Table of Contents

- Understanding the Need to Switch Product Types

- Core Steps in the Product Type Switch Process

- 1. Initiation and Authentication

- 2. Eligibility Check

- 3. Product Mapping and Data Transformation

- 4. Communication with Card Networks

- 5. Card Re‑issuance or Re‑programming

- 6. Immediate Reporting and Transaction Monitoring

- 7. Confirmation and Customer Communication

- Technical Architecture Supporting the Switch

- Front‑End Layer

- Orchestration Service

- Core Banking System

- Card Network Gateway

- Fraud and Credit Reporting Engines

- Customer Notification Service

- Compliance and Regulatory Considerations

- Best Practices for a Smooth Switch Experience

- Design for Simplicity

- Leverage Real‑Time Data

- Provide Transparent Cost Breakdown

- Automate Reporting

- Offer Immediate Access via Virtual Cards

- Monitor Post‑Switch Metrics

- Case Study: A Bank’s Migration to a New Travel Card

- Common Pitfalls and How to Avoid Them

- Delayed Network Responses

- Data Mismatch Errors

- Insufficient Customer Education

- Regulatory Oversights

- Future Trends in Product Switching

Switch credit card product type is a frequent request in today’s dynamic payments landscape. Whether a cardholder wants to upgrade from a basic rewards card to a premium travel card, or a bank aims to migrate a legacy product to a new digital offering, the process involves many moving parts. In this article we follow the journey of a typical card upgrade, from the initial request to the final activation, highlighting the systems, data flows, and regulatory checkpoints that ensure a smooth transition.

Imagine a mid‑size bank that has just launched a new suite of contact‑free, high‑limit cards designed for frequent travelers. A long‑time customer, who currently holds a standard cashback card, logs into the online portal and clicks “Switch to Travel Card.” Behind that simple click lies a complex orchestration of data validation, product mapping, and communication between the issuer’s core banking system, the card network, and third‑party processors.

In the sections that follow, we break down each stage of the switch, explain why immediate reporting matters, and provide actionable tips for issuers looking to streamline the experience. By the end of this guide, readers will have a clear picture of the technical and operational steps required to execute a product type change without disrupting the cardholder’s experience.

Understanding the Need to Switch Product Types

Cardholders may seek a product switch for several reasons:

- Desire for higher rewards rates or different reward categories.

- Need for increased credit limits to support larger purchases.

- Preference for newer features such as contactless payments or enhanced security.

- Regulatory or compliance requirements that dictate a change in product classification.

From the issuer’s perspective, offering a seamless switch can improve customer retention and reduce churn. It also allows banks to steer users toward higher‑margin products, supporting revenue goals.

Core Steps in the Product Type Switch Process

1. Initiation and Authentication

The journey begins when the cardholder initiates the request through a secure channel—online banking, mobile app, or call center. Strong authentication (e.g., multi‑factor authentication) verifies the identity of the requester, protecting against unauthorized switches.

2. Eligibility Check

Before any changes are made, the issuer runs a series of eligibility rules:

- Credit score and utilization thresholds.

- Outstanding balances and payment history.

- Product‑specific criteria such as travel frequency for travel cards.

If the cardholder fails any check, the system provides a clear, actionable message explaining why the switch cannot proceed.

3. Product Mapping and Data Transformation

Each card product is defined by a set of attributes: interest rate, reward structure, fees, credit limit, and network code. The switch engine maps the existing card’s attributes to those of the target product, ensuring that all mandatory fields are populated correctly.

During this step, data transformation may be required to align with the card network’s specifications. For example, a switch from a Visa Classic to a Visa Infinite card involves updating the Product Code and adjusting the Reward Tier fields.

4. Communication with Card Networks

Once the mapping is complete, the issuer sends a Product Change Message (PCM) to the card network (Visa, MasterCard, etc.). This message includes the new product code, updated limit, and any changed fee structures. The network validates the request against its own rules and, upon approval, issues a confirmation.

5. Card Re‑issuance or Re‑programming

Depending on the nature of the switch, the issuer may need to:

- Re‑program the existing card’s chip and magnetic stripe with new product data.

- Print and ship a new physical card bearing the updated branding.

- Issue a virtual card number for immediate use, especially for contactless or digital‑first customers.

Modern issuers often leverage contactless technology to push updates instantly, allowing the cardholder to start using the new product within minutes.

6. Immediate Reporting and Transaction Monitoring

Regulators require real‑time updates to credit bureaus and fraud monitoring systems when a card’s terms change. This is where immediate reporting matters. The issuer must send updated account status to credit reporting agencies, ensuring the cardholder’s credit file reflects the new product type without delay.

7. Confirmation and Customer Communication

After the network confirms the product change, the issuer sends a confirmation email or notification. The message includes:

- New card features and benefits.

- Effective date of the change.

- Instructions for activating a new physical card, if applicable.

Clear communication reduces confusion and sets expectations for any upcoming billing cycle adjustments.

Technical Architecture Supporting the Switch

Implementing a reliable switch workflow requires a robust technical stack. Below is a typical architecture diagram, described in prose:

Front‑End Layer

The user interface (web or mobile) captures the switch request and forwards it to the back‑end via a secure API. Front‑end validation checks basic eligibility (e.g., open balance) before submitting.

Orchestration Service

An orchestration engine coordinates the sequence of actions: eligibility verification, product mapping, network communication, and reporting. This service often runs on a micro‑service framework, enabling scalability and easy updates.

Core Banking System

The core system stores the master account record. When a switch is approved, it updates the account’s product code, credit limit, and fee schedule. Integration is typically achieved through standardized messaging formats such as ISO 20022 or proprietary APIs.

