Table of Contents

- Getting Started: First‑Time Access to the Regions Online Portal

- Step‑by‑Step Account Creation

- Logging In: The Routine That Keeps Your Finances Within Reach

- Standard Login Procedure

- Security Measures: Protecting Your Digital Wallet

- Two‑Factor Authentication (2FA)

- Secure Socket Layer (SSL) Encryption

- Automatic Logout and Session Timeouts

- Troubleshooting Common Login Issues

- Forgotten Password

- Incorrect Username or Password

- Browser Compatibility Issues

- Mobile App Login Problems

- Advanced Features Accessible After Login

- Reward Redemption

- Bill Pay and Automatic Payments

- Account Alerts and Notifications

- Viewing and Downloading Statements

- Best Practices for Maintaining a Secure Login Routine

- Regularly Update Your Password

- Enable Two‑Factor Authentication

- Monitor Account Activity Daily

- Use Trusted Devices and Networks

- Keep Your Contact Information Current

- What to Do If You Suspect Unauthorized Access

- Immediate Steps

- Follow‑Up Actions

- Exploring the Mobile Experience

- Key Features of the App

- Integrating Regions Bank Login with Other Financial Tools

- Setting Up Third‑Party Connections

Regions Bank credit card login is the gateway to managing your finances, monitoring transactions, and redeeming rewards—all from the comfort of your home or on the go. Whether you are a long‑time cardholder or have just received your first Regions credit card, the process of accessing your online account can feel like a small adventure, especially when you consider the security measures designed to protect your personal information. In this article we walk through the entire journey, from the first time you set up your credentials to the everyday practices that keep your account safe and productive.

Understanding the login experience begins with recognizing why Regions Bank invests heavily in its digital platform. The bank’s online portal offers real‑time balance updates, customizable alerts, and tools for paying bills, transferring funds, and tracking rewards points. By mastering the login procedure, you unlock these capabilities and gain a clearer picture of your credit health. This guide presents a clear, narrative‑driven walkthrough that reads like a short factual story, ensuring each step flows naturally into the next.

Before we dive into the specifics, let’s set the scene: imagine you’ve just received a notification that a new payment is due, or you spot a tantalizing travel reward you want to claim. You sit at your kitchen table, pull out your phone, and prepare to log in. The following sections will show you exactly what to do, what to expect, and how to handle any hiccups along the way.

Getting Started: First‑Time Access to the Regions Online Portal

The first encounter with the Regions Bank credit card login page can feel like opening a new chapter in a familiar book. If you have never logged in before, the bank requires you to create an online profile. This initial setup is straightforward, but attention to detail ensures a smooth future experience.

Step‑by‑Step Account Creation

- Visit the official website. Navigate to regions.com and locate the “Login” button at the top right corner.

- Select “Enroll” or “Register.” The portal will prompt you to enter your credit card number, Social Security number (or Tax ID), and the email address you wish to associate with the account.

- Create a username and password. Choose a unique username—often your email works well—and a strong password that combines uppercase letters, numbers, and symbols. Regions enforces a minimum of eight characters.

- Set up security questions. These will be used later for identity verification, especially if you need to reset your password.

- Verify your identity. You’ll receive a one‑time passcode via email or SMS. Enter this code to complete registration.

Once registration is successful, you are officially a member of the Regions online community. The next time you return, you’ll simply enter your username and password on the login screen, just as you would for any other secure website.

Logging In: The Routine That Keeps Your Finances Within Reach

Now that your profile exists, the regular login process is designed to be quick yet secure. Below is a concise description of what happens each time you access your account.

Standard Login Procedure

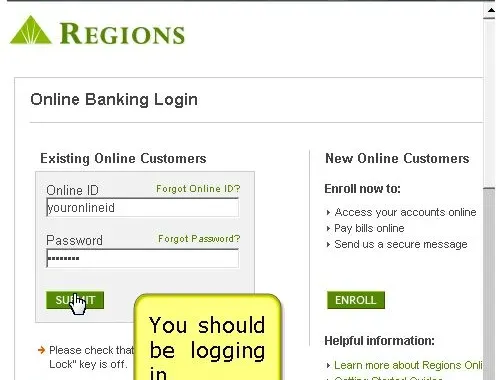

- Navigate to the Regions Bank login page.

- Enter your username (or email) in the first field.

- Type your password exactly as created, paying attention to case sensitivity.

- Click “Sign In.”

- If you have enabled two‑factor authentication (2FA), you will be prompted to enter a verification code sent to your mobile device.

Upon successful authentication, the dashboard appears, displaying your credit card balance, recent transactions, available credit, and any pending rewards. From here, you can explore deeper functionalities such as setting up automatic payments, reviewing statements, or redeeming points for travel.

Security Measures: Protecting Your Digital Wallet

Security is the backbone of every online banking experience. Regions Bank incorporates multiple layers of protection to ensure that only you can access your credit card information.

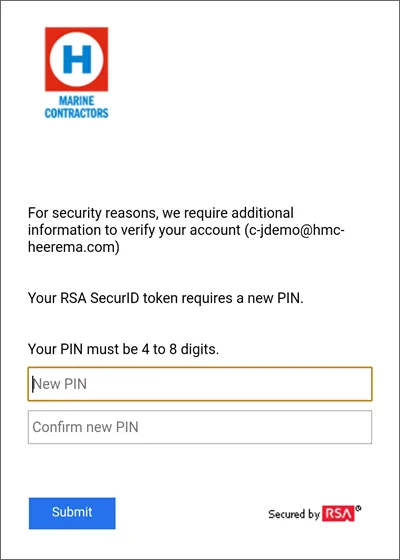

Two‑Factor Authentication (2FA)

Two‑factor authentication adds a second verification step beyond just a password. When you enable 2FA, the system sends a unique code to your registered mobile number or email address each time you sign in. This means that even if someone obtains your password, they cannot access your account without the second factor.

