Table of Contents

- Understanding APR and How It Affects Your Balance

- What Is APR?

- Daily Periodic Rate (DPR)

- Why the Daily Rate Matters

- Step‑by‑Step Calculation Methods

- Average Daily Balance (ADB) Method

- Adjusted Balance Method

- Previous Balance Method

- Practical Example: Calculating Interest on a $1,000 Balance

- Scenario 1: Standard Purchases with a 20% APR

- Scenario 2: Cash Advance with a Higher APR

- Tips to Minimize Credit Card Interest

- Pay the Full Balance Within the Grace Period

- Make Multiple Payments Throughout the Cycle

- Prioritize High‑APR Balances

- Consider Balance Transfers

- Use Online Calculators to Track Accrual

- Read the Fine Print on Variable APRs

- Combine Strategies for Maximum Savings

Calculating credit card interest can feel like deciphering a secret code, especially when statements list APR, daily rates, and balance types without clear explanation. Yet, mastering this calculation empowers you to see exactly how much each purchase costs you over time. In this guide we break down the math, walk through real‑world examples, and share strategies to keep interest from draining your wallet.

Whether you are a first‑time cardholder or someone who has been juggling balances for years, understanding the mechanics behind interest charges is essential. It not only helps you avoid surprise fees but also gives you leverage when negotiating with issuers or planning a payoff strategy.

Understanding APR and How It Affects Your Balance

What Is APR?

APR stands for Annual Percentage Rate. It represents the yearly cost of borrowing expressed as a percentage of the outstanding balance. Credit card issuers are required by law to disclose the APR on statements, but the figure alone does not tell you how much you will pay each month.

Daily Periodic Rate (DPR)

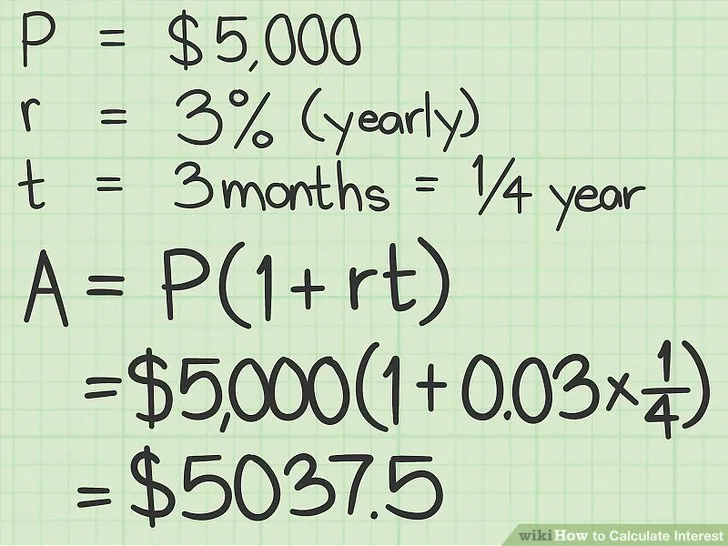

The APR is converted into a Daily Periodic Rate to calculate interest on a day‑by‑day basis. The formula is simple:

- DPR = APR ÷ 365

For example, a 20% APR translates to a DPR of 0.20 ÷ 365 ≈ 0.0005479, or 0.05479% per day. This tiny daily charge compounds over the billing cycle, producing the monthly interest amount.

Why the Daily Rate Matters

Because interest accrues each day, the balance you carry at the end of each day determines the amount added to the next day’s balance. A higher balance early in the cycle can generate more interest than the same balance incurred later. Understanding this timing helps you decide when to make payments for maximum savings.

Step‑by‑Step Calculation Methods

Average Daily Balance (ADB) Method

The most common method used by issuers is the Average Daily Balance. It works like this:

- Record your balance at the start of each day.

- Sum all daily balances for the billing cycle.

- Divide the sum by the number of days in the cycle (usually 30).

