Table of Contents

- Understanding the Basics of Cash Redemption

- Typical Redemption Rates

- Step‑by‑Step Process to Redeem Points for Cash

- 1. Log Into Your Online Account

- 2. Locate the Rewards Section

- 3. Choose the Cash Redemption Option

- 4. Confirm the Redemption Value

- 5. Submit the Request

- Maximizing the Value of Your Points

- Leverage Promotional Boosts

- Combine Points with Cashback Bonuses

- Consider Hybrid Redemptions

- Potential Pitfalls and How to Avoid Them

- Redemption Fees

- Lower Conversion Rates for Certain Card Types

- Expiration of Points

- Alternatives to Direct Cash Redemption

- Statement Credits vs. Direct Deposit

- Gift Cards and Merchandise

- Transfer to Airline or Hotel Loyalty Programs

- Real‑World Example: From Accumulation to Cash Withdrawal

- Tools and Resources to Track and Optimize Redemptions

- Frequently Asked Questions

- Can I redeem points for cash after a balance transfer?

- Is there a minimum number of points required?

- Do cash redemptions affect my credit score?

- What happens if my redemption request is denied?

- Final Thoughts

Redeeming credit card points for cash has become a practical way for many cardholders to transform the intangible value of rewards into something they can actually use. While travel redemptions often dominate the conversation, cash back offers a straightforward, flexible alternative that fits everyday budgeting needs. This article walks you through the mechanics, the best strategies, and the hidden costs that can affect the ultimate value you receive.

Imagine you have accumulated 50,000 points on a popular rewards card. You could book a flight, stay at a hotel, or you could simply convert those points into a direct deposit into your bank account. The decision hinges on understanding the redemption rate, the available channels, and the timing of your request. By the end of this guide, you will have a clear picture of how to turn those points into cash efficiently.

Understanding the Basics of Cash Redemption

Most credit card issuers allow points to be exchanged for cash in one of three common formats: statement credits, direct deposits, or checks. Each method has its own processing time and potential fees. Statement credits apply the cash value directly to your credit card balance, effectively reducing what you owe. Direct deposits place the cash into a linked bank account, while mailed checks provide a physical form of payment.

Typical Redemption Rates

- Standard rates usually range from 0.5 to 1 cent per point.

- Promotional periods may boost the rate to 1.5 cents per point for limited time.

- Some premium cards offer a flat 1 cent per point for cash redemptions, regardless of other reward categories.

For example, with a 1 cent per point conversion, 50,000 points translate to $500 in cash. However, a lower rate of 0.5 cents per point would only yield $250, highlighting the importance of checking the specific rate for your card.

Step‑by‑Step Process to Redeem Points for Cash

The actual redemption process varies by issuer but generally follows these steps:

1. Log Into Your Online Account

Start by accessing your credit card’s online portal or mobile app. If you’re unfamiliar with the interface, you might find resources like Understanding the Capital One Login Interface helpful for navigating the dashboard efficiently.

2. Locate the Rewards Section

Most platforms label this area as “Rewards,” “Points,” or “Cashback.” Here you’ll see your current point balance and the available redemption options.

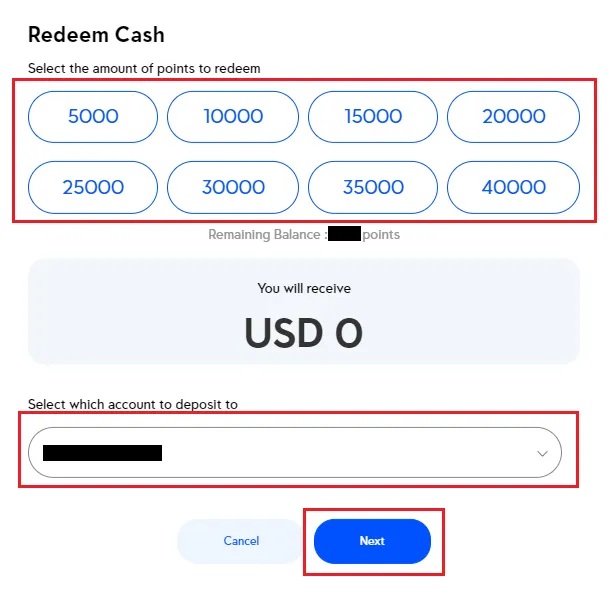

3. Choose the Cash Redemption Option

Select “Cash” or “Statement Credit” from the list. Some issuers may ask whether you prefer a direct deposit or a check; choose the method that aligns with your banking setup.

4. Confirm the Redemption Value

The system will display the cash amount you’ll receive based on the current conversion rate. Double‑check this figure, as some cards allow you to redeem in increments (e.g., minimum 5,000 points). Confirm that the amount meets your expectations before proceeding.

