Table of Contents

- Identify Common Skimming Hotspots

- Gas Stations and Convenience Stores

- ATMs and Banking Kiosks

- Restaurants and Fast‑Food Chains

- Physical Inspection Techniques

- Check the Card Slot

- Examine the Keypad

- Look for Tamper‑Evident Seals

- Adopt Secure Payment Practices

- Prefer Chip‑Enabled Cards Over Magnetic Stripes

- Use Contactless Payments

- Choose Paperless Statements

- Leverage Real‑Time Monitoring Tools

- Enable Transaction Alerts

- Regularly Review Account Activity

- Consider Virtual Credit Card Numbers

- Secure Your PIN and Personal Information

- Cover the Keypad When Entering Your PIN

- Avoid Reusing PINs Across Multiple Cards

- Change Your PIN Periodically

- Report Suspicious Devices Immediately

- Contact the Merchant

- Notify Your Card Issuer

- File a Report with Law Enforcement

- Maintain a Long‑Term Defense Strategy

- Stay Informed About Emerging Threats

- Educate Family and Friends

- Periodically Re‑Evaluate Your Security Setup

Credit card fraud has evolved alongside technology, and one of the most insidious threats today is the card skimmer. A skimmer is a discreet device that captures the magnetic stripe data of a card when it is swiped, often paired with a hidden camera that records the PIN. Understanding how these devices operate is the first line of defense. By recognizing the signs and adopting a set of simple habits, you can dramatically reduce the risk of having your card information stolen.

In the following story, we follow Alex, a frequent traveler who once fell victim to a skimming operation at a gas station. After the incident, Alex embarked on a mission to learn everything about skimmers and share the knowledge with others. The steps Alex discovered are the foundation of this guide, offering you a clear, actionable roadmap to protect your credit card from skimmers.

Identify Common Skimming Hotspots

Skimmers are strategically placed where card transactions are frequent and supervision is minimal. Knowing where to look can save you a lot of trouble.

Gas Stations and Convenience Stores

- Fuel pumps are the most popular targets because they operate 24/7 with little staff presence.

- Look for mismatched or loose card readers, especially those that feel bulkier than usual.

ATMs and Banking Kiosks

- Criminals often install skimmers inside the card slot or overlay them on the keypad.

- Check for any unusual markings, scratches, or a different texture on the keypad.

Restaurants and Fast‑Food Chains

- Point‑of‑sale (POS) terminals that are not permanently attached to the counter can be swapped quickly.

- Pay attention to the angle of the card slot; a misaligned reader may indicate tampering.

Physical Inspection Techniques

Before you insert your card, a quick visual and tactile check can reveal a hidden skimmer. Alex made this a habit during every trip, and the routine took less than a minute.

Check the Card Slot

- Ensure the slot is flush with the device and not protruding.

- Use a flashlight or your phone’s light to look inside; any foreign object or extra wiring is a red flag.

Examine the Keypad

- Press each button lightly; a loose or sticky key may hide a camera.

- Feel for a small hole or lens near the keypad—skimmers sometimes include a tiny camera to capture PIN entry.

Look for Tamper‑Evident Seals

- Many legitimate machines have tamper‑evident stickers or seals. If these are missing or appear broken, avoid the terminal.

Adopt Secure Payment Practices

Beyond inspection, changing how you pay can reduce exposure to skimmers. Alex discovered that technology offers safer alternatives without sacrificing convenience.

Prefer Chip‑Enabled Cards Over Magnetic Stripes

Chip cards generate a unique transaction code for each purchase, rendering stolen data useless. If a skimmer only reads the magnetic stripe, the chip protects you.

Use Contactless Payments

Tap‑to‑pay methods like Apple Pay or Google Pay encrypt your card details and never expose the actual card number. This approach is highlighted in Why Apple Pay Compatibility Matters for Credit Card Choice, emphasizing the added layer of security.

Choose Paperless Statements

Switching to electronic statements reduces the risk of physical mail being intercepted and can help you monitor transactions more promptly. For more benefits, see Why Choose Paperless Statements?.

Leverage Real‑Time Monitoring Tools

Detecting fraud early is critical. Alex set up alerts that notified him instantly of any transaction, allowing swift action.

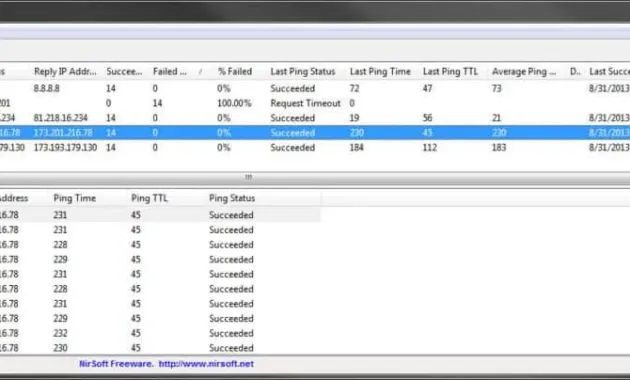

Enable Transaction Alerts

- Most banks offer SMS or email notifications for every purchase.

- Customize alerts for purchases above a certain amount or for foreign transactions.

Regularly Review Account Activity

Log in to your online banking portal at least once a week. Look for unfamiliar merchants, duplicate charges, or transactions in locations you haven’t visited.

Consider Virtual Credit Card Numbers

When shopping online, virtual card numbers mask your actual account details, limiting exposure if a site is compromised. Learn more about this technique in How Virtual Credit Card Numbers Work.

Secure Your PIN and Personal Information

Even with a protected card, a compromised PIN can still lead to unauthorized withdrawals. Alex adopted a set of habits that kept his PIN out of reach.

Cover the Keypad When Entering Your PIN

- Use your hand or body to shield the keypad from any hidden camera.

- Enter your PIN quickly but deliberately to avoid lingering.

Avoid Reusing PINs Across Multiple Cards

Unique PINs reduce the risk that a breach at one institution compromises all your accounts.

Change Your PIN Periodically

A routine change—every six months, for example—adds another barrier for potential thieves.

Report Suspicious Devices Immediately

When Alex discovered a suspicious device at a gas pump, he reported it to the station manager and the local police. Prompt reporting helps prevent further victimization.

Contact the Merchant

- Ask to speak with the manager and describe the irregularities you observed.

- Request that the device be inspected by a qualified technician.

Notify Your Card Issuer

Inform your bank or credit card company right away. They can place a temporary hold on the card, issue a new number, and monitor for fraudulent activity.

File a Report with Law Enforcement

Providing details such as location, time, and a description of the device assists investigators in tracking down the perpetrators.

Maintain a Long‑Term Defense Strategy

Protection against skimmers isn’t a one‑time effort; it requires ongoing vigilance. Alex integrated these practices into his daily routine, turning security into a habit rather than a chore.

Stay Informed About Emerging Threats

Criminals constantly adapt their methods. Subscribing to security newsletters or following reputable financial blogs keeps you updated on new skimming techniques.

Educate Family and Friends

Sharing your knowledge can create a community of informed consumers, reducing the overall success rate of skimming operations.

Periodically Re‑Evaluate Your Security Setup

Review your alerts, PINs, and payment preferences every few months to ensure they remain effective.

By following the steps Alex discovered—identifying hotspots, conducting quick physical checks, adopting chip or contactless payments, monitoring transactions in real time, protecting PINs, and reporting suspicious devices—you can build a robust defense against credit card skimmers. The effort required is modest compared to the potential financial and emotional impact of fraud. Remember, security is a series of small, consistent actions that together create a strong shield around your financial life.