Table of Contents

- Global Acceptance and Merchant Reach

- Geographic Coverage

- Online and Mobile Commerce

- Rewards and Incentive Programs

- Visa Signature and Visa Infinite

- Mastercard World and World Elite

- Security Features and Fraud Protection

- Tokenization and Contactless Payments

- Zero Liability Policies

- Advanced Authentication

- Travel Perks and Concierge Services

- Airport Lounge Access

- Travel Insurance

- Additional Value-Added Services

- Price Protection and Return Guarantee

- Entertainment and Dining Offers

- Financial Management Tools

- Choosing the Right Network for Your Needs

- Consider Your Travel Patterns

- Evaluate Reward Structures

- Look at Security Enhancements

- Check for Ancillary Services

When you swipe, tap, or insert your card at a checkout, the logo you see—Visa or Mastercard—does more than just signal payment acceptance. It determines the suite of protections, rewards, and conveniences that accompany every transaction. Understanding the subtle but important differences between these two giants can turn an ordinary purchase into a strategic financial decision. This article walks you through the core benefits of each network, offering a factual narrative that lets you compare them head‑to‑head.

Both Visa and Mastercard operate as payment processors, connecting merchants, banks, and consumers in a global ecosystem. While they share many similarities, each has cultivated its own set of programs, partnerships, and technological advances. By tracing the evolution of these features—from security layers to travel perks—you’ll see how the two networks have converged and where they still diverge.

Before diving into the specifics, remember that many of the advantages you experience are shaped not only by the network but also by the issuing bank’s card tier. Nonetheless, the network’s baseline offerings set the stage for what every cardholder can expect, regardless of the bank behind the card.

Global Acceptance and Merchant Reach

One of the first criteria shoppers consider is whether a card will be accepted wherever they travel or shop online. Visa and Mastercard both boast extensive acceptance networks, but there are nuanced differences worth noting.

Geographic Coverage

- Visa: Operates in over 200 countries and territories, with a slight edge in emerging markets thanks to early partnerships with local banks.

- Mastercard: Also present in more than 210 countries, Mastercard’s presence is particularly strong in Europe and parts of Asia where its co‑branding agreements with transit and hospitality providers are prevalent.

For most travelers, the practical outcome is that both logos will be accepted at the vast majority of merchants worldwide. However, if you frequently visit regions where one network has exclusive local agreements—such as Visa’s relationship with certain Caribbean banks—you may notice a marginally smoother experience.

Online and Mobile Commerce

Both networks support the latest e‑commerce standards, including 3‑D Secure (Visa Secure and Mastercard Identity Check). These tools add an extra verification step that reduces fraud while keeping checkout friction low. When you shop on platforms that list “Visa” or “Mastercard” as accepted payment methods, the underlying security protocol is automatically applied, safeguarding your data without extra effort on your part.

Rewards and Incentive Programs

Rewards are often the most visible benefit that influences a consumer’s choice of network. While the issuing bank ultimately decides the points or cash‑back structure, Visa and Mastercard each provide a foundation of incentive programs that issuers can build upon.

Visa Signature and Visa Infinite

- Access to exclusive travel discounts, hotel upgrades, and concierge services.

- Purchase protection up to $1,000 per transaction, covering accidental damage or theft of new purchases.

- Extended warranty that adds up to one additional year to the manufacturer’s warranty.

- Travel and emergency assistance, including medical referrals and legal services.

Mastercard World and World Elite

- World Elite cards offer a suite called “World Elite Mastercard Benefits,” featuring hotel and airline elite status upgrades, complimentary lounge access, and a $100 annual travel credit.

- Price Protection refunds the difference if you find a lower price on an identical item within 60 days of purchase.

- Mastercard’s “Identity Theft Protection” monitors personal information and provides restoration services if theft occurs.

Both networks also provide point‑conversion partners, allowing cardholders to transfer earned points to airline or hotel loyalty programs. For example, a Visa Signature card may let you convert points to a frequent‑flyer account at a 1:1 ratio, while a World Elite Mastercard might offer a similar conversion but with occasional promotional bonuses.

Security Features and Fraud Protection

Security is a non‑negotiable aspect of any payment card, and both Visa and Mastercard have invested heavily in technology that protects cardholders from unauthorized transactions.

Tokenization and Contactless Payments

Tokenization replaces your card number with a unique digital identifier when you use mobile wallets such as Apple Pay or Google Pay. Visa’s “Visa Token Service” and Mastercard’s “Mastercard Digital Enablement Service” work behind the scenes to ensure that the real card number never leaves your device. This reduces exposure to skimming and data breaches.

Zero Liability Policies

Both networks guarantee zero liability for fraudulent charges, provided the cardholder reports the incident promptly. The policy applies to most purchases, including online, in‑store, and phone orders. While the wording is similar, Mastercard’s policy often extends to unauthorized cash advances, whereas Visa’s focus is primarily on purchase transactions.

Advanced Authentication

- Visa Secure (formerly Verified by Visa): Uses dynamic authentication that evaluates risk based on device, location, and transaction amount.

- Mastercard Identity Check (formerly MasterCard SecureCode): Employs a similar risk‑based engine, with the added option of biometric verification where supported.

These layers of security are automatically applied during checkout, requiring no additional steps from the cardholder unless the transaction is flagged as high‑risk.

