Table of Contents

- Why Consider a Balance Transfer?

- Key motivations

- Preparing for the Transfer

- 1. Review Your Current Statements

- 2. Check Your Credit Score

- 3. Understand Transfer Fees

- 4. Verify Promotional Details

- Choosing the Right New Card

- Factors to evaluate

- Executing the Transfer

- Step‑by‑step process

- Managing the New Balance

- 1. Create a Payment Schedule

- 2. Track Utilization Ratio

- 3. Plan for the End of the Promotional Period

- 4. Avoid New Purchases on the Transfer Card

- Potential Pitfalls and How to Avoid Them

- Unexpected Fees

- Credit Score Drops

- Partial Transfers

- Promotional Rate Expiration

- Real‑World Example: A Step‑by‑Step Story

- Frequently Asked Questions

- Can I transfer a balance more than once?

- What happens if my transfer is denied?

- Do balance transfers affect my credit history?

- Is it possible to transfer a balance from a card that is already closed?

- Final Thoughts

Transferring a balance to a new card can feel like moving to a new home: you want the process to be smooth, the costs low, and the benefits high. Many cardholders start the journey because a competitor offers a lower interest rate or a lucrative welcome bonus. The keyword “transfer balance to new card” often appears in search queries of those looking for a fresh financial start. Understanding the mechanics, timing, and strategic considerations can turn a routine balance transfer into a powerful financial move.

In this article we walk through the entire lifecycle of a balance transfer—from preparing your accounts, choosing the right card, initiating the transfer, to managing the new balance. The narrative follows a typical cardholder’s experience, illustrating each step with concrete actions and practical tips. By the end, you’ll have a clear roadmap to execute a balance transfer confidently, while keeping an eye on credit health and long‑term savings.

Why Consider a Balance Transfer?

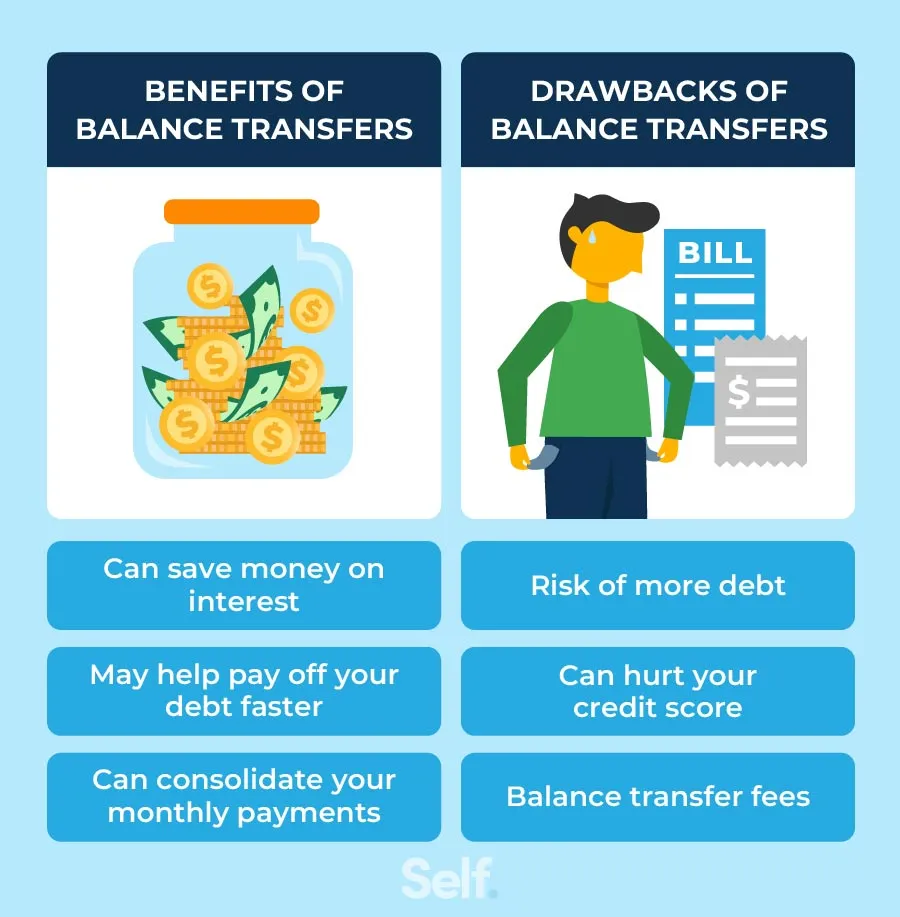

Most people start thinking about moving debt when the interest they pay becomes a significant drain on their budget. A lower APR on a new card can reduce monthly payments, free up cash flow, and accelerate debt repayment. Additionally, many issuers provide promotional periods with 0% APR for 12‑18 months, offering a window to pay down principal without accruing additional interest.

