Table of Contents

- Understanding Your New Visa Card

- What’s Included in the Package

- Why Activation Is Necessary

- Step‑by‑Step Activation Process

- 1. Phone Activation

- 2. Online Activation via Issuer’s Website

- 3. Mobile App Activation

- Common Issues and How to Resolve Them

- Activation Code Not Working

- Identity Verification Fails

- Card Not Recognized by Online Systems

- Unexpected Holds or Declines After Activation

- Security Measures After Activation

- Enable Transaction Alerts

- Set Up a Secure PIN

- Register for Virtual Card Numbers

- Know How to Temporarily Lock the Card

- Maximizing Benefits from Day One

- Activate Welcome Bonuses

- Explore Dining Rewards

- Utilize Travel Perks Early

- Consider Cash Advances Wisely

Activating a new Visa credit card is the first practical step after receiving that sleek piece of plastic in the mail. The keyword “activate my new Visa credit card” often appears in search queries because users want a clear, reliable roadmap that eliminates guesswork. This article walks you through the entire process, from the moment you open the envelope to the point where you can confidently make your first purchase.

Imagine the scene: you’ve just ordered a Visa card online, you’ve received the welcome packet, and you’re eager to test its purchasing power on an upcoming travel booking. Yet, the card sits idle until you follow the correct activation steps. By treating activation as a short narrative—opening the envelope, verifying identity, confirming activation, and securing the card—you’ll reduce friction and avoid common pitfalls.

Below, we present a comprehensive, story‑driven guide that blends practical instructions with security best practices. Whether you prefer phone activation, online portals, or mobile apps, each method is detailed with clear actions, tips, and troubleshooting advice. Let’s begin the journey from unopened envelope to fully active Visa card.

Understanding Your New Visa Card

Before you start the activation process, it helps to know what’s inside the welcome packet and why each component matters.

What’s Included in the Package

- Visa card – The physical plastic with your unique 16‑digit number.

- Activation instructions – A printed sheet that outlines phone numbers, URLs, and QR codes.

- Cardholder agreement – Legal terms that define your rights and responsibilities.

- Security code (CVV) – A three‑digit number on the back used for online purchases.

Why Activation Is Necessary

Activation links the card to your account in the issuer’s system, enabling transaction processing. Until activation, the card number exists but cannot be used for purchases, cash advances, or online payments. Moreover, activation triggers security protocols that protect against unauthorized use.

Step‑by‑Step Activation Process

Most issuers offer three primary activation channels: phone, online portal, and mobile app. Choose the one that fits your routine, then follow the detailed steps below.

1. Phone Activation

Phone activation is the most traditional method and often the quickest if you have a clear voice‑prompt system.

- Locate the toll‑free activation number on the instruction card.

- Dial the number using a landline or mobile phone.

- When prompted, enter the nine‑digit activation code printed on the back of the card (usually hidden under a scratch‑off panel).

- Verify your identity by providing the last four digits of your Social Security Number (SSN) and your date of birth.

- Listen for the confirmation message: “Your Visa card is now active.”

2. Online Activation via Issuer’s Website

If you prefer a digital route, most banks host a secure activation page.

- Visit the URL printed on the card’s instruction sheet (e.g., www.examplebank.com/activate).

- Log in using your existing online banking credentials. If you are a first‑time user, you may need to create a temporary password.

- Enter the card number, expiration date, and CVV.

- Answer security questions or input a one‑time passcode sent to your registered mobile number.

- Submit the form and wait for the on‑screen confirmation.

3. Mobile App Activation

Many modern issuers integrate activation directly into their mobile apps, streamlining the process.

- Download the bank’s official app from the App Store or Google Play.

- Open the app and log in; enable biometric authentication if offered.

- Navigate to the “Add New Card” or “Activate Card” section.

- Use the camera to scan the card’s front and back, or manually type the details.

- Confirm activation with a fingerprint, facial recognition, or a PIN.

Regardless of the channel you choose, the core elements—card number, personal identification, and a verification step—remain consistent. Completing any of these methods typically takes less than five minutes.

Common Issues and How to Resolve Them

Even with clear instructions, users occasionally encounter obstacles. Below are the most frequent problems and practical solutions.