Secure Socket Layer (SSL) Encryption

The login page uses SSL encryption, which creates an encrypted tunnel between your browser and Regions’ servers. Look for the padlock icon in the address bar to confirm you are on a secure page.

Automatic Logout and Session Timeouts

If you remain inactive for a set period (usually 10‑15 minutes), the system will automatically log you out. This prevents unauthorized access from an unattended device.

Troubleshooting Common Login Issues

![[Windows 11/10] Troubleshooting - PIN (Windows Hello) Login Failed](https://blog.avaller.com/wp-content/uploads/2026/01/windows-11-10-troubleshooting-pin-windows-hello-login-failed-630x380.webp)

Even with a well‑designed system, users sometimes encounter obstacles. Below are the most frequent problems and how to resolve them.

Forgotten Password

If you can’t recall your password, click the “Forgot Password?” link on the login page. You’ll be guided through a password reset process that typically involves:

- Entering your username or registered email.

- Answering one or more security questions.

- Receiving a reset link via email or a verification code via SMS.

- Creating a new password that meets the complexity requirements.

For a deeper dive on dispute processes that may arise after a login mishap, refer to our guide on how to dispute a credit card transaction within 60 days.

Incorrect Username or Password

Double‑check that you are typing the correct characters. Remember that passwords are case‑sensitive. If you suspect a typo, clear the fields and re‑enter the information. Persistent errors may indicate a locked account, in which case you should contact Regions’ customer service.

Browser Compatibility Issues

Older browsers may not support the latest encryption standards. Ensure you are using an up‑to‑date version of Chrome, Firefox, Safari, or Edge. Clearing your browser cache and cookies can also resolve unexpected login glitches.

Mobile App Login Problems

Regions Bank offers a mobile app for iOS and Android. If you experience difficulties logging in via the app, verify that the app is updated to the latest version and that your device’s operating system meets the minimum requirements. Re‑installing the app often resolves stubborn authentication errors.

Advanced Features Accessible After Login

Once you have successfully entered the portal, a suite of tools becomes available, turning a simple login into a powerful financial management session.

Reward Redemption

Regions credit cards frequently offer reward points that can be exchanged for travel, merchandise, or gift cards. To maximize your points, consider the strategies outlined in Unlock Your Rewards: The Ultimate Guide to Redeem Points for Gift Cards Online. The portal allows you to view your point balance, browse redemption options, and complete transactions with just a few clicks.

Bill Pay and Automatic Payments

Set up recurring payments to ensure you never miss a due date. The “Bill Pay” section lets you add payees, schedule future payments, and receive confirmation emails.

Account Alerts and Notifications

Customize alerts for low balances, large purchases, or upcoming payment due dates. These notifications can be sent via email, SMS, or push notification through the mobile app.

Viewing and Downloading Statements

Electronic statements are stored securely in the “Documents” tab. You can download PDFs for tax purposes or print them for personal records.

Best Practices for Maintaining a Secure Login Routine

Even though Regions Bank provides robust security, your personal habits play a crucial role in safeguarding your account.

Regularly Update Your Password

Change your password at least every six months. Choose a phrase that is easy for you to remember but difficult for others to guess.

Enable Two‑Factor Authentication

If you have not yet activated 2FA, do so immediately from the “Security Settings” area of the portal.

Monitor Account Activity Daily

Log in at least once a week to review recent transactions. Promptly report any unfamiliar charges to Regions’ fraud department.

Use Trusted Devices and Networks

Avoid logging in from public computers or unsecured Wi‑Fi networks. If you must use a public connection, consider employing a reputable VPN service.

Keep Your Contact Information Current

Ensure your email address and phone number are up to date. This guarantees you receive verification codes and important alerts without delay.

What to Do If You Suspect Unauthorized Access

In the rare event that you notice suspicious activity, act quickly to protect your finances.

Immediate Steps

- Log out of all active sessions.

- Change your password using the “Forgot Password?” link.

- Contact Regions Bank’s fraud hotline (available 24/7) to report the incident.

- Review recent transactions and flag any that you did not authorize.

Follow‑Up Actions

The bank will investigate the claim, possibly issuing a temporary freeze on your account while they verify the details. Throughout this process, maintain records of any communication and retain copies of the disputed transaction list.

Exploring the Mobile Experience

The Regions Bank mobile app mirrors the desktop portal’s functionality while adding convenience for on‑the‑go users.

Key Features of the App

- Biometric login (fingerprint or facial recognition) for faster access.

- Real‑time push notifications for purchases and bill reminders.

- Secure in‑app messaging to contact customer support.

- One‑tap reward redemption and travel booking tools.

When you first open the app, you will be prompted to enter your username and password, after which you can enable biometric authentication for future logins. This streamlines the process while maintaining high security standards.

Integrating Regions Bank Login with Other Financial Tools

Many users combine multiple financial platforms to gain a holistic view of their money. Regions Bank supports integration with popular budgeting apps such as Mint and YNAB via secure data feeds. By linking your credit card account, you can automatically import transactions, categorize expenses, and track spending trends without manual entry.

Setting Up Third‑Party Connections

- Log in to your Regions account.

- Navigate to “Settings” > “Account Connections.”

- Select the third‑party service you wish to connect.

- Follow the on‑screen prompts to authorize data sharing.

Remember that each third‑party connection may require its own security verification, reinforcing the layered protection approach that Regions Bank champions.

By mastering the Regions Bank credit card login process and embracing the tools that follow, you transform a routine digital interaction into a proactive financial strategy. From securing your credentials to leveraging rewards and integrating with budgeting software, each step contributes to a clearer, more empowered relationship with your credit card.