Table of Contents

- Why a Credit Limit Increase Matters

- Improved Credit Utilization Ratio

- Greater Purchasing Flexibility

- Access to Better Card Tiers and Perks

- When to Ask for an Increase

- Consistent Payment History

- Low Current Utilization

- Positive Credit Score Trend

- Upcoming Large Expenses

- Preparing Your Request

- Gathering Supporting Documents

- Knowing Your Credit Score

- Understanding the Issuer’s Policy

- How to Make the Request

- Online Portal Method

- Phone Call Script

- In‑Branch Visit

- What to Expect After the Request

- Soft vs. Hard Pull

- Possible Outcomes

- Next Steps if Denied

- Monitoring the Change

Requesting a credit limit increase is a common goal for many cardholders who want more flexibility and a healthier credit profile. The keyword “how to request credit limit increase” appears early because the topic is central to the story that follows. In this article you will follow a typical cardholder’s journey—from recognizing the need for a higher limit to preparing the perfect request and handling the issuer’s response.

Imagine a busy professional named Maya. She has used her credit card responsibly for three years, paying off balances each month and keeping her utilization low. Over time, her spending needs have grown—she’s planning a home renovation and wants to take advantage of a limited‑time travel promotion that requires a larger purchase. Maya decides it’s the right moment to ask for more credit. Her experience illustrates the steps many consumers take, and the same principles apply to you.

Before Maya dials her issuer, she reviews her recent statements, checks her credit score, and reads the issuer’s policy on limit increases. She also reads related guides, such as Understanding Credit Limit Increases: Soft vs. Hard Pulls, to avoid unexpected credit inquiries. With that background, she feels confident moving forward. Below is a comprehensive roadmap that mirrors Maya’s process, designed to help anyone who wonders how to request credit limit increase.

Why a Credit Limit Increase Matters

A higher credit limit can affect several aspects of personal finance. While the primary benefit is increased purchasing power, the secondary effects often have a lasting impact on credit health.

