Table of Contents

- Annual Fees and Pricing Structure

- Impact on Overall Cost

- Earn Rates and Points Structure

- Points Valuation

- Everyday Spending Comparison

- Travel Credits and Perks

- Airport Lounge Access

- Additional Annual Perks

- Redemption Flexibility and Value

- Practical Redemption Example

- Insurance and Protections

- Key Protection Differences

- Overall Value for Different Traveler Profiles

- Frequent Flyer

- Domestic Spender

- Occasional Vacationer

When the keyword Capital One Venture X vs Chase Sapphire Reserve appears in a traveler’s search, the expectation is a clear, data‑driven breakdown of two of the market’s most coveted premium cards. Both cards promise high‑value travel rewards, generous statement credits, and a suite of protections, yet their structures differ enough to sway the decision based on personal spending habits and travel style. This article walks through each element of the cards, presenting the facts in a straightforward narrative that lets you see how the pieces fit together.

Understanding the nuances begins with the basics: the annual fee, the introductory bonuses, and the ongoing earn rates. From there, we explore how each program handles travel credits, redemption flexibility, and ancillary benefits such as insurance coverage. Throughout the comparison, we reference relevant concepts—like purchase APR—to ensure the analysis remains grounded in the broader credit‑card ecosystem.

By the end, you will have a factual picture of which card aligns with your spending patterns, travel frequency, and redemption preferences, without the influence of hype or subjective opinion.

Annual Fees and Pricing Structure

Both cards carry a premium price tag, but the composition of the fee differs. The Capital One Venture X charges a $395 annual fee, while the Chase Sapphire Reserve sits at $550. The higher fee for the Reserve is partially offset by a $300 annual travel credit that automatically applies to travel purchases, effectively lowering the net cost to $250 if you fully utilize the credit.

The Venture X offers a $300 annual travel credit as well, but it is limited to bookings made through Capital One Travel. This restriction can affect how easily you capture the full credit, especially if you prefer alternative booking platforms.

Impact on Overall Cost

- Capital One Venture X: $395 fee – $300 credit = $95 net cost when credit is maximized.

- Chase Sapphire Reserve: $550 fee – $300 credit = $250 net cost when credit is maximized.

For a cardholder who rarely travels, the net cost difference becomes a decisive factor. However, heavy travelers who consistently spend on flights, hotels, and car rentals may find the broader travel credit applicability of the Reserve more valuable.

Earn Rates and Points Structure

Capital One Venture X awards 2X miles on all purchases, with a boost to 10X miles on hotels and rental cars booked via Capital One Travel. Meanwhile, the Chase Sapphire Reserve offers 3X points on travel (excluding the $300 travel credit purchases) and 3X points on dining worldwide. Both cards provide a robust introductory bonus: 75,000 miles for Venture X after spending $4,000 in the first three months, and 60,000 points for the Reserve after a $4,000 spend within the same period.

Points Valuation

When transferred to airline or hotel partners, both programs can yield a value of 1.25 to 2.0 cents per point, depending on the redemption strategy. In practice, many users find that the Reserve’s Chase Ultimate Rewards points retain a slightly higher average value when redeemed for travel through the Chase portal, due to the 1.5‑cent baseline conversion.

Everyday Spending Comparison

- For a consumer who spends $20,000 annually on groceries, gas, and general merchandise, the Venture X generates 40,000 miles (2X), equivalent to $400–$800 in travel value.

- The Reserve, with its 1X base rate on non‑travel purchases, yields 20,000 points, translating to $300–$600 in travel value when transferred.

The difference highlights why the Venture X often appeals to users with a high volume of non‑travel spend, while the Reserve shines for those whose budgets are already weighted toward travel and dining.

Travel Credits and Perks

Both cards provide a $300 travel credit, yet the mechanisms differ. The Reserve’s credit automatically reimburses any travel-related purchase—airfare, hotels, rideshares—once the card is used, making the benefit “hands‑off.” The Venture X credit, however, requires bookings to be made through Capital One Travel, a step that can be missed if the cardholder uses a third‑party site.

Airport Lounge Access

Both cards grant unlimited access to airport lounges, but through different networks. The Reserve offers Priority Pass Select membership, which includes over 1,300 lounges worldwide, plus access to the Chase Sapphire Lounge at select airports. The Venture X also includes Priority Pass Select, but adds Capital One lounges in select U.S. locations, providing a broader domestic lounge footprint.

Additional Annual Perks

- Capital One Venture X: $100 Global Entry or TSA PreCheck credit, $100 airline fee credit, and 10,000 bonus miles after $10,000 in travel spend.