Card Network Gateway

This component translates the issuer’s request into the network’s required message format. It handles acknowledgments, error handling, and retries in case of transient failures.

Fraud and Credit Reporting Engines

These subsystems receive real‑time updates to adjust risk scores and report to external bureaus. They must operate with low latency to comply with regulatory timelines.

Customer Notification Service

After successful completion, this service assembles and sends the confirmation communication via email, SMS, or in‑app push notification.

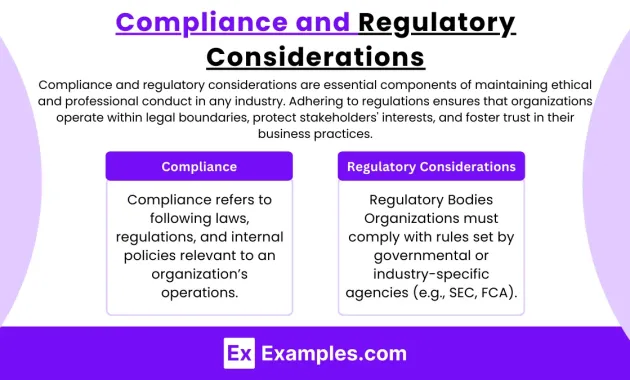

Compliance and Regulatory Considerations

Switching product types triggers several regulatory obligations:

- Truth in Lending Act (TILA): Issuers must disclose any changes in APR, fees, or rewards structures.

- Fair Credit Reporting Act (FCRA): Updated account information must be reported to credit bureaus within a prescribed timeframe.

- Payment Card Industry Data Security Standard (PCI DSS): Any re‑programming of card data must follow strict encryption and access controls.

- Consumer Financial Protection Bureau (CFPB) guidelines: Transparent communication and easy opt‑out options are required.

Failure to meet these requirements can result in fines, reputational damage, or increased fraud risk. Issuers should embed compliance checks into the orchestration workflow to automate validation.

Best Practices for a Smooth Switch Experience

Design for Simplicity

Limit the number of steps a cardholder must take. A single “Switch Now” button, followed by real‑time status updates, reduces friction.

Leverage Real‑Time Data

Integrate with a live credit scoring engine to evaluate eligibility instantly. This prevents delays caused by batch processing.

Provide Transparent Cost Breakdown

Show side‑by‑side comparisons of the current and target product, highlighting differences in APR, fees, and rewards. Transparency builds trust.

Automate Reporting

Implement automated feeds to credit bureaus and fraud monitoring platforms. Automation ensures compliance and speeds up the overall process.

Offer Immediate Access via Virtual Cards

When a physical card needs to be mailed, issue a virtual card number that can be added to digital wallets. This keeps the customer productive while waiting for the new card.

Monitor Post‑Switch Metrics

Track activation rates, first‑month spend, and support ticket volume. These metrics indicate whether the switch experience meets expectations and where improvements are needed.

Case Study: A Bank’s Migration to a New Travel Card

In early 2025, a regional bank decided to replace its aging “Premium Travel” card with a new “World Explorer” product that offered higher miles per dollar, no foreign transaction fees, and enhanced travel insurance. The bank followed the workflow outlined above:

- Customer Initiation: Over 5,000 eligible customers received an email invitation to switch. The click‑through rate was 22%.

- Eligibility Engine: An automated scorecard evaluated credit utilization and recent payment behavior. 4,600 customers passed.

- Product Mapping: The switch engine translated the old product code (PT‑001) to the new code (WT‑202). Limits were increased by 20% on average.

- Network Confirmation: Visa approved all PCMs within minutes, allowing the bank to issue virtual cards instantly.

- Reporting: Updated account data was pushed to Experian and Equifax within 24 hours, meeting FCRA timelines.

- Customer Communication: Each customer received a personalized email detailing new benefits and a link to download the virtual card.

The migration resulted in a 15% increase in travel‑related spend and a 10% reduction in support calls related to card upgrades. The bank’s success demonstrates the value of a well‑engineered switch process.

Common Pitfalls and How to Avoid Them

Delayed Network Responses

If the card network’s acknowledgment is slow, the customer may experience a gap in service. Mitigation: implement asynchronous callbacks and keep the customer informed with status updates.

Data Mismatch Errors

Incorrect product codes or limit values can cause re‑issuance failures. Mitigation: enforce strict schema validation before sending PCMs.

Insufficient Customer Education

Customers who don’t understand new fee structures may feel surprised later. Mitigation: use clear, side‑by‑side tables in the confirmation email.

Regulatory Oversights

Missing a reporting deadline can trigger penalties. Mitigation: schedule automated batch jobs that verify reporting logs daily.

Future Trends in Product Switching

As open banking and API ecosystems mature, we anticipate a shift toward real‑time, consumer‑driven product switching. Customers may soon be able to toggle between multiple product profiles within a single card, similar to switching between “modes” on a smartphone. Machine‑learning models will predict the optimal product for each user based on spending patterns, offering proactive suggestions.

In parallel, blockchain‑based tokenized cards could enable instantaneous product updates without re‑issuing physical cards, further reducing latency and operational cost.

For issuers planning to stay competitive, investing in flexible, API‑first architectures and robust data governance will be essential. Those who master the art of seamless product switching will not only retain more customers but also unlock new revenue streams through targeted product offerings.

By following the structured approach detailed above—starting with secure initiation, moving through eligibility, product mapping, network communication, and ending with transparent customer outreach—banks and fintechs can deliver a frictionless experience. The result is a satisfied cardholder who enjoys the benefits of the new product without interruption, and an issuer that meets compliance obligations while driving growth.