Table of Contents

- Understanding the Chime Credit Builder Card

- How to Access the Chime Credit Builder Card Login Portal

- Quick Tip: Bookmark the Direct Credit Builder URL

- Common Login Issues and How to Resolve Them

- Forgotten Password

- Account Locked After Multiple Failed Attempts

- Browser Compatibility Problems

- Two‑Factor Authentication (2FA) Issues

- Enhancing Security While Using the Chime Login

- Use Strong, Unique Passwords

- Enable Two‑Factor Authentication

- Protect Your Device From Skimmers

- Prefer Paperless Statements

- Managing Your Credit Builder Card After Login

- Loading Funds

- Making Payments

- Viewing Transaction History

- Setting Up Alerts

- Troubleshooting Payment and Balance Discrepancies

- Advanced Features: Leveraging the Credit Builder for Long‑Term Growth

- Automatic Reloads

- Exporting Transaction Data

- Integrating With Third‑Party Financial Tools

- Learning From Your Credit Reports

- What to Do If You Can’t Access Your Account

- Contact Customer Support Directly

- Submit a Formal Identity Verification Request

- Escalate Through the Regulatory Channel

Finding the Chime Credit Builder card login page can feel like searching for a hidden door in a maze of banking portals. For many new users, the process is straightforward, yet a few hiccups can turn a quick check into a frustrating experience. This article walks you through the entire journey—from locating the login screen to securing your account—so you can manage your Credit Builder card with confidence.

Chime, known for its fee‑free banking model, offers the Credit Builder card as a tool to help users establish or improve credit without the risk of traditional credit cards. Because the card lives entirely in the digital realm, accessing it requires a reliable online login method. Whether you’re checking your balance, reviewing payment history, or setting up automatic payments, the first step is always the same: reaching the correct login portal.

Below, we outline the essential steps, common pitfalls, and best‑practice security measures. By the end, you’ll know exactly how to sign in, what to do if you’re locked out, and how to keep your information safe while using the Chime platform.

Understanding the Chime Credit Builder Card

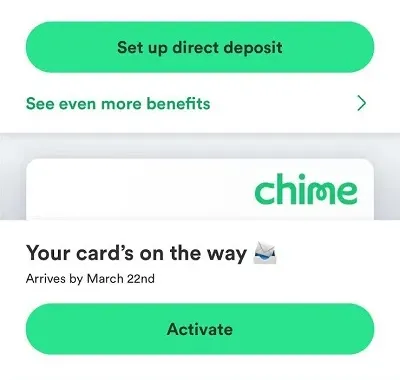

The Credit Builder card is a secured, reloadable card that reports your payment activity to the major credit bureaus. Unlike traditional credit cards, it doesn’t carry a preset credit limit; instead, the amount you load onto the card becomes your spending limit. This design helps users avoid debt while still building a positive credit history.

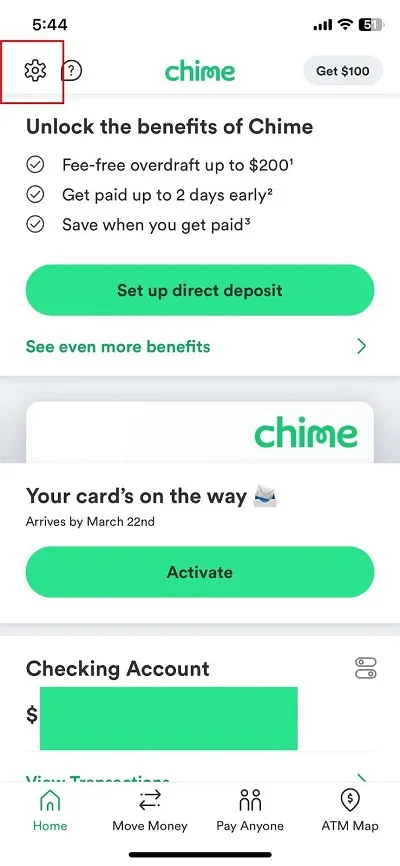

Because the card is linked directly to your Chime spending account, the same credentials you use for your primary Chime app grant you access to the Credit Builder dashboard. The login experience is unified, meaning you won’t need a separate username or password for the card itself.

