Table of Contents

- Understanding the Credit Card Grace Period

- How It Works

- When It Starts and Ends

- Transactions Not Covered

- Eligibility and Common Terms

- Key Terms to Know

- Impact of Carrying a Balance

- Impact on Interest Charges

- Illustrative Example

- Comparing Cards

- How to Maximize the Grace Period

- Set Up Automatic Payments

- Track Your Billing Cycle

- Use Multiple Cards Strategically

- Maintain Full Payments

- Watch Out for Cash Advances

- Potential Pitfalls and How to Avoid Them

- Missing the Payment Deadline

- Partial Payments

- Late Fees vs. Interest

- Understanding Promotional Rates

- Frequently Asked Questions

- Do balance transfers affect the grace period?

- Can I have a grace period on a revolving line of credit?

- What happens if I pay after the due date but before the statement is generated?

- Is the grace period the same for all types of purchases?

- How does the grace period affect my credit score?

When you first receive a credit card, the fine print often mentions a “grace period.” This term can feel abstract, but it directly influences whether you pay interest on your purchases. Understanding the credit card grace period is essential for anyone who wants to keep costs low and maintain a healthy credit profile. In this article, we walk through the mechanics, requirements, and strategies that surround this often‑overlooked feature.

Imagine a scenario where you shop for a new laptop, pay the bill in full before the due date, and never see a single cent of interest on that purchase. That outcome is possible because of the grace period, a window of time that gives you a chance to settle your balance without incurring finance charges. By treating the grace period as a routine part of your monthly financial rhythm, you can transform your credit card from a costly borrowing tool into a convenient, interest‑free payment method.

However, the grace period is not a guarantee; it depends on the card issuer, the type of transaction, and your payment behavior. The following sections break down these variables, provide practical tips, and answer common questions that cardholders often face.

Understanding the Credit Card Grace Period

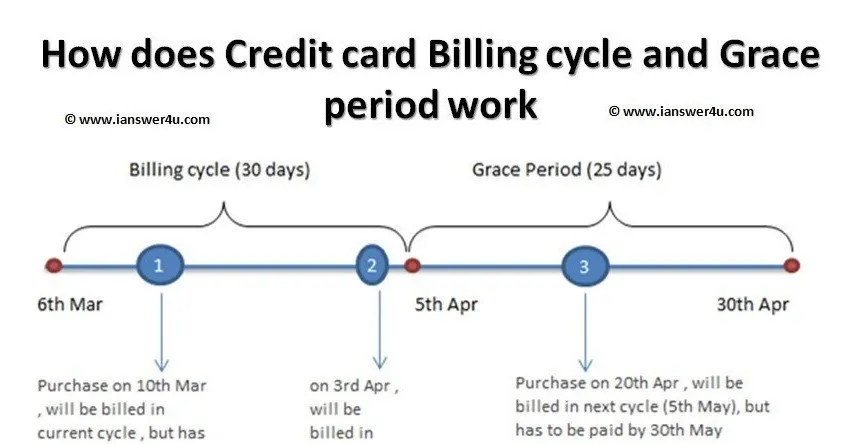

The grace period is the time between the close of a billing cycle and the due date for that cycle’s balance. If you pay the full balance by the due date, the issuer waives interest on purchases made during that cycle. Typically, the period ranges from 21 to 25 days, but the exact length varies by card.

How It Works

- Billing cycle end: The day your statement is generated, marking the start of the grace period.

- Due date: Usually 20‑25 days after the statement date. This is the deadline to pay the balance in full.

- Interest waiver: If the full balance is paid by the due date, no interest accrues on purchases made during that cycle.

When It Starts and Ends

The grace period begins the moment the billing cycle closes. For example, if your statement closes on the 5th of each month and the due date is the 30th, you have a 25‑day grace period. If you miss the full‑payment deadline, interest may be charged retroactively from the transaction date, not just after the due date.

Transactions Not Covered

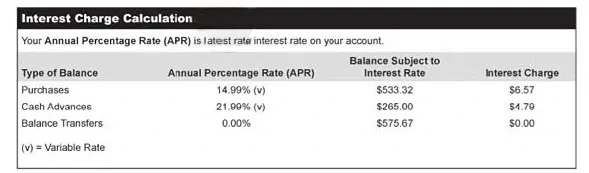

Not every transaction benefits from the grace period. Cash advances, balance transfers, and some fee types begin accruing interest immediately, regardless of whether you pay the balance in full. Understanding which activities are excluded helps you avoid unexpected charges.

Eligibility and Common Terms

Most revolving credit cards offer a grace period on purchases, but a few exceptions exist. Cards marketed as “no‑interest” or “low‑interest” may have different rules, and some prepaid or charge cards do not have a grace period at all because the balance is required to be paid in full each month.

Key Terms to Know

- Statement balance: The total amount owed as of the statement date.

- Outstanding balance: Any amount that remains unpaid after the due date.

