Table of Contents

- Understanding the Core Concepts

- Why Direct Person‑to‑Person Transfers Are Rare

- Legal Framework and Consent

- Legitimate Methods for Shifting Debt

- 1. Authorized User Strategy

- 2. Personal Loan Transfer

- 3. Balance Transfer Checks

- 4. Debt Consolidation Services

- Step‑by‑Step Guide to Executing a Transfer

- Step 1: Assess the Debt and Credit Situation

- Step 2: Discuss Terms and Obtain Written Consent

- Step 3: Apply for a Personal Loan

- Step 4: Disbursement and Debt Payoff

- Step 5: Set Up a Repayment Plan

- Potential Risks and How to Mitigate Them

- 1. Credit Score Impact

- 2. Default Risk

- 3. Fees and Hidden Costs

- 4. Tax Implications

- Alternative Strategies for Managing High Credit Card Debt

- Balance Transfer Credit Cards

- Debt Snowball vs. Debt Avalanche

- Negotiating with Creditors

- Credit Counseling Services

- Frequently Asked Questions

- Can I simply write a check to a friend to pay off my credit card?

- Is it legal to transfer a credit card balance to another person’s card without the issuer’s permission?

- What happens if the person I transferred the balance to defaults on their loan?

- Do balance transfer checks have a fee?

- Can I use a balance transfer to help a family member with bad credit?

- Best Practices for a Smooth Transfer

Transferring a credit card balance to another person can seem like a convenient way to help a family member or friend manage debt, but the process is more nuanced than a simple hand‑off. The phrase “transfer credit card balance to another person” often raises questions about feasibility, legality, and the impact on both parties’ credit profiles. Understanding the mechanisms that banks and credit card issuers provide, as well as the risks involved, is essential before attempting any balance shift.

In many cases, what people really mean is moving the debt from one credit card to another—often to take advantage of lower interest rates or promotional offers. However, when the destination is a card owned by a different individual, the situation changes dramatically. It introduces elements of consent, credit liability, and potential tax implications that are rarely covered in standard credit card FAQs.

This article walks through the entire landscape of transferring a credit card balance to another person. It outlines legitimate methods, outlines the legal framework, highlights common pitfalls, and offers practical tips to ensure the transaction does not jeopardize either party’s financial health.