How to Access the Chime Credit Builder Card Login Portal

Following these steps ensures you land on the correct login page quickly:

- Open your web browser and navigate to www.chimebank.com.

- Click the “Sign In” button located at the top‑right corner of the homepage.

- Enter the email address and password you use for your Chime account.

- Once signed in, locate the “Credit Builder” tab in the main navigation bar or within the dashboard menu.

- Click the tab to open the Credit Builder card interface, where you can view balance, transaction history, and payment options.

If you prefer using a mobile device, the same steps apply within the Chime mobile app. After logging in, tap the “Credit Builder” icon at the bottom of the screen to reach the same functionality.

Quick Tip: Bookmark the Direct Credit Builder URL

To save time, you can bookmark the direct URL that lands you on the Credit Builder dashboard after authentication. The link typically looks like https://app.chimebank.com/credit-builder. Bookmarking this page eliminates the need to navigate through the main dashboard each time you want to check your card.

Common Login Issues and How to Resolve Them

Even with a smooth interface, users sometimes encounter obstacles. Below are the most frequent problems and practical solutions.

Forgotten Password

Click the “Forgot password?” link on the sign‑in screen. Chime will send a password reset email to the address on file. Follow the instructions promptly, and choose a strong, unique password that combines letters, numbers, and symbols.

Account Locked After Multiple Failed Attempts

If you enter the wrong credentials too many times, Chime temporarily locks the account for security reasons. To unlock:

- Wait 15–30 minutes before trying again.

- Use the “Forgot password?” option to reset your credentials if you suspect you’ve forgotten them.

- Contact Chime support via the in‑app chat or phone line if the lock persists beyond the waiting period.

Browser Compatibility Problems

Some older browsers or those with aggressive privacy extensions can interfere with the login script. Use a modern browser such as Chrome, Firefox, or Edge, and ensure JavaScript is enabled. Clearing cache and cookies often resolves unexpected loading errors.

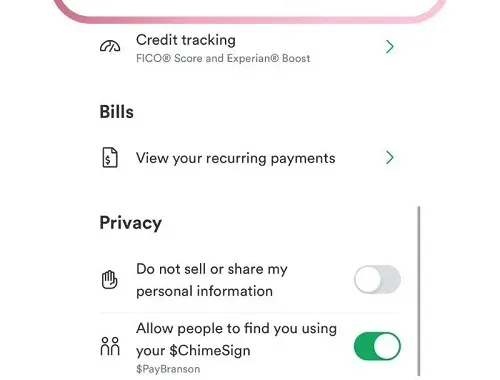

Two‑Factor Authentication (2FA) Issues

Chime may prompt you for a verification code sent to your registered phone number or email. If you don’t receive the code:

- Check your spam or junk folder for email codes.

- Verify that your phone number is up‑to‑date in the account settings.

- Resend the code and wait a few minutes before entering it.

Enhancing Security While Using the Chime Login

Security should never be an afterthought, especially when your Credit Builder card is tied directly to your credit profile. Below are essential practices to safeguard your login.

Use Strong, Unique Passwords

Never reuse passwords from other services. A password manager can generate and store complex passwords, reducing the temptation to recycle credentials.

Enable Two‑Factor Authentication

While Chime already uses verification codes, you can add an extra layer by linking a authenticator app (such as Google Authenticator) if the platform supports it. This reduces reliance on SMS, which can be vulnerable to SIM‑swap attacks.

Protect Your Device From Skimmers

Physical skimmers target card readers, but digital skimmers can appear in compromised browsers or malicious apps. Follow the steps outlined in How to Protect Your Credit Card from Skimmers – 7 Actionable Steps You Can Take Today to keep your device clean and your data safe.

