Table of Contents

- Understanding the Chip Damage Issue

- Typical Signs of a Damaged Chip

- Why the Chip Matters More Than the Magnetic Strip

- Why a Replacement Is Necessary

- Common Causes of Chip Damage

- Step‑by‑Step Guide to Requesting a Replacement Card

- 1. Verify the Issue Is Chip‑Related

- 2. Gather Necessary Information

- 3. Choose Your Preferred Contact Channel

- 4. Submit the Replacement Request

- 5. Confirm the Shipping Details

- 6. Destroy the Damaged Card Securely

- Preparing Documentation and Information

- Contact Channels and What to Expect

- Phone Support

- Online Messaging

- Mobile App

- Timing and Delivery Options

- Costs and Fees

- Protecting Your Account While Waiting

- Frequently Asked Questions

- Can I continue to use the magnetic stripe while waiting for the replacement?

- Will my credit limit change with the new card?

- What if the new card also arrives with a faulty chip?

- Is there a way to track the replacement card?

- Do I need to activate the new card?

When your credit card’s chip stops working, the inconvenience can quickly turn into a financial risk. Request replacement card for damaged chip is a phrase many cardholders search for, hoping to find a clear roadmap that takes them from a faulty card to a functional replacement without unnecessary delay. This article walks you through every step of the journey, from recognizing chip failure to receiving a new card, while highlighting best practices that protect your account during the transition.

Imagine you’re at a grocery store, swipe the card, and the terminal flashes an error. You try again, but the chip still won’t communicate. In that moment, the card’s inability to process transactions signals a chip malfunction, and you’re forced to consider a replacement. The process might seem bureaucratic, but most issuers have streamlined procedures that, when followed correctly, can be completed in a matter of days.

Below, we break down the entire replacement workflow, offer practical tips to speed up approval, and explain how to keep your finances safe while waiting for the new card to arrive.

Understanding the Chip Damage Issue

The chip embedded in modern credit cards is more than a tiny piece of metal; it stores encrypted data that authenticates each transaction. When physical wear, exposure to water, or a manufacturing defect damages the chip, the card can no longer perform the secure verification required for most purchases.

Typical Signs of a Damaged Chip

- Repeated “chip error” messages on POS terminals.

- Failure to complete online purchases that require chip data (often flagged as “card not supported”).

- Visible scratches, cracks, or corrosion on the chip surface.

- Inability to use contactless payments, which rely on the chip’s functionality.

Why the Chip Matters More Than the Magnetic Strip

While the magnetic stripe can still be swiped, it lacks the advanced encryption of EMV (Europay, Mastercard, Visa) chips. Using the stripe as a fallback increases the risk of fraud, and many merchants now refuse transactions that rely solely on the stripe. Hence, obtaining a functional chip promptly is essential for both security and convenience.

Why a Replacement Is Necessary

Continuing to use a card with a compromised chip exposes you to several risks. First, the likelihood of transaction declines rises, which can be embarrassing in everyday situations such as paying for fuel or dining out. Second, a faulty chip may signal underlying wear that could eventually affect the card’s magnetic stripe or even the card’s physical integrity.

Moreover, card issuers often have policies that limit liability for fraudulent charges only if the cardholder reports a chip malfunction promptly. Delaying a replacement could inadvertently increase your exposure to unauthorized transactions.

Common Causes of Chip Damage

Understanding what caused the chip to fail can help you avoid future incidents. Below are the most frequent culprits:

- Physical wear and tear: Repeated bending, exposure to extreme temperatures, or rough handling can degrade the chip’s circuitry.

- Moisture intrusion: Water, especially if the card is not dried properly, can corrode the chip contacts.

- Manufacturing defects: Occasionally, chips are shipped with imperfections that manifest after a short period of use.

- Contactless wear: Frequent tap‑and‑pay usage can wear down the antenna that works in tandem with the chip.

Step‑by‑Step Guide to Requesting a Replacement Card

The replacement request process typically follows a predictable pattern, regardless of the issuer. Below is a detailed, sequential approach you can follow.

1. Verify the Issue Is Chip‑Related

Before contacting your issuer, test the card on multiple terminals and, if possible, try the magnetic stripe at a different merchant. If the stripe works but the chip does not, you have enough evidence to justify a replacement request.

2. Gather Necessary Information

Most issuers will ask for the following:

- Full name and mailing address as it appears on the account.

- Card number (the first six and last four digits are usually sufficient for verification).

- Recent transaction details (date, amount, merchant) to confirm recent activity.

- Contact phone number and preferred communication method.

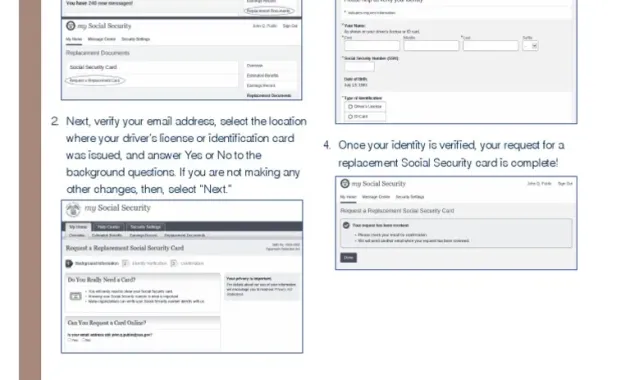

3. Choose Your Preferred Contact Channel

Issuers typically offer several avenues:

- Phone: The most direct method; you can speak with a representative and receive an immediate confirmation.

