Table of Contents

- Understanding Credit Limit Increases: Soft vs. Hard Pulls

- When a Hard Pull Is Triggered

- Preparing Your Account Before the Request

- Reduce Credit Utilization

- Update Your Reported Income

- Ensure a Clean Payment History

- Strategies to Request an Increase Without a Hard Pull

- Use the Issuer’s Online Portal

- Call the Customer Service Center

- Time Your Request Strategically

- Leverage Existing Relationship

- What Happens After You Submit the Request?

- Alternatives When a Soft‑Pull Increase Isn’t Possible

- Apply for a New Card with a Higher Limit

- Add an Authorized User

- Consider a Secured Credit Card

- Frequently Asked Questions

- Will a soft pull affect my credit score?

- How long does a soft‑pull limit increase take to reflect?

- Can I request a limit increase more than once?

- What if the issuer insists on a hard pull?

- Is there a difference in how purchases and cash advances are affected?

Request credit limit increase without hard pull is a common goal for many cardholders who want to boost their available credit while keeping their credit score intact. The process may seem opaque, but a clear understanding of how issuers evaluate requests can turn a routine inquiry into a successful outcome. By following a systematic approach—leveraging existing account data, timing the request wisely, and using the right communication channels—you can often secure a higher limit without triggering a hard inquiry.

In this article, we walk through the mechanics of credit limit adjustments, explain why a hard pull is sometimes unavoidable, and provide a step‑by‑step guide to making a request that stays soft. The narrative follows a typical cardholder’s journey from preparing the account to navigating the issuer’s response, offering practical tips that are grounded in how lenders actually operate.

