Table of Contents

- Understanding Pre‑Approval: What It Really Means

- Key Benefits of a Pre‑Approval Offer

- How Capital One Generates Pre‑Approval Offers

- Eligibility Factors: The Pillars of Approval

- Credit Score Ranges

- Debt‑to‑Income Ratio (DTI)

- Existing Relationship with Capital One

- Step‑by‑Step Guide to Securing a Pre‑Approval

- Step 1: Check Your Credit Score and Report

- Step 2: Review Capital One’s Card Portfolio

- Step 3: Initiate the Pre‑Approval Request Online

- Step 4: Evaluate the Offer Details

- Step 5: Complete the Full Application (Optional)

- Step 6: Receive Your Card and Activate

- Tips to Maximize Your Pre‑Approval Success

- Potential Pitfalls and How to Avoid Them

- Overlooking the Fine Print

- Ignoring Your Overall Credit Strategy

- Failing to Set Up Payment Reminders

- What Happens After You Receive the Card?

- Activate and Register Online

- Take Advantage of Introductory Offers

- Maximize Rewards Early

- Monitor Your Credit Score

- Plan for Annual Fee Evaluation

- Frequently Asked Questions About Capital One Pre‑Approval

- Can I receive multiple pre‑approval offers from Capital One?

- How long does a pre‑approval remain valid?

- Will a pre‑approval affect my existing credit cards?

- What should I do if I’m denied after the full application?

- Is there a way to increase my pre‑approved credit limit?

Pre‑approval for Capital One credit card can feel like the first page of a new chapter in your financial story. Imagine receiving a sleek envelope in the mail or an email notification that says you’re pre‑approved for a card that matches your lifestyle and spending habits. That moment often marks the beginning of a journey toward greater purchasing flexibility, better rewards, and a stronger credit profile. For many, the appeal lies not only in the benefits of the card itself but also in the confidence that comes from knowing the issuer has already given a preliminary nod.

In this article we walk through the entire process as if we were following a protagonist navigating the maze of credit applications. From the initial spark of curiosity—perhaps after seeing an advertisement for a Capital One card with a 0% APR intro—through the research phase, the soft pull inquiry, and finally the moment the card lands in the mailbox, each step is broken down. Along the way, we’ll share practical tips, explain the key criteria lenders evaluate, and highlight common pitfalls to avoid, all while keeping the narrative flowing like a short, factual story.

By the end of the guide, you’ll be equipped with the knowledge to assess your own readiness, submit a pre‑approval request confidently, and understand what to expect after you receive the green light. Let’s begin the journey.

Understanding Pre‑Approval: What It Really Means

Pre‑approval is a preliminary assessment that Capital One conducts using a soft credit pull, which does not affect your credit score. Unlike a full application that involves a hard inquiry, a pre‑approval indicates that, based on the information currently available, you meet the basic criteria for at least one of their card products. This stage serves as a safety net, allowing you to explore options without the risk of a score dip.

Key Benefits of a Pre‑Approval Offer

- Zero impact on credit score: Since only a soft pull is used, your credit remains unchanged.

- Tailored card suggestions: Capital One matches you with a card that aligns with your credit profile and spending patterns.

- Faster decision time: If you decide to move forward, the final approval often occurs within minutes.

- Confidence boost: Knowing you’re likely to be approved can simplify budgeting and planning.

How Capital One Generates Pre‑Approval Offers

Capital One leverages data from credit bureaus, internal scoring models, and your existing relationship with the bank (if any). The algorithm looks at factors such as credit utilization, payment history, length of credit history, and recent inquiries. If these elements fall within a predefined range, the system automatically generates a pre‑approval invitation.

Eligibility Factors: The Pillars of Approval

Even though the pre‑approval process is less stringent than a full application, understanding the underlying eligibility pillars helps you gauge your likelihood of success.

Credit Score Ranges

Capital One typically issues pre‑approval offers to consumers with a credit score of 670 or higher, which falls into the “good” to “excellent” categories. However, certain cards—especially those designed for building credit—may have lower thresholds. Checking your own score before pursuing a pre‑approval can give you a realistic expectation.