Beyond interest savings, a balance transfer can also be part of a broader credit‑card strategy. For example, upgrading your credit card to a version with better rewards or travel perks may come with a balance‑transfer incentive that sweetens the deal.

Key motivations

- Interest reduction: Replace a high‑rate card (e.g., 19% APR) with a promotional 0% APR offer.

- Consolidation: Combine multiple balances into a single payment stream.

- Reward optimization: Move debt to a card that aligns with your spending habits.

- Credit score management: Properly executed transfers can improve utilization ratios.

Preparing for the Transfer

Preparation is the foundation of a successful balance transfer. Skipping the groundwork can lead to hidden fees, missed deadlines, or even a dip in your credit score. Below we outline the critical steps to take before you click “Submit Transfer.”

1. Review Your Current Statements

Gather the most recent statements from each card you plan to transfer. Note the exact balances, current APRs, and any upcoming payment due dates. This information will help you match the transfer amount with the promotional limit of the new card.

2. Check Your Credit Score

A higher credit score improves your chances of being approved for a new card with favorable terms. Obtain a free credit report and look for any errors that could be corrected before you apply.

3. Understand Transfer Fees

Most issuers charge a fee—typically 3%–5% of the transferred amount. Calculate the fee in monetary terms and compare it against the interest you’d save. If the fee outweighs the savings, the transfer may not be worthwhile.

4. Verify Promotional Details

Read the fine print of the new card’s promotional offer. Important details include:

- Length of the 0% APR period.

- Maximum amount you can transfer.

- Whether the promotional rate applies to all balances or only new transfers.

- Post‑promotion APR.

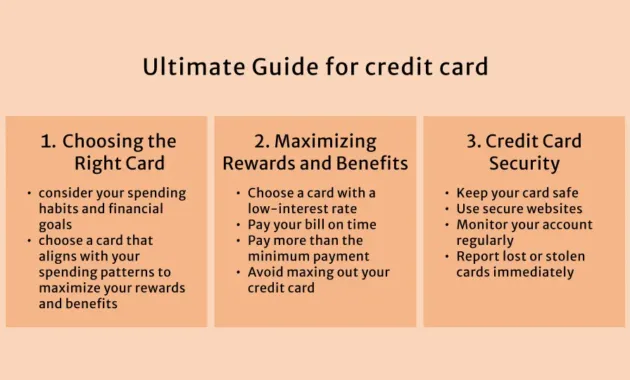

Choosing the Right New Card

The market offers a variety of balance‑transfer cards, each with its own set of incentives. Selecting the right card requires aligning the offer with your financial goals and spending patterns.

Factors to evaluate

- Promotional period length: Longer periods give more time to pay down debt without interest.

- Transfer fee percentage: Some premium cards waive the fee for high‑spending members.

- Credit limit: Ensure the limit covers the total amount you intend to move.

- Rewards structure: If you plan to use the new card for future purchases, consider cash‑back or travel rewards.

- Annual fee: Weigh the fee against potential savings; a $95 annual fee may be justified by a 0% APR for 18 months.

For a deeper dive into evaluating credit‑card upgrades, see the article on how to upgrade your credit card for more value.

Executing the Transfer

With your new card in hand and the numbers crunched, you’re ready to move the balance. The actual process typically takes place online or via phone with the new issuer.

Step‑by‑step process

- Apply for the new card: Complete the application, providing accurate personal and financial information.

- Receive approval and credit limit: Once approved, log into the new account portal.

- Locate the “Balance Transfer” option: This is often found under “Account Services” or “Transfers.”

- Enter the source card details: Provide the account number, current balance, and the amount you wish to transfer.

- Confirm the transfer fee: The system will display the fee; confirm if you accept.

- Submit the request: The issuer will process the transfer, typically within 5‑7 business days.

- Monitor both accounts: Verify that the old card reflects a reduced balance and that the new card shows the transferred amount plus fee.

During this window, continue making at least the minimum payment on the old card to avoid late fees. Once the transfer posts, you can stop payments to the old card, unless you wish to keep it open for credit‑utilization purposes.

Managing the New Balance

A balance transfer is not a “set‑and‑forget” solution. Effective management ensures you reap the interest‑saving benefits and maintain a healthy credit profile.