- Chase Sapphire Reserve: $300 annual travel credit, $100 Global Entry/TSA PreCheck credit, and 5% more value on points redeemed for travel through Chase Ultimate Rewards.

Redemption Flexibility and Value

Redemption options are a cornerstone of any premium card analysis. The Venture X allows miles to be used as a statement credit against travel purchases at a rate of 1 cent per mile, or transferred to a growing list of airline partners at a 1:1 ratio. The Reserve’s points can be redeemed for travel through the Chase portal at 1.5 cents per point, transferred to 14 travel partners, or used for cash back at 1 cent per point.

For travelers who prefer simplicity, the Venture X’s statement credit method mirrors a traditional “pay‑with‑points” experience, while the Reserve’s portal offers a built-in discount that can boost value without the need for partner transfers.

Practical Redemption Example

Consider a $1,200 flight booked directly with an airline. Using Venture X miles as a statement credit would require 120,000 miles (1 cent per mile). In contrast, the Reserve’s portal redemption would cost 8,000 points (1.5 cents per point), representing a substantially lower point cost. However, if the same flight is booked through a partner airline where points translate to 2 cents each, the Reserve would need only 6,000 points, and the Venture X would need 60,000 miles after transfer, underscoring the importance of transfer strategies.

For readers looking to learn more about maximizing travel statement credits, the guide Unlock Free Travel: How to Redeem Credit Card Points for Travel Statement Credit and Save Hundreds provides step‑by‑step instructions.

Insurance and Protections

Both cards come equipped with a suite of travel‑related insurances, but the specifics differ. The Reserve includes trip cancellation/interruption insurance up to $10,000 per person, primary rental car collision damage waiver (CDW), and travel accident insurance up to $1 million. The Venture X offers similar coverage levels, but its rental car CDW is secondary to the cardholder’s personal auto insurance, which may affect the claim process.

Key Protection Differences

- Chase Sapphire Reserve: Primary rental car insurance, making it the preferred choice for renters who do not carry personal collision coverage.

- Capital One Venture X: Secondary rental car insurance, requiring verification of personal coverage before a claim.

For users concerned about declined transactions, the article Why Was My Credit Card Declined? Uncover the Real Reasons and Fix Them Fast outlines common triggers and remediation steps, relevant for both cards given their high spend thresholds.

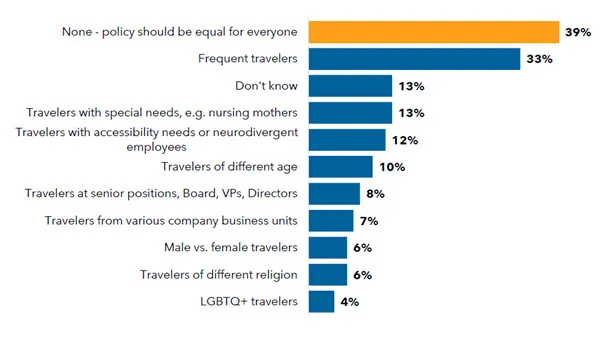

Overall Value for Different Traveler Profiles

When assessing value, it is helpful to categorize travelers into three primary groups: the frequent flyer, the domestic spender, and the occasional vacationer.

Frequent Flyer

A frequent flyer who spends heavily on airline tickets and luxury hotels may favor the Reserve for its higher points earn on travel, broader transfer network, and primary rental car insurance. The ability to redeem points at 1.5 cents per point via the Chase portal also adds immediate value.

Domestic Spender

A consumer whose budget is dominated by grocery, gas, and streaming services will likely see more miles accumulated with Venture X’s flat 2X earn on all purchases. The lower net annual cost after the travel credit further enhances its appeal for this segment.

Occasional Vacationer

For those who travel once or twice a year, the simplicity of the Venture X’s statement credit redemption and the inclusion of Capital One lounges may outweigh the Reserve’s higher fee and more complex point valuation. The decision then hinges on whether the traveler prefers a “set‑and‑forget” credit or is comfortable navigating transfer partners for higher redemption value.

Both cards also require a strong credit profile, typically a good to excellent credit score, and the ability to meet the introductory spend threshold to unlock the sign‑up bonus. Understanding the purchase APR and any potential fees is essential; a review of Defining Purchase Annual Percentage Rate can help gauge the cost of carrying a balance, though premium cards are best utilized when paid in full each month.

In the final analysis, the “winner” is not universal. The Capital One Venture X excels for users who prioritize flat‑rate earnings and a lower effective annual fee, while the Chase Sapphire Reserve shines for high‑spending travelers who can leverage its superior travel credit flexibility, primary rental car insurance, and higher redemption value through the Chase portal. Selecting the right card depends on matching the card’s strengths to your personal spending patterns, travel frequency, and redemption preferences.