Table of Contents

- Overview of Wells Fargo Credit Card Services

- Product Lineup at a Glance

- Key Features and Benefits

- Reward Structures

- Introductory APR Offers

- Digital Management Tools

- Eligibility and Application Process

- Required Documentation

- Tips for a Smooth Approval

- Fees and APR Structures

- Interest Rate Tiers

- Common Fees to Watch

- Rewards Programs in Detail

- Cash Wise® Card – Flat‑Rate Cash Back

- Propel American Express® – Points for Travel

- Active Cash® – Bonus Category Cash Back

- Customer Support and Digital Experience

- Security and Fraud Protection

- Zero Liability Policy

- Identity Theft Resources

- Managing Your Card Effectively

- Set Up Automatic Payments

- Monitor Spending Categories

- Leverage Promotional Offers

- Future Outlook for Wells Fargo Credit Card Services

Wells Fargo credit card services have evolved dramatically over the past decade, shifting from a simple line of credit to a comprehensive financial ecosystem. From the moment a potential customer first hears about a new card offer, the narrative begins with a promise of flexibility, rewards, and reliable support. Understanding how these promises translate into real‑world benefits requires a close look at the products, the application journey, and the ongoing management tools that Wells Fargo provides.

In this article we walk through the entire lifecycle of a Wells Fargo credit card—from the initial marketing material that lands in a mailbox, through the online application, to the everyday interactions that shape a cardholder’s experience. By examining each step, you’ll gain a clear picture of what to expect and how to make the most of the services offered.

Overview of Wells Fargo Credit Card Services

Wells Fargo offers a portfolio of credit cards designed to cater to different consumer needs, including cash back, travel rewards, and low‑interest options. The bank’s approach emphasizes integration with its broader banking services, allowing cardholders to see balances, make payments, and track rewards within a single online dashboard. This seamless experience reflects the bank’s commitment to convenience and financial visibility.

Product Lineup at a Glance

- Wells Fargo Cash Wise® Card – Focuses on straightforward cash back on everyday purchases.

- Wells Fargo Propel American Express® Card – Targets frequent travelers with points redeemable for flights and hotels.

- Wells Fargo Reflect® Card – Offers a low introductory APR for balance transfers and purchases.

- Wells Fargo Active Cash® Card – Provides higher cash back rates for specific categories like groceries and gas.

Each card is built around a set of core services: reward accrual, flexible payment options, and security safeguards. The synergy among these services is evident when you explore the digital tools that support them.

Key Features and Benefits

The hallmark of Wells Fargo credit cards lies in their blend of tangible benefits and digital conveniences. Below we break down the most frequently used features, illustrating how they serve both new and seasoned cardholders.

Reward Structures

Reward programs differ by card but share common principles: points or cash back are earned based on spend categories, and redemption can occur via statement credits, gift cards, or travel portals. For example, the Propel American Express® Card awards 3X points on travel purchases, a rate that competes well with many premium travel cards. If you’re interested in a broader comparison of travel‑related rewards, see our Ultimate Hotel Credit Card Benefits Comparison.

Introductory APR Offers

Balance‑transfer seekers often look for low introductory rates. The Reflect® Card typically provides a 0% APR for the first 12 months on balance transfers and purchases, giving cardholders breathing room to pay down existing debt without accruing additional interest. Understanding what constitutes a good APR is essential, and our guide on What Is a Good APR for a Credit Card? offers deeper insight.

Digital Management Tools

Wells Fargo’s online banking platform integrates credit card accounts with checking and savings, allowing users to set up automatic payments, receive real‑time transaction alerts, and monitor spending trends through visual dashboards. The mobile app further enhances this experience by offering biometric login, instant card lock/unlock, and the ability to redeem rewards on the go.

Eligibility and Application Process

The journey from interest to approval typically begins with a pre‑qualification check that does not affect your credit score. Prospective applicants enter basic information—such as income, employment status, and existing debt—to receive an instant indication of eligibility. If the result is positive, the next step is a full application, which involves a hard credit inquiry.

Required Documentation

- Social Security Number (or ITIN for non‑citizens)

- Proof of income (pay stubs, tax returns, or employer verification)

- Current residential address and contact information

- Existing Wells Fargo account details, if applicable

Tips for a Smooth Approval

Applicants can improve their chances by ensuring their credit report is free of errors, maintaining a credit utilization ratio below 30%, and having a stable employment history. For those looking to balance their credit mix, consider the impact of adding a credit card on overall credit health.

Fees and APR Structures

Understanding the cost side of a credit card is as important as its benefits. Wells Fargo cards generally charge an annual fee ranging from $0 to $95, depending on the product tier. While fee‑free cards like the Cash Wise® offer simplicity, premium cards may justify higher fees through richer rewards.

Interest Rate Tiers

APR can vary based on creditworthiness, with rates typically falling into three buckets: low (≈13% APR), average (≈18% APR), and high (≈24% APR). The exact APR is disclosed during the application, and the bank may adjust the rate after a promotional period ends.

Common Fees to Watch

- Late Payment Fee: Up to $40 per occurrence.

- Cash Advance Fee: Either 5% of the amount or $10, whichever is greater.