Travel Perks and Concierge Services

Frequent travelers often judge a card by the ancillary benefits it offers beyond the core transaction processing. Both Visa and Mastercard have built robust travel ecosystems that can add value to premium cards.

Airport Lounge Access

World Elite Mastercard holders receive complimentary access to over 1,000 lounges worldwide through the “Priority Pass” program, while Visa Infinite cards partner with “LoungeKey,” offering a comparable number of lounge entrances. The primary difference lies in the enrollment process and the number of complimentary guest passes each program provides.

Travel Insurance

- Visa Infinite: Includes trip cancellation/interruption insurance, travel accident insurance, and emergency medical coverage up to $1 million, provided the travel expenses are charged to the card.

- Mastercard World Elite: Offers similar coverage but often caps the medical expense reimbursement at $500,000 and may require a separate travel insurance enrollment step.

For cardholders who already have separate travel insurance, these built‑in benefits serve as a safety net rather than a primary coverage source.

Additional Value-Added Services

Beyond the headline features, both networks provide a variety of supplementary services that can influence day‑to‑day card usage.

Price Protection and Return Guarantee

Mastercard’s Price Protection refunds the price difference if a purchased item drops in price within a set period, while Visa’s Return Guarantee extends the merchant’s return window by up to 90 days for qualifying purchases. These programs can be especially useful for high‑ticket items such as electronics or appliances.

Entertainment and Dining Offers

Both Visa and Mastercard maintain partnerships with entertainment venues, restaurants, and retail brands to deliver exclusive discounts. For example, Visa’s “Visa Deals” portal lists limited‑time offers on dining, while Mastercard’s “Priceless Cities” program provides curated experiences in major metropolitan areas.

Financial Management Tools

Through their respective mobile apps, Visa and Mastercard allow cardholders to track spending, set budget alerts, and freeze or unfreeze cards instantly. These tools have become standard, but the user interface and integration with third‑party budgeting apps can differ. Mastercard’s “Mastercard Send” enables peer‑to‑peer transfers in real time, a feature that Visa has begun to roll out via “Visa Direct.”

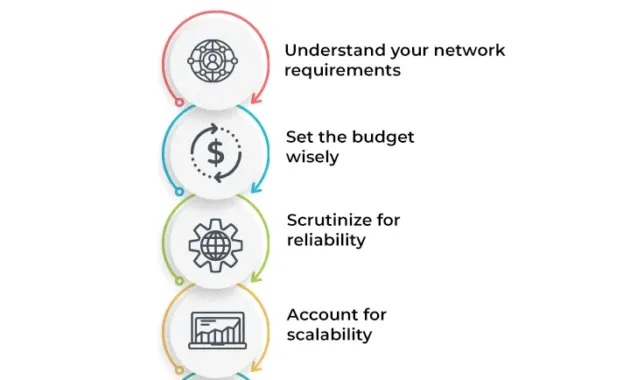

Choosing the Right Network for Your Needs

The decision between Visa and Mastercard often boils down to the specific card product you’re considering rather than the network alone. However, a few practical guidelines can help you align the network’s strengths with your financial habits.

Consider Your Travel Patterns

If you travel frequently to regions where one network has stronger lounge partnerships or local merchant discounts, that network may provide a smoother experience. For instance, a World Elite Mastercard might be preferable for travelers who value Priority Pass access, while a Visa Infinite card could be better for those who prioritize extensive travel insurance coverage.

Evaluate Reward Structures

Examine how the issuing bank layers its rewards on top of the network’s baseline benefits. Some Visa Signature cards combine points with hotel elite status upgrades, whereas certain Mastercard World Elite cards pair cash‑back bonuses with exclusive dining discounts. Matching the reward style to your spending patterns—whether you earn points, miles, or cash back—will maximize the card’s value.

Look at Security Enhancements

Both networks offer comparable zero‑liability protection, but if you rely heavily on mobile payments, you might appreciate Visa’s broader integration with Samsung Pay and Apple Pay, while Mastercard’s tokenization service is known for its seamless compatibility with a wider range of Android wallets.

Check for Ancillary Services

Features like price protection, return guarantees, and concierge assistance can vary by card tier. If you frequently purchase high‑value items or enjoy curated experiences, a card that includes a robust return guarantee or exclusive event access could tip the balance.

Ultimately, the best approach is to compare the specific cards offered by your bank, paying close attention to the network‑level benefits outlined above. By aligning those baseline features with your personal financial goals, you can select a card that feels like a natural extension of your wallet.

For readers interested in exploring how card benefits intersect with other financial tools, the Unlock the Benefits of Navy Federal Credit Union Credit Cards – Your Complete Guide provides a practical look at network perks in a credit union setting. Additionally, understanding how to manage your statements securely can be vital; see How to Download Credit Card Statements Quickly and Securely – Your Complete Guide for best practices. If you’re rebuilding credit, the 7 Best Credit Cards for Bad Credit Rebuilding That Actually Help Your Score article outlines options that still enjoy Visa or Mastercard network benefits.

By focusing on the tangible, network‑wide advantages—global acceptance, security layers, travel perks, and value‑added services—you can make an informed decision that aligns with both your everyday purchases and long‑term financial strategy.