Understanding Credit Limit Increases: Soft vs. Hard Pulls

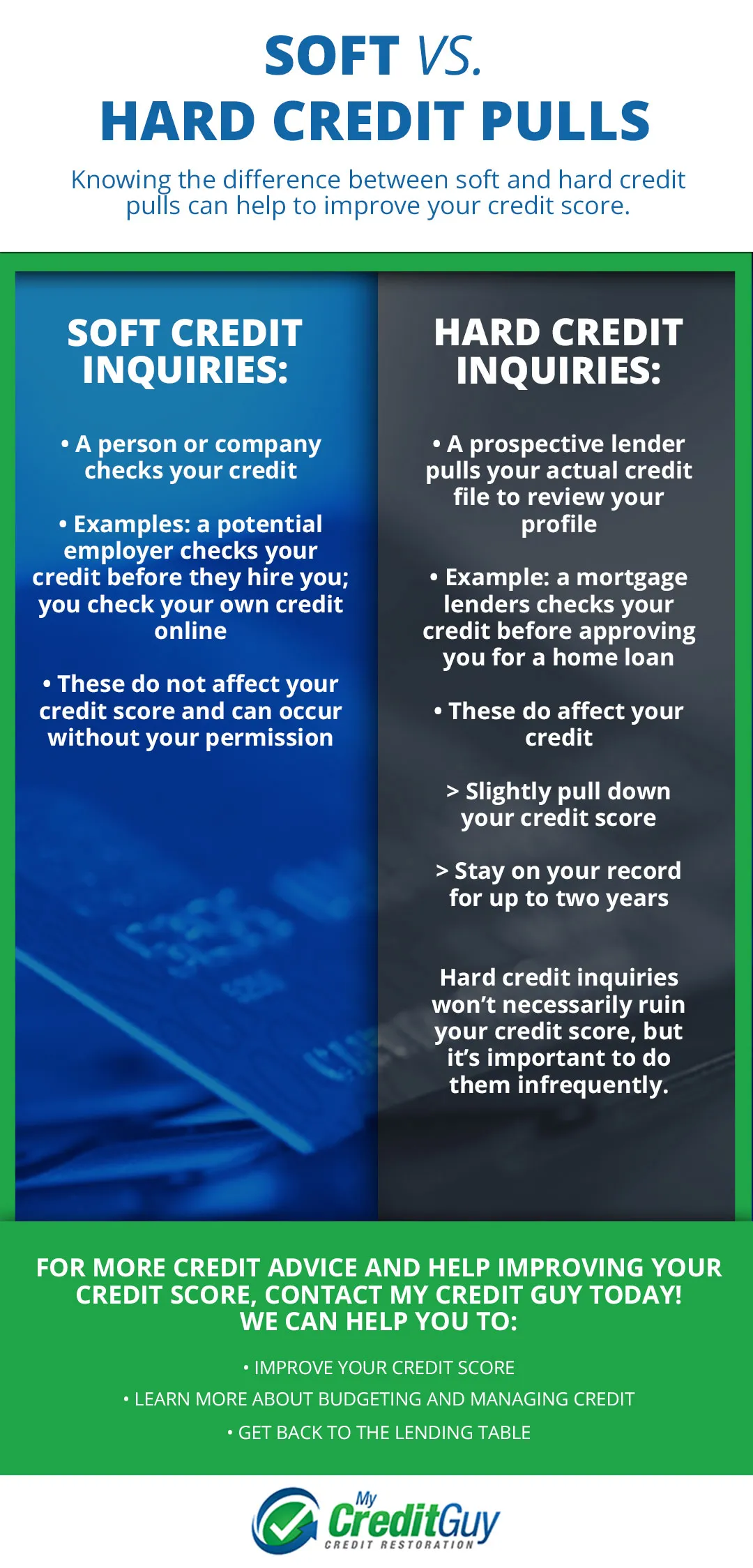

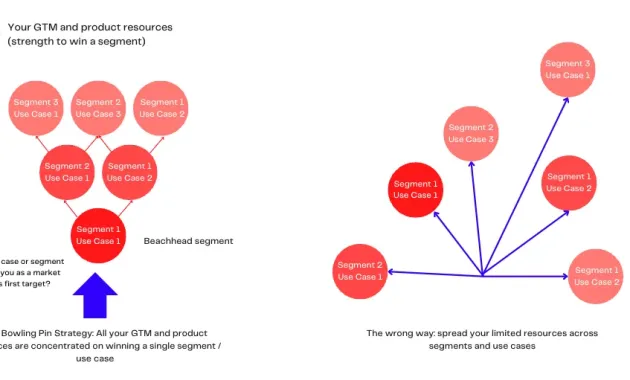

Credit card issuers have two primary ways to assess a limit increase request: a soft pull or a hard pull. A soft pull checks your credit information without affecting your credit score, similar to the review that occurs when you log into an online portal. A hard pull, on the other hand, is recorded on your credit report and can lower your score by a few points, especially if you have multiple recent inquiries.

When a Hard Pull Is Triggered

- Significant credit line expansions (e.g., doubling the limit)

- Requests made shortly after a recent credit application

- Accounts with limited payment history or high utilization

- Issuer policies that default to hard pulls for certain credit tiers

Understanding these triggers helps you avoid unnecessary score dents. Most issuers will start with a soft pull if the requested increase is modest and your account shows strong performance.

Preparing Your Account Before the Request

Preparation is the most reliable way to influence the issuer’s decision while keeping the inquiry soft. Below are three key actions you can take.

Reduce Credit Utilization

Utilization—how much of your available credit you’re using—is a major factor in credit scoring models. Aim to keep it below 30 % and preferably under 10 % for the best impression. Paying down balances a few days before you request an increase can create a snapshot that reflects responsible usage.

Update Your Reported Income

Many issuers let you adjust your annual income through their online portal or by speaking with a representative. A higher declared income can justify a larger credit line without needing a hard inquiry. For guidance on navigating the portal, see our article on Online Portal: First‑Time Login and Account Setup.

Ensure a Clean Payment History

Late payments, even a single missed due date, can make issuers more cautious. Review your recent statements and address any pending issues before you initiate the request. A track record of on‑time payments for at least six months strengthens your case.

