Table of Contents

- Decoding the Basic Structure of a Credit Card Statement

- 1. Account Summary

- 2. Transaction Details

- 3. Important Dates

- 4. Minimum Payment Information

- 5. Interest and Fees Summary

- Key Figures to Watch for Accuracy

- Verify Every Transaction

- Confirm Fees and Interest

- Reconcile Your Balance

- How to Use the Statement to Manage Your Finances

- Track Spending Categories

- Leverage Reward Opportunities

- Plan for the Grace Period

- Practical Tips for a Smooth Statement Review

- Tip: Pay More Than the Minimum

- Tip: Watch for Seasonal Fees

- When Something Doesn’t Add Up: The Dispute Process

- Integrating Statement Review into a Larger Financial Strategy

- Common Misconceptions Clarified

- Final Thoughts

How to read a credit card statement is a question many cardholders ask the moment they receive their monthly paper or electronic bill. The document may look dense, filled with numbers, codes, and unfamiliar terms, but it is essentially a snapshot of every financial move you made with that card during the billing cycle. Understanding each section equips you to catch errors, control spending, and protect your credit score.

Imagine opening your statement and instantly recognizing where every dollar went, why certain fees appeared, and how the balance affects your future borrowing power. This clarity transforms a routine piece of mail into a powerful tool for financial stewardship. In the following guide we walk through the anatomy of a typical statement, highlight the most important figures, and share practical tips to master it without getting overwhelmed.

Decoding the Basic Structure of a Credit Card Statement

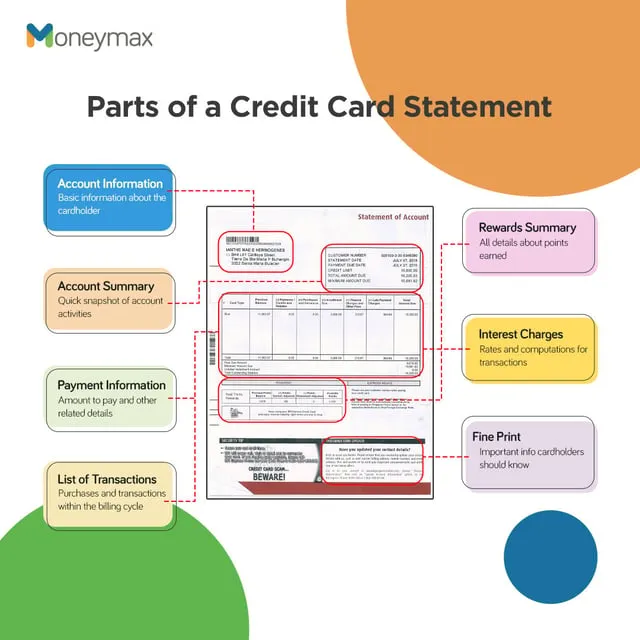

A credit card statement is organized into several consistent sections, regardless of the issuer. Recognizing these sections helps you locate the information you need quickly.

1. Account Summary

- Previous Balance: The amount you owed at the start of the billing cycle.

- Payments & Credits: Any payments you made, refunds, or adjustments applied during the period.

- New Purchases: Total of all transactions categorized as purchases.

- Cash Advances & Fees: Amounts borrowed as cash and any associated fees.

- New Balance: The sum you now owe, combining all activity.

2. Transaction Details

This section lists each purchase, payment, fee, and interest charge. Entries typically include:

- Date of transaction

- Merchant name

- Amount

- Transaction type (e.g., purchase, cash advance, fee)

3. Important Dates

- Statement Date: The day the statement is generated.

- Payment Due Date: The last day you can pay without incurring a late fee.

- Grace Period End: If you pay the full balance by the due date, you avoid interest on new purchases.

4. Minimum Payment Information

The statement tells you the smallest amount you must pay to keep the account in good standing. It usually consists of a percentage of the balance plus any accrued interest and fees.

5. Interest and Fees Summary

Here you’ll find the annual percentage rate (APR) for purchases, cash advances, and balance transfers, as well as any fees charged during the cycle (e.g., annual fee, late payment fee).

Key Figures to Watch for Accuracy

Spotting inaccuracies early can save you from unnecessary charges and protect your credit history. Below are the figures you should verify each month.

Verify Every Transaction

- Check that the merchant name matches where you actually shopped.

- Confirm the amount and date; a small discrepancy may indicate a duplicate charge.

- Look for unauthorized purchases; if you spot any, you’ll need to dispute a credit card charge promptly.

Confirm Fees and Interest

- Annual fees should appear once a year; ensure you were notified beforehand.

- Late fees are charged only if you miss the due date; check the payment posting date.

- Cash advance fees are typically a percentage of the amount withdrawn; verify that you actually took a cash advance.

Reconcile Your Balance

Take the previous balance, add all new charges, subtract payments and credits, then add any interest. The result should match the new balance shown. If it doesn’t, flag the discrepancy with your issuer.

How to Use the Statement to Manage Your Finances

Beyond verification, a credit card statement can serve as a personal finance dashboard. By analyzing patterns, you can make smarter budgeting decisions.

Track Spending Categories

- Group transactions by category (e.g., groceries, travel, dining) to see where your money goes.

- Use this insight to set realistic spending limits for each category.

