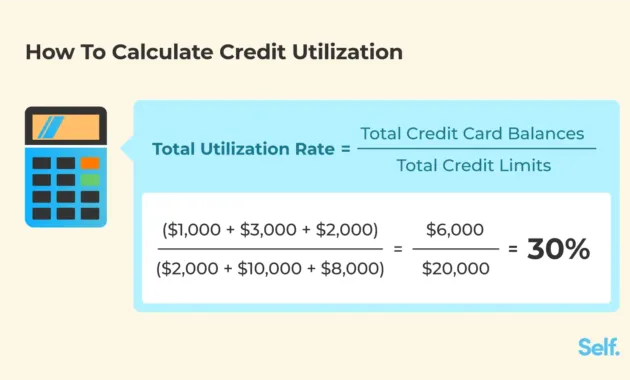

The credit utilization ratio (sometimes called the credit usage ratio) is a percentage that reflects how much of your revolving credit you’re currently borrowing. It is calculated by dividing the total outstanding balances on all your revolving accounts by the sum of all your credit limits, then multiplying by 100. For example, if you have a total credit limit of $10,000 across three cards and your current balances add up to $2,500, your utilization ratio is 25%.

Why It Matters

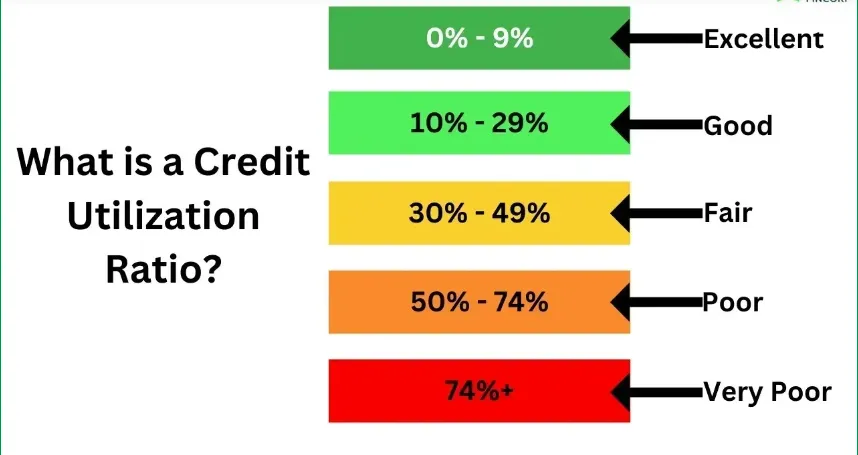

Credit scoring models, especially FICO and VantageScore, treat utilization as a proxy for credit risk. A high ratio suggests that a borrower may be overextended, while a low ratio signals prudent credit management. In most scoring algorithms, utilization accounts for roughly 30% of the total score—making it the second‑most influential factor after payment history.

Beyond the score, the ratio influences the interest rates you’re offered, the credit limits you may receive, and even the terms of new loan applications. Lenders often set internal thresholds; a utilization above 45% may trigger a higher APR or a request for additional documentation.

How to Calculate Credit Utilization

Overall Utilization

To determine your overall utilization, gather the current balances from every revolving account—credit cards, lines of credit, and any other revolving facilities. Add those balances together, then add together all the credit limits for those accounts. The formula looks like this:

- Overall Utilization % = (Total Balances ÷ Total Credit Limits) × 100

Most credit monitoring services display this percentage automatically, but doing the math yourself can help you verify accuracy and spot errors.

Per‑Card Utilization

Each credit card also has its own utilization rate, calculated using the same method but limited to a single account. Monitoring per‑card ratios is useful because some scoring models weigh the highest individual utilization more heavily than the overall average. If one card sits at 80% while the rest hover around 10%, your score may suffer despite a modest overall ratio.

Consider Alex’s situation: He carried a $1,200 balance on a card with a $1,500 limit (80% utilization) while his other two cards showed only $200 balances on $4,000 limits each (5% utilization). His overall utilization was 20%, but the high single‑card figure dragged his score down.

Impact on Credit Scores

FICO vs. VantageScore

Both major scoring systems use utilization, but they handle the data slightly differently. FICO typically looks at the average utilization over the last 12 months, smoothing out short‑term spikes. VantageScore, on the other hand, may place more emphasis on the most recent month’s data. This distinction explains why a sudden large purchase can cause a temporary dip in a VantageScore, while a FICO score remains more stable.