Debt‑to‑Income Ratio (DTI)

While DTI is not always directly queried during the soft pull, the lender’s internal model estimates it using available data. A lower DTI indicates that you have sufficient income relative to existing obligations, which improves pre‑approval odds.

Existing Relationship with Capital One

If you already hold a checking, savings, or credit product with Capital One, the bank has more data points to evaluate your financial behavior. Existing customers often receive personalized pre‑approval offers that reflect their loyalty and payment history.

Step‑by‑Step Guide to Securing a Pre‑Approval

Now that you understand what pre‑approval entails, let’s walk through the process as a clear, sequential story.

Step 1: Check Your Credit Score and Report

Begin by obtaining a free copy of your credit report from the major bureaus—Equifax, Experian, or TransUnion. Look for errors, outdated information, and any negative marks that could be contested. If you spot an inaccurate late payment, you might consider using resources like How to Dispute a Credit Card Charge – The Simple Process That Saves Your Money to correct the record before proceeding.

Step 2: Review Capital One’s Card Portfolio

Explore the range of cards Capital One offers—cash back, travel rewards, secured cards for rebuilding credit, and more. Identify which product aligns with your financial goals. For instance, the Capital One Quicksilver Cash Rewards Card is popular among everyday spenders, while the VentureOne offers travel points with a modest annual fee.

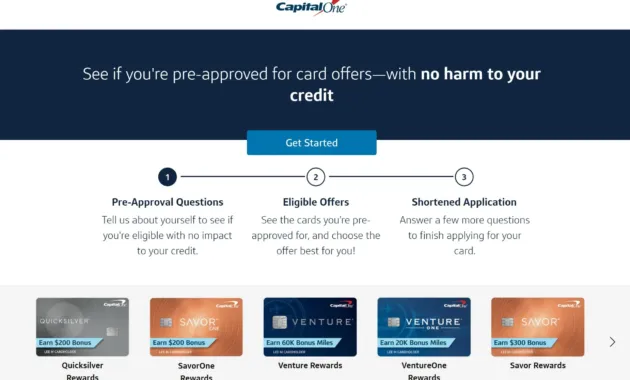

Step 3: Initiate the Pre‑Approval Request Online

Visit Capital One’s official website and locate the “Pre‑Approval” section. You’ll be prompted to enter basic personal information—name, address, Social Security number (last four digits), and date of birth. This initiates a soft pull, and the system will instantly reveal whether you qualify for a pre‑approved offer.

Step 4: Evaluate the Offer Details

If you receive a pre‑approval, carefully read the terms: interest rate (APR), annual fee, rewards structure, and any introductory offers. Compare these against your spending habits to ensure the card delivers real value. This is also the moment to consider the impact of potential hard inquiries if you proceed to full application.

Step 5: Complete the Full Application (Optional)

Should you decide to accept the pre‑approval, you’ll transition to a full application. This step triggers a hard credit pull, which may cause a temporary dip of a few points. Provide any additional documentation requested—such as proof of income—to expedite the decision.

Step 6: Receive Your Card and Activate

Within 7–10 business days, your new Capital One card should arrive. Follow the activation instructions, set up online account access, and consider enrolling in automatic payments to avoid missed due dates.

Tips to Maximize Your Pre‑Approval Success

While the process is straightforward, a few strategic actions can improve your chances and set you up for long‑term success.

- Maintain low credit utilization: Aim for under 30% of your total available credit across all cards.

- Pay all bills on time: A clean payment history is a strong signal to lenders.

- Avoid new hard inquiries: Refrain from applying for other credit cards or loans in the weeks leading up to your pre‑approval request.

- Keep personal information consistent: Discrepancies in address or name spelling can cause delays.

- Leverage existing relationships: If you already bank with Capital One, log into your online account to see personalized offers.

- Understand the card’s rewards cycle: Some cards offer higher cash back on specific categories that rotate quarterly; plan your spending accordingly.

Potential Pitfalls and How to Avoid Them

Even with a pre‑approval in hand, certain missteps can derail the final approval or lead to future difficulties.