- Many issuers now provide visual breakdowns; if yours doesn’t, consider exporting the data to a spreadsheet.

Leverage Reward Opportunities

If your card offers points, miles, or cash back, the statement often includes a rewards summary. Compare your earnings against your spending to ensure you’re maximizing the program. For deeper insight on how rewards fit into a broader strategy, read the untold truth about credit cards.

Plan for the Grace Period

The grace period allows you to avoid interest on new purchases if you pay the full balance by the due date. Mark the due date on your calendar and set up automatic payments for at least the full balance each month. This habit preserves your credit score and reduces long‑term costs.

Practical Tips for a Smooth Statement Review

- Set a Routine: Allocate a specific day each month—often right after the statement date—to review your bill.

- Use Online Access: If you haven’t yet, register for online access. Digital statements are searchable, and many platforms let you flag questionable items instantly.

- Download PDFs for Records: Keep a digital archive in case you need to reference past statements during disputes or tax preparation.

- Set Alerts: Enable transaction notifications via SMS or email; they act as a real‑time check before the monthly statement arrives.

- Know Your APRs: Different APRs apply to purchases, cash advances, and balance transfers. Understanding which rate applies prevents surprise interest charges.

Tip: Pay More Than the Minimum

While the statement lists the minimum payment, paying only that amount extends the time you carry a balance and increases interest costs. Aim to pay at least 1‑2 % of the balance or, better yet, the full amount each month.

Tip: Watch for Seasonal Fees

Some cards add temporary fees for foreign transactions, airline ticket purchases, or promotional balance transfers. These will appear in the fees section; note them so you can factor them into future budgeting.

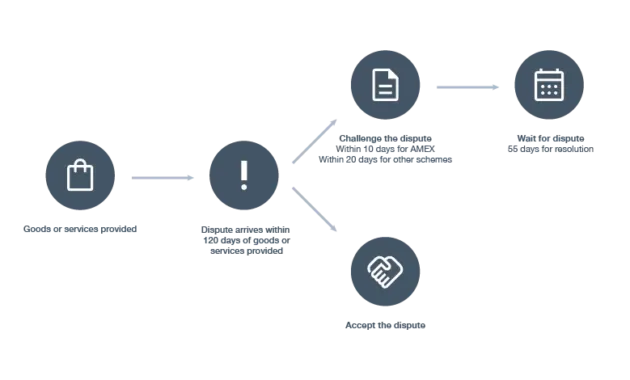

When Something Doesn’t Add Up: The Dispute Process

If you discover an error, act quickly. Most issuers require disputes within 60 days of the statement date. Here’s a concise roadmap:

- Gather evidence: receipts, screenshots, or merchant confirmations.

- Contact the card issuer’s customer service, referencing the transaction ID and date.

- Submit a written dispute if required, using the issuer’s online portal or mailed form.

- Keep a record of all communications and follow up until the issue is resolved.

Following the proper steps not only protects your money but also helps maintain a clean credit history.

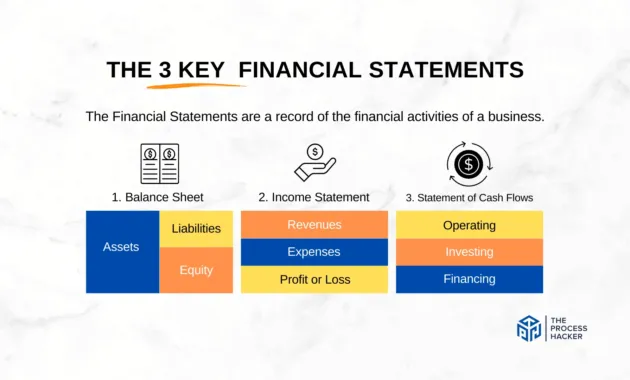

Integrating Statement Review into a Larger Financial Strategy

Reading a credit card statement is one piece of a broader personal finance puzzle. Pair this habit with regular budgeting, monitoring your credit score, and setting long‑term financial goals. For example, understanding how your balance influences your credit utilization ratio (the amount of credit you’re using compared to your total limit) can guide decisions about paying down debt or requesting a credit limit increase.

Incorporate statement reviews into quarterly financial check‑ins. During these sessions, compare your current spending trends with past periods, assess whether your rewards program still aligns with your habits, and adjust payment strategies accordingly.

Common Misconceptions Clarified

- “I only need to check the total balance.” – The total tells you what you owe, but the transaction list reveals where the balance originates, allowing you to catch fraudulent activity early.

- “If I pay the minimum, I’m fine.” – Paying only the minimum avoids late fees but accumulates interest, potentially leading to debt spirals.

- “Interest only applies to cash advances.” – Interest can accrue on purchases if you don’t pay the full balance by the due date, and on balance transfers if promotional periods expire.

Final Thoughts

Mastering how to read a credit card statement transforms a routine document into a strategic resource. By systematically reviewing each section, verifying transactions, and leveraging insights for budgeting and reward optimization, you keep your finances transparent and under control. Establishing a consistent review habit, using online tools, and acting promptly on any discrepancies will safeguard both your wallet and your credit reputation. In an era where credit plays a central role in daily life, taking the time to understand your statement is a small investment that yields lasting financial clarity.