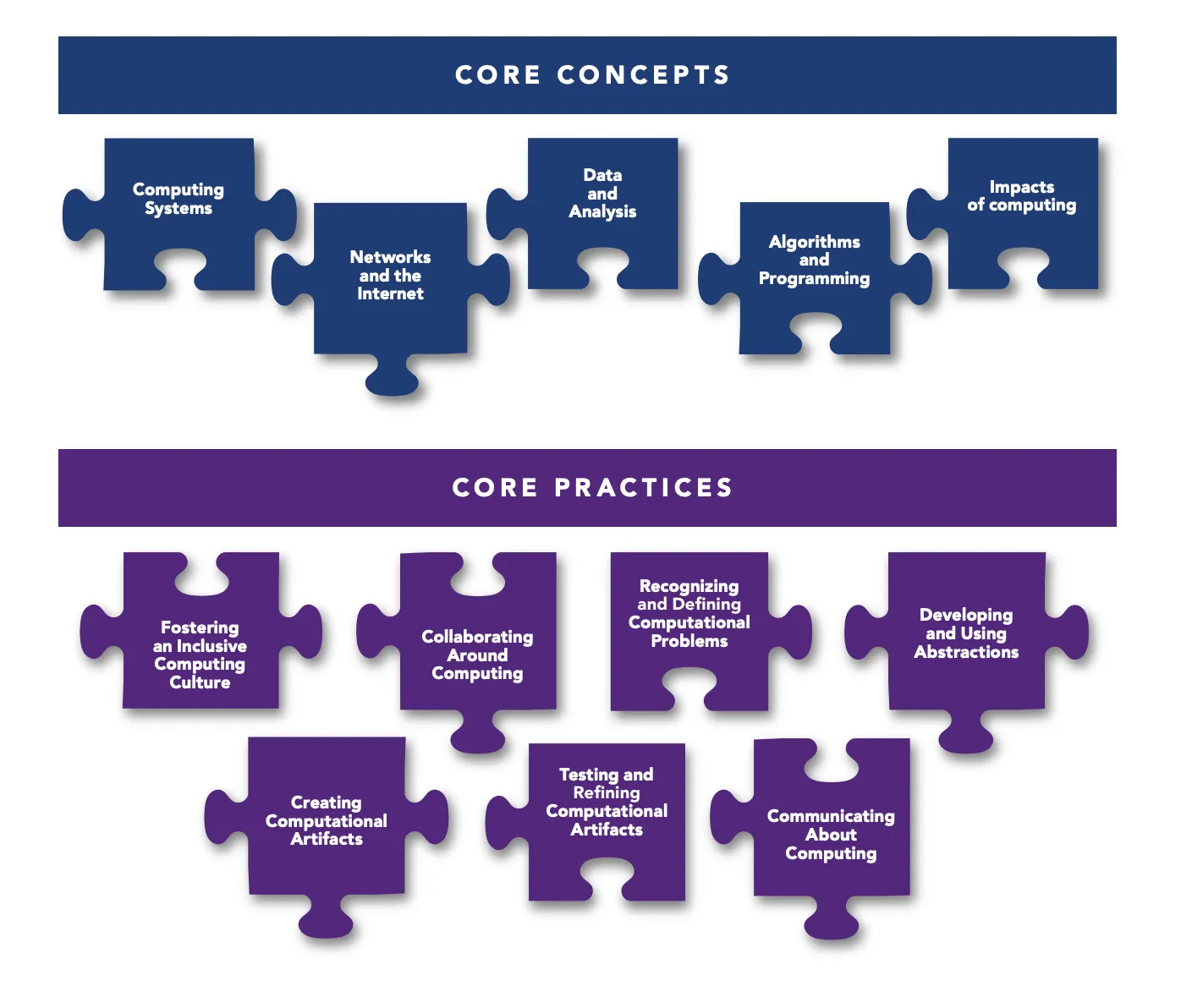

Understanding the Core Concepts

Before diving into specific procedures, it is crucial to clarify what “balance transfer” actually means in the credit industry. A balance transfer typically involves moving an existing debt from one credit card account to another, usually to obtain a lower Annual Percentage Rate (APR) or a promotional 0% period. Most issuers allow transfers only between accounts that they own, and they often require the receiving account to be in the same name as the applicant.

Why Direct Person‑to‑Person Transfers Are Rare

- Credit Liability: Credit cards are personal liability contracts. The person whose name appears on the account is legally responsible for the debt.

- Issuer Policies: Card issuers generally prohibit third‑party transfers to prevent fraud and ensure that the debtor’s creditworthiness is accurately assessed.

- Regulatory Oversight: Financial regulations in many jurisdictions demand clear documentation of who owes what, making informal transfers risky.

Legal Framework and Consent

Any attempt to shift a balance to another person must involve explicit consent from the receiving party and, in most cases, approval from the credit card issuer. Without proper documentation, the transaction could be considered a breach of contract, potentially leading to penalties or account closure. For instance, the how to safely opt out of a credit card interest rate increase guide emphasizes the importance of clear communication with the issuer before any alteration to account terms.

Legitimate Methods for Shifting Debt

While direct person‑to‑person balance transfers are limited, several legitimate pathways exist to achieve a similar outcome. Each method carries its own set of requirements and considerations.

1. Authorized User Strategy

Adding the other person as an authorized user on your credit card can indirectly shift the burden. The authorized user gains a secondary card linked to the primary account, and any purchases they make contribute to the same balance. Though the primary account holder remains fully liable, this approach allows the secondary party to contribute payments toward the debt.

- Pros: No need for a new credit application; can improve the authorized user’s credit score if payments are timely.

- Cons: The primary holder retains full legal responsibility; mismanagement can damage both credit reports.