Overlooking the Fine Print

Some pre‑approved cards carry high APRs after the introductory period. If you anticipate carrying a balance, calculate the long‑term cost using an online credit card calculator. This prevents unpleasant surprises down the line.

Ignoring Your Overall Credit Strategy

Applying for a new card should fit within a broader plan. If you’re actively working to pay down debt, consider the impact of additional credit on your debt‑to‑income ratio. Resources like How to Pay Off Credit Card Debt Fast – 7 Proven Strategies That Actually Work can help you prioritize debt repayment before adding new credit.

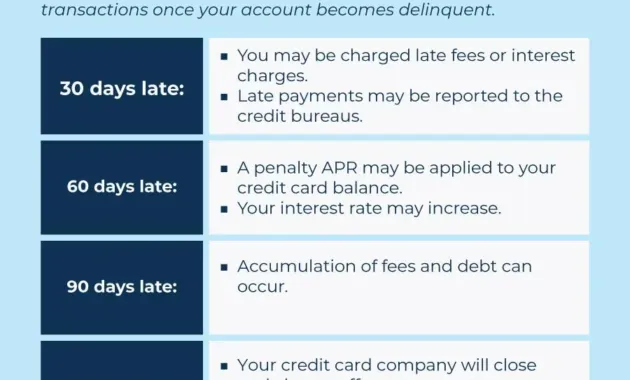

Failing to Set Up Payment Reminders

Missing a payment can quickly erode the goodwill earned from a pre‑approval. Use calendar alerts or automatic payments to stay on track.

What Happens After You Receive the Card?

Receiving your Capital One card marks the start of a new financial chapter. Here’s a roadmap for the first few months.

Activate and Register Online

Visit the Capital One portal or mobile app to activate the card, set a PIN, and customize alerts. Online access also lets you monitor transactions in real time, which is essential for detecting fraudulent activity.

Take Advantage of Introductory Offers

Many Capital One cards feature a 0% APR on purchases or balance transfers for the first 12–15 months. Use this window wisely to make larger purchases you can repay before interest accrues.

Maximize Rewards Early

If your card offers bonus points for meeting a spending threshold within the first three months, plan your regular expenses—groceries, gas, utilities—to meet that goal without overspending.

Monitor Your Credit Score

Capital One provides free credit score updates through its online dashboard. Keep an eye on any fluctuations, especially after the hard pull from the final application. A stable or improving score indicates you’re managing the new credit responsibly.

Plan for Annual Fee Evaluation

Some cards carry an annual fee that may be justified by high rewards, while others have no fee. After a year, assess whether the benefits outweigh the cost. If not, consider downgrading to a no‑fee version or switching to a different issuer.

Frequently Asked Questions About Capital One Pre‑Approval

Can I receive multiple pre‑approval offers from Capital One?

Yes, it’s possible to be pre‑approved for more than one card, especially if you meet the criteria for both cash‑back and travel‑reward products. However, you should apply for only the card that best matches your needs to avoid unnecessary hard inquiries.

How long does a pre‑approval remain valid?

Typically, a pre‑approval is valid for 60‑90 days. If you miss this window, you can re‑initiate the soft pull to obtain a fresh offer.

Will a pre‑approval affect my existing credit cards?

No. Since a soft pull is used, your current credit accounts and scores remain untouched. Only the final full application triggers a hard pull.

What should I do if I’m denied after the full application?

Review the denial letter for specific reasons. Common causes include recent late payments or a high credit utilization ratio. Address these issues, wait a few months, and then re‑apply.

Is there a way to increase my pre‑approved credit limit?

After you’ve had the card for a few months and demonstrated responsible usage, you can request a credit limit increase through the online portal. Capital One may approve the increase with another soft pull.

By following the steps outlined above, you can navigate the pre‑approval landscape with confidence, turning what might seem like a complex process into a clear, manageable journey. Whether you’re looking to earn cash back on everyday purchases, enjoy travel perks, or simply build credit, Capital One’s pre‑approval system offers a low‑risk entry point. Stay disciplined, keep an eye on your credit health, and let the card work for you, not the other way around.