Table of Contents

- The Foundations: Near Field Communication (NFC) and EMV Standards

- Key Components of an NFC‑Enabled Transaction

- Step‑By‑Step: What Happens When You Tap

- Why Tokenization Matters

- Security Layers Beyond the Card

- Benefits for Consumers and Merchants

- Real‑World Example: Travel Rewards Cards

- Challenges and Limitations

- The Future: From Tap to Seamless Authentication

- Potential Impact of Apple Pay Compatibility

- Practical Tips for Using Contactless Payments Safely

- 1. Keep Your Card in Good Condition

- 2. Monitor Transaction Alerts

- 3. Set Personal Spending Limits

- 4. Combine With Mobile Wallets When Possible

- 5. Stay Informed About Issuer Policies

Contactless credit card payment has become a staple in everyday transactions, offering speed and convenience that traditional swipe or chip‑and‑pin methods struggle to match. At its core, this technology relies on a blend of radio‑frequency communication, sophisticated encryption, and industry standards that keep your money safe while you simply tap a card. Understanding the mechanics behind the tap can demystify the process and help you appreciate why this method is gaining ground worldwide.

In the next few minutes, we’ll walk through the journey of a single transaction—from the moment the card meets the reader to the final settlement in the merchant’s account. Along the way, you’ll learn about the hardware that powers the interaction, the software that encrypts the data, and the protocols that ensure every payment is both fast and secure. By the end, the invisible dance of electromagnetic fields and cryptographic keys will feel as familiar as the sound of a cash register.

The Foundations: Near Field Communication (NFC) and EMV Standards

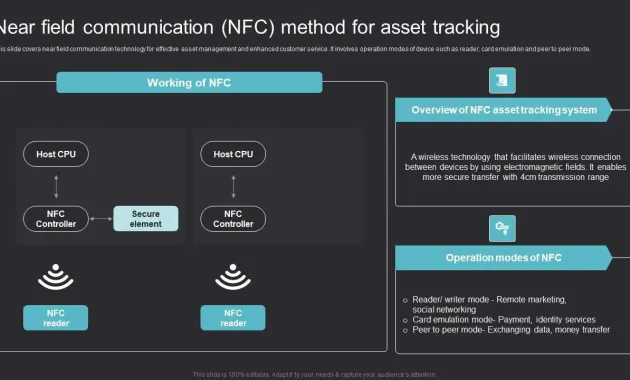

Contactless cards use Near Field Communication (NFC), a short‑range wireless technology that enables two devices to exchange data when they are within a few centimeters of each other. NFC operates at 13.56 MHz and can transfer small amounts of data at rates up to 424 kbps—more than sufficient for a payment token.

Underlying the NFC exchange is the EMV (Europay, MasterCard, Visa) standard, which defines how chip cards interact with payment terminals. EMV ensures that every card—whether inserted, swiped, or tapped—conforms to a set of security rules, such as dynamic data generation and mutual authentication. The combination of NFC and EMV creates a reliable, globally recognized framework for contactless payments.

Key Components of an NFC‑Enabled Transaction

- Contactless Card Antenna: A thin coil embedded in the card captures the magnetic field emitted by the reader and powers the chip.

- Secure Element (SE): The chip stores encrypted credentials and performs cryptographic operations without exposing raw data.

- Payment Terminal: Equipped with an NFC reader, it generates a radio field, captures the card’s response, and initiates the transaction.

- Acquirer & Issuer Networks: After the terminal sends the data, the acquirer forwards it to the card‑issuing bank for authorization.

Step‑By‑Step: What Happens When You Tap

When you place your contactless credit card near a payment terminal, a tightly choreographed sequence unfolds within a fraction of a second:

- Field Activation: The terminal emits an alternating magnetic field. The card’s antenna harvests this energy, activating the chip without any battery.

- Handshake & Data Exchange: The card and terminal exchange a short “handshake” to confirm they support the same protocol version. The terminal then requests a payment token.

- Token Generation: The card’s secure element creates a one‑time cryptogram (also called a dynamic data element) that combines the transaction amount, a transaction counter, and a secret key known only to the issuer.

- Authorization Request: The terminal forwards the token, along with merchant ID and other metadata, to the acquirer, which routes it to the issuer.

- Issuer Validation: The issuing bank decrypts the token, verifies the cryptogram, checks account status, and decides whether to approve the transaction.

- Response Delivery: An approval or decline message travels back through the same path, reaching the terminal almost instantly. A green light or beep confirms success.

- Settlement: At the end of the day, all approved transactions are batched and settled through the card network, crediting the merchant’s account and debiting the cardholder’s balance.

Notice that the actual primary account number (PAN) never leaves the card. Instead, the token and cryptogram act as a proxy, dramatically reducing the chance of fraud if the data is intercepted.

Why Tokenization Matters

Tokenization replaces sensitive card details with a surrogate value that is useless outside the specific transaction. Even if a malicious actor captures the NFC transmission, the data cannot be reused because:

- The cryptogram is valid for only one transaction.

- Each token incorporates a unique transaction counter.

