Table of Contents

- What Defines a High Sign‑Up Bonus?

- Key Metrics to Evaluate

- Top Cards Offering Massive Bonuses in 2024

- How to Maximize the Bonus

- Common Requirements and How to Meet Them

- Spending Thresholds

- Credit Score and Income

- Annual Fees

- Time Constraints

- Potential Pitfalls and How to Avoid Them

- Annual Fee Trap

- Interest Charges

- Limited Redemption Options

- Credit Score Impact

- Spending Inflation

Credit cards with high sign‑up bonuses have become a cornerstone of modern personal finance, offering new cardholders a substantial influx of points, miles, or cash back after meeting a relatively short spending threshold. For many consumers, these bonuses can cover the cost of a round‑trip flight, a weekend getaway, or a sizable statement credit, effectively turning everyday purchases into valuable rewards.

Understanding the mechanics behind these offers is essential before you dive in. The allure of a 50,000‑point bonus or a $500 statement credit can be compelling, but the true value depends on factors such as the required spend, the card’s ongoing rewards rate, and any associated annual fees. By examining each component carefully, you can determine whether a high‑value sign‑up bonus aligns with your spending habits and financial goals.

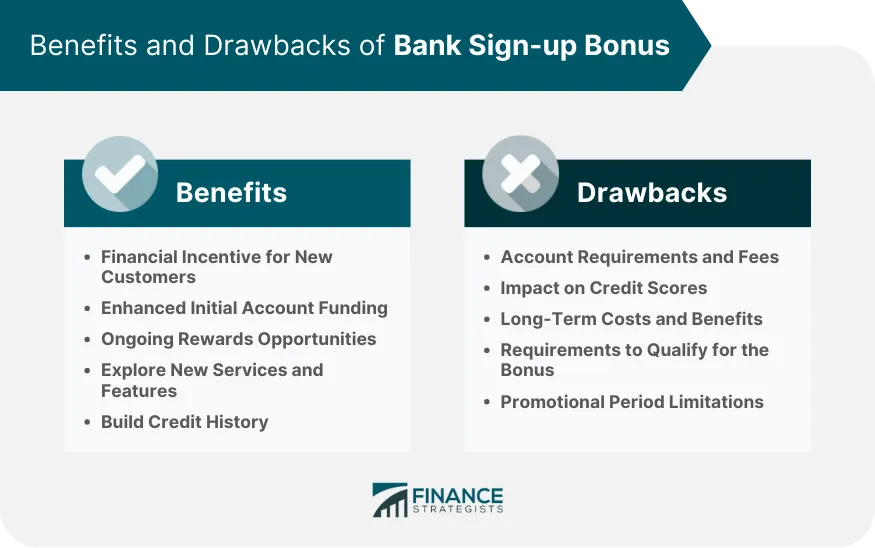

In the following sections, we will explore what constitutes a “high” sign‑up bonus, review the top cards currently delivering the biggest incentives, and outline practical strategies to meet the spending requirements without disrupting your budget. Additionally, we will discuss potential pitfalls—such as high fees, credit score impacts, and limited redemption options—so you can make an informed decision.

What Defines a High Sign‑Up Bonus?

A sign‑up bonus, also known as an introductory offer, is awarded after a cardholder spends a predetermined amount within a set period, typically three to six months. The size of the bonus varies widely across issuers and product categories. While a modest $150 bonus is common among many consumer cards, a “high” bonus generally falls into one of the following ranges:

- Travel‑focused cards: 50,000 – 100,000 points or miles, often equating to $500 – $1,000 in travel value.

- Cash‑back cards: $300 – $500 statement credit, or equivalent cash‑back points.

- Premium cards: Combined bonuses that include points, airline miles, and hotel status upgrades.

These thresholds are not arbitrary; they reflect the issuer’s calculation of the long‑term value a customer will bring through ongoing usage. High bonuses are typically paired with higher annual fees, but the net benefit can still be positive if you can fully leverage the rewards.

Key Metrics to Evaluate

- Bonus value per dollar spent: Divide the monetary value of the bonus by the required spend to gauge efficiency.

- Annual fee vs. bonus offset: Determine how many months of the fee the bonus covers.

- Redemption flexibility: Points that transfer to multiple airline or hotel partners often hold more value than proprietary rewards.

- Credit score impact: High‑value cards may require a strong credit profile; a hard inquiry can temporarily lower your score.

Top Cards Offering Massive Bonuses in 2024

The market continues to evolve, with issuers competing for high‑spending consumers. Below is a curated list of cards that currently feature some of the most generous sign‑up bonuses, along with brief overviews of their core benefits.