2. Personal Loan Transfer

If the goal is to move debt to someone else’s name, a personal loan can serve as an intermediary. The recipient takes out a loan in their name and uses the proceeds to pay off the original credit card balance. This method fully transfers liability but requires the recipient to qualify for the loan.

- Pros: Clear legal responsibility; fixed repayment schedule.

- Cons: May involve loan origination fees and higher interest rates than promotional balance transfers.

3. Balance Transfer Checks

Some credit card issuers provide balance transfer checks that can be written to a third party. The check can be deposited into the recipient’s bank account, and the issuer credits the amount against the original balance. However, this option is rarely available and often comes with higher fees.

Before using such a check, verify the issuer’s policy. The how to quickly update your credit card billing address guide notes that many issuers treat balance transfer checks as extensions of the account holder’s liability, meaning the original cardholder remains responsible if the recipient defaults.

4. Debt Consolidation Services

Third‑party debt consolidation firms sometimes offer solutions that involve moving debt to a new account opened in the recipient’s name. While these services can simplify the process, they often charge significant fees and may affect credit scores during the application phase.

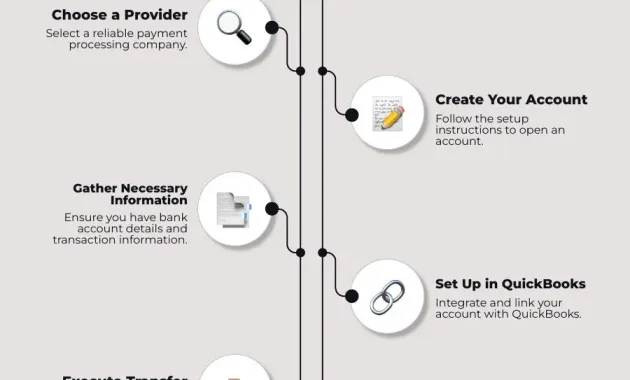

Step‑by‑Step Guide to Executing a Transfer

Assuming you have identified a legitimate method, the following steps outline a typical process for transferring a credit card balance to another person using a personal loan as an example.

Step 1: Assess the Debt and Credit Situation

- Calculate the total balance, including interest accrued.

- Check both parties’ credit reports for any red flags that might affect loan approval.

- Determine whether the recipient can secure a loan with a lower APR than the current credit card rate.

Step 2: Discuss Terms and Obtain Written Consent

Both parties should draft a simple agreement outlining:

- Exact amount to be transferred.

- Repayment schedule and responsible party.

- Consequences of missed payments.

This document, while not legally binding in many jurisdictions, provides clear evidence of mutual understanding, which can be valuable if disputes arise.

Step 3: Apply for a Personal Loan

The recipient applies for a personal loan. Important considerations include:

- Interest rate and term length.

- Any origination or prepayment penalties.

- Impact on the recipient’s credit utilization ratio.

Step 4: Disbursement and Debt Payoff

Once approved, the loan funds are transferred to the original cardholder’s bank account. The cardholder then makes a payment to the credit card issuer, effectively clearing the balance.

Step 5: Set Up a Repayment Plan

The recipient begins repaying the personal loan according to the agreed schedule. It is advisable to set up automatic payments to avoid missed deadlines, which can damage credit scores.

Potential Risks and How to Mitigate Them

Even when following a legitimate pathway, several risks can jeopardize the financial stability of both parties. Understanding these risks allows you to implement safeguards.

1. Credit Score Impact

Transferring debt often involves new credit inquiries and changes in credit utilization. Both can temporarily lower credit scores. To mitigate:

- Apply for loans only when necessary and limit the number of inquiries.

- Maintain low utilization on existing cards by paying down balances promptly.

2. Default Risk

If the recipient fails to repay the loan, the original cardholder may still be liable for any remaining balance on the credit card. Establishing a legally binding agreement or collateral can reduce this risk.

3. Fees and Hidden Costs

Balance transfer checks, loan origination fees, and early repayment penalties can add up. Always read the fine print and calculate the total cost of the transfer versus the interest saved.