- Issuers can revoke compromised tokens instantly.

For a deeper dive into protecting your card from skimmers, check out How to Protect Your Credit Card from Skimmers – 7 Actionable Steps You Can Take Today, which explains how tokenization works hand‑in‑hand with other security layers.

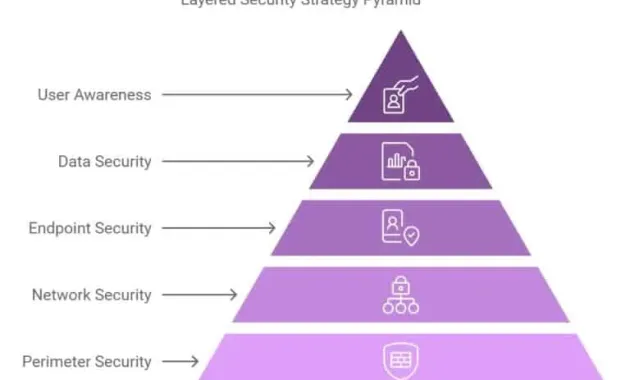

Security Layers Beyond the Card

While the card itself provides a strong first line of defense, the ecosystem adds several additional safeguards:

- Card‑Not‑Present (CNP) Controls: For online purchases, merchants often require a CVV or two‑factor authentication, complementing the tokenized data.

- Limit Caps: Many issuers set a maximum amount (e.g., $50 or $100) for contactless transactions without PIN verification, limiting exposure.

- Behavioral Analytics: Real‑time monitoring flags unusual spending patterns, prompting additional verification.

- Network Encryption: Data traveling between terminal, acquirer, and issuer travels over TLS‑encrypted channels.

These layers collectively create a defense‑in‑depth approach, making contactless payments one of the safest methods available today.

Benefits for Consumers and Merchants

From the consumer’s perspective, the biggest advantage is speed. A typical tap takes under 500 milliseconds, allowing lines to move faster and reducing the physical contact required—a factor that surged in popularity during the pandemic.

Merchants enjoy higher throughput, lower transaction costs (because fewer steps reduce processing fees), and improved customer satisfaction. Moreover, contactless terminals often support mobile wallets, giving merchants a broader reach without needing additional hardware.

Real‑World Example: Travel Rewards Cards

Travel‑focused credit cards often highlight contactless convenience when you’re rushing through airport security or boarding gates. For instance, the 7 Credit Cards That Pay for Your TSA PreCheck – Save Money on Every Trip article discusses how fast tap‑and‑go can complement the speed of TSA PreCheck, creating a seamless travel experience.

Challenges and Limitations

Despite its advantages, contactless payment is not without hurdles:

- Device Compatibility: Older terminals may not support the latest NFC standards, leading to failed taps.

- Transaction Limits: In some regions, regulatory caps on contactless amounts can inconvenience high‑value purchases.

- Physical Damage: A bent or demagnetized antenna can render the card unreadable.

- Consumer Awareness: Some users still misunderstand that “tap” does not mean “no security,” leading to misplaced confidence.

The Future: From Tap to Seamless Authentication

Emerging trends suggest that the next generation of contactless payments will blur the line between card and mobile wallet. Biometric verification (fingerprint or facial recognition) can be embedded in the card’s SE, enabling a “tap‑plus‑verify” model without a PIN.

Additionally, the rise of Understanding the Payment Landscape points toward a more unified ecosystem where tokenization, blockchain, and AI‑driven fraud detection converge to make every tap even more secure and instantaneous.

Potential Impact of Apple Pay Compatibility

Apple Pay’s integration with contactless card networks demonstrates how hardware and software can work together. For card issuers, supporting Apple Pay means tapping into a broader audience that values digital wallets. Read more about this synergy in Why Apple Pay Compatibility Matters for Credit Card Choice.

Practical Tips for Using Contactless Payments Safely

1. Keep Your Card in Good Condition

A damaged antenna can cause intermittent failures. Store your cards in a protective sleeve and avoid exposing them to strong magnets.

2. Monitor Transaction Alerts

Enable push notifications from your issuer. Immediate alerts help you spot unauthorized use before it becomes a larger issue.

3. Set Personal Spending Limits

If your issuer allows it, configure a lower daily limit for contactless use. This adds an extra layer of protection without sacrificing convenience.

4. Combine With Mobile Wallets When Possible

Mobile wallets add device‑level security (biometrics, passcodes) on top of the card’s tokenization, creating a double shield.

5. Stay Informed About Issuer Policies

Periodically review your card’s terms regarding contactless limits, liability coverage, and renewal procedures.

By following these simple practices, you can enjoy the speed of tap‑and‑go while maintaining the robust security that the technology offers.

The journey of a contactless credit card payment is a fascinating blend of physics, cryptography, and industry cooperation. Each tap hides a cascade of invisible processes designed to protect your money, speed up commerce, and adapt to an increasingly digital world. As standards evolve and new innovations emerge, the humble tap will likely become an even more integral part of everyday life, shaping how we think about money, identity, and convenience.