- Secure online messaging: Log in to your account portal and send a request through the encrypted chat or messaging system.

- Mobile app: Many banks embed a “Replace Card” button within the app, streamlining the process.

For instance, the USAA Credit Card login page offers a clear navigation path to request a new card directly from the dashboard.

4. Submit the Replacement Request

When you speak with a representative or fill out the online form, clearly state that the chip is damaged and you need a replacement. Ask for the estimated delivery timeframe and any fees that might apply.

5. Confirm the Shipping Details

Most issuers send replacement cards via standard mail, but many also provide expedited shipping for a fee. Verify the address and request tracking if available. Some issuers even let you pick up a temporary card at a local branch while you wait.

6. Destroy the Damaged Card Securely

Once the new card arrives and you have activated it, cut the old card into small pieces, ensuring the chip is completely destroyed. This prevents any possibility of data recovery.

Preparing Documentation and Information

Having the right documents ready can shave minutes off the call and reduce the chance of being asked to call back.

- Identification: Government‑issued ID (driver’s license, passport) for in‑person requests.

- Recent statement: A PDF or printed copy showing the last few transactions.

- Proof of address: Utility bill or bank statement if the issuer requires confirmation.

While most issuers can verify your identity using internal data, having these items on hand demonstrates preparedness and can speed up the process.

Contact Channels and What to Expect

Each contact method has its own timeline and level of convenience.

Phone Support

Typical wait times range from 2 to 10 minutes during business hours. Once you reach a representative, the replacement can be processed in under five minutes. Expect a confirmation number and an estimated delivery date.

Online Messaging

Secure messaging usually replies within 24 hours. Some banks have AI‑driven bots that can handle simple replacement requests instantly, while more complex issues may be escalated to a human agent.

Mobile App

Many modern apps feature a “Replace Card” workflow that guides you through a series of screens. You’ll often receive push notifications with real‑time updates on shipping status.

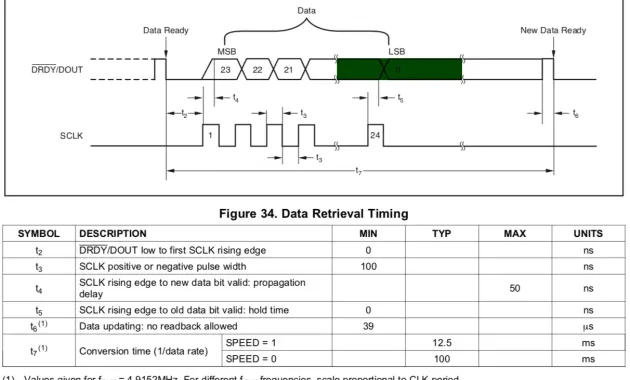

Timing and Delivery Options

Standard delivery typically takes 7‑10 business days, but many issuers offer the following alternatives:

- Expedited shipping: 1‑3 business days for an additional fee (often $5‑$15).

- Branch pickup: Some banks let you collect a replacement card from a local branch within the same day.

- Digital card activation: While waiting for the physical card, you can often generate a temporary virtual card number for online purchases. Learn more about virtual cards in How Virtual Credit Card Numbers Work.

Costs and Fees

In most cases, issuers replace damaged cards at no charge, especially if the damage is not caused by user negligence. However, certain situations may incur fees:

- Premium cards: High‑limit or rewards cards sometimes carry a replacement fee (e.g., $15‑$25).

- Expedited shipping: As noted, faster delivery often requires a fee.

- International shipping: If you are abroad, the cost may be higher, and you might need to confirm your address with the issuer.

Protecting Your Account While Waiting

During the interim period between reporting the damage and receiving the new card, take these precautions:

- Monitor transaction alerts daily. Set up real‑time push notifications for any charges.

- Use a virtual card number for online purchases, limiting exposure of the physical card’s details.

- Consider a temporary credit limit increase if you anticipate higher spending; a higher limit can mitigate the inconvenience of a lost or delayed card. For more insight, read Why a Credit Limit Increase Matters.

- Keep a backup payment method (debit card, cash, or a secondary credit card) readily available.

Frequently Asked Questions

Can I continue to use the magnetic stripe while waiting for the replacement?

Yes, most merchants still accept swipe transactions, but be aware that many will prompt you to insert the chip. Some newer terminals may reject the stripe entirely, so have an alternative payment method ready.

Will my credit limit change with the new card?

The replacement card retains the same credit limit, interest rate, and rewards structure as the original. Any pending transactions will still apply to your existing balance.

What if the new card also arrives with a faulty chip?

Contact the issuer immediately and request another replacement. Most banks will prioritize a second replacement and may offer a free expedited shipment.

Is there a way to track the replacement card?

Many issuers provide a tracking number once the card is dispatched. You can usually view the status through the online portal or mobile app.

Do I need to activate the new card?

Yes. Activation typically requires a phone call or a one‑time login to the issuer’s website. Follow the instructions that come with the card; activation also confirms receipt of the replacement.

By following the steps outlined above, you can transition smoothly from a damaged chip to a fully functional replacement card, minimizing disruption to your daily spending and safeguarding your financial information.

Remember, the key to a swift resolution lies in early detection, clear communication with your issuer, and proactive security measures while you wait. With the right preparation, a damaged chip becomes a minor hiccup rather than a major setback.