- Finance charge: The interest assessed on balances that are not paid in full.

- Grace period reset: Paying the full balance each month resets the grace period for the next cycle.

Impact of Carrying a Balance

If you carry a balance from one month to the next, most issuers will suspend the grace period until the balance is paid in full. This means new purchases will start accruing interest immediately, even if you later pay them off before the next due date. The suspension can persist for several billing cycles, making it crucial to clear any lingering balance as soon as possible.

Impact on Interest Charges

Interest on credit cards is usually calculated using a daily periodic rate (APR divided by 365) applied to the average daily balance. During the grace period, this calculation is effectively paused for new purchases. By consistently paying the statement balance in full, you eliminate the daily interest compounding that would otherwise increase your debt.

Illustrative Example

Suppose you spend $1,200 on a card with a 20% APR, and the billing cycle ends on the 1st of the month. If you pay the $1,200 by the due date on the 25th, you pay $0 in interest. If you only pay the minimum $30, the remaining $1,170 will start accruing interest from the day of each purchase, potentially adding $20‑$30 in finance charges each month.

Comparing Cards

When evaluating new cards, look beyond rewards and fees. The length of the grace period can be a differentiator, especially for consumers who aim to avoid interest entirely. Some premium cards advertise longer grace periods, which can be beneficial for larger purchases.

How to Maximize the Grace Period

Leveraging the grace period effectively requires discipline and a clear understanding of your billing cycle. Below are actionable steps you can take to keep interest at bay.

Set Up Automatic Payments

Schedule an automatic payment for the full statement balance a few days before the due date. This ensures you never miss the deadline, even if a transaction occurs close to the due date.

Track Your Billing Cycle

Mark the statement closing date on your calendar. Knowing when the cycle ends helps you plan purchases. If you need to make a large purchase, consider doing it early in the cycle to maximize the grace period.

Use Multiple Cards Strategically

If you have cards with differing billing cycles, you can stagger purchases to align with the longest grace periods. For example, you might use a card whose cycle ends on the 10th for a $2,000 purchase, giving you up to 30 days before interest can apply.

Maintain Full Payments

Paying the statement balance in full each month not only preserves the grace period but also positively impacts your credit utilization ratio, a key factor in credit scoring. A lower utilization ratio signals responsible credit management.

Watch Out for Cash Advances

Since cash advances start accruing interest immediately, avoid using your credit card for ATM withdrawals unless absolutely necessary. If you do need cash, consider alternative options like a personal loan with a lower APR.

Potential Pitfalls and How to Avoid Them

Even diligent cardholders can fall into traps that nullify the grace period. Recognizing these pitfalls early can save you from surprise finance charges.

Missing the Payment Deadline

A single missed payment can trigger a penalty APR and suspend the grace period. To avoid this, set up reminders and keep a buffer in your checking account.

Partial Payments

Paying less than the full statement balance—even if you cover most of it—still counts as carrying a balance. This will end the grace period for the next cycle, causing interest to accrue on new purchases.

Late Fees vs. Interest

Late fees are separate from interest charges but can compound the financial impact. While the grace period protects against interest, it does not waive late fees if you miss a payment.

Understanding Promotional Rates

Some cards offer 0% introductory APR on purchases for a set period. During this promotion, the grace period may be irrelevant because interest is already waived. However, once the promotional period ends, the regular grace period rules apply.

Frequently Asked Questions

Do balance transfers affect the grace period?

Yes. Balance transfers typically start accruing interest immediately, similar to cash advances. If you transfer a balance during a billing cycle, you lose the grace period for that amount.

Can I have a grace period on a revolving line of credit?

Most revolving credit cards provide a grace period on purchases. However, lines of credit such as home equity or personal loans often calculate interest daily without a grace period.

What happens if I pay after the due date but before the statement is generated?

Interest may still be assessed on the unpaid portion for the days it was overdue. Some issuers apply the finance charge retroactively from the transaction date, so it’s best to pay by the stated due date.

Is the grace period the same for all types of purchases?

Generally, the grace period applies to standard retail purchases. Exceptions include recurring subscription fees, which some issuers treat as “installment” or “service” charges that may not be covered.

How does the grace period affect my credit score?

Consistently paying the full statement balance demonstrates responsible credit behavior, which can improve your payment history—the most significant factor in credit scoring. Additionally, keeping your utilization low by paying in full benefits your score.

Understanding the credit card grace period equips you with a powerful tool for managing debt and preserving financial flexibility. By aligning your spending habits with the timing of billing cycles, setting up reliable payment methods, and staying aware of transactions that bypass the grace period, you can effectively use your card without paying unnecessary interest.

Take the time to review your card’s terms, note the statement closing and due dates, and incorporate automatic full‑balance payments into your routine. With these practices, the grace period becomes a reliable safety net, allowing you to enjoy the convenience of credit while keeping costs under control.