Table of Contents

- Understanding Recurring Payments on Credit Cards

- How They Are Set Up

- Common Reasons for Unwanted Recurrences

- Identifying Unwanted Recurring Charges

- Reviewing Statements

- Using Online Banking Tools

- Steps to Stop a Recurring Credit Card Payment

- 1. Contact the Merchant Directly

- 2. Use Your Card Issuer’s Dispute Process

- 3. Cancel Through Your Online Banking Settings

- Prevent Future Unwanted Recurrences

- Set Up Alerts and Notifications

- Maintain a Subscription Tracker

- Leverage Card Features for Extra Protection

- Regularly Review Your Credit Utilization

- Stay Informed About Merchant Policies

Stop recurring credit card payment is a phrase many cardholders whisper when a subscription slips through the cracks of their budgeting system. The frustration of seeing the same charge reappear each month, often unnoticed until the statement arrives, can feel like a silent drain on personal finances. This article follows a typical cardholder’s journey—from the first surprise on a statement to the decisive actions that put an end to unwanted recurring charges.

Imagine opening your monthly statement and spotting a $19.99 charge from a service you never signed up for. The feeling is familiar: a mix of confusion, annoyance, and urgency. You wonder how the payment was authorized, why it keeps happening, and most importantly, how to stop it before the next cycle. The following sections break down the process in a clear, narrative style, guiding you through identification, cancellation, and prevention, all while keeping your credit health intact.

Understanding the mechanics behind recurring payments and the tools at your disposal empowers you to act confidently. By the end of this guide, you will have a reliable roadmap to eliminate unwanted charges, protect your credit utilization ratio, and maintain control over your financial flow.

Understanding Recurring Payments on Credit Cards

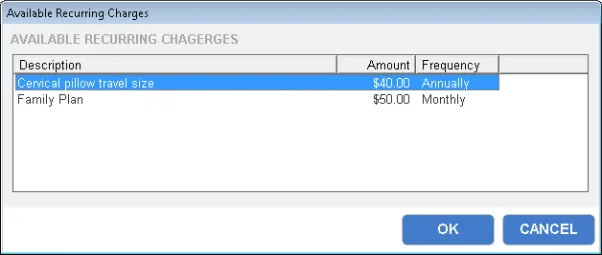

Recurring payments are automatic charges that a merchant processes at regular intervals—monthly, quarterly, or annually—using your credit card information. These can be legitimate subscriptions such as streaming services, gym memberships, or utility bills, but they can also stem from forgotten trials, outdated contracts, or even fraudulent activity.

How They Are Set Up

When you first agree to a subscription, the merchant typically requests your card number, expiration date, and CVV. This data is stored securely, often through a tokenization service, allowing the merchant to charge your card without requiring you to re‑enter details each billing cycle. The authorization may be presented as a one‑time transaction that later converts into a recurring schedule.

- Tokenization: Replaces sensitive card data with a unique identifier, reducing exposure risk.

- Authorization vs. Capture: An initial authorization holds funds; subsequent captures withdraw them on the scheduled date.

- Merchant Agreements: Some merchants include “auto‑renewal” clauses in the terms of service, which you may have accepted without realizing the long‑term impact.

Common Reasons for Unwanted Recurrences

Unwanted recurring charges often arise from:

- Forgotten free‑trial periods that automatically convert to paid subscriptions.

- Legacy services that were cancelled verbally but not reflected in the billing system.

- Third‑party platforms that bundle multiple services under a single charge.

- Fraudulent use of compromised card details.

Recognizing these patterns helps you pinpoint the source quickly, especially when cross‑referencing with the Understanding Credit Utilization Ratio article, which explains how each recurring charge can affect your available credit.

Identifying Unwanted Recurring Charges

The first concrete step is to confirm which charges are recurring and which are legitimate one‑off purchases. This requires a systematic review of your statements and the use of online tools provided by your card issuer.

Reviewing Statements

Begin by pulling the last three to six months of credit card statements. Look for patterns:

- Same merchant name appearing on the same date each month.

- Identical charge amounts, especially those ending in .99 or .95, typical of subscription pricing.

- Charges from merchants you don’t recognize; these may be parent companies using different brand names.

Mark each recurring entry and note the date, amount, and description. This list will serve as a reference when you contact merchants or your bank.

Using Online Banking Tools

Most banks now provide transaction categorization and recurring payment alerts within their online portals. Log in to your account—if you need a refresher on the process, see the guide on how to sign in to your Bank of America credit card account. Within the dashboard, locate sections such as “Recurring Payments” or “Subscriptions.” These tools automatically flag repeat charges, saving you time.