Improved Credit Utilization Ratio

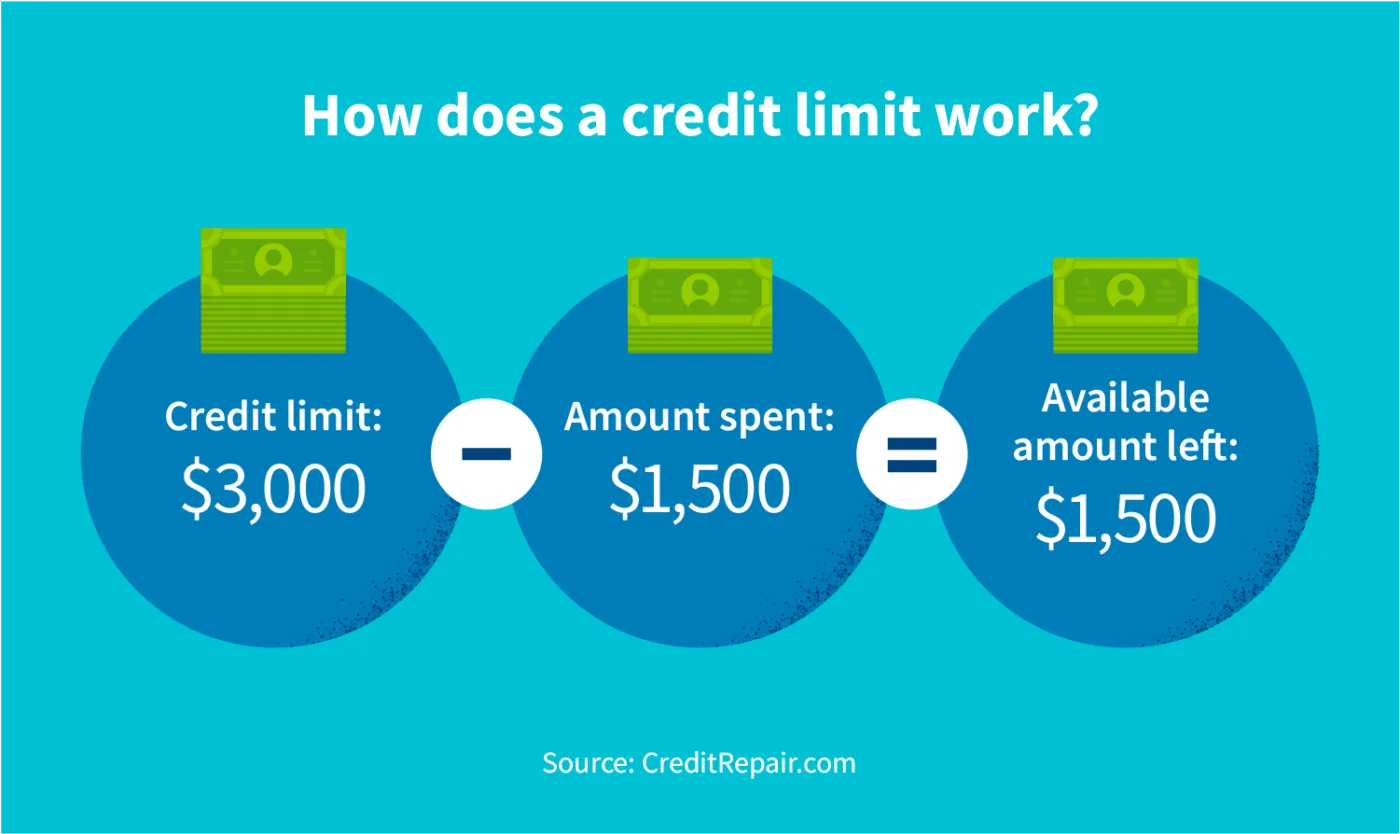

Credit utilization—total balances divided by total limits—is a key factor in most credit scoring models. Keeping utilization below 30 % is generally advised; below 10 % is ideal for optimal scores. By raising the limit, you automatically lower the utilization ratio, assuming your spending habits stay the same. This can boost your credit score over time.

Greater Purchasing Flexibility

A larger limit allows you to make bigger purchases without maxing out your card. This is useful for emergencies, large household expenses, or travel bookings that require a single high‑value transaction.

Access to Better Card Tiers and Perks

Many issuers tier cards based on usage and credit line. A higher limit may qualify you for premium tiers that offer travel insurance, lounge access, or higher rewards multipliers. Understanding these tiers can be part of your motivation to ask for more credit.

When to Ask for an Increase

Timing is crucial. Requesting too early may lead to a denial, while waiting too long could mean missing out on opportunities. Below are signals that indicate a good moment to make the ask.

Consistent Payment History

If you have paid at least six consecutive monthly statements on time, your issuer sees you as low risk. Maya’s three‑year streak of on‑time payments gave her a strong case.

Low Current Utilization

When your utilization consistently stays under 20 %, it signals to the lender that you are not dependent on credit and can handle a higher limit responsibly.

Positive Credit Score Trend

A credit score that has risen over the past six months shows improved creditworthiness. You can check this trend on free credit monitoring services or by downloading your year‑end credit card summary to see the overall picture.

Upcoming Large Expenses

If you anticipate a major purchase—like a home remodel, a new car, or a vacation—having a higher limit before the transaction can prevent declines and keep your utilization low.

Preparing Your Request

Preparation increases the likelihood of approval. Think of it as gathering evidence for a loan application, even though the process is often simpler.

Gathering Supporting Documents

- Recent pay stubs or a letter from your employer confirming income.

- Tax returns if you are self‑employed.

- Proof of assets, such as a recent bank statement showing savings.

- Current credit report showing your score and utilization.

Having these documents ready allows you to respond quickly if the issuer asks for verification during the call or online chat.

Knowing Your Credit Score

Before you ask, locate your latest credit score. If it is above 700, you are in a strong position. Scores between 650‑700 may still succeed, especially with a solid payment history. Below 650, you might consider waiting until your score improves.