Strategies to Request an Increase Without a Hard Pull

The following tactics are designed to keep the inquiry soft while maximizing the likelihood of approval.

Use the Issuer’s Online Portal

Most banks provide a “Request Credit Limit Increase” option within their account dashboard. When you submit through the portal, the system typically runs a soft pull. Make sure your profile reflects the latest income and employment details. If the portal asks for a reason, select “increase spending needs” or “upcoming travel plans”—both are viewed favorably.

Call the Customer Service Center

When you speak directly with a representative, you can request a soft pull explicitly. Use a calm, factual tone and state: “I’d like to request a credit limit increase and prefer that it be processed with a soft credit inquiry.” Some issuers will honor the request, especially if you have a strong payment record.

Time Your Request Strategically

Issuers are more likely to approve soft‑pull increases after certain events:

- Receiving a salary raise or new source of income

- Achieving a recent boost in your credit score (e.g., after paying off a loan)

- Reaching a milestone of 12‑month account age

Aligning your request with these milestones signals reduced risk to the lender.

Leverage Existing Relationship

If you hold multiple products with the same bank—such as a checking account, mortgage, or auto loan—the issuer may view you as a low‑risk, high‑value customer. Mentioning this relationship can persuade the representative to use a soft pull, as they already have a comprehensive view of your financial behavior.

What Happens After You Submit the Request?

Once the request is processed, the issuer will communicate the outcome via email, app notification, or mailed letter. The possible responses are:

- Approved with the requested amount: Your new limit is instantly available.

- Approved with a lower amount: The issuer may offer a modest increase that still benefits your utilization ratio.

- Denied: The issuer provides a reason, often tied to credit utilization, recent inquiries, or insufficient income.

If denied, you can ask for clarification without a hard pull. Understanding the rationale helps you address the underlying issue—whether it’s reducing utilization, updating income, or waiting for a longer credit history.

Alternatives When a Soft‑Pull Increase Isn’t Possible

Sometimes the issuer’s policy mandates a hard pull for any increase above a certain threshold, or they may simply deny the request. In those cases, consider the following alternatives that preserve or improve your credit capacity.

Apply for a New Card with a Higher Limit

Opening a new credit card can instantly add to your total available credit. Choose a product that aligns with your spending habits, such as a travel rewards card. For example, the Capital One Venture X vs Chase Sapphire Reserve comparison highlights cards that often start with generous limits for qualified applicants.

Add an Authorized User

If you have a trusted family member, adding them as an authorized user can increase the overall credit available to your household while also helping the user build credit.

Consider a Secured Credit Card

Secured cards require a cash deposit that serves as the credit limit. While not ideal for all, a secured card can provide a safety net and, over time, be converted to an unsecured product with a higher limit.

Frequently Asked Questions

Will a soft pull affect my credit score?

No. Soft inquiries are recorded separately from the factors that determine your score, so they have no impact on the numbers lenders see.

How long does a soft‑pull limit increase take to reflect?

Most issuers update the limit within 24 hours of approval, though some may apply the change immediately in the online portal.

Can I request a limit increase more than once?

Yes, but spacing requests at least six months apart is advisable. Frequent requests can signal financial stress to the issuer.

What if the issuer insists on a hard pull?

Ask for a detailed explanation. If the increase is critical, you may decide to accept the hard pull, but weigh the potential score impact against the benefit of a higher limit.

Is there a difference in how purchases and cash advances are affected?

Yes. While a higher limit improves your overall purchasing power, cash advances often have separate limits and may be subject to a higher purchase annual percentage rate (APR). Understanding both limits helps you avoid unexpected fees.

By following these steps—optimizing your account, timing your request, and communicating clearly—you can often secure a credit limit increase without a hard pull. The key is to present yourself as a low‑risk borrower through solid payment history, updated income information, and responsible utilization. Even if a particular request is denied, the process itself provides valuable insight into how issuers view your credit profile, allowing you to make informed decisions about future strategies.