- Multiply the resulting average by the DPR.

- Multiply that figure by the number of days in the cycle to get the interest charge.

Mathematically:

Interest = (Sum of Daily Balances ÷ Days) × DPR × Days

Since the “Days” term cancels out, the equation simplifies to:

Interest = Average Daily Balance × DPR × Days

Adjusted Balance Method

With the Adjusted Balance method, you first subtract any payments or credits posted during the cycle, then apply the DPR to the reduced balance for the remaining days. This method can result in slightly lower interest if you make payments early in the cycle.

Previous Balance Method

Some issuers, though less common today, calculate interest based on the balance at the end of the previous billing period, ignoring any new purchases or payments made during the current cycle. This approach often produces higher interest charges for active users.

Practical Example: Calculating Interest on a $1,000 Balance

Scenario 1: Standard Purchases with a 20% APR

Assume you start the month with a $1,000 balance, make no payments, and the billing cycle is 30 days.

- DPR = 0.20 ÷ 365 = 0.0005479

- Average Daily Balance = $1,000 (since the balance never changes)

- Interest = $1,000 × 0.0005479 × 30 ≈ $16.44

At the end of the cycle, you would owe $1,016.44 if you only made the minimum payment.

Scenario 2: Cash Advance with a Higher APR

Many cards impose a separate APR for cash advances, often 25% or more. Suppose you take a $500 cash advance on day 10, the APR for cash advances is 25%.

- DPR (cash advance) = 0.25 ÷ 365 = 0.0006849

- Days of cash advance balance = 20 (days 10‑30)

- Interest on cash advance = $500 × 0.0006849 × 20 ≈ $6.85

- Interest on original $1,000 balance (still 20% APR) = $1,000 × 0.0005479 × 30 ≈ $16.44

- Total interest = $16.44 + $6.85 = $23.29

This example shows how a higher APR on a cash advance can quickly increase the total cost, even when the advance amount is smaller than the primary balance.

Tips to Minimize Credit Card Interest

Pay the Full Balance Within the Grace Period

Most cards offer a grace period on new purchases: if you pay the entire statement balance by the due date, no interest accrues. The credit card grace period can be a powerful tool, but it disappears once you carry a balance.

Make Multiple Payments Throughout the Cycle

Every payment reduces the daily balance, which in turn lowers the average daily balance. Even a small payment early in the month can shave off a few dollars of interest.

Prioritize High‑APR Balances

If you have both purchases and a cash advance, direct extra payments to the higher‑APR portion first. This approach reduces the compounding effect of the larger daily rate.

Consider Balance Transfers

Many issuers provide promotional 0% APR balance‑transfer offers for 12‑18 months. Transferring a high‑interest balance can give you a window to pay down principal without additional interest, provided you avoid transfer fees that typically range from 3% to 5% of the amount transferred.

Use Online Calculators to Track Accrual

Many banking apps include interest calculators that show projected charges based on your current balance and payment schedule. Using these tools helps you visualize how each dollar paid today impacts tomorrow’s interest.

Read the Fine Print on Variable APRs

Variable APRs can change with the prime rate. Keep an eye on market news; a rise in the prime rate will increase your DPR automatically. Knowing when a change is likely can motivate you to pay down balances before rates climb.

Combine Strategies for Maximum Savings

For a holistic approach, start by paying the full balance each month to enjoy the grace period. If that’s not feasible, focus on early, multiple payments and prioritize the highest APR balances. Supplement these actions with a balance‑transfer offer when possible, and always monitor your statement for any APR adjustments.

By understanding the exact math behind your credit card interest, you transform a vague monthly charge into a clear, controllable figure. This knowledge not only demystifies your statement but also equips you with concrete actions to reduce costs, improve your credit health, and make smarter financial decisions. The next time you look at your bill, you’ll see the interest number and know exactly how it was calculated—and more importantly, how to lower it.