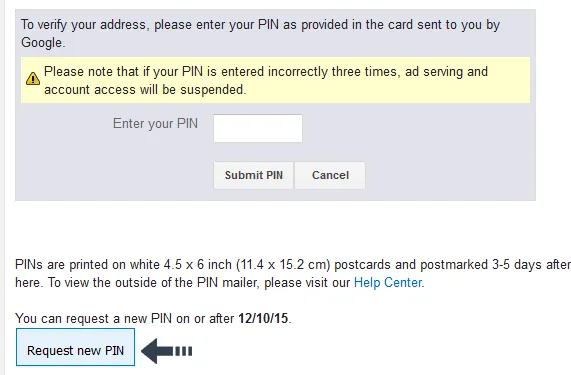

Understanding the Issuer’s Policy

Every bank has its own criteria. Some perform a soft pull (which does not affect your score) while others use a hard pull. Reading the issuer’s FAQ or speaking with a representative can clarify this. The article Understanding Credit Limit Increases: Soft vs. Hard Pulls explains the difference in detail.

How to Make the Request

There are three common channels: online portal, phone, and in‑branch visit. Choose the one that matches your comfort level and the issuer’s preferred method.

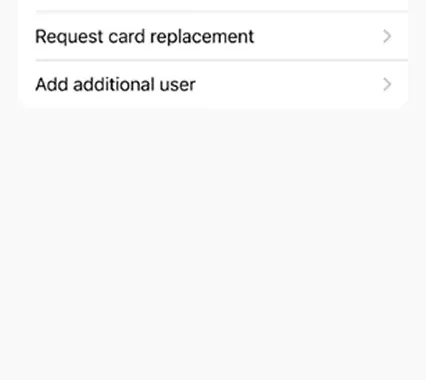

Online Portal Method

- Log in to your credit card account.

- Navigate to the “Account Services” or “Credit Limit Increase” section.

- Enter the desired new limit and any supporting information requested.

- Submit the request and wait for an instant decision or a follow‑up email.

Most banks provide an instant soft‑pull decision for modest increases, making this the fastest route.

Phone Call Script

If you prefer a personal touch, call the customer service number on the back of your card. Here is a concise script you can adapt:

“Hello, my name is Maya. I have been a cardholder for three years, and I have consistently paid my balance in full each month. I would like to request a credit limit increase to $15,000 to accommodate an upcoming home renovation. My current income is $85,000 per year, and my credit score is 735. Could you let me know what information you need to process this request?”

Speak clearly, have your documents nearby, and take notes on the representative’s name and any reference number they provide.

In‑Branch Visit

Visiting a local branch can be advantageous if you have a strong relationship with a personal banker. Bring your ID, recent pay stub, and a printed copy of your credit report. The banker can often process the request on the spot, and you may receive immediate feedback.

What to Expect After the Request

The issuer will review your account, credit score, and the information you supplied. The outcome can be an approval, a partial increase, or a denial. Understanding the possible scenarios helps you plan your next steps.

Soft vs. Hard Pull

If the issuer uses a soft pull, your credit score remains unchanged. A hard pull may cause a minor dip—typically 5‑10 points—but this is temporary. Knowing which method applies helps you avoid unwanted score impacts.

Possible Outcomes

- Full Approval: You receive the exact amount you requested.

- Partial Increase: The issuer offers a lower amount than asked. You can accept or negotiate further.

- Denial: The request is declined. The issuer should provide a reason, such as recent high balances or insufficient income.

Next Steps if Denied

If you receive a denial, consider the following actions:

- Ask for the specific reason and any steps you can take to improve your eligibility.

- Work on reducing existing balances to lower utilization.

- Wait 3‑6 months before reapplying, giving your credit profile time to improve.

- Explore other credit cards that may offer higher limits based on your current score.

Monitoring the Change

Once approved, verify the new limit on your next statement or online account. Confirm that the increase is reflected correctly, and continue to keep utilization low to reap the credit‑score benefits.

By following these steps—timing the request, preparing documentation, choosing the right channel, and understanding the issuer’s evaluation—you can increase the likelihood of a successful outcome. Maya’s experience shows that a thoughtful approach, rather than a spontaneous ask, leads to a smoother process and better financial results.