1. Create a Payment Schedule

Divide the transferred amount by the number of months left in the promotional period. Set up automatic payments to meet or exceed this amount each month. This disciplined approach prevents interest from kicking in once the 0% period ends.

2. Track Utilization Ratio

Your credit utilization—the percentage of total available credit you’re using—affects your credit score. Aim to keep utilization below 30% across all cards. If the transferred balance pushes you over this threshold, consider making additional payments early.

3. Plan for the End of the Promotional Period

Before the 0% APR expires, decide whether to pay off the remaining balance, refinance again, or transition the balance to a low‑interest personal loan. Setting a reminder a month before the end date gives you ample time to explore options.

4. Avoid New Purchases on the Transfer Card

Many issuers apply the standard APR to new purchases immediately, even during the promotional period. To keep the transfer benefits intact, use a different card for everyday spending, especially if it offers better rewards or lower rates for purchases.

Potential Pitfalls and How to Avoid Them

Even with careful planning, balance transfers can present challenges. Recognizing common pitfalls helps you sidestep costly mistakes.

Unexpected Fees

Some cards charge a fee for late payments during the promotional period, which can also void the 0% APR. Always pay on time and consider setting up alerts.

Credit Score Drops

Opening a new card creates a hard inquiry, which can temporarily lower your score. Additionally, a higher overall credit limit can improve utilization, but only if you keep balances low. Monitor your score after the transfer and take corrective action if needed.

Partial Transfers

If the promotional limit is lower than the balance you wish to move, you may end up with a partial transfer, leaving a residual balance on the old card that continues to accrue interest. In such cases, prioritize paying off the remaining balance quickly or look for a second transfer offer.

Promotional Rate Expiration

Missing the expiration date can be costly. Set calendar reminders well in advance and consider pre‑paying a portion of the balance before the rate reverts.

Real‑World Example: A Step‑by‑Step Story

Maria, a 34‑year‑old marketing manager, carried a $7,500 balance on a card with a 19% APR. She discovered a new card offering 0% APR for 15 months with a 3% transfer fee and a $10,000 credit limit. Here’s how Maria executed the transfer:

- She pulled her latest statements and noted the $7,500 balance and a $150 upcoming payment.

- Maria checked her credit score (720) and found no errors.

- She calculated the transfer fee: 3% of $7,500 equals $225.

- She confirmed the new card’s promotional terms and applied online. Approval arrived within minutes, granting her a $10,000 limit.

- Using the new card’s portal, Maria entered her old card’s details and requested a $7,500 transfer.

- Within five days, the old card showed a $0 balance, and the new card displayed a $7,725 balance (including the fee).

- Maria set up automatic monthly payments of $515 (the $7,725 divided by 15 months) and scheduled alerts one week before each due date.

- She kept her old card open, using it occasionally to maintain a low utilization ratio, and avoided new purchases on the transfer card.

- Eight months later, Maria had paid $4,120 toward the balance, leaving $3,605. With four months remaining in the promotional period, she increased her payment to $1,000 per month to finish the balance before the APR reset.

Maria’s disciplined approach saved her roughly $1,200 in interest, while the $225 fee was offset by the lower cost of borrowing. Her credit score also improved due to a reduced utilization ratio.

Frequently Asked Questions

Can I transfer a balance more than once?

Yes, you can initiate multiple transfers, but each new card will have its own promotional terms and fees. Be mindful of overlapping promotional periods and overall credit utilization.

What happens if my transfer is denied?

A denial usually stems from insufficient credit limit, a low credit score, or a high existing debt load. Review the denial reason, improve the identified issue, and consider applying for a different card.

Do balance transfers affect my credit history?

Opening a new account creates a hard inquiry and adds a new line to your credit report. However, paying down debt can improve your score over time by lowering utilization and demonstrating positive payment behavior.

Is it possible to transfer a balance from a card that is already closed?

Generally, you must have an active account to transfer a balance. If a card is closed, you’ll need to settle the balance before considering a transfer.

Final Thoughts

Transferring a balance to a new card can be a strategic move that reduces interest costs, simplifies payments, and supports a healthier credit profile. By preparing meticulously, selecting the right card, and managing the transferred balance with discipline, you can maximize the benefits while avoiding common pitfalls. Remember to keep an eye on fees, monitor your credit utilization, and plan ahead for the end of the promotional period. When executed correctly, a balance transfer becomes more than a temporary fix—it becomes a catalyst for long‑term financial stability.