- Chase Sapphire Preferred® Card – 60,000 bonus points after $4,000 spend in the first three months. Points are worth 1.25¢ each when redeemed for travel through Chase Ultimate Rewards, translating to $750 in travel credit. The $95 annual fee is modest relative to the bonus value.

- American Express® Gold Card – 60,000 Membership Rewards points after $4,000 spend in the first six months, plus $120 dining credit. Points are most valuable when transferred to airline partners, potentially exceeding $1,000 in travel value.

- Capital One Venture X Rewards Credit Card – 100,000 miles after $10,000 spend in the first six months, plus a $300 annual travel credit and lounge access. The $395 annual fee is offset quickly if you can meet the spend requirement.

- Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard® – 50,000 miles after $4,000 spend in three months, plus a free checked bag and preferred boarding on American Airlines flights.

- Discover it® Miles – 35,000 bonus miles (equivalent to $350 in travel) after $1,000 spend in the first three months. No annual fee makes it a low‑risk entry point for bonus hunters.

How to Maximize the Bonus

Meeting the spending threshold efficiently is crucial. Below are practical tips to achieve the required spend without inflating your regular expenses:

- Consolidate recurring bills (utilities, phone, streaming services) onto the new card.

- Pre‑pay upcoming expenses such as insurance premiums or tuition, if the provider allows credit‑card payments.

- Utilize “card‑linked” shopping portals that give extra points on purchases you would make anyway.

- Consider gifting or buying prepaid cards for friends and family, then reimbursing them in cash.

- Schedule larger purchases (appliances, electronics) during the promotional window.

For those new to reward strategies, our comprehensive guide on how to redeem credit card points for cash offers a clear roadmap for converting accumulated points into tangible savings.

Common Requirements and How to Meet Them

Every high‑bonus card shares a set of baseline requirements. Understanding these elements helps you prepare before submitting an application.

Spending Thresholds

The required spend typically ranges from $1,000 to $10,000 within the first three to six months. While lower thresholds are easier to meet, higher thresholds often accompany larger bonuses, creating a favorable cost‑to‑benefit ratio if you can accommodate the spend.

Credit Score and Income

Premium cards generally target applicants with a credit score of 720 or higher and a stable income. A higher credit score not only improves approval odds but also reduces the likelihood of a steep interest rate if you carry a balance.

Annual Fees

Annual fees can range from $0 to $550. A common strategy is to calculate the “break‑even point” by dividing the bonus value by the fee. For example, a $500 bonus on a $95 fee card yields a net gain of $405, assuming you redeem the points at full value.

Time Constraints

The bonus window is limited. Missing the deadline means forfeiting the entire offer, regardless of how much you have already spent. Setting calendar reminders for the final day can prevent accidental lapses.

Potential Pitfalls and How to Avoid Them

High sign‑up bonuses can be enticing, but they also carry hidden challenges. Being aware of these issues can safeguard your financial health.

Annual Fee Trap

Some cardholders keep a high‑fee card only for the bonus, then let the fee erode future earnings. To avoid this, evaluate whether the ongoing rewards (e.g., 2 × points on travel) justify the yearly cost after the bonus period ends.

Interest Charges

If you carry a balance, interest can quickly outweigh any bonus benefits. For cards with high fees, consider paying the balance in full each month or using a 0% APR balance transfer to manage large purchases without incurring interest.

Limited Redemption Options

Points that cannot be transferred to travel partners or redeemed for cash often have lower monetary value. Prioritize cards that offer flexible redemption channels, such as statement credits, travel bookings, or transfers to airline/hotel loyalty programs.

Credit Score Impact

Applying for multiple cards in a short period can generate several hard inquiries, temporarily lowering your score. Space out applications and monitor your credit report to ensure no unexpected negatives arise.

Spending Inflation

Attempting to meet the spend requirement by making unnecessary purchases can lead to budget overruns. Stick to essential expenses and use the tips in the earlier section to accelerate spend without waste.

For readers interested in broader financial optimization, the article on low interest rate credit card options provides insights into balancing reward acquisition with cost control.

By approaching high sign‑up bonuses with a disciplined plan, you can reap substantial benefits while maintaining financial stability. Begin by selecting a card that aligns with your spending patterns, ensure you meet the requirements within the allotted window, and keep an eye on the ongoing cost‑benefit analysis after the introductory period.

Remember, the true power of a sign‑up bonus lies not only in the initial points or cash but also in how effectively you integrate the card into your broader financial strategy. With thoughtful planning, the bonus can serve as a launchpad for a rewarding, cost‑efficient lifestyle.