- Foreign Transaction Fee: Usually 3% of the transaction amount unless the card is travel‑focused.

Balancing these costs against rewards is critical; sometimes the annual fee is offset by the cash back earned on regular spending. Our article on The Hidden Cost of Convenience delves into this calculation.

Rewards Programs in Detail

Each Wells Fargo credit card comes with its own rewards ecosystem. Below we outline the mechanics of the most popular programs.

Cash Wise® Card – Flat‑Rate Cash Back

Cardholders earn 1.5% cash back on every purchase, with no caps or category restrictions. Rewards are automatically credited to the statement each month and can be redeemed as a direct deposit to a linked checking account.

Propel American Express® – Points for Travel

Travelers receive 3X points on flights, hotels, and car rentals, and 1X on all other purchases. Points accumulate in the Wells Fargo rewards portal, where they can be transferred to airline partners or redeemed for travel bookings. The portal also provides a comparison tool for maximizing point value.

Active Cash® – Bonus Category Cash Back

This card offers a tiered cash back structure: 3% on groceries and gas, 2% on dining, and 1% on all other purchases. Seasonal promotions may boost rates on select merchants, encouraging strategic spending.

For drivers who prioritize fuel savings, the Ultimate Gas Station Credit Card Reviews offers a side‑by‑side comparison of fuel‑focused rewards.

Customer Support and Digital Experience

Wells Fargo emphasizes accessible support channels, including 24/7 phone service, live chat, and in‑branch assistance. The bank’s digital experience extends to a robust mobile app that allows users to:

- View real‑time transaction history.

- Set up customizable alerts for spending thresholds.

- Lock or unlock the card instantly if it’s misplaced.

- Redeem rewards directly from the app.

Customers can also enroll in the “SmartPay” feature, which automatically schedules payments based on the due date, helping avoid late fees. The integration of credit card data with checking and savings accounts provides a holistic view of personal finance, aligning with the modern consumer’s desire for unified financial management.

Security and Fraud Protection

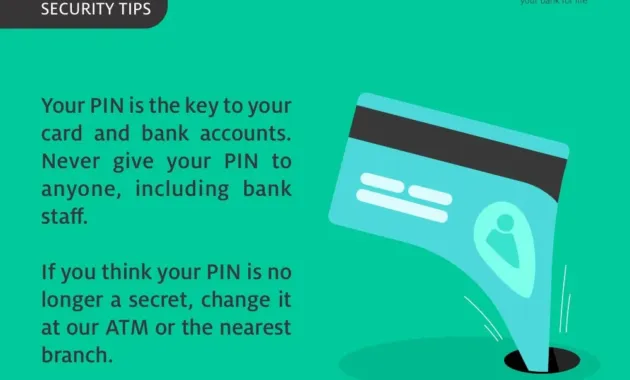

Security measures are woven into every layer of Wells Fargo’s credit card services. The bank employs tokenization for online transactions, ensuring that card numbers are never exposed to merchants. Additionally, advanced fraud detection algorithms monitor spending patterns and trigger alerts for suspicious activity.

Zero Liability Policy

Cardholders are protected from unauthorized charges, provided they report the incident promptly. This policy applies to both online and in‑store transactions, reinforcing confidence in the card’s safety.

Identity Theft Resources

Wells Fargo offers free credit monitoring and identity theft resolution services for eligible customers. If a breach occurs, the bank assists with filing police reports, placing fraud alerts, and restoring compromised accounts.

Managing Your Card Effectively

Owning a Wells Fargo credit card is only one part of the financial story; managing it wisely determines the overall outcome. Below are practical steps to keep the card working for you.

Set Up Automatic Payments

Automating at least the minimum payment each month prevents late fees and protects your credit score. The “SmartPay” feature can be configured to pay the full balance, ensuring you avoid interest altogether.

Monitor Spending Categories

Use the mobile app’s expense categorization to identify high‑spending areas. Align these insights with your card’s reward structure—shift grocery purchases to the Active Cash® Card, for instance, to capture the 3% cash back rate.

Leverage Promotional Offers

Wells Fargo periodically runs limited‑time promotions that boost point earnings or offer bonus cash back. Keeping an eye on email alerts and the rewards portal ensures you don’t miss opportunities to accelerate earnings.

Future Outlook for Wells Fargo Credit Card Services

Looking ahead, Wells Fargo is poised to expand its digital footprint, incorporating AI‑driven budgeting tools and deeper integration with third‑party fintech platforms. Anticipated enhancements include personalized reward recommendations based on spending habits and a streamlined application process that leverages real‑time credit scoring.

As the financial landscape continues to shift toward contactless and mobile‑first experiences, Wells Fargo’s commitment to security, customer service, and reward innovation positions its credit card suite as a reliable option for a broad spectrum of consumers.

Whether you are a first‑time cardholder seeking a simple cash‑back solution, a frequent traveler chasing premium points, or a borrower looking for a low‑interest balance transfer, understanding the full scope of Wells Fargo credit card services helps you choose the product that aligns with your financial goals. By staying informed about fees, rewards, and digital tools, you can maximize the value of your card while maintaining a secure, hassle‑free experience.