Additionally, many issuers allow you to set up custom alerts that notify you via email or SMS whenever a transaction matches a specific pattern you define. This proactive approach can catch new unwanted recurrences before they accumulate.

Steps to Stop a Recurring Credit Card Payment

Once you have identified a charge you wish to stop, follow these structured actions. The order presented reflects the most efficient path to resolution, minimizing the need for escalation.

1. Contact the Merchant Directly

Most legitimate merchants will honor a cancellation request if you reach out to their customer service. Prepare the following before you call or email:

- Full name as it appears on the account.

- Last four digits of the credit card used for the subscription.

- Exact amount and date of the most recent charge.

- Reference number or subscription ID if provided.

When you speak with the representative, request written confirmation of the cancellation and ask for a clear timeline for the final charge, if any. Keep this confirmation for future reference.

2. Use Your Card Issuer’s Dispute Process

If the merchant is unresponsive or refuses to cancel, you can initiate a dispute through your card issuer. This process typically involves:

- Logging into your online banking portal.

- Finding the transaction in question and selecting “Dispute” or “Report a Problem.”

- Providing a brief explanation (e.g., “Unauthorized recurring charge”) and attaching any correspondence with the merchant.

- Submitting the dispute and awaiting a provisional credit, usually within 30 days.

During the dispute, the issuer may place a temporary hold on the merchant’s ability to charge your card, effectively halting further recurring payments.

3. Cancel Through Your Online Banking Settings

Some banks allow you to block future charges from a specific merchant directly from the account interface. Look for options such as “Block Merchant” or “Stop Recurring Payments.” Activating this feature sends a signal to the payment network to reject any subsequent attempts from that merchant’s identifier.

Remember, blocking a merchant does not automatically refund past charges; it simply prevents new ones. Pair this step with a dispute if you’ve already been overcharged.

Prevent Future Unwanted Recurrences

Stopping a single unwanted payment is valuable, but establishing safeguards ensures you won’t face the same issue again. The following practices embed a habit of vigilance into your financial routine.

Set Up Alerts and Notifications

Configure your card’s notification settings to receive real‑time alerts for any transaction exceeding a chosen threshold, say $5. This immediate feedback lets you spot unfamiliar charges within minutes, rather than weeks.

- SMS Alerts: Quick and hard to miss.

- Email Summaries: Good for monthly overviews.

- Push Notifications: Ideal for smartphone‑centric users.

Maintain a Subscription Tracker

Keep a simple spreadsheet or use a budgeting app to log all active subscriptions. Include columns for:

- Service name

- Start date

- Renewal frequency

- Cost per period

- Cancellation deadline

Review this tracker quarterly. Deleting entries for services you no longer need prevents “zombie subscriptions” from lingering unnoticed.

Leverage Card Features for Extra Protection

Many credit cards now offer “virtual card numbers” that can be generated for one‑time or limited‑use transactions. By assigning a virtual number to a subscription, you can easily deactivate it without affecting your primary card number.

Another useful feature is the ability to set a “spending limit” for specific merchants. If you suspect a merchant might charge you beyond the agreed amount, you can cap the maximum charge, thereby avoiding surprise overages.

Regularly Review Your Credit Utilization

Each recurring charge contributes to your overall credit utilization ratio, which is a key factor in credit scoring. By keeping this ratio below 30 %, you protect both your credit score and your financial flexibility. For a deeper dive into why utilization matters, refer to the article Understanding Credit Utilization Ratio. Consistently monitoring this metric helps you see the broader impact of each subscription on your credit profile.

Stay Informed About Merchant Policies

Before signing up for any new service, read the terms of service, especially sections titled “Automatic Renewal,” “Billing,” or “Cancellation Policy.” Knowing the required notice period—often 30 days—prevents unexpected renewals. When possible, opt for “manual renewal” options that require you to confirm each billing cycle.

Lastly, be aware of the Hidden Truth About Minimum Payments on Credit Cards. While it focuses on a different aspect of credit management, understanding how minimum payments interact with recurring charges can help you avoid a scenario where a small, unnoticed subscription pushes you into paying only the minimum, thereby extending debt repayment.

By following these steps—identifying the charge, contacting the merchant, leveraging your issuer’s tools, and establishing preventive habits—you create a robust defense against unwanted recurring credit card payments. The process may seem detailed, but each action builds toward a clearer, more controlled financial picture. As you continue to monitor your statements and maintain organized records, the likelihood of a surprise charge slipping through diminishes dramatically.

Take the initiative today: review your latest statement, flag any unfamiliar repeat charges, and apply the methods outlined above. In doing so, you not only stop a single unwanted payment but also reinforce a disciplined approach that safeguards your credit health for the long term.