4. Tax Implications

In some jurisdictions, forgiving a debt or transferring it without consideration may be treated as a gift, potentially subject to gift tax. Consulting a tax professional is advisable if the transferred amount is substantial.

Alternative Strategies for Managing High Credit Card Debt

If transferring the balance to another person proves too complex or risky, consider these alternatives that keep the debt within your control while still offering financial relief.

Balance Transfer Credit Cards

Many issuers provide promotional 0% APR balance transfer offers for a limited period, typically 12–18 months. This can provide a breathing room to pay down principal without accruing additional interest.

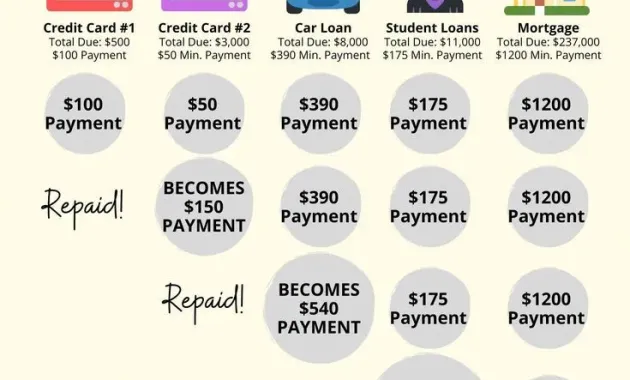

Debt Snowball vs. Debt Avalanche

Two popular repayment strategies can accelerate debt reduction:

- Debt Snowball: Pay off the smallest balances first to gain momentum.

- Debt Avalanche: Target the highest‑interest balances first to minimize total interest paid.

Negotiating with Creditors

Contact your credit card issuer to discuss hardship programs or interest rate reductions. In some cases, issuers will lower rates temporarily for borrowers demonstrating financial distress.

Credit Counseling Services

Non‑profit credit counseling agencies can help you develop a debt management plan (DMP) that consolidates payments and may secure lower interest rates through negotiated agreements with creditors.

Frequently Asked Questions

Can I simply write a check to a friend to pay off my credit card?

Yes, you can give a friend a check for the amount you owe, and they can pay the credit card on your behalf. However, the debt remains legally yours, and any missed payments will affect your credit score.

Is it legal to transfer a credit card balance to another person’s card without the issuer’s permission?

Doing so without the issuer’s consent typically violates the terms of the credit agreement and can result in penalties, account closure, or legal action. Always obtain explicit approval from the issuer before attempting a transfer.

What happens if the person I transferred the balance to defaults on their loan?

The original credit card balance would already be paid off, so your credit card account would be clear. However, you may still be responsible for the personal loan if you co‑signed or if the loan is in your name.

Do balance transfer checks have a fee?

Most issuers charge a fee ranging from 3% to 5% of the transferred amount, plus any applicable interest if the promotional period expires before the balance is paid in full.

Can I use a balance transfer to help a family member with bad credit?

Indirectly, yes—by adding them as an authorized user or by helping them qualify for a personal loan. Direct transfers remain restricted, and the family member’s credit profile will still influence loan eligibility.

Best Practices for a Smooth Transfer

Following a structured approach can reduce stress and protect both parties’ financial interests.

- Document Everything: Keep records of all communications, agreements, and transaction receipts.

- Verify Issuer Policies: Contact the credit card company’s customer service to confirm permissible transfer methods.

- Maintain Open Communication: Regularly check in on repayment progress to avoid misunderstandings.

- Consider Professional Advice: Seek counsel from a financial advisor or attorney for large sums.

- Plan for Contingencies: Establish a backup repayment plan in case the primary method fails.

By adhering to these practices, you can navigate the complexities of transferring a credit card balance to another person while minimizing risk.

Ultimately, the decision to shift debt should be based on a careful analysis of costs, benefits, and the trustworthiness of the parties involved. While the allure of helping a loved one or easing personal financial pressure is understandable, the legal and financial frameworks governing credit cards demand diligence and transparency. Whether you choose a direct method like a balance transfer check, an indirect strategy such as an authorized user arrangement, or an alternative debt‑management approach, the key lies in thorough preparation and clear communication.