Activation Code Not Working

- Check for scratches: Ensure the activation code panel is fully revealed. A partially scratched area can produce an incorrect number.

- Retry the entry: Mistyping a single digit is easy; re‑enter the code carefully.

- Contact support: If the code remains unrecognized, call the issuer’s helpline. Have your card and personal ID ready.

Identity Verification Fails

Verification failures often stem from outdated personal information. Before you begin activation, confirm that your mailing address, phone number, and email are current. Updating your details can be done securely via the issuer’s online portal. For guidance on maintaining up‑to‑date contact info, see The Simple, Foolproof Way to Update Your Credit Card Contact Info and Keep Your Account Safe.

Card Not Recognized by Online Systems

Some users report that the card number isn’t accepted on the activation website. This can happen if the card is still in the “pending issuance” state. In such cases, wait 24–48 hours after receipt, then try again. If the problem persists, contact the issuer’s technical support.

Unexpected Holds or Declines After Activation

After activation, a small test transaction (often $0‑$1) may appear as a “hold.” This is a normal verification step used by merchants to confirm the card’s validity. For a deeper dive into how holds work, read What Is a Credit Card Hold? Uncover the Hidden Mechanics Behind Your Transactions.

Security Measures After Activation

Activating the card is only the first line of defense. Implementing additional security habits protects you from fraud and unauthorized use.

Enable Transaction Alerts

Most issuers allow you to receive real‑time notifications via SMS or email. Turn these on in the app or online dashboard so you can spot suspicious activity instantly.

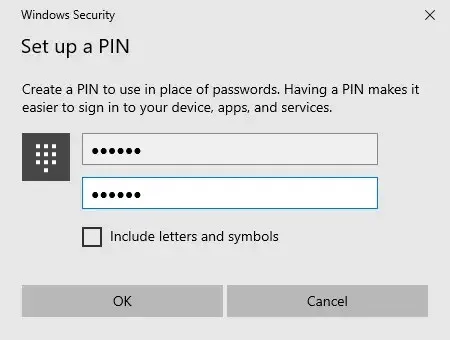

Set Up a Secure PIN

Choose a PIN that is not easily guessable—avoid birthdays, sequential numbers, or repetitive digits. Change the PIN at an ATM or via the app within the first week of activation.

Register for Virtual Card Numbers

If you shop frequently online, consider generating a virtual card number for each merchant. This shields your primary account number from exposure.

Know How to Temporarily Lock the Card

Misplacing the card doesn’t have to mean a compromised account. Most banks provide a one‑click “lock” feature in their mobile apps. Learn how to lock and unlock your Visa card efficiently by consulting resources such as How to Temporarily Lock Your Credit Card – A Complete Guide to Safeguarding Your Money.

Maximizing Benefits from Day One

Once your Visa card is active and secure, you can begin leveraging its rewards, protections, and convenience.

Activate Welcome Bonuses

Many Visa cards offer a sign‑up bonus after you spend a certain amount within the first 90 days. Track your spending using the issuer’s budgeting tools to ensure you meet the threshold without overspending.

Explore Dining Rewards

If your card includes dining points, start by using it at partner restaurants. For a curated list of cards that excel in dining rewards, check out 10 Best Credit Cards for Dining Rewards – Turn Every Meal Into Points. Even if your card isn’t a dedicated dining card, many Visa programs provide extra points for food‑related purchases.

Utilize Travel Perks Early

Many Visa cards bundle travel insurance, airport lounge access, and rental car coverage. Verify that these benefits are active by logging into your account and reviewing the “Benefits” tab.

Consider Cash Advances Wisely

If you anticipate needing cash quickly, understand the processing steps and fees. A cash advance incurs a higher APR and may trigger a separate hold on your account. For detailed mechanics, read How a Cash Advance Is Processed before proceeding.

By integrating these strategies into your daily financial routine, you transform a newly activated Visa card from a simple payment tool into a powerful asset that supports your lifestyle and financial goals.

In summary, activating your Visa card is a straightforward, three‑step journey: verify your identity, confirm activation through your chosen channel, and immediately apply security measures. Address any hiccups promptly, stay informed about holds and transaction alerts, and begin extracting value from rewards and protections as soon as possible. With this knowledge, you’ll move from the moment of unboxing to confident, secure spending in just minutes.