5. Submit the Request

After confirming the details, submit the redemption request. Processing times differ: statement credits often appear within 24‑48 hours, while direct deposits may take 3‑5 business days. Checks can take up to two weeks to arrive by mail.

Maximizing the Value of Your Points

Cash redemption is convenient, but it isn’t always the most valuable use of points. To ensure you’re getting the best possible return, consider the following strategies.

Leverage Promotional Boosts

Credit card issuers occasionally run promotions that increase the cash conversion rate. Subscribe to your issuer’s email alerts or check the rewards portal regularly to catch these limited‑time offers. A 1.5 cent per point promotion, for instance, can raise a $500 cash redemption to $750.

Combine Points with Cashback Bonuses

Some cards offer a “cashback boost” when you redeem points after meeting a spending threshold within a calendar year. If you’re close to the threshold, it might be worth waiting a few weeks to unlock the higher rate.

Consider Hybrid Redemptions

If your card allows it, you can sometimes split points between travel and cash. Using a portion of points for a discounted flight and the remainder for cash can balance the higher travel value with the flexibility of cash.

Potential Pitfalls and How to Avoid Them

While the process is straightforward, certain hidden costs can erode the value of your cash redemption.

Redemption Fees

A few issuers charge a small fee for cash withdrawals, especially when requesting a physical check. Always review the fee schedule before confirming the redemption.

Lower Conversion Rates for Certain Card Types

Entry‑level reward cards often provide a lower cash conversion rate compared to premium cards. If you hold multiple cards, compare the rates across your portfolio and redeem through the one offering the highest value.

Expiration of Points

Points may expire if your account remains inactive for a set period, typically 12‑24 months. Regularly using or redeeming points prevents loss of earned value.

Alternatives to Direct Cash Redemption

If cash isn’t your top priority, explore other redemption avenues that could deliver greater value.

Statement Credits vs. Direct Deposit

Statement credits effectively reduce your balance, which can indirectly improve your credit utilization ratio—a factor in credit scoring. Direct deposits increase liquid cash but don’t impact credit utilization.

Gift Cards and Merchandise

Gift cards often carry a slightly higher conversion rate than pure cash, especially during retailer promotions. However, they lack the flexibility of cash.

Transfer to Airline or Hotel Loyalty Programs

Transferring points to travel partners can sometimes yield values of 1.5 to 2 cents per point or more, far exceeding cash rates. This option is worth exploring if you have travel plans on the horizon.

Real‑World Example: From Accumulation to Cash Withdrawal

John, a 34‑year‑old marketing manager, earned 45,000 points over 18 months on a card that offered a baseline cash rate of 1 cent per point. During a seasonal promotion, the rate jumped to 1.2 cents per point for cash redemptions. John logged into his account, navigated to the rewards section, and selected a direct deposit. He redeemed 40,000 points, receiving $480 (40,000 × 1.2¢). The remaining 5,000 points were saved for a future travel redemption where the transfer rate to an airline partner was 1.8 cents per point, equating to $90 in travel value.

This example demonstrates the advantage of timing redemptions to coincide with promotional rates while also preserving points for higher‑value uses.

Tools and Resources to Track and Optimize Redemptions

Effective point management requires a clear view of balances, rates, and upcoming promotions. Several tools can help:

- Reward Calculators: Online calculators let you input point balances and conversion rates to compare cash, travel, and gift‑card values.

- Spending Trackers: Apps that categorize expenses can show you how quickly you’re accruing points and whether you’re on track for bonus thresholds.

- Financial Blogs: Articles such as Unlock Savings with Low Interest Rate Credit Card Options – Your Guide to Smarter Spending often highlight new redemption opportunities and rate changes.

Frequently Asked Questions

Can I redeem points for cash after a balance transfer?

Yes. Points earned on purchases remain eligible for cash redemption even if you’ve transferred a balance to a 0% APR card. For more details on balance transfers, see What Is a 0% APR Balance Transfer?.

Is there a minimum number of points required?

Most issuers set a minimum, often 5,000 or 10,000 points. Check your card’s terms to avoid a denied request.

Do cash redemptions affect my credit score?

Direct cash redemptions do not impact your credit score. However, using points for statement credits can lower your credit utilization, which may positively influence your score.

What happens if my redemption request is denied?

Denials typically result from insufficient points, an expired promotion, or a violation of the issuer’s redemption policy. Contact customer service for clarification and possible alternatives.

Final Thoughts

Redeeming credit card points for cash offers a simple, flexible way to make the most of your rewards without the complexity of travel bookings or merchandise selections. By understanding the conversion rates, timing your redemptions to capture promotional boosts, and being aware of potential fees, you can maximize the cash value of your points. Combining cash redemptions with strategic use of travel transfers or gift‑card options can further enhance overall rewards value, ensuring that every point earned contributes meaningfully to your financial goals.