Furthermore, VantageScore introduces a “high utilization” factor that flags any single account exceeding 90% usage. FICO does not have an explicit penalty for that threshold, though it still influences the overall utilization component.

Best Practices for Managing Utilization

Keep Below 30%

Industry experts commonly recommend keeping your overall utilization under 30%. The sweet spot for many borrowers is 10% or lower, which signals to lenders that you have ample credit cushion. If you’re aiming for a top‑tier score, try to maintain a ratio between 5% and 10%.

Pay Balances Early

Credit card issuers typically report balances to the bureaus once a month, often on the statement closing date. By paying down the balance before that date, you can ensure a lower utilization is reported. Setting up automatic payments for a few days before the close can make this habit effortless.

Request Credit Limit Increases

Increasing your total credit limit while keeping the same balance automatically reduces your utilization. Most issuers allow you to request a limit increase online or via phone. Before you ask, ensure your payment history is solid and that you haven’t opened too many new accounts recently, as those factors can affect the issuer’s decision.

Strategic Use of Multiple Cards

Spreading purchases across several cards can keep each card’s utilization low. However, opening too many new accounts can temporarily lower the average age of your credit history—a factor that also influences scores. Balance is key. For instance, Alex consolidated his spending onto two cards with higher limits after closing a rarely‑used third card, which lowered both his overall and per‑card utilization without harming his credit age.

Leverage Balance Transfers Wisely

If you’re carrying a high balance on a card with a low limit, a balance transfer to a card with a higher limit (and preferably a 0% introductory APR) can instantly improve utilization. The transfer itself does not change the total debt, but it redistributes it across higher limits, reducing the percentages. For a deeper dive on how balance transfers work, see the guide on how credit card balance transfers actually work.

Monitor Your Credit Regularly

Regularly checking your credit reports helps you catch errors that could inflate your reported utilization, such as incorrectly reported balances or outdated limits. Many credit bureaus now offer free monthly credit score updates, and several credit‑card apps provide real‑time utilization dashboards.

Understand the Role of Authorized Users

Adding an authorized user to a credit card can increase the total credit limit visible on the primary account, thereby lowering utilization for both the primary holder and the authorized user. However, the primary must maintain disciplined spending; otherwise, the added limit could be quickly consumed.

Integrate Utilization Management with Daily Financial Routines

Embedding utilization checks into your budgeting workflow can make the practice sustainable. For example, after reconciling your monthly expenses, glance at your credit‑card dashboard and note the utilization percentages. If any card exceeds 30%, plan a targeted payment before the next statement closing.

Use Technology to Your Advantage

Many banking apps let you set utilization alerts. When a balance reaches a predefined percentage of its limit, you receive a notification. This proactive approach prevents accidental spikes. Additionally, some financial‑management tools can simulate how a payment will affect your utilization, helping you decide the optimal amount to pay each month.

Consider the Bigger Picture

While utilization is critical, it does not exist in isolation. Pairing low utilization with on‑time payments, a diverse credit mix, and a long credit history creates a robust credit profile. If you’re looking for a new premium card, comparing how different issuers treat utilization can be insightful. For example, the analysis in Which Premium Card Wins? Chase Sapphire Preferred vs. Amex Gold – The Ultimate Showdown highlights how issuers evaluate utilization when offering elite rewards.

Finally, accessing your credit‑card accounts efficiently can streamline the process of monitoring utilization. If you use a Bank of America card, the step‑by‑step walkthrough in how to seamlessly sign in to your Bank of America credit card account makes it easy to check balances, set alerts, and manage payments—all essential actions for keeping utilization under control.

By treating the credit utilization ratio as a daily metric rather than an occasional check, you turn a static number into a dynamic lever for financial improvement. Small, consistent actions—paying early, requesting modest limit increases, and spreading balances strategically—can gradually lower the ratio, boost your credit score, and open doors to better loan terms, lower interest rates, and premium credit‑card benefits. As Alex discovered, the moment he reduced his highest‑card utilization from 80% to 25% by paying early and requesting a limit bump, his credit score jumped by 30 points, and a lender approved his mortgage application with a favorable rate.