Prefer Paperless Statements

Going paperless reduces the chance of sensitive information being intercepted through mail. Learn more about the benefits in Why Choose Paperless Statements?

Managing Your Credit Builder Card After Login

Once you’re logged in, the dashboard offers a suite of tools designed to help you manage and grow your credit responsibly.

Loading Funds

Click the “Add Money” button to transfer funds from your Chime spending account to the Credit Builder card. The amount you load determines your spending limit for that cycle.

Making Payments

Set up one‑time or recurring payments to ensure you never miss a due date. Timely payments are reported to the credit bureaus, directly influencing your credit score.

Viewing Transaction History

The transaction list provides details such as merchant name, date, and amount. Regularly reviewing this list helps you spot unauthorized activity early.

Setting Up Alerts

Enable push or email notifications for low balances, upcoming payments, and suspicious login attempts. Alerts keep you informed without having to log in repeatedly.

Troubleshooting Payment and Balance Discrepancies

Occasionally, you may notice a difference between the balance shown on your Credit Builder card and the amount you expect. Here’s how to address it:

- Pending Transactions: Purchases may remain pending for up to 3‑5 business days, temporarily reducing available credit.

- Reload Delays: Transfers from your primary Chime account can take a few minutes to process. Refresh the dashboard after a short wait.

- Fees and Adjustments: While Chime advertises no fees, certain merchant refunds or reversals might affect the displayed balance.

If discrepancies persist beyond 48 hours, contact Chime support through the in‑app chat. Provide screenshots of the balance view and any relevant transaction details to expedite resolution.

Advanced Features: Leveraging the Credit Builder for Long‑Term Growth

Beyond basic usage, the Credit Builder card offers several advanced options that can accelerate your credit journey.

Automatic Reloads

Schedule automatic transfers from your spending account each payday. Consistent reloads ensure you always have a usable limit without manual effort.

Exporting Transaction Data

Download CSV or PDF statements for personal record‑keeping or tax purposes. Exported data can also be imported into budgeting apps for holistic financial planning.

Integrating With Third‑Party Financial Tools

Many budgeting platforms (e.g., Mint, YNAB) support direct syncing with Chime. By linking your account, you gain real‑time insight into both your spending and Credit Builder activity.

Learning From Your Credit Reports

Periodically request a free credit report from the three major bureaus. Compare the reported payment history from your Credit Builder card with the report to confirm accurate reporting. This practice mirrors the guidance found in Unlock the Full Potential of Your First Premier Bank Credit Card Login – A Complete Guide, emphasizing the importance of monitoring credit activity across platforms.

What to Do If You Can’t Access Your Account

When all standard recovery methods fail, you may need to verify your identity through additional channels.

Contact Customer Support Directly

Use the secure chat within the app or call the toll‑free number listed on Chime’s website. Have your government‑issued ID, Social Security number, and recent transaction details handy to speed up verification.

Submit a Formal Identity Verification Request

Chime may ask you to upload a photo of your ID and a selfie for facial verification. This process is standard for financial institutions dealing with credit‑building products.

Escalate Through the Regulatory Channel

If you suspect fraud or unauthorized account closure, you can file a complaint with the Consumer Financial Protection Bureau (CFPB). Keep records of all communications for reference.

By following these steps, you’ll minimize downtime and regain access to your Credit Builder card promptly.

Understanding the Chime Credit Builder card login process is more than a technical skill; it’s a cornerstone of responsible credit management in a digital‑first banking world. With clear navigation, robust security habits, and an awareness of the card’s features, you can harness the full power of Chime’s credit‑building ecosystem.

Remember, the journey to a stronger credit score starts with a single, secure login. Keep your credentials safe, stay proactive about monitoring activity, and take advantage of the tools Chime provides. Over time, those small, consistent actions will translate into measurable improvements in your credit profile, opening doors to better financial opportunities.